88E - What to watch out for in the next 12 months

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and Associated Entities, own 3,800,000 88E shares at the time of publication. S3 Consortium Pty Ltd has been engaged by 88E to share our commentary and opinion on the progress of our Investment in 88E over time.

It's been two months since our oil exploration investment 88 Energy (ASX:88E) completed its most recent oil drilling event on the North Slope of Alaska.

As is customary with the oil and gas exploration Investments we make, 88E was targeting a truly company making discovery with the drilling of the Merlin-2 appraisal well.

88E’s Merlin-2 well was targeting 652 million barrels (mean, unrisked, prospective).

The odds of making a new discovery with high risk exploration wells is often a lot less than 50%.

Unfortunately probabilities prevailed here and the exploration gods did not hand 88E a commercial discovery at Merlin-2.

This wasn’t entirely unexpected.

While the odds are stacked against exploration success, what makes Investing in these high risk explorers worth the risk is the potential upside in the event the exploration gods DO deliver, and a major discovery is made.

Now that the dust has settled on Merlin-2, and the 88E share price has come off from its pre-drill highs, it's time we sat down and reviewed 88E, and what we are looking for over the next 12 months from this Investment.

Today we will review 88E in detail, and present our Investment Memo for 88E for the next 12 months.

We also went back and reviewed our previous Investment Memo-rating our investment thesis and how we went.

88E generally drills a high impact exploration well early each calendar year, and by Investing early and waiting for the share price run up in the lead up to the result, we can execute our standard oil & gas exploration Investment Plan.

We will look to build our 88E position over the coming months in anticipation for 2023 drilling.

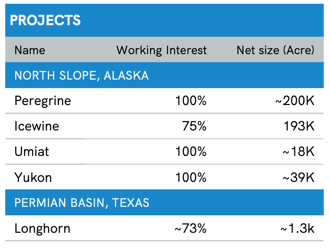

88E owns multiple exploration assets on the North Slope of Alaska, controlling a total of ~420,000 acres. It also recently acquired a producing asset onshore US.

Alaska’s North Slope is home to one of the biggest conventional oil & gas discoveries in the world (Prudhoe Bay) which has produced the equivalent of ~12 billion barrels of oil to date

More recently Alaska has also hosted new major discoveries from the likes of US$158BN oil major ConocoPhillips with its 400-750 million barrel Willow Discovery, and OilSearch /Armstrong/Respol’s 900 million barrel Pikka discovery.

We have Invested in 88E with the goal to see them deliver the next major oil discovery in Alaska.

Here’s a snapshot of 88E’s current projects:

Following the failure at the Merlin-2 well on Project Peregrine, we think most of the focus for 88E this year will be on its “Project Icewine”.

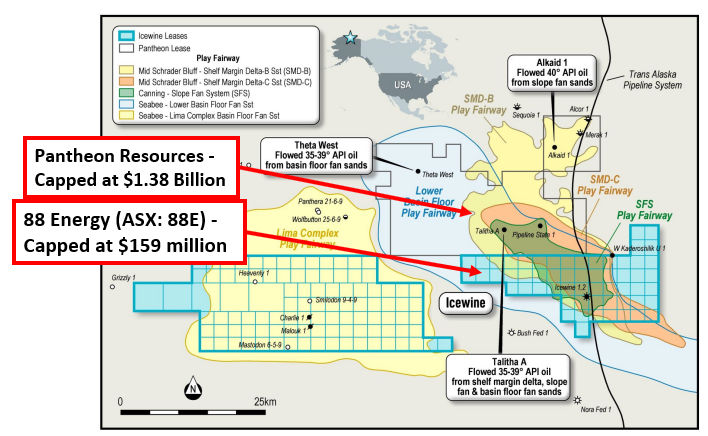

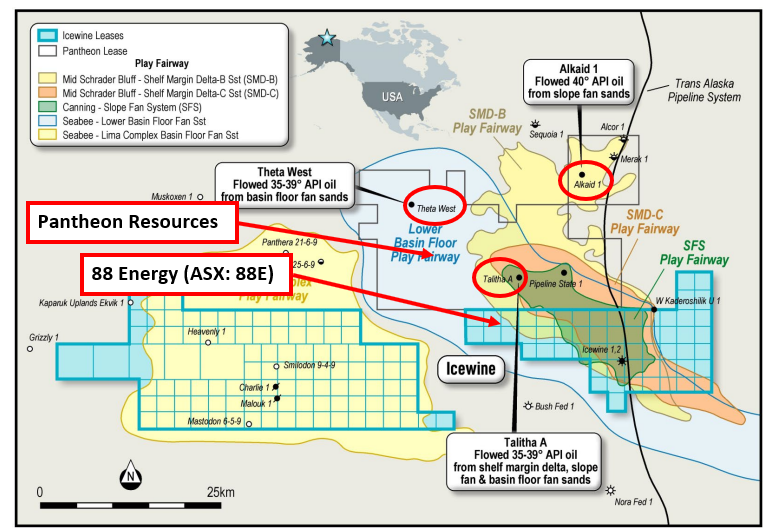

88E’s Project Icewine comprises ~193,000 (net) acres, which sits adjacent to UK listed Pantheon Resources projects.

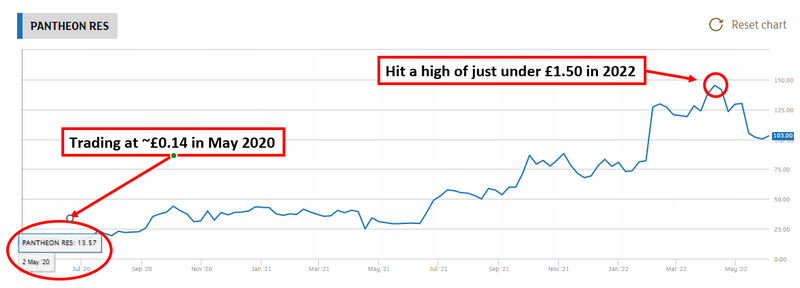

Pantheon Resources is currently capped at A$1.38 billion, having gone from a sp of ~ £0.14 in May 2020 to as high as £1.50 - an almost ~ 1,000% increase.

Pantheon’s 10 bagger share price run is completely due to its Alaskan exploration success - on ground right next door to 88E.

Whilst 88E was busy drilling Merlin-1 and Merlin-2 to the west at Project Peregrine, Pantheon has been flow testing three different wells that sit directly to the north of 88E’s Project Icewine.

Those three different wells (Alkaid-1, Talitha-A and Theta West-1) all flowed high quality, light oil, with flow rates between 57 and 108 barrels of oil per day.

You can see the wells in the white boxes on the map below - those blue squares are all 88E’s Project Icewine:

Pantheon believes it has a world class discovery on its hands - and given the company’s valuation, the market seems to think its got something of value here too.

Next month, Pantheon is going to run its first commercial, long term production test.

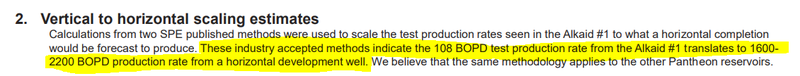

Pantheon believes that by drilling a horizontal development well at one of the three targets, it has potential to achieve a 1,600 to 2,200 barrels of oil per day production rate.

That sort of production rate from one well could be company making for any oil and gas explorer.

In order to run this production test, Pantheon will be drilling the Alkaid #2 well in July.

Pantheon’s drilling of the Alkaid #2 well is going to be closely watched by 88E Investors, as 88E holders are getting another free peek at what's below the surface directly to the north.

After watching its neighbour Pantheon strike oil on well after well, 88E followed up these developments with an independent review of the publicly released drilling data and also data available to 88E from its own previous drilling and exploration work at Icewine.

This independent review concluded that each of the Pantheon reservoir units extend into 88E’s Project Icewine acreage.

This means that 88E’s project area could be a part of what Pantheon's technical director Bob Rosenthal described as having the potential of “unlocking an enormous basin play”.

With Project Icewine already having a ~1.7 billion barrel (mean unrisked) prospective resource, 88E will be looking to boost this via an upcoming Independent Resource Estimate update in the near term.

Armed with this, and evidence of local exploration success in the form of Pantheon to the north, we think 88E is going to be in a strong position to attract a farm in partner to Project Icewine.

Alongside a farm in partner, we think 88E will want to test Icewine again, and see if it can get similar flow rates to what Pantheon is seeing.

One of the key reasons we hold 88E in our portfolio is because year in year out it maps out and executes these high risk high exploration programs, with the 2023 re-run shaping up to be at Project Icewine.

If 88E can prove that the Pantheon reservoir units do extend into its acreage at Project Icewine by confirming actual flowing oil, it can quickly put itself front and centre of a new basin wide discovery in Alaska.

Regular readers will know that we have a clearly defined Investment plan when it comes to oil and gas exploration.

We look to Invest in company’s maturing drilling programs well in advance of the catalyst, when the market has yet to have noticed the opportunity yet.

We then wait for the company to get closer to the drilling program and look to de-risk our position leading up to a major catalyst event like drilling or production testing.

We are now holding onto 88E well ahead of an exploration program at its Project Icewine and at a time where the market seems to be fully focused on the negative result that came from the recent drilling program.

We think that this will mean as we get closer to the next major drilling event, 88E’s share price should do what it usually does...

As part of our initial 2022 Investment Memo we listed the drilling of Merlin-2 as the only key objective for the year.

The drilling program was completed in early April and resulted in 88E plugging and abandoning the well after determining the reservoir section unsuitable for production testing.

Effectively this means 88E did not intercept any working oil and gas reservoirs that could be translated into a new discovery.

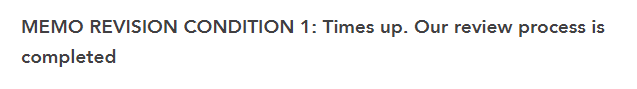

This is all part and parcel of high risk high reward drilling, but given this was our only key objective in our initial 88E Investment Memo and with the objective now completed (albeit with a disappointing failed outcome) we have decided to do an Investment Memo refresh for 88E.

To see our assessment of how 88E did against our previous Investment Memo, check out this link.

In the educational article below, we outlined the specific conditions where we do an Investment Memo refresh, in 88E’s case the applicable revision is condition 1.

🎓 To learn more about what type of company events trigger an update to our Investment Memo’s check out our educational article here.

As part of the revision process, our team sat down and discussed our 88E Investment thesis.

One of the key talking points from our discussions was the activity of 88E’s London listed neighbour Pantheon Resources who have recently flow tested three separate wells right along its project boundaries (the boundaries shared with 88E).

As we mentioned above, all of these wells have returned commercially viable flow rates.

The market has rewarded Pantheon, re-rating its share price from 14p per share to £1.05, where it now trades with a market cap of A$1.38 billion.

Only a few weeks ago, 88E had an independent third party assessment completed, which evaluated all of the publicly available drilling data released by Pantheon Resources and 88E.

Importantly the conclusion from that assessment was that all of the Pantheon reservoir units extend onto the Project Icewine acreage owned by 88E.

We think Project Icewine is going to drive the most value for 88E shareholders over the next 12 months.

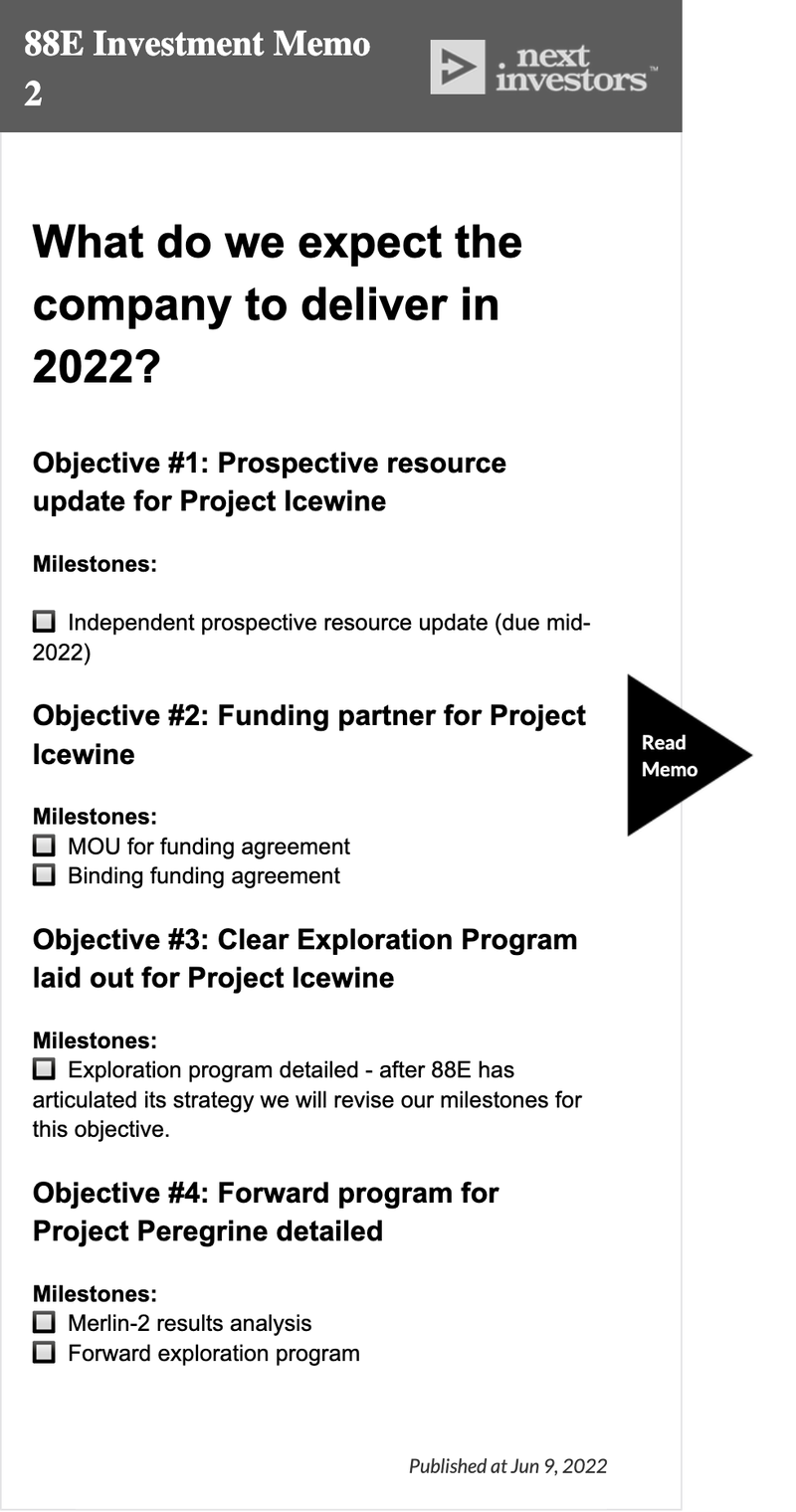

As a result, in our NEW 2022 Investment Memo for 88E, we have set the work leading up to and including exploration work at Project Icewine as our primary focus.

To see our complete NEW 2022 88E Investment Memo which shows all of the key reasons for our Investment in 88E, the key objectives we want to see achieved for the rest of the year, and the key risks to our Investment thesis.

CLICK HERE TO SEE OUR NEW 2022 88E INVESTMENT MEMO

To see all of the key objectives we want to see the company achieve in 2022/2023, click on the image below.

Some background on 88E’s Project Icewine

Project Icewine is the main focus in our revised Investment Memo so it's important we summarise what 88E got up to across this project area the last time it was active here.

88E’s most recent drilling event on the project was the Charlie-1 well in early 2020, which it drilled alongside a farm in partner, Premier Oil.

Just before drilling the Charlie-1 well, 88E signed Premier up to a US$23M farm-in deal where Premier would end up with a 60% interest in Charlie-1 at the end of the drilling program.

Ultimately Premier withdrew from the project and walked away with no ownership interest.

That deal was signed in August 2019 and 88E’s share price going into that drilling program more than doubled from ~1.2c per share up to ~2.6c per share before coming back down to trade around the same levels it is at today.

Although no discovery was made with the Charlie-1 well, we think the interest from Premier Oil in 88E’s Project Icewine during a period where oil prices were trading around US$50 per barrel was a clear sign that oil and gas companies can see potential in this acreage.

What is different now is that since the drilling of Charlie-1, Pantheon has delivered three successful wells to the north of Icewine, and re-rated to a A$1.38 billion market cap company.

Neighbour Pantheon’s work to date all adds value to 88E’s ground

Moving on from Charlie-1, this time the focus at Project Icewine is on the parts of 88E’s ground that sit rnear the border with its UK listed neighbour Pantheon Resources.

Pantheon’s ground has had over $335M spent on exploration over a decade - and all of the publicly released data and results help 88E better understand its own acreage, without 88E having to spend much at all.

Whilst 88E was busy drilling Merlin-2, Pantheon had exploration success in three different wells directly to the north of 88E.

Pantheon recently completed flow testing across the Alkaid-1, Talitha-A and Theta West-1 wells and confirmed reservoir deliverability of light, sweet oil.

The first well was the Alkaid-1 well which flowed ~108 barrels of oil per day, which at first glance may not sound that interesting.

The catch is that Pantheon later revealed that a planned horizontal well (which would capture more of the reservoir unit) could actually translate into a ~1,600 to 2,200 barrels of oil per day production rate - which is a part of the reason why we think the market values Pantheon where it is today.

Second is the Theta West-1 well, where Pantheon only recently completed a drilling program to test for reservoir quality.

The results of the program were again encouraging, with the well flowing high quality, light oil at rates that averaged ~57 barrels of oil per day ("BOPD") with peak rates exceeding 100 BOPD over 2.5 days.

In fact Pantheon actually commented on the results saying that the result “meets the company's pre-drill expectations, confirms the presence, quality, and mobility of light sweet crude oil”.

The key takeaway from this being that again, Pantheon confirmed a commercially viable, working petroleum system which could potentially form part of a larger field development project.

Finally, the Talitha-1 well which sits closest to 88E’s project boundary.

Pantheon finished flow testing this well in February this year and similarly to the results of both Alkaid and Theta West-1, the well flowed high quality light oil at an average of ~73 barrels of oil per day over a three day test period.

That’s three wells from three delivering high quality, light flowing oil.

The key takeaway here being that Pantheon has proven a commercially viable, working petroleum system.

One thing that really stood out to us was the comments Pantheon’s technical director Bob Rosenthal said after the flow testing at the Talitha-1 well:

“Operations at Talitha #A have confirmed our geologic model and we are now on the path to unlocking an enormous basin play.”

We think that there is a good chance that 88E’s ground forms part of this “enormous basin play”.

Below again is the map showing all three of the wells Pantheon Resources drilled and where 88E’s ground sits with respect to this.

In order to get more evidence of what 88E might be sitting on, the company recently had an independent third party assessment to see if the reservoir units from Pantheon Resources ground extend into 88E’s ground.

The independent third party assessment completed by consultants (Jordan & Pay) evaluated all of the publicly available drilling data released by Pantheon Resources across those three wells and all of the data that 88E had on hand from previous exploration programs.

Older 88E investors will recall the Icewine #1 and Icewine #2 wells drilled on this acreage, as well as the Charlie-1 well - all of this exploration data was fed into the independent consultants models and calculations.

The conclusion the consultants reached was that all of the Pantheon reservoir units extend onto the Project Icewine acreage owned by 88E.

With these learnings, 88E recently announced that it is “optimistic that a production test in the Icewine East acreage could potentially yield a similar or better result than seen during the testing of Alkaid-1”.

Remembering the Alkaid-1 well is where Pantheon thinks that a horizontal well could potentially yield a 1,600 to 2,200 barrels of oil production rate.

So what’s next at Project Icewine?

Prospective resource update 🔄

88E confirmed in a recent Investor Presentation that it expects to release an updated prospective resource update over Project Icewine in “mid 2022”.

Given it's already mid 2022 now, we don't think this objective is far away from being achieved.

The project currently has a ~1.7 billion barrels of oil equivalent mean prospective resource.

With all of the learnings from the work Pantheon did it will be interesting to see what the prospective resource becomes.

Funding agreement for a drilling program 🔄

88E has managed to attract farm-in interest here before - Premier Oil in 2019.

Things working in 88E’s favour to attract a farm in partner in the near term are:

- We are now in a much higher oil price environment - offering higher rewards for successful high risk oil exploration

- 88E’s neighbour keeps drilling successful wells directly to the north

- Independent consultants have confirmed that all Pantheon’s reservoir units run directly onto 88E’s ground

- The 1.7 billion barrels mean prospective oil resource might get bigger - an even bigger prize for a successful drill.

We are expecting 88E to announce some sort of funding agreement for Project Icewine this year.

88E had $32.6M in cash in the bank at the end of the March quarter, however we expect a lot of this to be spent on closing out any costs left over from the Merlin-2 appraisal well.

88E hinted at this funding deal being worked on in the background in the recent investor presentation so it wouldn't surprise us if the company was already fielding discussions with interested parties at the moment.

88E has cash flow producing assets too

In February this year, 88E made a slight change to the composition of its project portfolio after acquiring cash flow producing production assets.

Before the acquisition 88E was a pure play explorer focused on its portfolio of Alaskan exploration prospects.

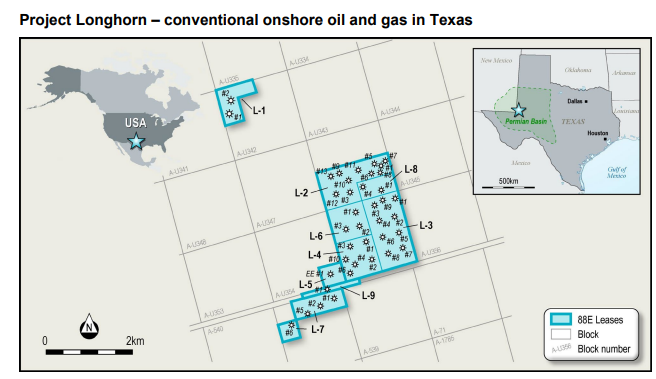

The acquisition was a ~73% non-operated interest in producing oil and gas assets in the Permian Basin, Texas, USA, a project called ‘Project Longhorn’.

88E is simply a financial partner on this project, pro rata contributing to required investments and receiving cash flow from production. 88E is not required to be involved in any of the day to day operations of the asset.

We think this is the perfect structure for 88E’s ownership interest, so that 88E can solely focus on its Alaskan exploration assets.

Project Longhorn has a 2P reserves figure of ~2.1 million barrels of oil equivalent (net to 88E).

Currently the project is made up of ~32 wells that bring in ~400 barrels of oil equivalent per day net to 88E (of which ~70% is oil and the remainder gas).

Via planned workovers, 88E has ambitions to raise production to as high as 1,300 barrels per day by 2024.

We see the acquisition as a good project to have in the portfolio.

88E spends most of its time in between large scale drilling events, periods where the company is burning cash preparing for the drilling program.

Adding a project like this to the portfolio means 88E can benefit from the high oil prices and bring in a project that helps cover the everyday costs of running the company.

At ~400 barrels of oil equivalent per day (net to 88E) at the current oil price of US$110/barrel, that means ~US$44,000 in revenue per day or ~US$16M in revenues/year.

For the March quarter, 88E received ~$600k in cash distributions from the project which is the first sign of the potential cash flows these projects could yield 88E.

More interestingly though, recently 88E confirmed that the joint venture was on track to complete seven different capital works programs, which it thinks could double current production rates by the end of 2022.

If these programs are successful then the cash flow figures could become significantly more interesting.

Having the production assets is a positive and it helps with derisking the cash burn in between the high impact drilling programs.

However we are still primarily Invested in 88E for the almost annual high impact exploration events.

So what about Project Peregrine?

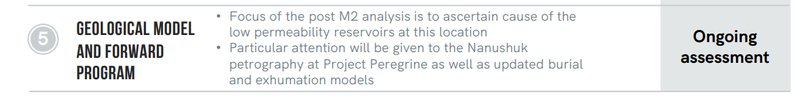

We are still waiting on 88E to release all of the detailed analysis work that sits behind the Merlin-2 drilling program.

We were disappointed to see the results from the drilling program return no commercial discovery, but we hope to see some learnings regarding the geology in the area and the type of structures 88E did intercept.

Once the results have been analysed in detail we expect to see 88E put together a detailed future exploration program over the project area.

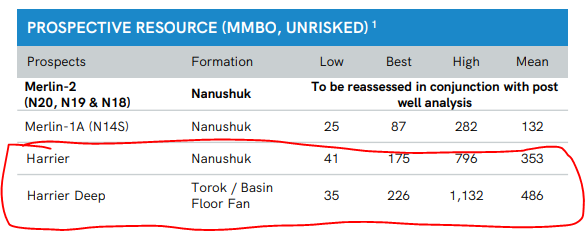

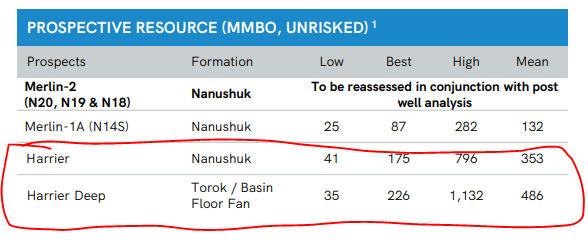

Project Peregrine sits on ~195,373 acres and still has the untested Harrier/Harrier Deep prospects which we think 88E could drill at a later date.

Importantly these are both independent prospects.

This means that the failure to make a discovery at the Merlin prospect has no correlation to these other prospects.

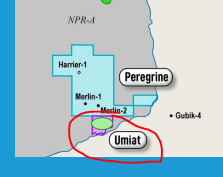

88E also holds the Umiat leases which sit adjacent to the southern border of 88E’s Project Peregrine.

These leases are smaller in size compared to Project Peregrine but we could potentially see 88E follow up historical flow testing work which managed to return flow rates of up to ~800 barrels of oil per day.

At this stage, Project Peregrine and Umiat are not included in detail in our 2022 Investment Memo for 88E as we dont expect many high impact catalysts to be delivered here over the next 12 months.

However we will keep an eye on how things develop across these prospects, especially considering ConcoPhillips are likely to become more active over the Willow oil fields in 2023.

Investment strategy:

Regular readers will know that we like to invest in oil and gas explorers during times where the market is either not interested in the company or the company is just very far away from a big drilling event.

88E has just come off the back of a failed exploration program and seen its share price fall from ~4c per share to 1.2c per share.

With the next drilling event not clearly defined as yet, we see 88E as sitting perfectly in that “quiet period” where the market isn't interested in the next big catalyst and the company is still fine tuning its exploration programs.

For those that are new here, our Investment plan from our 2022 88E Investment Memo is attached below:

What are the risks:

Our NEW 2022 88E Investment Memo:

Below is our NEW 2022/2023 88E Investment Memo where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our 88E Investment Memo you’ll find:

- Key objectives for 88E in 2022/2023

- Why we invested in 88E

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.