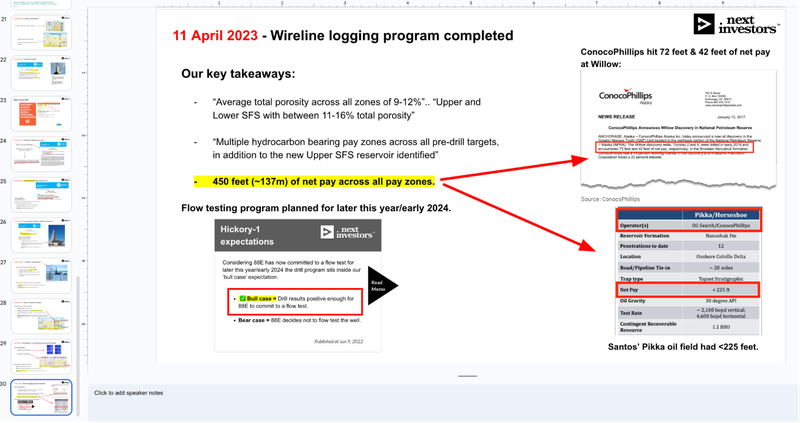

88E delivers 450 feet (~137m) of net pay - now we wait for the flow test…

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 24,387,632 88E shares at the time of publishing this article. The Company has been engaged by 88E to share our commentary on the progress of our Investment in 88E over time.

Is this the next big oil discovery on the North Slope of Alaska?

88 Energy (ASX:88E 🇦🇺| OTC: EEENF 🇺🇸) hit an estimated 450 feet (~137m) of net pay across all pay zones on its just concluded drilling campaign.

88E hit higher than expected porosity and reservoir thickness - with porosity up to ~16% and delivering higher than expected gross/net pay.

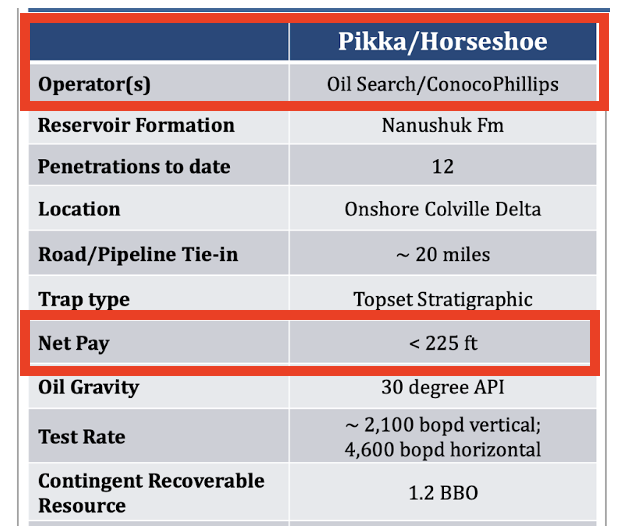

For context, 88E’s net pay numbers are larger than the multi billion dollar Pikka and Willow discoveries on the North Slope and the porosity levels are approaching similar levels.

However - those large discoveries had strong oil flow rates associated with them that proved their commerciality - we don't know what 88E can deliver yet.

On that front, 88E is now planning a flow test for the multiple pay zones as early as possible in the next winter drilling season, late 2023 / early 2024.

The higher the flow rate, the more commercial the discovery, and the higher the valuation of 88E’s asset.

88E’s 2023 well was drill testing a 647 million barrel prospective mean unrisked resource (net to 88E) on the North Slope of Alaska, in the USA.

The project is located next to the Dalton Highway and the Trans Alaska Pipeline (which sends oil down to the lower 48 states of the USA) - this is going to help a lot if 88E can bring the asset up to development stage.

But for now - it's all about the Hickory-1 drill results.

In short, the results have confirmed or exceeded our pre-drill expectations as Investors.

The market looks to have priced in this result, with 88E’s share price not moving much either up or down. We think this provides a strong base in the lead up to the flow test next season.

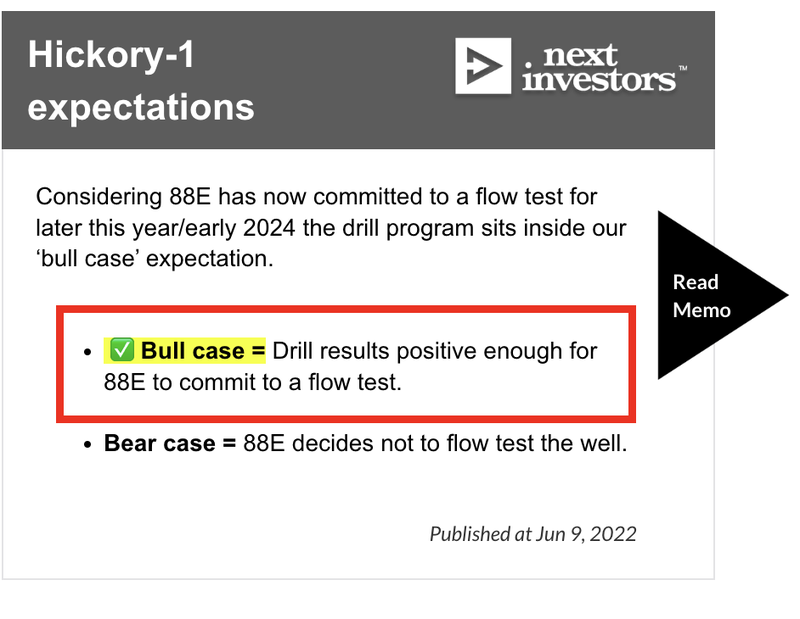

With 88E’s well being cased and suspended, and 88E’s firm commitment to flow test, 88E has hit our bull case expectation for the Hickory-1 drill program:

What did 88E confirm?

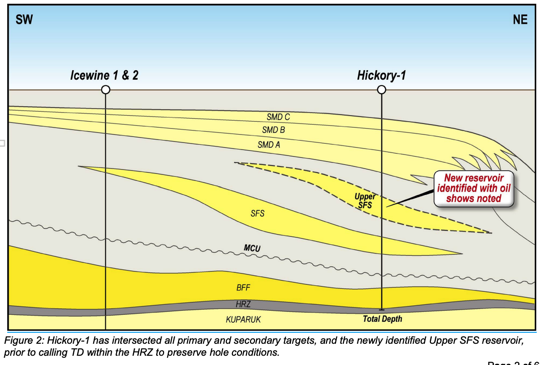

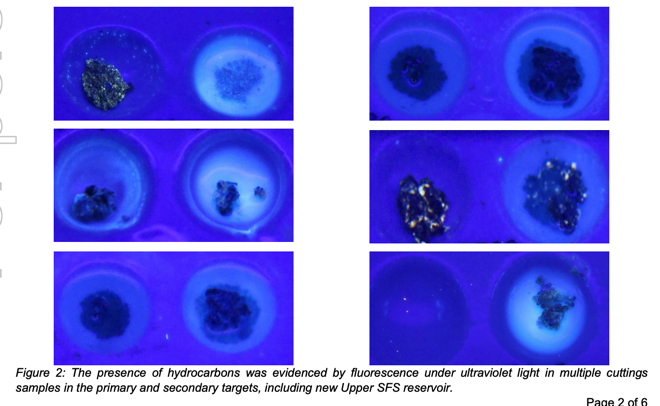

“Multiple hydrocarbon bearing pay zones across all pre-drill targets, in addition to the new Upper SFS reservoir identified”

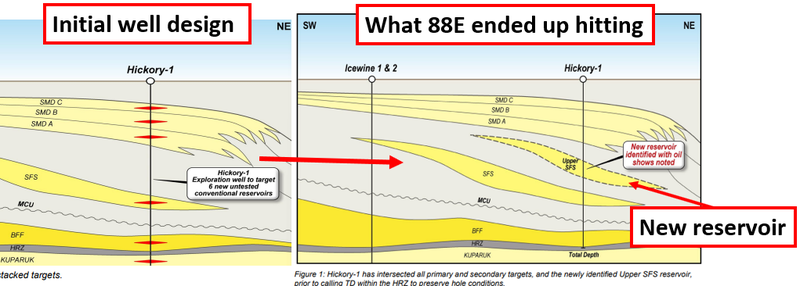

88E hit hydrocarbons in six stacked targets, one of which was unexpected and outside of the pre-drill plan.

“Average total porosity across all zones of 9-12%”.. “Upper and Lower SFS with between 11-16% total porosity”

Porosity refers to the space in the rocks that hold oil or gas. The higher the porosity, the more oil/gas there is likely to be.

For some context, ConocoPhillips’ ~600 million barrel Willow oil field in Alaska had porosity levels averaging ~17% in its discovery wells.

Pre-drill expectations met or exceeded on reservoir quality & thickness (higher than expected porosity in SFS and BFF)

Pre-drill estimates being exceeded on reservoir quality and thickness are always a good sign and means 88E will have a lot more data to work with going into its flow testing program.

While most of the above speak to reservoir quality and is a good indicator of the wells potential to flow oil to surface, we think the market missed the significance of the “net pay” numbers 88E released.

How can 88E deliver a material share price re-rate?

“Net pay” refers to the reservoir thickness.

Typically, the bigger the net pay, the bigger the oil/gas reservoirs.

With net pay numbers established, 88E has removed considerable downside on its acreage.

88E now needs to run a flow test and confirm the reservoirs can flow oil to the surface at commercial rates.

This is what the market is waiting for next.

We think the 450 feet (~137m) of net pay is a strong result as it compares favourably to other recent large discoveries on the North Slope - ConocoPhillips Willow and Santos’ Pikka.

HOWEVER - we don't have a flow rate yet from 88E.

Both of those examples delivered thousands of barrels per day of flow rates, which proved the value of the oil discoveries.

As we await 88E’s flow testing, let's see what is possible when it comes to oil discoveries on the North Slope of Alaska.

Please note what we are about to run through are extreme upside cases, and whilst on the North Slope, were generated in completely different rocks to 88E.

We are not suggesting 88E can attain these kinds of results moving forward. Even a fraction of this kind of success would result in an economic discovery for 88E.

Alaska oil discovery #1 case study - ConocoPhillips’ Willow discovery

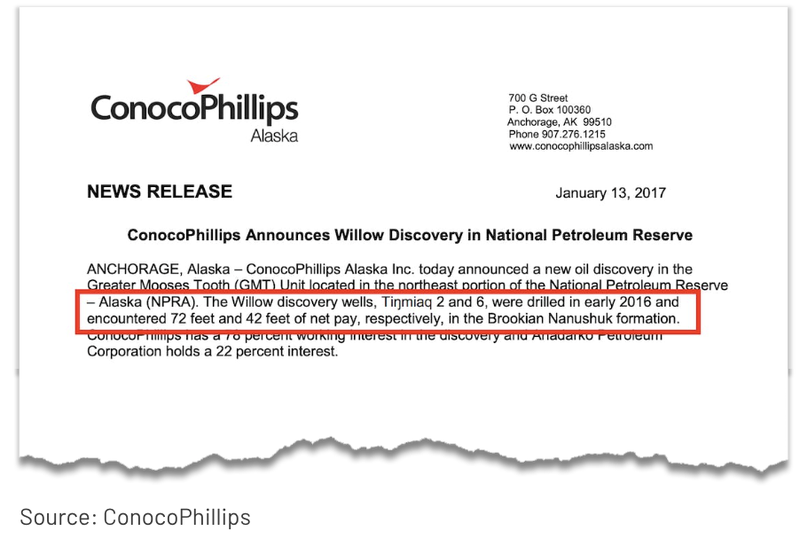

Oil super major ConocoPhillips made the Willow discovery on the North Slope of Alaska back in 2016 and hit net pay of 72 feet and 42 feet across two discovery wells.

This is considerably less net pay than 88E’s 450m of net pay result yesterday.

In early 2017 after flow testing, ConocoPhillips produced ~3,200 barrels per day over ~14 hours.

The project was deemed one of the biggest discoveries in the North Slope over the last 20 years (at the time).

Willow contains ~600 million barrels of recoverable oil and ConocoPhillips plans to spend ~US$7BN building the project.

Willow will ultimately be capable of producing ~180,000 barrels of oil per day at peak production.

The project on its own is expected to deliver ~US$8 to US$17BN in tax revenues for the federal government alone - indicating just how strong the project economics will be despite the large CAPEX number to develop the project.

88E currently has a prospective resource of ~647 million barrels of oil (excluding the newly found upper SFS reservoir unit).

Alaska oil discovery #2 - Pikka - now owned by Santos

Another discovery in the North Slope of Alaska, USA - the Pikka oil field first discovered in 2013.

At the time, the owners of the project hit <225 feet in net pay across the Qugruk 3 well.

Oil flowed ~2,100 barrels of oil per day from a vertical well and ~4,600 barrels of oil per day from a horizontal well a few years later.

In 2017 Oil Search paid US$400M for a 22.5% stake in the project, before doubling its interest in the project by paying another US$450m in 2019.

Eventually, Oil Search ended up merging with Santos in a deal worth over US$17.6BN.

Now the field holds ~1.2 billion barrels of recoverable oil and ASX listed oil and gas major Santos recently made a Final Investment Decision to spend up to US$2.6BN with plans to produce ~80,000 barrels of oil per day.

Back to 88E...

88E hit 450 feet of net pay and has a prospective resource of ~647 million barrels of oil (excluding the newly found upper SFS reservoir unit).

Whilst 88E’s net pay was higher than both the Willow and Pikka discoveries, the big unknown is what kind of flow rate 88E can achieve on its acreage.

Willow and Pikka host different rocks and reservoir systems, which delivered their flow rates.

88E still needs to prove it can produce light oils when it flow tests later this year.

The two discoveries mentioned above are far more advanced than 88E’s and have gone through the flow testing process - proving strong reservoir deliverability and moving into feasibility studies/development.

Again - this is where 88E’s flow test program later this year/early 2024 comes into play.

While the results are strong so far, ultimately the flow testing will determine whether or not Hickory-1 has delivered a commercially viable discovery and whether or not 88E’s project can one day be developed into a producing oil field.

This brings us to our “Big Bet” for 88E.

Our 88E Big Bet

“88E makes a large oil discovery that is acquired by a major for over A$1BN.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our 88E Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor 88E’s progress since we first Invested and how the company is performing relative to our “Big Bet”, we maintain the following 88E Progress Tracker:

What has 88E got so far at Hickory-1?

So far 88E has delivered the following:

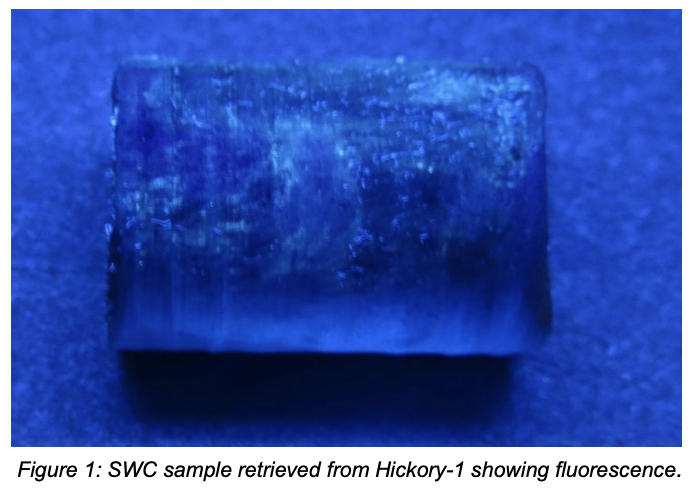

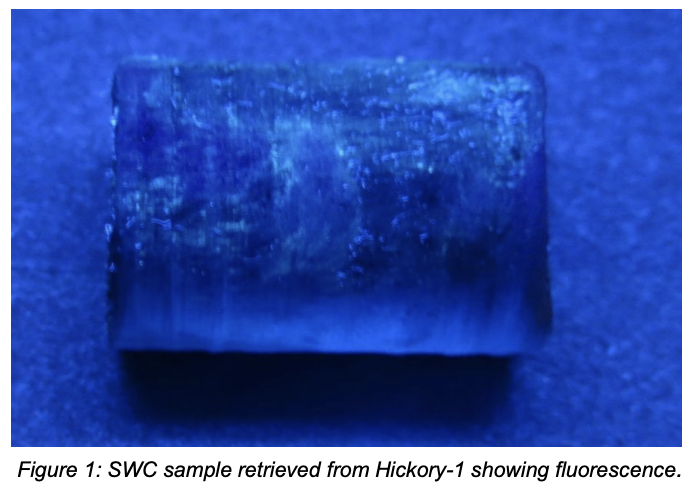

- ✅ Fluorescence (an indicator of oil presence) - Fluorescence across multiple reservoir units.

- ✅ Oil in samples - Oil shows from multiple reservoir units.

- ✅ Mud gas readings - Elevated mud gas readings across multiple reservoir units.

- ✅ New reservoir unit identified (unexpected) - 88E hit a new reservoir unit that sits outside of its current prospective resource estimate.

- ✅ ~450 feet in net pay - 88E hit over 2,000 feet in gross pay and ~450 feet in net pay across multiple reservoir units.

- ✅ Average porosity of ~9-12% across all zones - At a high level, porosity measures how much oil and or gas sits inside the rocks. Highlight results came from the upper SFS and Lower SFS where porosity was between 11-16%.

- ✅ Flow test planned for late 2023/early 2024.

Why didn’t the 88E share price go up?

With the Hickory-1 well drilled and wireline logging results released, the first phase of 88E’s drill program for this year is largely complete.

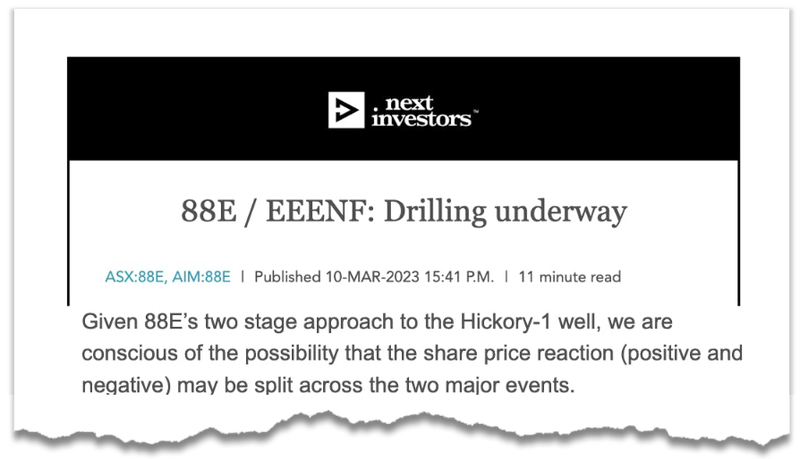

In our previous note on the 10th of March we mentioned that the market reaction to 88E’s drill program may be split over two major events - first drilling and then the flow test next season.

After yesterday’s announcement 88E traded flat for the day ending the day at 1c per share.

As a result, 88E’s share price reaction has played out largely as we expected.

We saw a small increase in the share price in the drill results (from our Average Entry Price) and we suspect any large re-rate could come leading into the flow testing programme (on speculation of a positive results), or after the flow testing program (assuming it is successful).

So far throughout this drill program, 88E’s share price reached a peak of ~1.2c per share. This is ~20% above our average entry price going into this drilling program.

Given the Hickory-1 well was an ‘appraisal well’ (meaning it was targeting a known hydrocarbon system) we think the market may always have been placing more emphasis on the eventual flow testing of the well rather than the drilling of it.

Our view is that the drill program, despite not re-rating 88E’s share price up, has fundamentally improved the company’s position by mitigating ‘exploration risk’.

Another positive is that despite negative market conditions the company’s share price has also held up slightly above the two previous capital raises completed at 0.9c and 0.95c per share.

A positive sign that there was still some strong buying into the drill results.

Of course, other factors also play a role in the share price reaction post big drilling events.

On the weekend, we sent a note to our subscribers titled: Why do Small Cap Share Prices go up?

One of the four reasons we mentioned was “positive market sentiment”.

We think one of the reasons why the market didn't react to 88E’s news yesterday was because of poor broader market sentiment. This ultimately led to more sellers than buyers (people seeing the good news as a chance to sell).

Typically in rough markets even if the news is positive, sellers who have been waiting for an opportunity to go to cash use the good news to sell into buying irrespective of how good the news is.

Obviously, in bull markets, it works the opposite way leading to large gaps up in share prices.

Where do we stand with our Investment in 88E?

Regular readers know that our strategy for early stage oil and gas explorers is to:

- ✅ Invest long before the drilling starts - we did this by Investing at both of the previous capital raises at 0.9c per share and 0.95c per share.

- ✅ Patiently hold while the company does all of the pre-drilling work - We held all the way through to early 2023.

- 🔄 Wait for the company’s share price to rise closer to the drilling date, free carry into the speculative buying and ride the rest of our position into a drilling result (hopefully a good one).

So far, we haven't seen a big move higher and so haven’t been able to Free Carry.

We did manage to Top Slice our Investment, selling ~25% of our pre-drill position in order to de-risk in the event of a negative result.

As the share price hasn't re-rated up off the back of what we think are strong drilling results, we suspect the market is waiting to see what comes from the flow testing program.

Our plan is to hold the majority of our position closer to the flow testing program.

We suspect this flow test and the preparation work will be the next major catalysts for a re-rate in the 88E share price.

If between now and the flow testing program, 88E’s share price is lower than where we started building our position (at ~0.9c to 0.95c per share) we may even look to increase our position.

This is our Investment strategy, however, it's not right for everyone and may not suit your risk profile or circumstances. Always seek professional investment advice when investing in high risk small cap exploration stocks.

What’s next for 88E?

Drilling of the Hickory-1 well ✅:

✅ Drilling commencement - 10 March 2023.

✅ Drilling to 10,650 feet Total Depth (TD) - Drilling completed 3 April 2023.

✅ Wireline logging program - Completed 11 April 2023.

Next, 88E will case and then suspend the well for flow testing (late 2023/early 2024), this is expected to take another 5-7 days to complete.

Next we will be watching to see the detailed data analysis from the Hickory-1 well.

After this, we will look to reset our 88E Investment Memo as the company prepares for flow testing of the well later this year/into early 2024.

Our 88E Investment Memo:

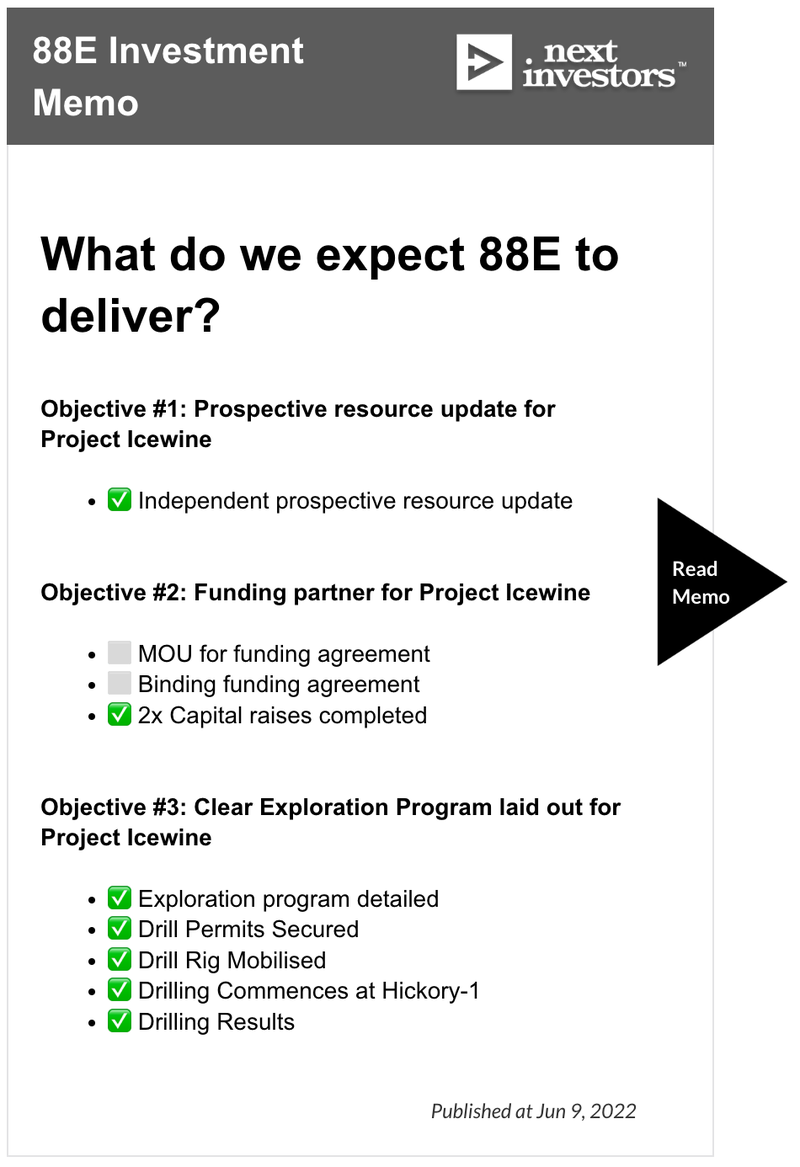

After yesterday’s announcement, 88E has completed all of the key objectives we set for the company as part of our second 88E Investment Memo (88E Memo #2).

Having completed drilling and with final net pay numbers announced, our focus is now on the flow testing program the company plans to run later this year/early 2024.

We will watch to see what comes from the detailed analysis the company is doing on the drilling data but we expect this to be largely procedural and more to do with the planning of the flow testing program.

We will be looking to launch our new 88E Investment Memo once 88E has put together a program of works for its upcoming flow testing program.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.