$31M ASX Small Cap Telco Posts $16.7M Annual Recurring

Last month we introduced award-winning telecommunications service provider Vonex Ltd (ASX:VN8) as our latest portfolio addition.

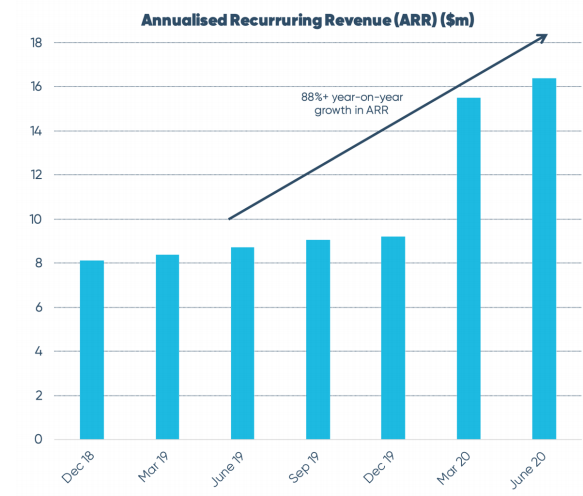

Part of our reasoning, was the impressive Annual Recurring Revenue (ARR) base that the company has been building in the in-demand telecommunications industry.

Recurring revenue, facilitated by the acquisition of 2SG, has provided Vonex with forward earnings predictability. The 2SG acquisition cannot be underestimated, having provided Vonex with substantial sales momentum.

A full year contribution in fiscal 2021 will see the company generate robust growth in the next 12 months, after 2SG negotiated an agreement to supply business grade mobile broadband to ASX 300 company, Data#3 (ASX: DTL).

Following the acquisition, Vonex has enjoyed 122% mobile broadband sales growth, 247% mobile voice sales growth and 53% NBN and 4G back sales growth.

Vonex is currently one of three technology companies in our long-term portfolio.

Our other two tech stocks also continue to perform well.

MyFiziq (ASX: MYQ) is currently up 750%, having been as high as 1200% since we first took a position, while our first tech long term portfolio company WhiteHawk (ASX: WHK) has a current return of 244%.

We are hoping for long term, sustainable price appreciation with VN8 as well.

As we alluded to in our last article, Vonex has delivered strong growth, generating predominantly recurring and sticky revenue.

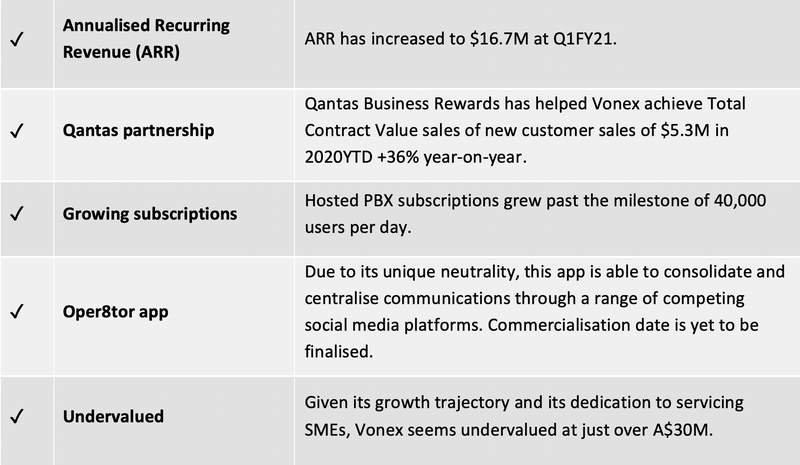

In fact, the revenue base and current market cap of circa $31M suggests substantial upside, particularly as it continues to develop, deliver and license advanced communications technologies.

ASX small cap telco peers such as Spirit Telecom Ltd (ASX: ST1) - $186.5M market cap, and Uniti Group (ASX: UWL) $656.8M, suggests there is tremendous growth potential here in VN8.

Whilst still in the telco space, VN8 is focused predominantly on the small to medium enterprise (SME) market, giving it a significant point of difference.

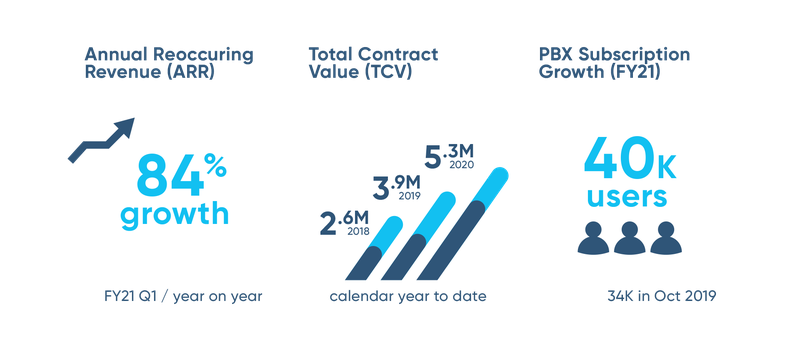

As such, the past 12 months have been a stand-out for Vonex and its successes this year are illustrated in its latest quarterly, with highlights including growth in wholesale customers and order value, with Mobile Broadband orders up 122%, Mobile Voice up 247% and NBN with 4G backup up 53% year-on-year in Q1 FY21. One further highlight is the Total Contract Value (TCV) of new customer sales of $5.3million in 2020 YTD, up 36% year-on-year.

September quarter continues VN8’s momentum from June

The June quarter delivered Vonex (ASX:VN8) the strongest operational and financial quarter the company has delivered since listing on the ASX. One of the key takeaways was the 84% increase in annualised recurring revenue during fiscal 2020. At that stage this number stood at $16.4 million.

It has been an impressive growth trajectory, demonstrating Vonex’s stability and resilience.

The highlights have continued in the September quarter.

- Unaudited sales revenue of $4.44 million for the quarter increased by 84% compared to the prior corresponding period (PcP) of $2.41 million

- Annualised Recurring Revenue (ARR) grew by 84% year on year to $16.7 million

- Cash receipts from customers totalled $4.22 million, an increase of 68% compared to PcP of $2.51 million

- Cash at end of quarter totalled $4.02 million

Further highlights include:

Divisional successes

Vonex is split into two divisions: Vonex Wholesale and Vonex Telecom.

The wholesale division continues to scale, with the company securing new customers and delivering strong growth in revenue.

The aforementioned integration of 2SG Wholesale in 2H of FY20 into the company, saw Vonex expand its offering to small and medium enterprise (SME) customers by developing and delivering new products.

This was reflected in sales growth across the Wholesale product suite.

The numbers are excellent.

Mobile Broadband orders are up +122% year-on-year for the quarter, Mobile Voice +247% and NBN with 4G backup +53% over the same period.

The acquisition has enabled Vonex to capture cross-selling opportunities identified prior to the 2SG Wholesale integration.

Expansion will continue in FY21, following a commitment from Optus to open up its 5G network to Vonex via 2SG. Vonex is finalising launch preparations for internet services that utilise 5G speeds powered by Optus.

2SG’s dealings with ASX300 company, Data#3 Ltd (ASX: DTL) is also translating into customer wins.

As for retail operations, Vonex Telecom, this too continues to expand.

Vonex has achieved Total Contract Value of new customer sales YTD in 2020 of $5.3 million, an increase of 36% year-on-year.

SME user numbers continue to grow, driven by its partnership with Qantas Business Rewards (QBR) and Vonex's status as Qantas' preferred business-focused telco provider.

This is now a long-standing partnership which Finfeed first covered in September 2019:

QBR is marketing Vonex to its base of more than 250,000 SME members who use QBR's exclusive offers to save money, earn Qantas points and plan ahead for the growth of their business.

With signs Australia’s borders will reopen before Christmas, this could prove even more beneficial for Vonex.

Also, of significance is the more than 40,800 registered active users who now use ONdesk, Vonex's Private Branch Exchange cloud-based phone service.

Active PBX users are a key indicator of Vonex's business development progress as it looks to penetrate the multibillion-dollar Australian market for telco services to SMEs.

The final word

In an industry with a reputation for poor customer service, Vonex stands out.

The company has a high satisfaction rating among SME customers, and has only had zero complaints in Q1FY21, compared with an industry average which increased by 28%.

We believe there is significant upside in the Vonex story as it continues to win friends and influence SMEs.

We are not the only ones.

Analyst, PAC Partners has been on board the Vonex train all year, having set its price target at 28 cents a few months ago.

It is currently sitting at 16 cents.

On current trend, this next financial year could be a game changer for the company.

If numbers continue to rise, so could its share price.

We will continue to watch the Vonex story unfold as we believe our portfolio holding will be vindicated in the long-term.

The Vonex investment case:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.