A Beginners Guide to Investing in ASX Listed Small Cap Stocks

Published 07-JUN-2022 12:52 P.M.

|

19 minute read

We have been investing in the small cap market for 20+ years. We have made money, lost money and learned many hard lessons along the way.

We use our experience to curate a small cap stock portfolio of high potential investments, a few of which have returned +1000% gains over our journey.

Today, we want to share with you the most important lessons we have learned throughout our investing journey, the common mistakes to avoid and tricks of the trade to help you improve your investing acumen.

Here is how we will break it down:

- Be an investor, not a trader.

- Write an investment memo

- Diversify your stock portfolio

- Create a selling strategy, and stick to it

- Avoid the hype

- Don’t fall in love with your stocks

- Keep track of your company’s cash balance

- Understand your internal psychology

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

1. Be an investor, not a trader

People often get the terms investor and trader mixed up.

Investors have thoroughly analysed a company and are prepared to hold onto the investment for the long term, patiently waiting for the company to execute on its business strategy over time.

Whereas traders buy into a stock purely for the purpose of short-term price action.

Traders buy based on price action and hype surrounding a stock, and often the company’s business plan is secondary.

Being a small cap investor means you’re not a trader - we think of ourselves as investors.

Being an investor involves following a disciplined due diligence process, understanding all aspects of the business, assessing the skills and abilities of the management team, and most importantly....waiting.

Waiting for the business to execute its strategy.

Investing takes time, years even, which means that it’s important to understand the company’s business strategy and the various risks that it will need to overcome BEFORE investing.

Being a long term investor is hard. If the share-price falls soon after the stocks bought, it can be difficult to hold on.

Even if you had the best intentions of being an investor, you’ll often become a trader, pulling your money out too early before the company has had a chance to execute on its business plan.

The ‘90-90-90 Rule’ highlights this point. It’s an unsaid rule in the broking world that 90% of traders lose 90% of their capital within the first 90 days of account opening.

We are not traders, we are investors. Those that wait for their businesses to execute the plan over the long term.

We don’t get caught up in the day-to-day share price swings in the market, but get excited about the company ticking off milestones and objectives that grow the underlying value of the business.

Trading is best reserved for market participants who have had significant experience reading charts, algorithms to support and are well aware of the risks involved.

Being an investor is about assessing a company’s potential, having a plan and sticking to it.

2. Create an investment memo

Simply put, there is no substitute for spending time understanding a stock.

Before we make any investment decision (to buy or NOT to buy a stock) we write an Investment Memo about that company.

Many rookies will buy into a stock without any clear research that backs up their investment decision, then wonder why the stock trades sideways or down shortly after that investment.

When this happens, more often than not, that rookie did not have a plan.

Today we will share with you our tried and true investing methodology. This includes writing an investment memo for each company and answering some key questions:

What does the company do?

First, you want to objectively assess what the goal of the business is. You can usually find this in company presentations or on the company website.

If it is a junior explorer, try to understand what the company is exploring for. If the business is selling a product, what are they selling and who are the customers? Where is the company located and how will the company eventually ‘make money’?

Try to keep this description short, like you’re explaining the company to your parents.

What is the Macro Theme behind the company?

All companies will have macro-economic factors that affect the supply or demand of their end products or services.

Try to articulate this macro-theme and whether your investment will benefit from the growing (or anticipated to grow) mainstream news coverage of the product, service or industry that your company operates.

An example of a strong macro-theme in 2022 is the growing demand for Energy Transition Metals for Electric Vehicles, i.e. lithium. This has resulted in many lithium exploration and production companies benefitting, with share prices appreciating strongly.

Why do you like the company as an investment?

This may seem obvious, but often rookie investors can’t independently articulate why they like an investment, outside of “it was recommended by my friend” or “strong online chatter indicates that this thing will moon”.

It’s important to come up with your own reasons for liking a company.

We often like companies because of:

- Excellent management

- A strong macro-theme

- We like the project or product

- Tight capital structure

- And a multitude of other reasons

Do the research, pick a few reasons why you like the company and write them down so that you can check back in six months time to see if the reasons still hold true.

What do you want to see the company achieve in the next 12 months?

This is probably the most important part of the Investment Memo - setting the objectives and holding the company to account.

An objective is a broad statement or goal that you want to see the company achieve by a certain timeframe (for example):

- Drill main target by Q1 2023

- Complete Phase III Clinical trial by H2 2023

- Secure 3 new customer contracts by the end of 2022

Along the way, there will be a lot of milestones and updates that the company will provide on the way to achieving the main goal on time. We break these down into milestones:

Objective “Drill main target by Q1 2023”.

Milestones:

- Identify priority drill targets with EM surveys

- Secure permitting and heritage agreements

- Secure drilling contractor

- Commence drilling

- Drilling results update - visual core samples

- Assay results

Setting these milestones and objectives helps to focus your attention on what is most important for the business. It allows you to objectively assess the investment, whether they DID or DID NOT meet the objective within the stated time frame.

The goal is to pick 2-3 key objectives, with 4-5 milestones under each objective. If it is too difficult to find those milestones, setting the broad objectives is okay as well.

What risks does the company face?

This is the last section of an investment memo.

This is where you can brainstorm the risks and challenges that the company may face while trying to reach its objective.

For example, a junior explorer may face the risk of not finding what it is looking for. Delays from permitting and approvals are big risks in the small cap space.

If these risks materialise, and compound with multiple risks and delays affecting the company, the share price will often suffer.

Therefore, it is important to understand the risks of the investment, what the company is doing to mitigate these risks and whether the investment thesis is maintained through multiple risks materialising.

We have set up a template for you to create your own Investment Memo:

CLICK HERE TO DOWNLOAD OUR INVESTMENT MEMO TEMPLATE

This is just ONE way in which we analyse companies. There are lots of other factors that go into an investment decision, but we have found that this is the best way to analyse lots of investments at scale.

3. Diversify your stock portfolio

Small cap stocks are highly speculative investments and can experience significant volatility resulting in large losses very quickly. We think that it is a HUGE mistake to have a large portion of your portfolio invested in a single stock.

How much is a large portion?

We think any stock that makes up more than 20% is a risky holding that should be further looked into.

Some people may have their ENTIRE wealth invested in one stock. Even worse, some use credit to fund speculative purchases.

This is an almost-certain recipe for disaster.

Small cap stocks are inherently high-risk, high-reward, which means that they have the potential to go up significant multiples. But if things go wrong, and they do, an investment could go to zero.

In the end, losses are an inevitable aspect of investing in stocks of any size or calibre, they are a part of the learning process.

We mitigate our risk by placing multiple ‘bets’ on different stocks.

We target multiple companies in different industries and at different stages of the company life cycle so that if one of the company’s value increases significantly, it can outweigh the losses of other stocks in the portfolio.

It’s important when investing in high risk small caps to have enough horses in the race so that if one of them takes off, the portfolio makes money overall.

4. Create a selling strategy, and stick to it

So you’ve decided to make your first investment in a stock. But before you do, it's important to come up with an exit strategy.

An exit strategy in the case the stock goes up OR if it goes down.

If the stock goes up

When the stock you have invested in rerates higher as the company executes its plan, you may want to have a strategy to de-risk your position.

We use a method called “Free Carrying”.

To free carry a stock means to sell your initial investment dollar amount and leave the profit invested for the long term.

By ‘free carrying’ a stock, you can reduce the downside risk of losing your initial capital by safely pulling it out once the stock has appreciated in price.

Small cap investing is volatile and market conditions can send share prices falling. So by not ‘banking the wins’ and ‘free carrying’ your investment, you may miss out on an opportunity to lock in profit from your hard work.

Internally, we call this process “slicing the cheese”, taking small amounts of profit out of the investment once it has a significant share price re-rate.

A good rule of thumb is that if the value of one single stock position is keeping you up at night, you may have invested too much and it might be time to sell some of that position.

If the stock goes down

Just like when a stock goes up, it is important to have a disciplined exit strategy when the stock price falls.

Despite how good the company sounded when you initially invested, it may have failed to execute on its business plan, market conditions may have changed, or the company’s risks may have materialised - degrading the value of your stock.

At this point, we like to reassess the investment and consult the memo that we wrote when we initially invested.

Ask yourself: Is the company following the plan it claimed it would? Do I still like the prospects of the company? Does the investment still fit my risk appetite? Were the risks within its control and it just got unlucky? Can I still trust this company to execute on its business plan going forward?

Answering these questions will help you determine whether you still want to remain invested in the company.

If you do decide to stick it out, it may be worth re-writing the investment memo, if circumstances have materially changed.

If the company is not meeting its objectives and your initial investment thesis has materially changed, it may be best to look for other investment opportunities.

Remember, a large part of investing is about managing risk.

When you are at a profit on a stock, it is best to take profits and free-carry to reduce risk.

When the stock is suffering and the company is not executing its intended plan, it is best to objectively reassess the business by reviewing your investment memo.

Then you decide to remain invested or decide to exit the stock.

All in all, it is of utmost importance to have an exit strategy BEFORE you invest in a stock.

5. Avoid the hype

Hype around a certain stock or company is one of, if not the greatest risk a rookie small caps investor is faced with.

It is often easy to jump on the bandwagon with others hyping the newest exciting stock that has been trending upwards after a positive announcement.

All of this hype is great if you know how to react to it and not let it impact the rational investor in you, just remember not to get caught up in it.

Firstly, stick to your own research. Use online chatter only to judge the sentiment of other holders and find valuable leads to research. Ignore what people on the internet tell you to do, and back your own judgement.

Remember, DO NOT let the chatter and hype directly guide your investment decisions without conducting adequate research.

Secondly, be mindful of what is happening. Often chat rooms can erupt in overly positive hype - misleading the inexperienced investor into the impression that the stock price is about to explode and they will be the only one to miss out.

This creates a very dangerous form of FOMO (Fear Of Missing Out), often leading rookie investors to buy the stock hastily without creating a well researched Investment Memo.

Having an Investment Memo before investing in a company protects you from being carried away by the unnecessary hype around a stock that you don’t own.

On the flip side, if you already own a stock that becomes hyped up it can be a big boon.

We find that the best strategy in this case is to go against the herd and sell some at a profit during the hysteria.

Generally, the price will creep back down after the hypers move onto the next hot stock - this can provide an excellent opportunity to then buy back in if you truly believe in the company and are in it for the long term.

It can be hard to sell when all of a chat room is in hysterics about a huge imminent price rise, you may often be waiting for the stock to keep moving up that extra 5% or 10%.

But learn to recognise ‘hype’ for what it is and the best strategy is to average down your position during such hysteria.

An important thing to look out for when monitoring chat rooms is an AFSL.

In chat rooms and on Social Media, you see internet posters recommending certain stocks to buy. However, in Australia it is illegal to provide such financial advice UNLESS you hold an Australian Financial Services Licence (AFSL) or are a Corporate Authorised Representative (CAR) of one.

In the end, hype around a stock can have its negatives and positives (depending on whether you hold the stock).

However, it is your responsibility to not get carried away with such hype and make brash investment decisions as a result.

This is why we place such importance on an Investment Memo, as it keeps us focused on the company, and not the hype.

6. Don’t fall “in love” with your stocks

Investments are there to make you money, not to make you fall in love.

Falling ‘in love’ with a stock or a company’s resource often leads to irrational decision making.

This is why we create investment memos and regularly reassess our investments, as it provides an objective benchmark to measure a company’s progress.

Your most loved stock may be underperforming, but you still think it’s the best thing in the world...at this time, the best thing to do is reassess.

Reassess whether the objectives you have listed in your investment memo are on-track to being achieved. If the milestones and objectives are not being achieved, ask yourself, do I still like the company? Should I remain invested?

After you reassess your most loved stock, you may realise that the company's goals have changed, or maybe the management has changed. You may not like the new management and the plan it has for the company is not what you invested for. Consider the investment on its merits at that point in time - if you were not already invested, would you decide to invest today?

This is an investment and must be treated ruthlessly. You need to expand your horizons and look objectively at some other stocks (a wide range of companies preferably) and stop treating stocks like your first high school crush.

A healthy dose of scepticism goes a long way in this game.

A good sign that you are in love with your stock is to analyse how you feel when someone criticises the company.

If you get angry or feel threatened, you’re probably not evaluating the company objectively on its merits.

If you are confident in your own research, it shouldn’t matter what other people say.

Remember, an investment memo is your best friend when trying to assess your investments. It helps keep you focused, objective and rational when making decisions.

7. Keep track of your company’s cash balance

One of the biggest challenges that small cap stocks face is funding.

Companies need (your) cash to operate, they need cash to drill, to sell their product or service, to pay staff and to develop technology, and sometimes they will need cash for a new project or venture.

Cash is the backbone of any small cap business, and without bringing in revenue by having a reliable product to sell, small cap companies typically get cash by issuing shares to the market.

Investors need to be aware that these “capital raises” can keep the share price down for a period of time, as the market churns through all the shares issued and the existing holdings are diluted.

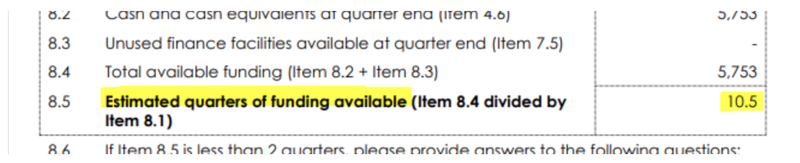

A handy hint to spot an upcoming cap raise - if you want to see if a company is likely to raise cash soon, just go to their most recent quarterly “Appendix 4C” announcement and scroll to section 8 and find the line item titled “estimated quarters of funding available” and you will see how many quarters of funding management thinks it has left based on its current cash burn:

If the number is less than 2 quarters... expect a cap raise soon.

There are other ways for companies to raise cash however, mainly through debt funding.

When a company uses debt to raise capital, it works in a similar way to a loan.

The company will need to repay the debt to the entity that lent the funds (often a bank), with an interest component included.

Typically, businesses that raise capital using debt will have cash flows that can be used to pay back the loans.

You will rarely see speculative mining exploration companies, or early stage biotech companies take out large amounts of debt to fund operations.

This is because such speculative companies likely don’t have the stable cash flows to make the regular loan repayment.

Raising capital through debt can have its benefits, as it doesn’t dilute the stock of the company as no new shares are being issued.

However, the debt must be repaid in a certain time frame with interest. Even for cash flow positive businesses, this can suppress the company’s growth as cash flows are used to repay the loan rather than grow and develop the business.

As an investor, it is important that you keep track of how much cash a company holds, or if it has conducted any recent capital raisings.

It’s usually best to avoid investing in stocks that are low on cash and are about to conduct a capital raise.

This is because it will mean imminent dilution of your shareholdings in the company. In such a case, it is best to wait for the capital raising to be completed and then buy into the stock.

8. Understand your own internal psychology

The final lesson that we want to teach is to do with understanding your own internal psychology when investing.

Being aware of your own behaviour and its impact on decision making can allow you to be wary of potential mistakes.

Having FOMO when you see a chat room hyping up a certain stock can be an example of an overly emotional psychology. It is important to recognise this and avoid it at all costs.

Some individuals may also feel immense stress when their investments are experiencing stagnation and losses. You may even feel it is impacting your daily behaviour such as sleep and eating habits.

If this is the case, you are too invested in the stock.

You should assess whether you are emotionally ready to put money on the line and believe strongly in a business’s potential - no matter if it fails or succeeds in the end.

But remember, only invest money you are prepared to lose.

To do this, you must first evaluate your own internal psychology. Through this evaluation, you will recognise whether your internal psychology is in the right zone to participate in a risky investment.

Remember that it is very important to control irrational or emotional temptations when it comes to stocks.

Sticking to your investment memo is what we find as the best way to remain objective when investing. If a business fails to meet your investment thesis and objectives, it must be reassessed objectively.

We will leave you with the following quote just to showcase how powerful your internal psychology can be:

“Doing well with investments has little to do with how smart you are, and a lot to do with how you behave” - Morgan Housel, Author of The Psychology of Money

We hope that these 8 lessons will help you in your investing journey.

Best of luck.

Next Investors.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.