What could commercialisation actually look like for DXB?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,525,000 DXB shares and 625,000 DXB options at the time of publication. The Company has been engaged by DXB to share our commentary on the progress of our Investment in DXB over time.

US$9,900 per month.

US$120,000 per year. For one patient alone.

This is what insurance companies are willing to pay for the treatment of rare kidney diseases.

While those dollar figures sound like a lot for one patient, it is much cheaper than the alternatives like dialysis or a kidney transplant, and insurance companies know this.

Our Investment Dimerix (ASX:DXB) is currently in a Phase 3 clinical trial for FSGS, a rare kidney disease where a huge number of patients currently wind up on dialysis or need a kidney transplant.

Those numbers above are the price set for a similar drug that has just received accelerated FDA approval for an adjacent rare kidney disease, and provide a good idea of what DXB may be able to achieve when it reaches commercialisation stage.

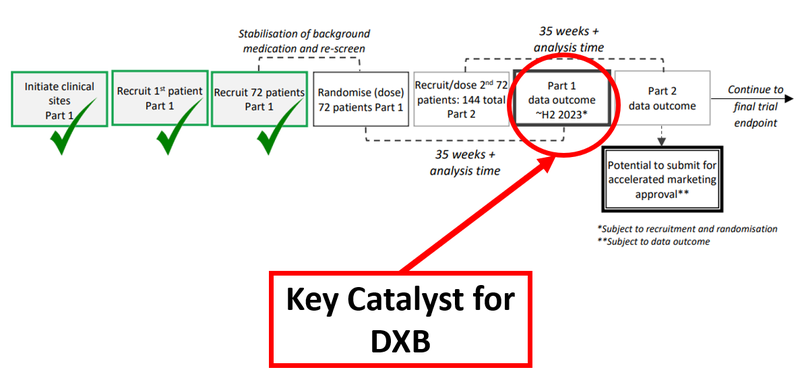

“Interim analysis” results for the first 72 patients in DXB’s Phase 3 trial for FSGS are due in the second half of this year - we think likely in Q3.

This is a big catalyst for DXB and will have a binary result . Basically, a committee that has access to data on the trial says, “yes keep going, DXB’s treatment is working and safe” or a “no stop, it isn’t working or isn’t safe”.

A “yes” to continue the clinical trial, significantly de-risk the project.

DXB is targeting ~40,000 patients in the US and ~220,000 across 7 major markets, which is small in the context of other major diseases that impact millions.

For this reason, treatments such as DXB’s are designated “orphan” drugs by the FDA.

Orphan drug designation encourages companies to research and commercialise treatments for rare diseases, via various financial incentives and an accelerated process with the FDA.

Ultimately, orphan drugs command more expensive pricing, which insurance companies are prepared to pay.

Two weeks ago another company, Travere, received accelerated FDA approval for a drug to treat an adjacent rare kidney disease. The company set the price point at US$120,000 per year, per patient.

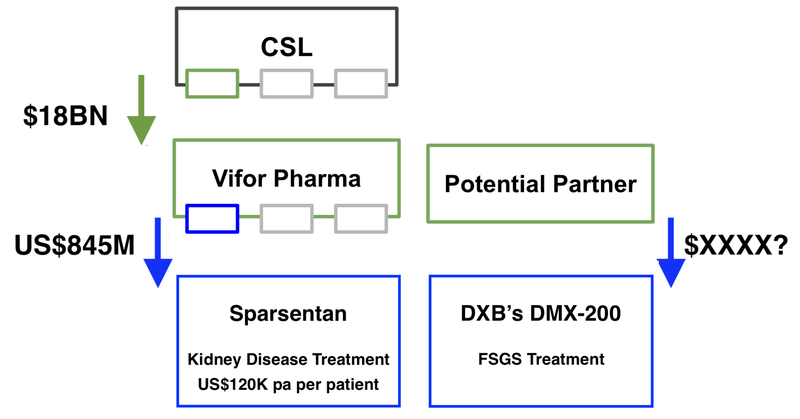

This follows on from that company’s licensing deal to sell the kidney treatment for up to US$845M (based on sales based milestones) to Vifor Pharma.

That licensing deal may have contributed to Aussie biotech goliath CSL sweeping in and acquiring Vifor’s portfolio of kidney treatments in an $18BN transaction last year.

We think that the price point of US$120,000 per patient, per annum, gives us a good insight into what DXB's treatment could be worth - if it proves to be effective.

The licensing deal also gives DXB Investors, such as ourselves, an indication of the value of its kidney treatment to a potential partner (up to US$845M)... if it has a successful clinical trial and the drug gets to market.

We think that IF DXB’s clinical trials are successful, DXB could command a similar price point and achieve a deal of similar size or better.

This is the upside in DXB - which is currently capped at $35M and is rapidly approaching a valuation inflection point - with the release of interim analysis results for its Phase 3 trial in a few months time.

Note that sparsenten has been approved by FDA (at the accelerated approval point for an orphan drug), which means that it is significantly more de-risked than DXB’s treatment. Just because sparsenten had a successful clinical trial doesn’t mean that the same will happen to DXB.

The company’s deal with Vifor was also done in September 2021 when market sentiment towards biotech companies was more positive. So it’s worth noting that DXB’s ability to make a similar deal will also depend on the biotech market landscape at the time.

We hope that a partnership/licensing deal could be on the horizon for DXB (especially if the Phase 3 results are a success), with CEO Nina Webster doing plenty of miles in the air to meet potential partners, attending major biotech conferences in the US and Europe in recent months.

After nearly two years holding DXB - this is a critical phase for the company.

There’s now a big catalyst approaching, and we know more clearly what a potential deal could look like...

As we mentioned above, DXB’s treatment has orphan drug status with the US FDA, meaning that it is eligible for accelerated approvals and commands orphan drug pricing.

Drugs like DXB’s are often cheaper than the alternative treatment like a kidney transplant or dialysis which can cost hundreds of thousands of dollars more.

This means that the ultimate payer, the insurance companies, are amenable to premium pricing for the drugs.

Driven by premium orphan drug pricing, the total global market for FSGS was recently valued at US$12.6BN.

DXB had previously placed average orphan drug pricing at US$7,000 a month and US$84,000 a year - sparsentan’s pricing is roughly ~40% higher than that.

In addition to the other rare kidney disease for which sparsentan received accelerated FDA approval, the drug is currently also in a Phase 3 trial (called DUPLEX) for the treatment of focal segmental glomerulosclerosis (FSGS).

Sparsentan works on a different part of the kidney destruction pathway to that of DXB’s treatment, which is why it is called a “complementary” drug, as we explain later in this note.

It’s also worth noting that sparsentan has a “black box” safety warning - this means patients require regular monitoring by doctors that prescribe the drug.

On the other hand, DXB’s treatment has a well established safety profile through multiple successful clinical trials.

That extra monitoring by doctors could inhibit sales of sparsentan, which could imply a greater deal value for DXB’s treatment.

All of this leads us to the following conclusion...

Given a US$845M licensing deal for Travere’s kidney treatment, and a price set for sparsentan at US$120,000 per year, there is a clear value comparison for DXB’s treatment.

Any potential deal DXB signs would hinge on the interim analysis results which DXB anticipates in Q3 2023, having completed the recruitment for the first part of its clinical trial in December last year.

In order to get to that interim analysis, DXB has opened 70 clinical trial sites in 11 countries to recruit 72 patients.

That’s roughly one site per patient - it’s a rare disease after all.

DXB is pressing ahead to recruit the full 144 patients needed to get accelerated FDA approval via the Part 2 data outcome, with the latest update last month noting that 96 patients were enrolled.

Below is the timeline of DXB’s Phase 3 trial with the crucial interim analysis results highlighted:

The interim trail analysis is the next big catalyst for us, and like with any catalyst, there’s a waiting period during which the market can do all sorts of things.

But waiting isn’t easy, and the market is clearly impatient with DXB, with the stock now trading at 11 cents and a market cap of ~$35M, having previously held steady in the ~15 cent share price range since May of last year.

We’ve held the large majority of our position since our Initial Investment in DXB at 20 cents and intend to continue to hold the majority into the interim analysis results.

As we’ve found out in recent months, opening 70 clinical trial sites in 11 countries isn’t cheap.

There is a big cost to delivering a Phase 3 clinical trial, but the rewards are big if successful, as shown by the Travere/Vifor deal.

Now that DXB’s Phase 3 clinical trial is underway, we hope that much of the upfront set-up costs are now behind the company, with the sites active and recruiting.

In terms of DXB’s current cash position, it held $5.7M at December 31st, and recently received a prepayment of ~$2.8M on its R&D tax incentive claim.

This amount accrues interest at the compounded rate of 1.17% per month, and is due on 30 September of this year.

We think it was the right choice to secure this non-dilutive funding now, and the maturity of that prepayment should come when the R&D grant funds are made available by the ATO, meaning DXB can pay back the advance it received.

We think DXB now has enough runway to make it to the interim analysis results - but it may also move to shore up the balance sheet ahead of the results too.

We hope that a partnership/licensing deal could be on the horizon, with DXB CEO Nina Webster recently attending major biotech conferences in the US and Europe.

With large numbers of potential partners gathered at these conferences we suspect that, behind the scenes, competitive tension around DXB’s FSGS treatment could be building.

We’re happy to wait as DXB works to secure the best deal possible for shareholders like ourselves, even if that means some short term share price pain.

As for that potential deal though...

It could be quite big, as we have highlighted above, and using sparsentan as a benchmark, we think our Big Bet for DXB is achievable.

Below is our Big Bet for DXB:

Our Big Bet

“DXB re-rates 10x by successfully commercialising its drug through Phase-III clinical trials”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our DXB Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We’ve been following DXB’s progress towards this Big Bet in our DXB Progress Tracker:

Benchmarking DXB’s FSGS treatment

Before delving deeper into how sparsentan represents a valuation benchmark for DXB’s FSGS treatment, we think it's important to establish that the two are not direct competitors in the market.

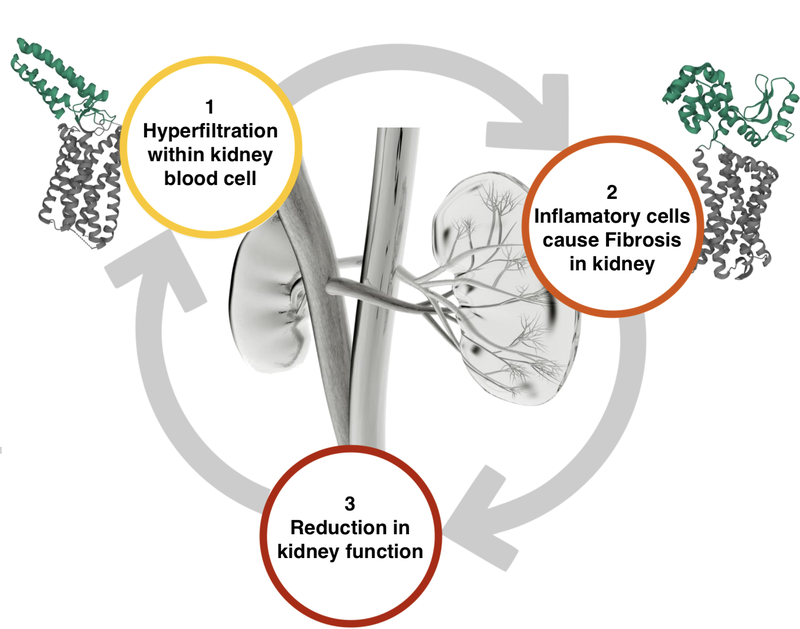

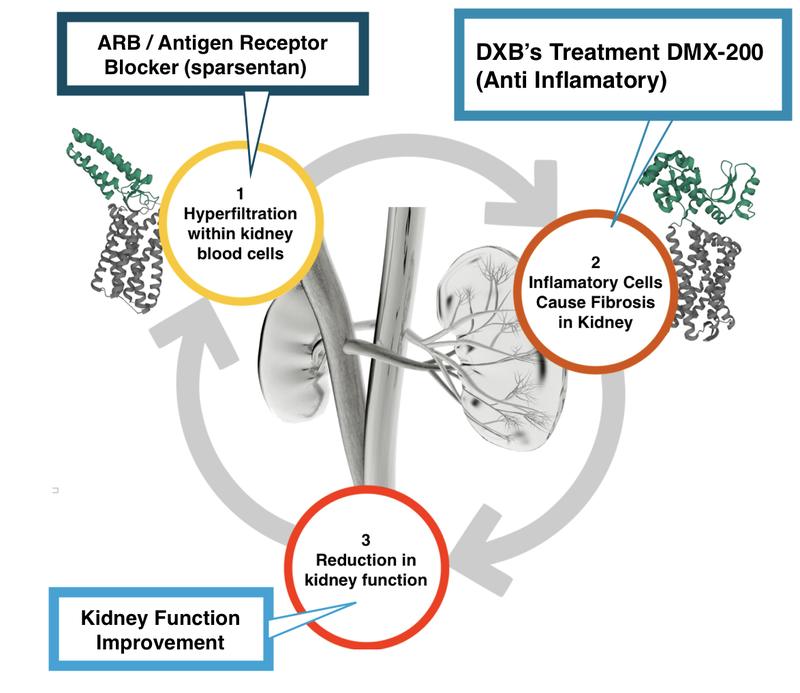

As we mentioned before, DXB's treatment is complementary to sparsentan. This is because they both work on different points on the kidney destruction pathway.

Here is what the kidney destruction pathway looks like for a patient with FSGS:

Here is what it (hopefully) will look like with DXB’s treatment in combination with an Antigen Receptor Blocker (ARB) like sparsentan:

Sparsentan was developed by Travere Therapeutics which was able to secure a long term licensing deal with Vifor Pharma with a value of up to US$845M.

That included an upfront payment of US$55 million, US$135 million in total regulatory and market access related milestone payments and up to US$655 million in total sales-based milestone payments.

Vifor was subsequently acquired by Aussie biotech giant CSL for a whopping $18.8BN in large part due to Vifor’s portfolio of kidney treatments.

Here’s quick rundown on what happened with sparsentan:

- The FDA granted accelerated approval to sparsentan, the first and only non-immunosuppressive therapy approved to treat IgA nephropathy (IgAN).

- IgAN is a rare kidney disorder that involves the buildup of immunoglobulin A (IgA), a protein that helps the body fight infections.

- The company plans to charge US$9,900 for a 30-day supply, or about US$120,000 a year. Travere estimates that there are 30,000 to 50,000 patients who could get the drug when it launches.

- Sparsentan is also in a Phase 3 trial for the treatment of focal segmental glomerulosclerosis (FSGS) - the trial is called DUPLEX.

- Sparsentan has toxicity warning particularly related to liver toxicity, foetal toxicity and certain drug interactions - “the company will have to run a risk evaluation and mitigation strategy, or REMS, as part of the approval. It will require doctors to go through special training, and patients to be enrolled in a monitoring program, in order for the drug to be prescribed.”

And here’s why this really matters to DXB:

- Pricing will be the same for sparsentan for both IgAN and FSGS, which provides a benchmark for DXB’s treatment pricing (and consequently partnership/licencing negotiations) pending successful interim analysis results.

- We note that similar to sparsentan, DXB’s treatment is targeting ~40,000 patients in the US alone and ~220,000 patients across 7 major markets.

- We think sparsentan’s approval is an important precedent for rare kidney disease orphan treatments - and DXB’s treatment could also benefit from the accelerated approval pathway.

- Comparatively with sparsentan, our view is that DXB’s DMX-200 has a well established safety profile.

- If sparsentan is approved for FSGS, the monitoring required for sparsentan could inhibit sales, which could imply a greater deal value for DXB’s treatment in the market.

In light of this deal, and as a result of the fact sparsentan is complementary, our main point today is as follows...

We think sparsentan could act as a benchmark for DXB’s pricing and potential deal value in negotiations with major pharmaceutical companies.

...should DXB’s Phase 3 study on DMX-200 go well, and the interim analysis results come back positive.

What’s next for DXB?

🔄 Completion of recruitment (144 patients)

We’re looking for additional patient recruitment updates on the 144 patients DXB needs to complete Part 2 of the trial which could unlock accelerated marketing approval. The latest update has placed the number at 96 enrolled patients as of 08 February 2023.

🔄 The big catalyst: interim analysis results (Part 1 data outcome)

Based on what we know about the timeline and structure of DXB’s Phase 3 trial, we anticipate the interim analysis results in Q3 2023.

The results in the interim analysis will come via the independent Data Safety Monitoring Board (DSMB) which will essentially determine if the trial should continue through to the final endpoint, as it has access to unblinded data from the trial.

The DSMB decision will be binary and a positive result we think would be a proxy for determining the efficacy of DXB's treatment - i.e. if it's getting results along a key metric for kidney function improvement then the DSMB will recommend the trial continue.

This is a binary result for DXB and as such we only have a bull and a bear case:

- Bull Case: Enough evidence to continue the trial

- Bear Case: Trial paused or stopped

What could go wrong?

Early stage biotech risk - A lot hinges on the effectiveness of DXB’s treatment as measured in the Phase 3 results. If DXB’s treatment is not sufficiently effective this could harm the potential deal value size.

Rare disease specific risk - As FSGS is a rare disease, DXB will have to continue recruiting to hit the necessary 144 patients for the Part 2 data outcome, which could be either difficult or expensive.

Commercialisation risk - DXB might not be able to secure a partnership/licensing deal, which would hurt the share price.

Funding risk - Our DXB Investment Memo from 2022 reflected DXB’s solid funding position at the time and funding risk could now materialise if a partnership/licensing deal is not struck or the continued funding of patient recruitment eats into the cash balance further and DXB has to tap the market for more cash.

Our DXB Investment Memo

In our DXB Investment Memo you’ll find:

- Key objectives for DXB

- Why we Invested in DXB

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.