Welcoming ASX: BPM to our Portfolio

Today’s new investment falls into our early stage exploration category - and we are searching for lead-zinc.

This is a high risk, high return investment, located near a recent giant discovery. It’s key drilling event is expected late in 2021 - so like we always do we are getting in early, well before the main event as we are patient investors and happy to wait.

We like this company because of its tiny $10M market cap and tight cap structure... into which they have just acquired an exploration project right next to one of the biggest metals discoveries in Australia this year.

Today we welcome the 20th addition to the Next Investors portfolio...

Introducing BPM Minerals (ASX:BPM)

$10M capped BPM has just announced the acquisition of projects near $440M lead-zinc discovery, one project is just 40km away along strike.

We will continue to update you on BPM’s progress over the coming months. In the meantime, here is a quick introduction:

A few weeks ago a company called Rumble Resources 8 bagged from 10c to a high of nearly 80c, after hitting not one, but two high grade lead-zinc drill results. Rumble has been hovering around 70c (a $440M market cap) for the last few weeks as it awaits more drilling results...

Today we have invested in BPM who now has exploration permits (granted and applied for) right near Rumble and will also commence looking for lead-zinc.

Now keep in mind, this is early stage exploration where our strategy is to invest early and wait for a price rise in the lead up to drilling and aim to free carry into the result.

Regular readers know that we like to hold a handful of early stage exploration plays in our long term portfolio - preferably near a previous giant discovery trying to emulate that success.

We are invested in PUR to copy $2.4 BN Chalice PGE-Ni-Cu discovery.

We are invested in GAL to copy $1.8 BN Sirius nickel discovery.

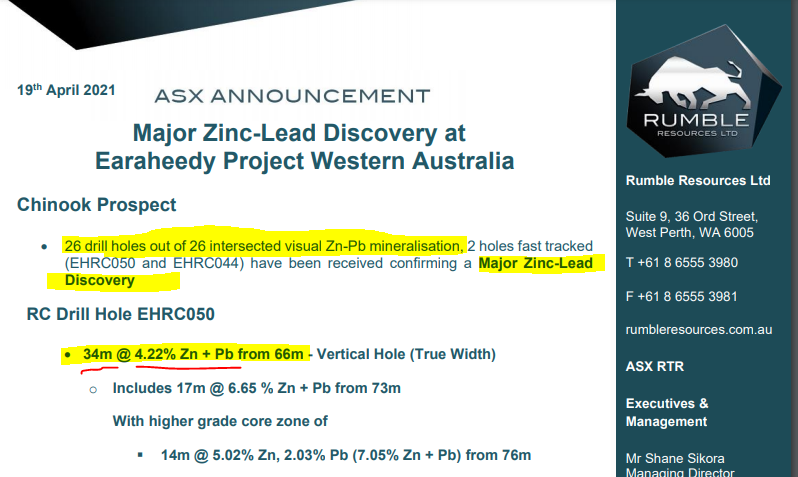

A quick background on Rumble’s $440M discovery a few weeks ago - we want $10M capped BPM to find a similar discovery.

Here is the now famous Rumble announcement:

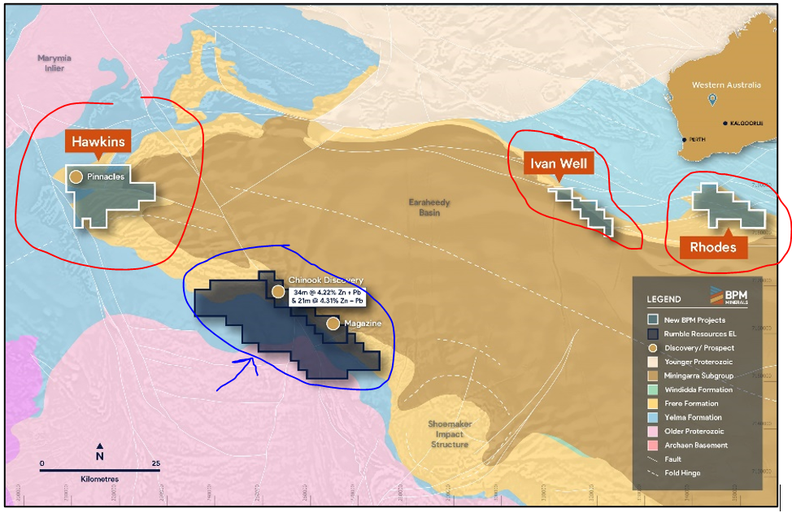

Here are the tenements and the location of BPM’s new projects relative to Rumble:

All of BPM’s new projects are the stratigraphic equivalent of Rumbles’ discovery - this is geologist speak for “all of BPM’s projects (circled in red) are on the exact same subdivisions of rock layers based on the age of the rock as Rumble’s big discovery (circled in blue).”

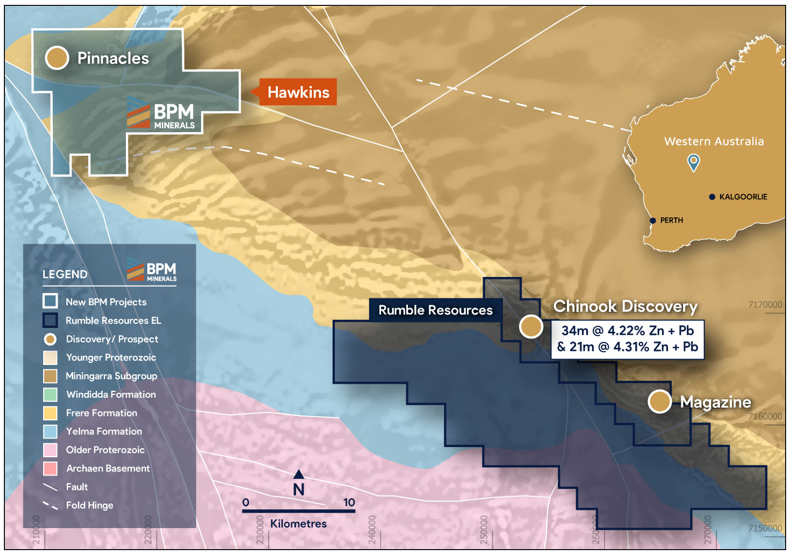

It’s early days, and there is some work to do, but at this stage, this is the BPM drill target that we like the most - its called Pinnacles and it sits in the Hawkins permit, on strike from the Rumble discovery:

Back Story: So how did BPM get this project near Rumble’s $440M discovery?

As soon as Rumble 8 bagged from its hit huge lead-zinc discovery in the Earaheedy Basin - every single bit of land around it was instantly snapped up by explorers hoping to find similar valuable ground.

ASX exploration aficionados remember the same thing that happened when Sirius made its $1.8BN discovery in the Fraser Range, and when Chalice made its $2.4BN PGE-Ni-CU discovery in the Julimar province (we are invested in both PUR and GAL too).

Smart geologists and prospectors snap up all the geologically similar land around the discovery - but may have to pay overs following a massive discovery nearby.

The luckier geologists are already positioned BEFORE the discovery, when no one is looking at the region.

A geologist we follow closely in the space, Brendan Borg, happened to already privately own two permits in the Earaheedy Basin, but was actually looking for iron ore and manganese at the time...

Turns out the two permits are the stratigraphic equivalent of the Rumble discovery - so obviously the search for lead-zinc on the permit has become a priority.

When you have an exploration permit you are allowed to explore for anything on that land, so switching focus from iron ore-manganese to lead-zinc is allowed.

Right place, right time? Lucky?

Yes - but we always welcome a bit of luck in the early stage exploration game.

So the next step was to get this project into a listed vehicle (BPM Minerals), re-interpret the historical data for lead-zinc and start exploration drilling as soon as possible.

We are glad to be on the ride and hope this string of luck can continue.

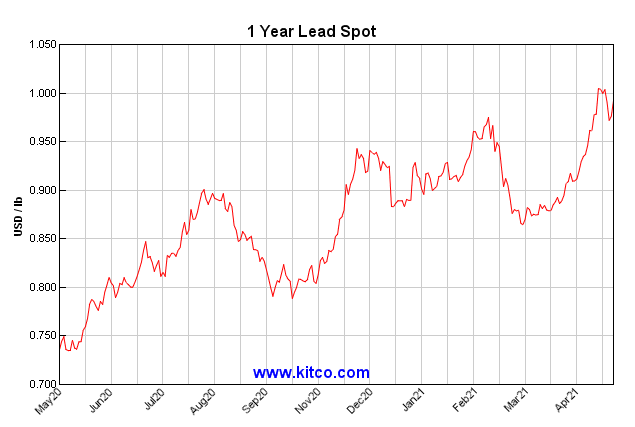

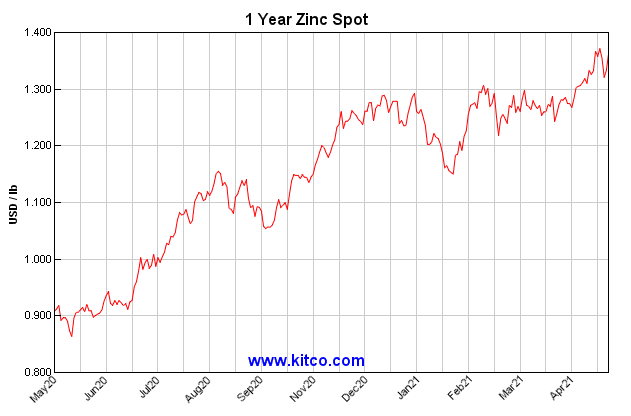

Why Lead-Zinc?

If Rumble’s rapid 8 bagging on a lead-zinc discovery isn't enough to get the blood flowing, here is why lead-zinc matters in the metals markets:

Lead is still widely used for car batteries, pigments, ammunition and cable sheathing.

Most zinc is used to galvanise other metals, such as iron, to prevent rusting.

All commodities seem to be surging up, so we think it’s a good time to be in a few explorers leveraged to discovery success - we are hoping for a “stronger for longer” commodities super cycle for a few years - now that would be grand for exploration investors.

Always keep in mind that commodity prices might come back down too and there could be no super cycle - which wouldn’t be fun.

Our Investment Plan for BPM

Our plan is broadly the same for all of our early stage explorers.

Just like we did with 88 Energy, we invest early, patiently hold in the lead up to drilling, free carry and take some profit before the drill and hold a significant position for drilling results.

A more detailed investment plan in our deep dive analysis in the coming weeks.

What happens next?

Here is what we are watching out for at our favourite drill target, Pinnacles at the Hawkins Permit:

BONUS: What else does BPM have to keep us entertained till lead-zinc drilling at Hawkins?

Quite a lot actually...

We have primarily invested for the drilling of Pinnacles at Hawkins and the other lead zinc projects - but BPM has other really interesting assets - we will give you a deeper dive on those in our in depth analysis in the coming weeks.

In summary, here are the other assets BPM has:

- Nepean Nickel Project - aircore drilling done, MLEM surveys to come

- Santy Gold - 17 priority gold, nickel-copper and base metal drill targets

- Claw project - Gold, Silver, Zinc, Copper and lead. Early and yet to be explored.

Our main reasons for investing in BPM is to emulate Rumble’s $440M discovery with lead zinc drilling, holding patiently for BPM’s drilling event in late 2021.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.