VN8 grows to $51M Annual Recurring Revenue with Latest Acquisition

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,273,182 VN8 shares at the time of publishing this article. The Company has been engaged by VN8 to share our commentary on the progress of our Investment in VN8 over time.

We Invested in emerging telco Vonex (ASX:VN8) to see it aggressively grow by making acquisitions with the goal of ultimately being acquired itself by a major telco.

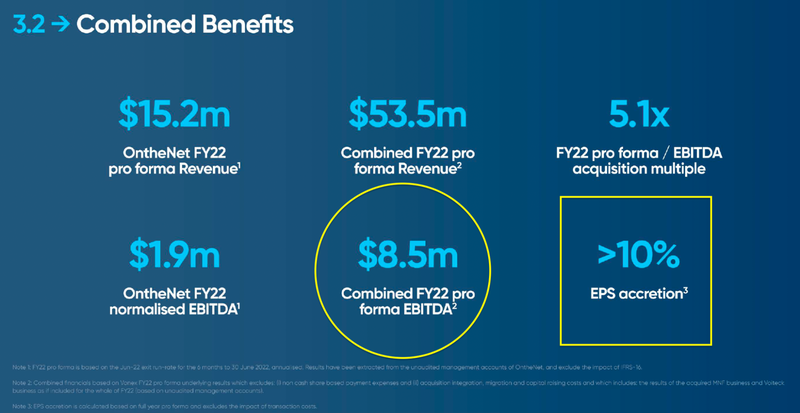

Today, VN8 announced an agreement to acquire Queensland based telco OntheNet, adding ~$15M in recurring revenue and ~$2M in EBITDA.

This acquisition grows VN8’s annual recurring revenue to ~$51M and underlying EBITDA to ~$8.5M (on a pro forma basis).

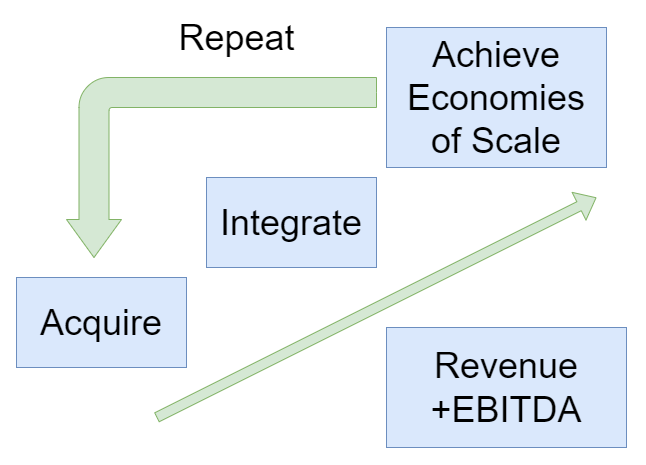

VN8 is following the tried and tested telco consolidation strategy to growth, driving revenue through: acquisition, integration and achieving economies of scale.

This was the strategy followed by telco major Uniti Group - which recently sold for $3.6BN, only four years after its ASX listing for just $32M - a nice win for long term shareholders.

Since we first Invested in VN8 three years ago, the company has made four strategic acquisitions, primarily funded by non-dilutive debt facilities, which are progressively being repaid through profits generated from the acquired assets.

Despite the revenue growth, solid EBITDA and acquisitions being primarily funded by, VN8 has been trading sideways or down slowly in line with the broader market for the last 18 months.

Today VN8 has a $25.3M market cap, which is less than several of its peers in the space:

- Superloop - $316M

- Pentanet - $87M

- Swoop Holdings - $76M

- Spirit Technology Solutions - $43M

Of course in any peer comparisons we do need to take into account a company’s debt and cash. According to VN8’s latest presentation, VN8 has pro forma $22.5M debt and $2.9M cash - which gives the company an enterprise value of ~ $45M.

We think that today’s acquisition positions VN8 well to post consecutive years of strong earnings and cash flow growth, while improving VN8’s product offering and cross selling opportunities.

Our Big Bet

VN8 grows to a size that attracts a takeover bid from a larger telco (at multiples of our Initial Entry Price) by acquiring and consolidating smaller telco businesses.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our VN8 Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

In the land of telcos, it is very much a case of eat or be eaten.

Over 83% of ASX listed telcos with market caps between $15M - $500M have been acquired since 2010.

This isn’t slowing down either, with M&A (mergers and acquisitions) activity in the sector having increased over the past five years, topping $51.5BN last year.

The recent example of this is Uniti Group going from a $32M small cap at its IPO in 2019, accelerating its growth via acquiring several businesses, before becoming a $3.6BN takeover meal for NZ’s Morrison & Co in August 2022.

Our ~$25M-capped VN8 (estimated post acquisition EV of ~$45M) has very much been following this same strategy since listing in 2018, having acquired four significant telco businesses over that span.

With that in mind, let’s take a look at the acquisition today.

A closer look at the latest acquisition

Today, VN8 added another acquisition to its portfolio - OntheNet.

OntheNet is a Queensland based telco that provides data network, voice and hosting/colocation services primarily to SMEs (small and medium enterprises).

VN8’s new acquisition delivered FY22 pro forma revenue of $15.2M and pro forma EBITDA of $1.9M.

What we like about the transaction is that it is “accretive” to VN8’s key financial metrics, including earnings per share (EPS), EBITDA and free-cash flow (FCF) on a full year pro forma basis.

Quick translation - VN8 is getting out the "credit card" to buy this company, but the cashflow benefits are immediate, and will help fund the repayments.

On a FY22 pro forma basis, adding this business to VN8 would deliver $52.4M of revenue and $8.5M of underlying EBITDA.

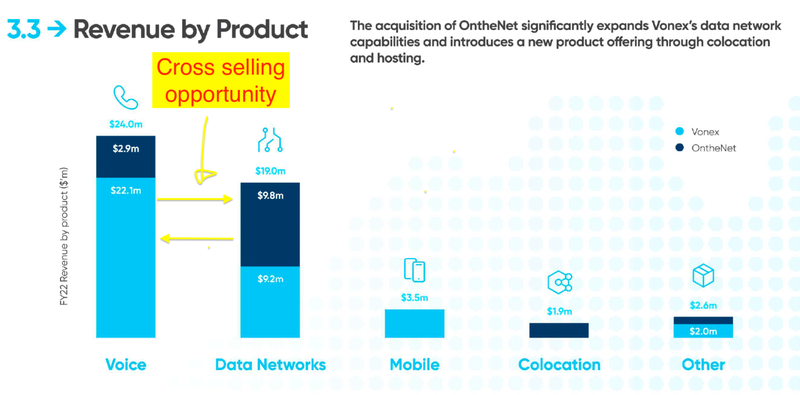

OntheNet provides a new product suite for VN8, adding data network services to the mix, which broadens VN8’s revenue sources.

The immediate impact of the acquisition is that VN8 expands its customer base by adding OntheNet’s customers to its own.

The bigger play is that VN8 can also offer its own current product suite such as PBX-hosted telco services to OntheNet’s customers... and vice versa.

If VN8 can sell OntheNet’s products to its existing customer base, it can grow its revenues per customer at the same time as increasing customer numbers.

This should better place VN8 to post consecutive EBITDA and cashflow positive financial years.

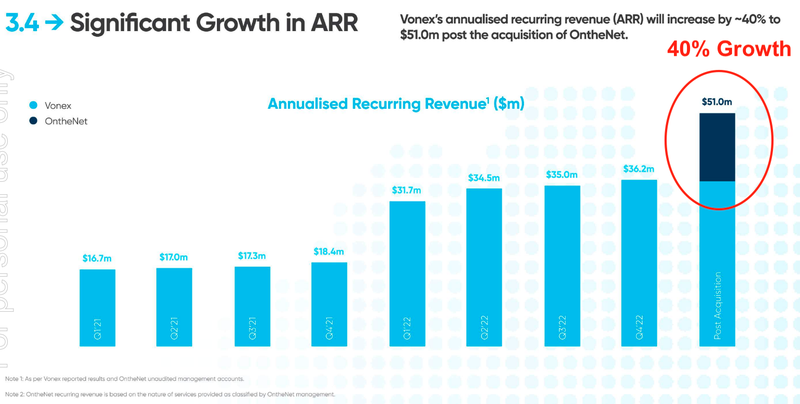

A key metric we track is Annual Recurring Revenue (ARR), which is essentially the amount of revenue expected to repeat annually.

ARR can be considered an indicator of future revenues, as there is quite some confidence in these revenues repeating.

With ~97% of OntheNet’s revenue being recurring in nature, VN8 expects a 40% increase in ARR to ~$51.0 million following this acquisition.

How will VN8 pay for the acquisition?

VN8 will pay $9.6M, with $7.7M in cash and $1.9M in escrowed shares, contingent upon customer related metrics in the 12 months post completion.

VN8 has decided to primarily fund this transaction out of debt and future cash flows, providing minimal dilution for existing VN8 shareholders.

VN8 made its final $833,000 monthly debt repayment on 2 August 2022 to Symbio (formerly MNF Group) as part of last year’s MNF Direct Business acquisition.

That leaves $14.5M of its Longreach debt facility tapped, of which VN8 pays off ~$500k each quarter. With the new acquisition, $8M of further debt has been added to the facility.

We commented in our previous note that making that final MNF Direct acquisition debt repayment would free up significant cash flow of around $10M annually for further acquisitions and growth opportunities.

So although VN8 is adding debt to its books again, it is using the debt to acquire a cash generating asset which will be used to pay down the debt in the future... and once the debt is paid, VN8 will be able to put the cash towards its next acquisition target.

Then repeat...

So, what’s next for VN8?

We believe VN8 is well positioned for a positive re-rate if it can sustain its growth trajectory and ultimately deliver positive cashflow and earnings over successive years. This fits with our key objectives as per our Investment Memo we put together for our Investment in VN8 in February 2022:

Next up for the company will be to integrate its latest acquisitions and report on the impact. We will keep track of VN8’s progress, and provide updates accordingly.

🔲 Completion of transaction/ integration of OntheNet (2H22)

🔲 Completion of integration of Direct Business (2H22)

🔲 Further potential acquisitions (2H22-23)

🔲 Sustain cashflow positive quarters going forward (2H22)

🔲 EBITDA positive (2H22)

🔲 125k PBX users (4Q22 - 1H23)

Our VN8 Investment Memo

Back in February of 2022 we put together our VN8 Investment Memo - in that you’ll find:

- Key objectives for VN8 in 2022

- Why we continue to hold VN8

- What the key risks to our investment thesis are

- Our investment plan

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.