Uranium in the USA - GTR Entitlement Offer about to go live

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 16,662,000 GTR shares and 746,615 options at the time of publishing this article. The Company has been engaged by GTR to share our commentary on the progress of our Investment in GTR over time.

The US uranium industry is undergoing a major resurgence.

In the decades between 1953 and 1980 the US was the world’s biggest producer of uranium.

Most of its uranium production was in the state of Wyoming.

These days, most uranium in the US comes from Kazakhstan, a country that contributes ~46% of the world's supply.

As for enriched uranium — the type used in nuclear power plants — Russia and China collectively control around 60% of the market. These countries are not the USA’s best friends right now.

As part of an effort to localise critical supply chains, US senators recently tabled a proposed bill that would ban Russian sourced uranium and look at restarting local uranium production.

The big question is - where will all this local uranium come from?

With the US home to the world's largest nuclear reactor fleet, there’s going to be a major need for new sources of local uranium, and it needs to come fast.

All of this bodes well for uranium companies with established in-ground resources in the USA.

Just like our Investment GTI Energy (ASX: GTR).

GTR currently has an Entitlement Offer that's about to open for existing holders and those that buy GTR shares by today.

This entitlement offer will be a 1 for 10 offer of new shares to buy at 0.9c per share. For every two new shares purchased, investors receive 1 free listed option exercisable at 3c per share which expires on 30 October 2024.

Today we will cover what GTR is up to in the uranium space in the USA, and provide more details on the Entitlement Offer.

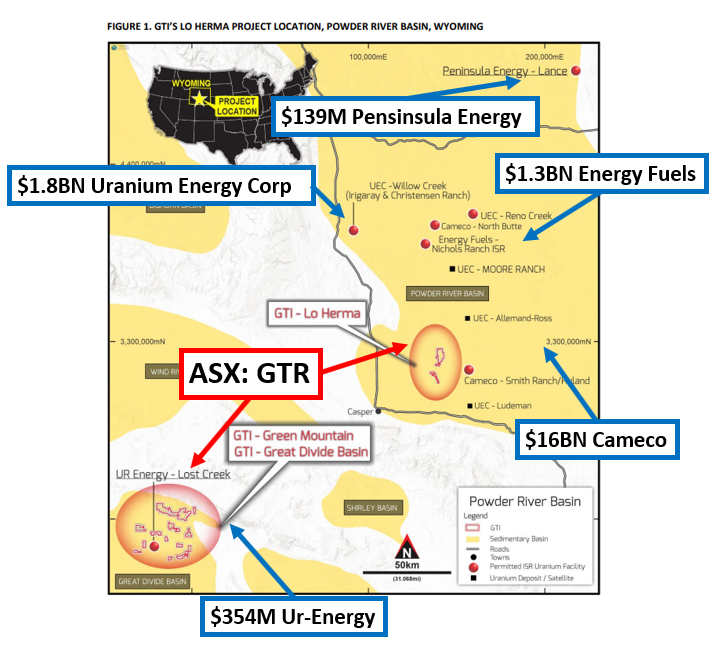

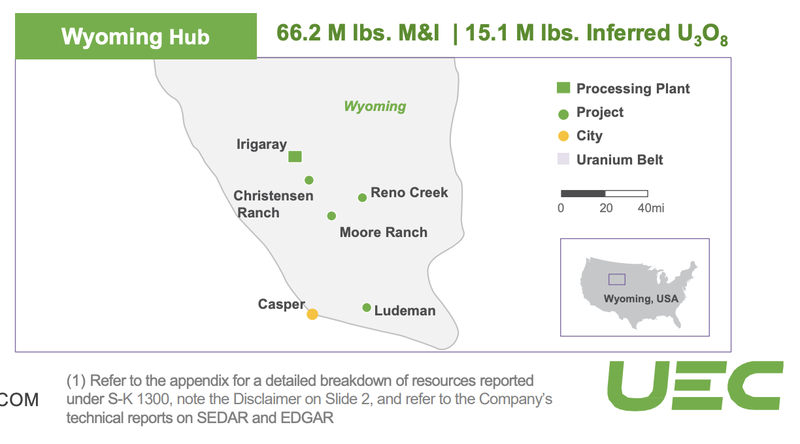

GTR has four uranium exploration and development projects in the US — three in Wyoming and one in Utah.

Both Wyoming and Utah are “uranium friendly” states, with a rich history of uranium mining.

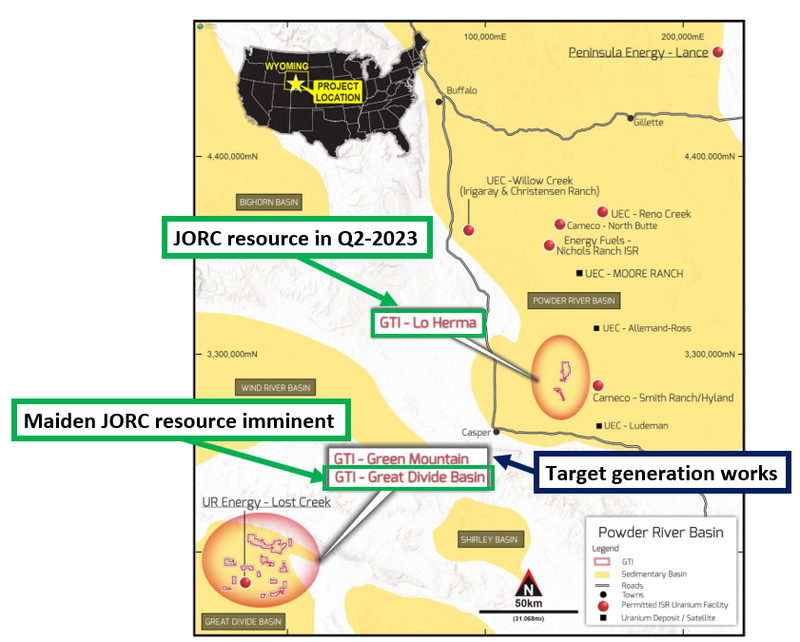

GTR plans to have two uranium JORC resources announced in the next 4 months across its Wyoming projects.

GTR’s newest project is what we are currently most interested in, as it could be the one that results in an eventual re-rate of the company's share price.

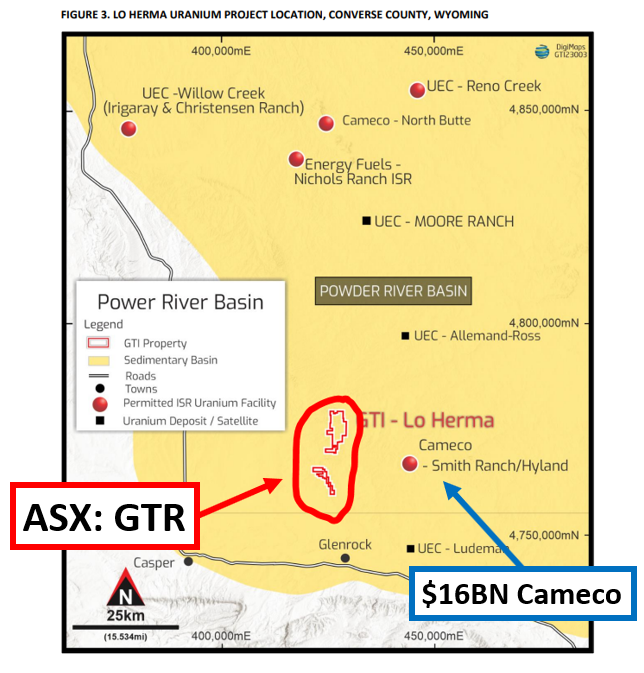

In late February, GTR staked ~8,000 acres of ground (now called the Lo Herma project) in Wyoming.

This new project is within 16km of $16BN Cameco’s ISR uranium plant (the largest production site in Wyoming) and ~80km of five permitted ISR uranium production facilities.

GTR’s project also sits within close proximity to the companies leading the restart of uranium production in the USA including Uranium Energy Corp, Ur-Energy and Energy Fuels and Peninsula Energy.

Last week, GTR acquired a data set over the newly staked project (Lo Herma).

This data set comprises historical drilling data totaling 1,445 drill holes (~161,000m) — that’s 7x as many holes that GTR has drilled in Wyoming to date.

GTR picked up the project organically (by staking it) and is now only paying US$950k for a dataset that has a current estimated replacement value of ~A$15M.

GTR is saving time (years of drilling seasons) and money (replacement value of A$15M) - which means it can accelerate the pace it can get to a defined resource on this ground.

With the current rush into US uranium projects, we like this accelerated strategy.

Now armed with the data set, GTR will look to convert the drill data into a modern database before it develops a resource model.

GTR expects to put out a maiden inferred JORC resource on the project before the end of Q2.

This inferred resource will allow for a better comparison between GTR and other uranium peers with defined resources.

GTR entitlement offer details

To fund progress across all of its projects, GTR is currently raising capital at 0.9c per share via a placement and a rights issue.

For every two new shares purchased, investors receive 1 free listed option exercisable at 3c per share which expire 30 October 2024.

The $2.3M placement at 0.9c per share has already been completed.

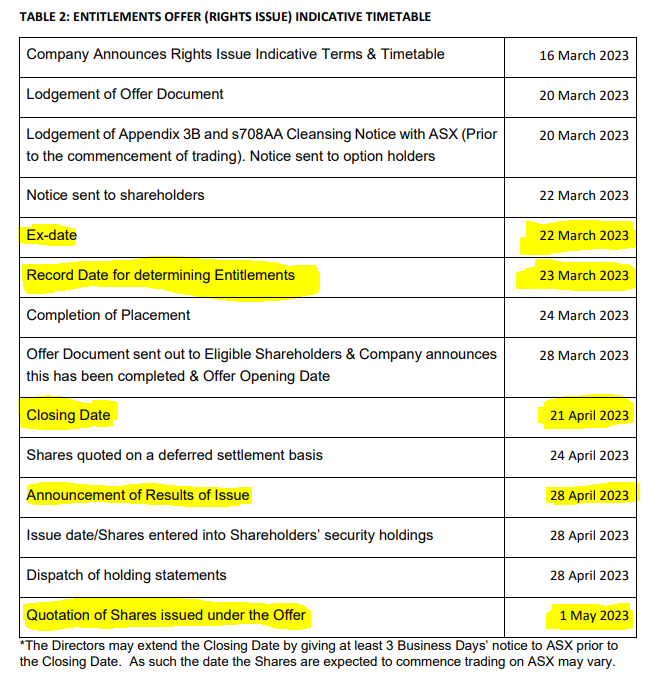

GTR is now running an entitlement issue on the same terms as the placement for existing shareholders and those that hold shares on the record date of 23 March.

Participating GTR shareholders are eligible to purchase shares on a 1 for 10 basis at 0.9c per share and receive 1 free attaching listed option (GTRO) for every two new shares subscribed. The options will be exercisable at 3c per share, and expire 30 October 2024.

The rights issue ex-date is tomorrow (22 March).

This means that the last day to buy GTR shares and also be eligible for the rights issue is today, 21 March.

The entitlement rights issue is fully underwritten by the lead broker CPS Capital.

We intend to take up our full entitlement in the rights issue.

After both the placement and the rights issue, GTR should have around $7.4M cash on hand ($3.8M at 31 Dec 2022 + $2.3M placement + $1.3M rights issue).

Note that this estimate is before the US$950k payment made for the new project and doesn't take into account any other cash burn during the current quarter.

While GTR advances a maiden resource estimate for the new project, Lo Herma in Wyoming, it also expects to put out a JORC resource over its other Wyoming project (Great Divide Basin), where it recently ran a ~19,500m drill program.

This means that over the next 4 months or so, GTR could have new maiden JORC resources at two of its projects.

This puts GTR in a position where bigger uranium companies in the region could see it as a potential uranium resource consolidation opportunity. GTR’s in-ground resources could be looked at as potential feed for their existing uranium processing plants.

Now, of course, this is pure speculation on our part. There is no guarantee that any major company is interested in GTR’s ground in particular and this is only one possible scenario for GTR.

But while this upside scenario is one that may or may not happen, consolidation of uranium juniors by the multi-billion dollar capped companies in Wyoming isn't new.

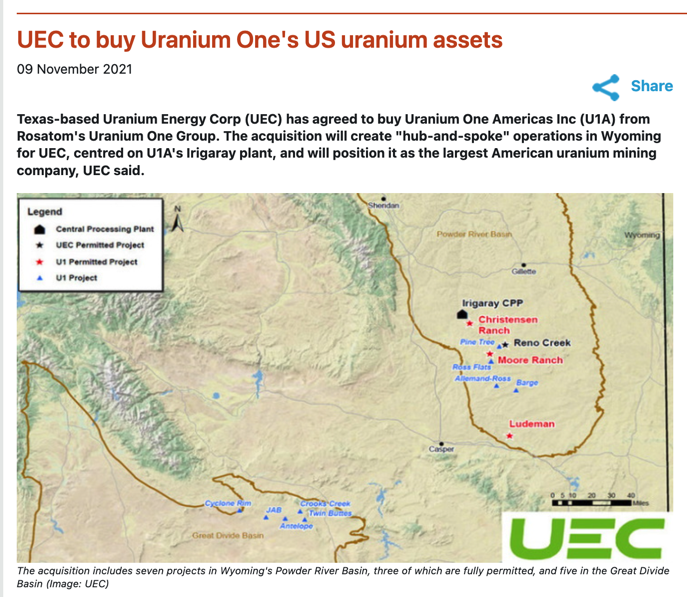

$1.8BN Uranium Energy Corp took over Uranium One’s 100 million pound uranium resource in a US$134M deal in November 2021.

In September 2022, Uranium Energy Corp’s CEO reaffirmed its “Hub and Spoke” operations strategy on Twitter.

$UEC Wyoming Hub & Spoke Platform holds the largest resource base of fully permitted ISR projects in the U.S. Today's resource report is the culmination of multiple acquisitions we've successfully completed since 2017 to fulfill a strategic objective of U.S. uranium leadership. https://t.co/Wez4wwEVI1

— Amir Adnani (@AmirAdnani) September 15, 2022

It's also interesting to note that Uranium Energy Corp was recently paid US$18.75M to supply uranium to the US strategic reserve. It's now just months away from putting its projects back into production - as other Wyoming neighbours look to do the same.

We think the cash from the near term producers in the region will eventuallly flow to junior explorers in the region, especially explorers with in-ground resources that are near processing hubs.

Again, there is no guarantee that GTR’s projects will be acquired, it's pure speculation on our part. GTR is a small cap, high risk exploration stock.

This brings us to our “Big Bet” for GTR which is as follows:

Our ‘Big Bet’:

“Prove out a large resource base in the “uranium capital” of the USA and generate offtake or acquisition interest as the USA moves to secure local uranium supply”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GTR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For our summary of GTR’s progress over time and how today’s announcement contributes to our Big Bet see our GTR Progress Tracker.

GTR’s broader Wyoming assets on the map

GTR is now moving towards maiden in-ground resource estimates across two of its three projects in Wyoming, here they are on the map:

More on the new GTR project

GTR is acquiring drilling data for US$950k that has a replacement cost of A$15M.

The actual drilling was done back in the 1970-80s and the data took around a decade to compile.

The US operates a bit differently to Australia, in that the ownership of mining exploration rights and any previous data collected on that ground is not connected.

After both the placement and rights issue GTR’s implied market cap is $17.2M at 0.9c per share - which is slightly more than the replacement value of the acquired drilling data.

GTR is paying just US$950,000 and will receive:

- Data for ~1,500 drillholes (530,000 ft or 161,544m of drilling) including geophysical data for all holes.

- The data also includes a report on the different mineralised zones, including a summary table of estimated mineral resources.

All of the available data, including some additional surveys that GTR will be running over the next few months, will allow for GTR to prepare a maiden resource estimate over the project.

GTR expects the resource to be announced before the end of Q2 this year — without the need to drill any more holes.

Putting the cost and time advantages aside, GTR’s project also benefits from its location in the uranium capital of the USA - Wyoming.

GTR’s ~8,000 acre project sits:

- Within 10 miles of Cameco’s Smith Ranch-Highland ISR uranium plant (largest production site in Wyoming)

- Within 100 miles of both Peninsula Energy and Ur-Energy who have plans to be producing uranium by next month (April).

- Within 50 miles of five permitted ISR uranium production facilities.

So we think GTR is definitely in the right place for the USA uranium resurgence.

The latest on the uranium space in Wyoming

In our last note, we mentioned the potential consolidation opportunities in the Wyoming uranium space.

Wyoming has produced over 230 million lbs of uranium historically and is home to the world's largest ISR amenable uranium deposits in the western hemisphere.

Over time, US production was cut back and most of the uranium projects were put on care and maintenance.

Throughout that period companies like Uranium Energy Corp popped up and started scooping up projects as part of their “hub and spoke” production strategies.

Simplistically, a “hub and spoke” strategy involves acquiring projects with established resources (the spokes) within close proximity to a company’s own processing infrastructure (the hub).

In recent years Uranium Energy Corp has focused specifically on mergers and acquisitions with the latest deal being a takeover of Uranium One for ~US$134M.

With companies in Wyoming preparing to put projects back into production, the US government has committed up to US$10BN in support for the domestic nuclear power industry.

To top it off, the US government also recently introduced a bill to ban Russian imports of uranium.

Here’s that Uranium Energy Corp CEO again - tweeting about this news:

Here we go.

— Amir Adnani (@AmirAdnani) February 15, 2023

House Energy & Commerce Committee bill has been introduced (HR-1042) to immediately ban Russian low-enriched #uranium into the U.S. 🇺🇸

👉 https://t.co/pk6JHPWN0a pic.twitter.com/pPU3bSlQfd

Until now the US wasn't in a position to ban uranium imports because it was so dependent on supply from Russia. It had no choice.

But 2023 seems to be the year that everything changes for the US domestic uranium industry with the producers in the region finally bringing uranium projects back online.

Below is our take on the developments of the big uranium players in the region:

$354M Ur-Energy Inc

Ur-Energy just raised US$46.1M. The company mentioned that it would look to use the cash for “possible future acquisitions or other strategic transactions”.

Ur-Energy’s Lost Creek project sits right in and amongst GTR’s projects in Wyoming.

In the video below, Ur-Energy’s CEO talks about how the licensed processing facility can process 2.4 million pounds of uranium whereas its own project produces 1.2 million pounds.

So Ur-Energy has built more production capacity than it can currently utilise, which really re-affirms its M&A strategy.

The title of this video is another final clue that Ur-Energy is on the M&A path - “Ur-Energy CEO John Cash tells LSE he is looking for quality M&A opportunities”.

You couldn't get a clearer signal that Ur-Energy is looking to acquire more uranium assets in Wyoming...

$1.8BN Uranium Energy Corp

Uranium Energy Corp recently sold US$17.85M in uranium to the US strategic uranium reserve.

The company’s Wyoming project holds the largest resource base of fully permitted in-situ recovery (“ISR”) projects in the United States.

$1.3BN Energy Fuels

Energy Fuels recently sold US$18M in uranium to the US strategic uranium reserve.

Energy Fuels’ project is fully licensed and on standby, ready to be put into production.

$139M Peninsula Energy

Peninsula Energy recently committed to restarting its project in Wyoming with production expected to commence in Q1 2023.

Why we like GTR

GTR is exposed to the US based uranium resurgence. Within that macro thematic, here’s why we like it right now:

- GTR will have JORC resources defined by the end of Q2 2023. That’s not far away. We have seen that the bigger uranium companies in the state have an appetite for ISR uranium projects that come with JORC resources.

- GTR’s projects are surrounded by uranium companies pursuing “hub and spoke” strategies. This region in Wyoming provides a significant domestic base for uranium production. GTR is well located for a junior explorer establishing a resource base through exploration.

- GTR is targeting ISR amenable uranium. ISR uranium is the lowest cost source of uranium production globally. Low cost domestic ISR uranium projects are critical to US energy independence in a world where security of supply is an issue.

- GTR’s market cap is leveraged to success. With a market cap of $17.2M and well funded following the current capital raises, we think GTR is leveraged to success amid increased attention on the uranium thematic.

More on GTR’s capital raise and key dates

Again, here is what happening on the corporate front:

- GTR raised $2.3M via a placement at 0.9c per share.

- For every two shares subscribed for investors also get a listed GTR option (GTRO). Those options are exercisable at 3c per share and expire on 20 October 2024.

Now GTR is about to kick off a $1.3M fully underwritten rights issue on the same terms as the placement.

Key dates for the rights issue:

- Ex-date (22 March 2023) - shares purchased on or before the 21st of March will be given an entitlement in the rights issue (i.e. shares must be held in the investors name on the record date of 23rd March).

- Closing Date (21 April 2023) - the due date for the rights issue applications.

- Results of rights issue (28 April 2023) - we should know how much GTR raised from the rights issue.

- Quotation of new shares (1 May 2023) - when the shares from the rights issue are expected to be listed.

What might happen during and after the raises?

Naturally, after a capital raise is announced at a discount to the market price, in the short term we would expect the share price to trade near the capital raise price.

We have already seen this happen over the last few days with GTR’s share price now trading at the 0.9c per share cap raise price.

There are often some investors who participate in raises to take advantage of the discount and sell out quickly.

This is not unexpected and, especially when markets are rough, investors may look to lock in some profits quickly.

We also note that while the rights issue is running, volumes traded on market will be lower than usual as investors will increase their positions off market.

We may see a pick up in GTR volumes today as investors look to buy additional shares that will be eligible for the 1:10 rights issue (plus the free listed options that come with the raise).

We are long term investors in GTR and will participate in the Rights Issue.

Despite a rough few years for GTR investors, the new cash provides GTR a runway to actually execute its business plan and progress its projects, including its new one.

What’s next for GTR?

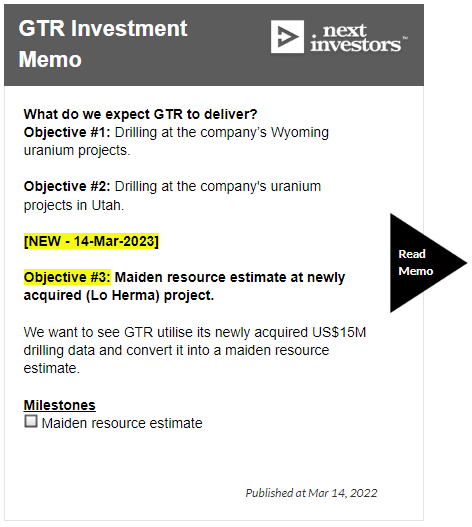

Maiden resource estimate at newly acquired projects (Lo Herma) 🔄

After the recent acquisition we want to see GTR put together its maiden resource estimate across its newly acquired ground (Lo Herma project).

GTR expects this by the end of Q2 2023.

After the Lo Herma project acquisition, we added another objective to our GTR Investment Memo that’s centred around booking a maiden resource estimate at this project.

Maiden resource estimate at existing projects (Great Divide Basin project) 🔄

GTR recently completed ~19,500 metres of drilling across its Great Divide Basin project.

The Great Divide Basin project sits near the Lost Creek ISR uranium deposit which has a 13 million pound (measured/indicated resource) at an average grade of 0.048% uranium with an average grade x thickness (GT) of 0.2.

While we don't expect the company to achieve a maiden resource of this size, it provides a good reference point.

We want to see GTR put out a maiden resource estimate or at least an exploration target.

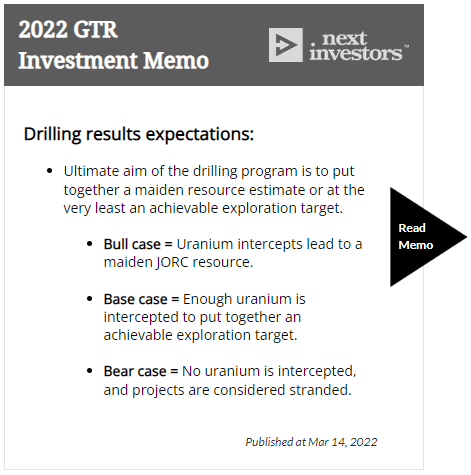

Our bull/base/bear case expectations are as follows:

Target generation works at its Wyoming Green Mountain project 🔄

GTR is starting geophysical surveys at its Green Mountain project in April.

The program will be used to rank high priority drill targets ahead of a planned drill program in Q3 2023.

See our Quick Take on that news here: GTR targeting maiden resource, geophysics in Wyoming.

This project shares a border with Rio Tinto and is within close proximity to $1.3BN Energy Fuels’ 30 million pound Sheep Mountain uranium deposit.

GTR risks

GTR has now raised capital and while the dilution to existing holders is painful, the company has mitigated short term funding risk.

In the long term, we expect funding risk to remain given the company isn't producing cashflows and will be spending cash on exploration.

Today we have added funding risk to our GTR Investment Memo:

Our GTR Investment Memo

Below is our GTR Investment Memo where you can find a short, high level summary of our reasons for Investing.

In our GTR Investment Memo, you’ll find:

- Key objectives for GTR for the coming year - starting from March 2022

- Why we are Invested in GTR

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.