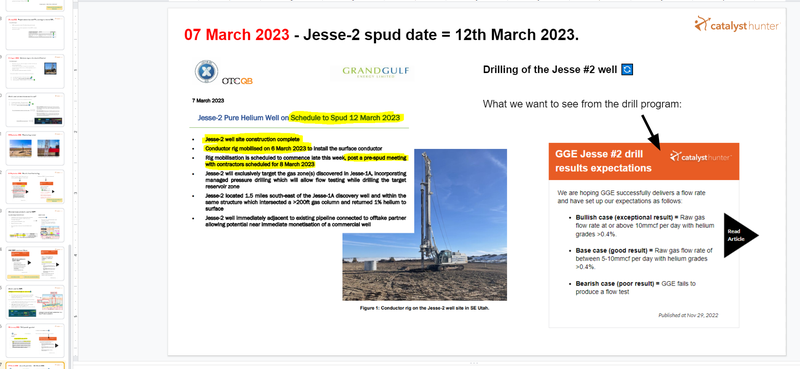

Spud date set for GGE's US helium drilling - 12th March

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 25,011,058 GGE shares at the time of publishing this article. The Company has been engaged by GGE to share our commentary on the progress of our Investment in GGE over time.

We have a start date.

On 12th March - that's in five days time - our 2021 Catalyst Hunter Pick of the Year Grand Gulf Energy (ASX:GGE) will start drilling its Jesse-2 helium well in Utah, USA.

This well is a follow up to a discovery well drilled last year.

Before going into this drilling event, here’s what we already know about GGE’s USA helium project:

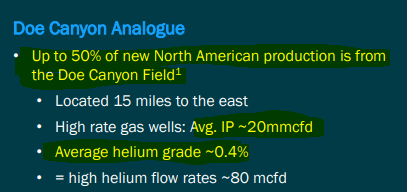

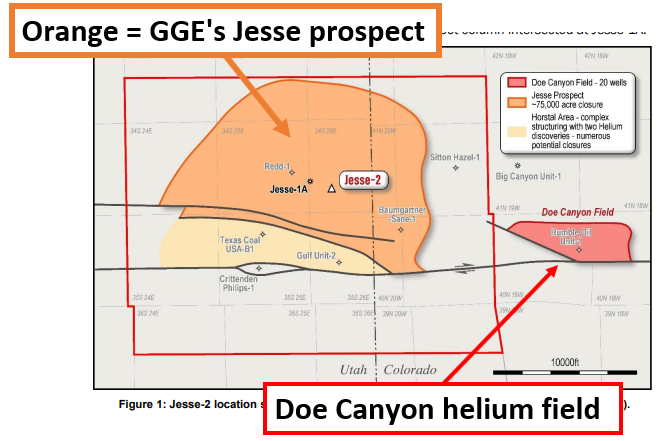

- It sits ~24km away from the Doe Canyon helium field - responsible for ~50% of North American helium supply).

- GGE already has an offtake agreement in place for its helium with the owner of the nearby Lisbon helium processing plant.

- There is idle pipeline infrastructure that GGE can tie its well into (assuming the drill program is successful).

GGE’s goal with this new well is to produce a commercially viable flow rate.

Last year GGE hit net pay of ~31m and helium grades of ~1% on the Jesse-1 well.

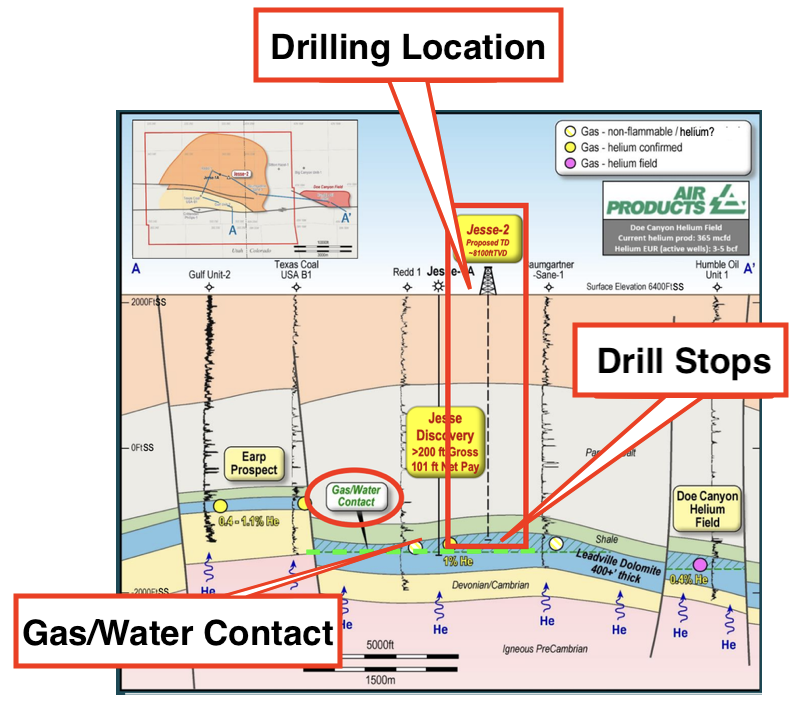

The only issue was that GGE drilled into the “water contact zone” - which meant the company was unable to produce a flow rate at the time.

Key lessons have been learnt from last year’s well, and this time round, GGE plans to drill to just above the water contact zone, which should allow it to hopefully produce that flow rate.

Below is a visual of the well design - GGE plans to leave 16 metres of space between the bottom of the well and the known gas/water contact zone. This should avoid the layer full of fluid, and enable gas to flow to the surface freely from the well.

A commercial flow rate is the last step before a project can be upgraded from discovery/development project to one that is producing and capable of generating revenues for a company.

Drilling is expected to start on the 12th of March.

In terms of duration of drilling, last year it took GGE 2-3 months from spudding to a flow test.

So while GGE is taking onboard the lessons learnt last year, and will also be drilling a shallower well, we can reasonably expect to see the results from this well in a similar time period.

Here is what we will be watching out for during GGE’s drilling:

After drilling starts, GGE may look to put out announcements about helium readings as the well reaches its intended total depth.

Usually increases in helium concentrations versus background levels mean that a company is getting closer to the source of all that helium.

Given the Jesse-2 well is more of an appraisal well (meaning it is drilling into a known discovery) we are hoping the announcements are similar to the ones put out when GGE drilled Jesse-1.

Ultimately we want to see GGE produce a commercially viable flow rate from its Jesse-2 well.

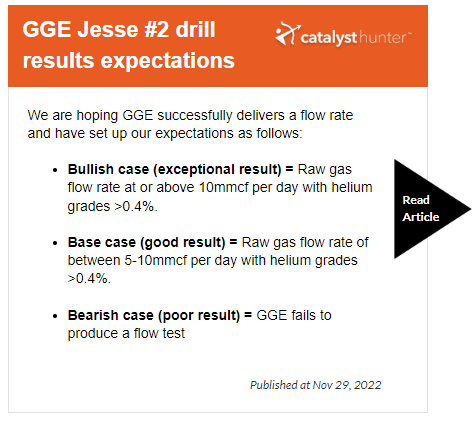

As detailed in our November 2022 GGE Investment Memo, we will analyse GGE’s drill results in context to our relative to our bull, base and bear case expectations which are as follows:

We have based our expectations on the flow rates that are being achieved at the Doe Canyon helium field ~24km east of GGE’s project which produces ~50% of North American helium projection across ~20 wells.

The average flow rate across the Doe Canyon wells is ~20mmcf per day with helium grades of ~0.4%.

With the Jesse-2 well drilling into an already known discovery, we are less focused on what is in the ground and more focused on whether or not GGE can make it flow to the surface.

What will a successful flow test mean for GGE?

GGE is next door to US$68BN Air Products Doe Canyon Helium field.

Firstly, If GGE manages to produce a flow rate, it will be done right next door to the Doe Canyon helium field.

Doe Canyon is owned by New York listed US$68BN Air Products and is responsible for ~ 50% of the USA’s helium production.

For some context on the potential, below is an image of the two fields side by side:

Domestic US helium prices are up by over 300% in the last 12 months

Second, GGE would have managed to produce a flow rate at a time when US spot prices for helium are soaring - up over 300% (from US$500/mcf to US$2,000/mcf) in the last 12 months.

Late last year NASA signed a contract with Air Products worth up to US$1.07BN and at a helium price >US$1,100/mcf.

AND at a time when the US needs more reliable local sources of helium as it builds up its onshore semiconductor production capabilities.

There’s US$260BN in commitments from companies like Intel, Samsung and Micron Technologies to build US-based semiconductor facilities - all of them will need helium.

Given geopolitical tension is increasing in Taiwan (the world’s primary source of semiconductors), we think it will be a big decade for the US semiconductor industry, and by extension, aspiring local helium producers in the region like GGE.

The recent introduction of the CHIPS act by the US government, which allocates $280BN of support to the domestic semiconductor industry, is yet another sign of how local supplies will become more important over the medium-long term.

GGE’s project sits right next to idle pipeline infrastructure

Finally, GGE’s helium project sits immediately adjacent to idle pipeline infrastructure that runs directly to a nearby helium processing plant.

This processing plant is owned by GGE’s offtake partner Paradox Resources - so GGE already has a local customer lined up.

GGE’s location advantage makes the imminent drilling program particularly interesting especially given that GGE already de-risked its project with last year’s drilling.

New discoveries, no matter how large, can be deemed “stranded” - due to large capital expenditure requirements to build processing plants and pipelines to get the resource to customers.

GGE doesn't have this problem. Instead, all it has to do is produce a commercial helium flow rate, tie it into local infrastructure and start producing and selling helium.

Given this existing infrastructure advantage and the offtake agreement with Paradox Resources, GGE could be in a position where it can start selling its helium with little to no CAPEX very quickly.

All that is needed now is a commercially viable flow rate which is exactly what GGE will be targeting with its drilling of the Jesse-2 well.

Here is what we know about GGE’s project right now:

- ✅ A proven helium structure: A >61m gross gas column (with ~31m of independently audited net pay)

- ✅ Commercial helium grades: Helium grades of up to 1% returned to surface (higher than our 0.4% expectation)

For GGE to deliver a commercial helium project it needs:

- 🔄 Commercially viable flow rate: GGE’s Jesse-2 well is being drilled with this goal in mind.

Of course, it's no guarantee that GGE can secure a commercial flow rate, and there's a lot of work to be done, but if GGE can prove up a helium field on the scale of Doe Canyon, with similar flow rates, we expect this would deliver an outsized return for GGE investors.

In line with our Investment Plan we have sold a further ~17% of our Total Holdings since our last note on January 5th and in anticipation of the drilling campaign. We are now Free Carried on our Initial Investment in GGE.

We are hoping GGE is able to go from helium developer to producer and is able to drill out future helium wells from cash flow generated from the Jesse prospect.

This brings us to our “Big Bet” for GGE:

Our ‘Big Bet’

“GGE makes a commercial helium discovery, ties it into the existing local processing infrastructure, and becomes a USA helium producer - or gets taken over.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GGE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress GGE has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following GGE “Progress Tracker”:

See our GGE Progress Tracker here:

What’s next for GGE?

Drilling of Jesse-2 well 🔄

Drilling is expected to begin on the 12th of March - which is less than a week away now.

Last year's drill program started on the 26th of April, drilling reached final depth by the 30th of May and an initial flow test result was released on the 29th of June.

Overall the program took ~ two months to complete.

With drilling now scheduled to start on the 12th of March we should know whether or not GGE has managed to produce a commercially viable flow test by the end of Q2.

Permitting for a third helium well 🔄

GGE also confirmed in its most recent announcement that permitting was underway for a third well in early 2023.

To see our deep dive into GGE’s other exploration prospects check out our previous note here: GGE Hits Gas Column. Flow Rate and Helium Concentration to be Tested Next.

Our GGE Investment Memo:

The ultimate purpose of our Investment Memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our GGE Investment Memo, you’ll find:

- Key objectives we want to see GGE achieve

- Why we Invested in GGE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.