Shell flared gas in the Taroom Trough - next door to EXR

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,444,000 EXR Shares and 1,555,357 EXR Options at the time of publishing this article. The Company has been engaged by EXR to share our commentary on the progress of our Investment in EXR over time.

Earlier this week, reports emerged that oil and gas supermajor Shell was flaring gas in the Taroom Trough in Queensland.

Our Investment Elixir Energy (ASX:EXR) has acreage next door to Shell in the Taroom Trough.

EXR is currently running flow tests on its well.

EXR has already delivered a flow rate of 2.5 million cubic feet of gas from the lower section of the well, and in a few weeks time it will flow test the upper sections.

EXR’s final set of flow test results are due in the coming weeks.

As we wait for that to happen, it was good to read an article in the AFR covering Shell’s ‘apparent’ gas flare next door to EXR.

It's always nice when one of our Investments catches the attention of mainstream media:

(Check out the full article here)

We say “apparent”, as while Shell declined to confirm the gas flow, AFR writers have seen a photograph of the gas flare:

Shell is drilling three appraisal wells in the area as part of early stage exploration.

Shell has been active in the Taroom Trough for a while now, and clearly they like what they are seeing.

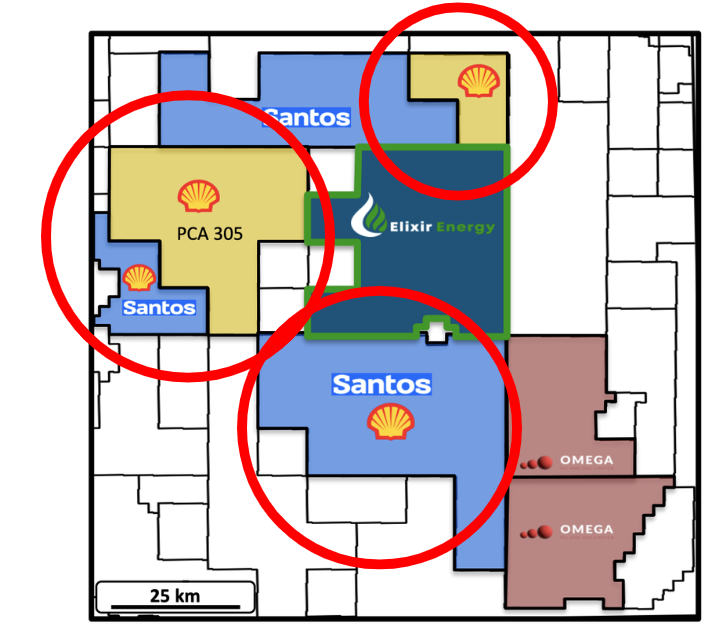

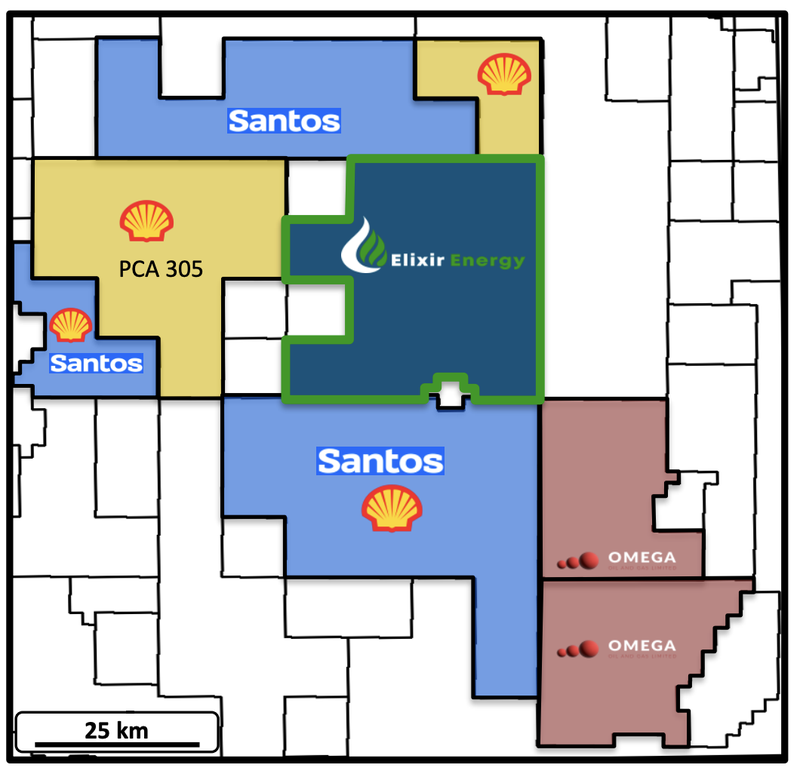

As we noted above, EXR’s project sits right next door to Shell.

The gas flare the AFR is referring to in its article is likely to have come from one of the blocks in the map below.

Notably another big gas company - Santos - is also in the neighbourhood...

EXR has already produced a 2.5 million standard cubic feet per day flow rate from its well on the border of ground held by Shell.

That flow rate is already above what the company thinks are needed for commercially viable projects in the region.

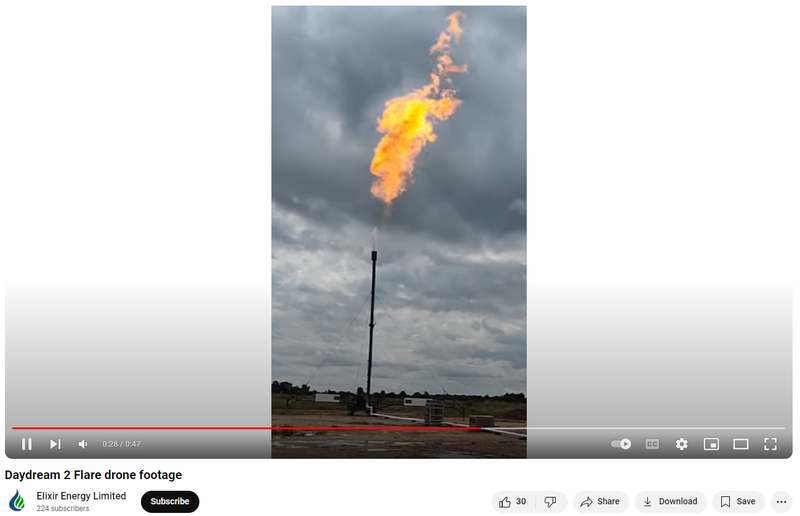

And while we haven't seen Shell’s gas flare and Shell has not reported it, we have seen (and heard) EXR’s gas flare nearby:

(EXR’s gas flare from earlier in the year)

As we mentioned above, EXR still has the second phase of its flow test to come.

This flow test will combine all of the reservoirs in the well and deliver what could be an even higher flow rate than the 2.5 million cubic feet of gas it already has.

EXR is currently waiting on a coil tubing unit (it's currently with “a neighbouring operator” - we wonder who that is... ) to finish the clean up phase of the testing and expects that to arrive by the end of this month.

EXR’s final flow test should come as soon as that is complete.

The big kicker for EXR investors - all the flow rates recorded to date and about to be tested are coming from a vertical well.

There is significant scope to increase the overall gas flow rate by drilling horizontal wells.

So far EXR has managed to prove to its deeper pocketed neighbours and the market that its project flows gas to surface and could be a part of any development that happens in the basin.

In that AFR article from earlier in the week, there were some quotes from MST Marquee energy analyst Saul Kavonic, commenting on the potential of the Taroom Trough:

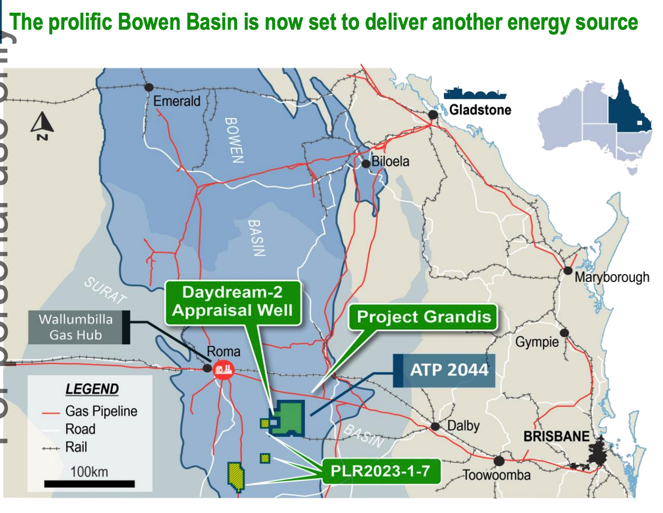

“This is the only new exploration play with that [TCF gas] potential, which is also close to infrastructure”

We tend to agree - the Taroom Trough sits next to existing pipeline infrastructure, gas processing plants and LNG export terminals.

He also said on EXR and its neighbours in the region:

“If they can prove horizontal wells work in this tight coal seam gas play, it could open up several more tcf [trillion cubic feet]) of gas for the east coast”

There are likely to be a lot of eyes on EXR’s project now - especially given EXR is in the middle of a flow test.

EXR’s project has a 3.6TCF prospective resource (unrisked mean basis) and ~1.47TCF contingent resource.

A contingent resource means it's a discovery, and one step away from being declared commercially viable - that is probably where those horizontal wells could do the trick...

In its most recent Investor Presentation, EXR teased a 500 well development scenario for its project (assuming the flow rate comes in at commercial rates).

That next phase of development is probably where a bigger player like Shell could take EXR’s asset and run with it.

We see EXR’s flow rate as the key step needed to unlock any partnership discussions with majors who can help EXR fund that eventual development plan.

In a video published after EXR’s first set of flow test results, EXR’s MD Neil Young made mention of partnerships:

(Neil teases partnerships at 3:10 and at 4:58 of the video - but the whole video is worth a watch)

Why we like EXR’s Queensland gas project

EXR’s team have been there and done it all before:

We think EXR has the right team in place to build a company out of this Queensland asset - assuming the flow tests continue to be successful.

EXR’s Chairman Richard Cottee has built up and sold a gas company before and is considered “the Godfather” of Coal Seam gas in Queensland.

Cottee took Queensland Gas Company from a $20M capped junior through to a $5.3BN takeover back in 2008 - the company doing the buying was BG Group (now Shell)...

(Source)

We also note EXR’s Managing Director Neil Young is ex-Santos management, and Director Stephen Kelemen ran Santos’ Coal Seam gas portfolio.

If anyone knows how to extract value from this asset then it's likely to be EXR’s team...

Multi billion dollar majors are active in the region

When multi Trillion Cubic Feet (TCF) resources are being defined, it's important to have some major capital partners interested in a region...

Finding those resources is one thing, but optimising well designs, drilling big horizontal wells and commercialising those resources is a whole other ball game.

We think EXR has the right people interested in this part of Queensland, with deep enough pockets to make something of the region's potential.

The billionaire Flannery family and the Texan Butler family (through the privately owned company Tri-Star) are major backers of EXR’s regional peer Omega Oil & Gas Ltd.

Tri-Star are pioneers of the Queensland gas industry, having drilled Queensland’s first commercial coal seam gas well in the 1990s.

Those initial investments and subsequent discoveries laid the foundations for Queensland’s $80BN LNG industry.

And of course Shell is active next door to EXR as we covered extensively above.

Shell took over BG Group for £47B (Source) - that was the company that EXR’s chairman played a role in building up in Queensland.

Here is the map again showing where EXR’s project is relative to its neighbours:

East Coast of Australia (and the rest of the world) is desperate for gas

- The global Liquefied Natural Gas (LNG) markets - The three LNG plants in Gladstone near EXR’s project (see location on the map below) have never operated at full capacity and could take more gas feedstock to ship to international markets.

- The east coast gas markets - EXR’s project sits next to the Wallumbilla Gas Hub which distributes gas to the east coast market. The east coast of Australia is forecast to be short gas in 2028 and expected to start experiencing momentary shortages in 2025-6. EXR could provide gas into that market.

The macro tailwinds for east coast gas explorer’s/developers just keeps getting stronger and stronger.

The longer the delay to bring on new supplies, the worse the forward outlook gets.

We can see a scenario in the future where overnight, east coast gas supply is the biggest talking point in the country and everyone is rushing (pouring cash into) bringing new supply on to the market.

What an analyst think success looks like for EXR

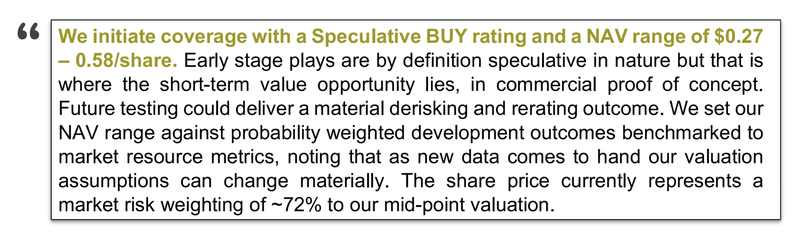

Taylor Collison analyst Andrew Williams recently published a report on EXR which set the stage for what the upside potential could be for the company on a successful flow test program:

In the note, Williams mentions that EXR is currently trading “capitalisation reserves metric of $0.08/g” based on its 1.27 TCF contingent resource and that a success case with the flow test could re-rate that to a level more in line with its pre-development or small scale peers...

The re-rate would be by ~3.5 to 5.6x... with a share price range of 27c to 58c per share... (if a flow rate is successful).

Of course, at the same time it’s important to note that analyst price targets are based on a number of assumptions that may not prove correct. Never rely solely on a price target to make an investment decision. Do your own research before making an investment.

The report from Taylor Collison lays out the EXR upside scenario, along with the risks.

You can read the full report here: Elixir Energy Limited (ASX:EXR) Taylor Collison Report

Our Big Bet for EXR

“EXR to achieve a $1BN market cap through successfully advancing one or more of its three projects: its Mongolia gas project, Mongolia green hydrogen project, and/or its Queensland gas project.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EXR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What is next for EXR?

🔄 Flow test results

EXR’s latest update was that ~40% of the fracking fluids from its well had been cleaned up.

The company also mentioned it was waiting on a coil tubing unit to finish the clean up phase of the well - EXR said this would be back by the end of this month.

So we should get the final flow test results after the clean up stage is done.

Going into the final phase of the flow test, our expectations are as follows:

- Bull case = >5mmcf per day flow rate

- Base case = 2-5mmcf per day flow rate (Already achieved ✅)

- Bear case = <2mmcf per day flow rate

So far EXR has already hit our “base case” scenario, and may even achieve our “bull case” scenario depending on how well the next phase of the flow test goes.

The current program is just testing just ~19% of the well’s gas-bearing zones, meaning that there is optionality for EXR depending on the results of the program.

What could go wrong?

The key risk for EXR now is “Development Risk”.

EXR has so far managed to de-risk the project from an exploration perspective by flowing gas to surface.

Following the flow test, the focus will begin to shift to moving to the development stage, which is likely to require significant capital investment - ideally from a partner.

In the short term the key risk is still the “risk of mechanical failure”.

Things can and do go wrong with drilling, earlier this year EXR’s flow test was delayed due to mechanical issues with the well.

Now EXR is waiting on a coil tubing unit to finalise the clean up phase of its well.

These type delays could continue to be a problem and delay the final flow test result for EXR in the short term.

To see all of the risks specific to EXR read our EXR Investment Memo.

Our EXR Investment Memo

Our Investment Memo provides a short, high-level summary of our reasons for Investing. We use this memo to track the progress of all our Investments over time.

Below is our EXR Investment Memo, where you can find the following:

- What does EXR do?

- The macro theme for EXR

- Our EXR Big Bet

- What we want to see EXR achieve

- Why we are Invested in EXR

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.