PUR’s first lithium brine drilling in Argentina starting next quarter

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 19,915,999 PUR shares and the Company’s staff own 1,116,668 PUR shares at the time of publishing. The Company has been engaged by PUR to share our commentary on the progress of our Investment in PUR over time.

We need 700% more lithium by the end of the decade.

The only way to do so is to get more discoveries into production.

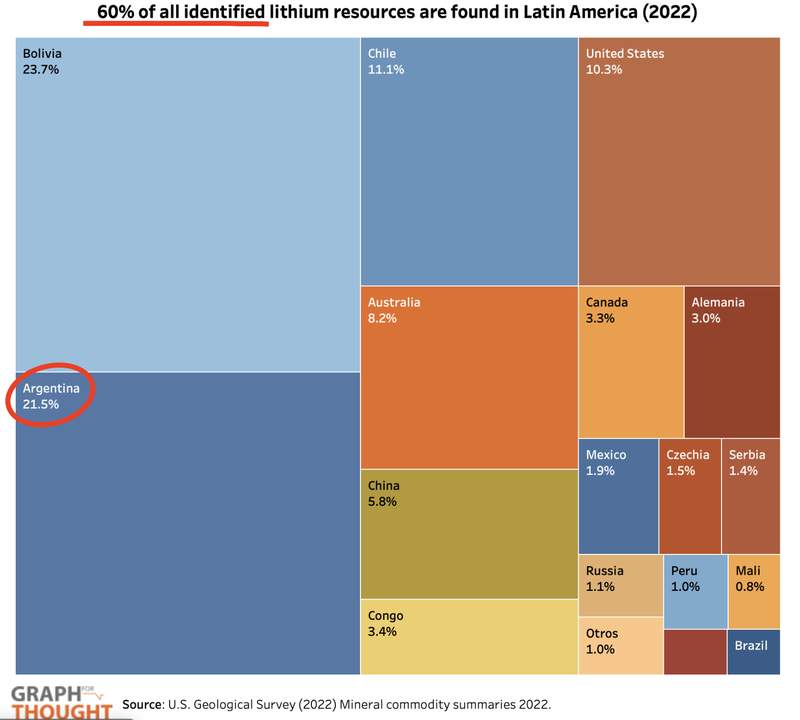

The obvious place to look for new lithium supply is South America’s “lithium triangle” - which contains 60% of the world's lithium resources and reserves.

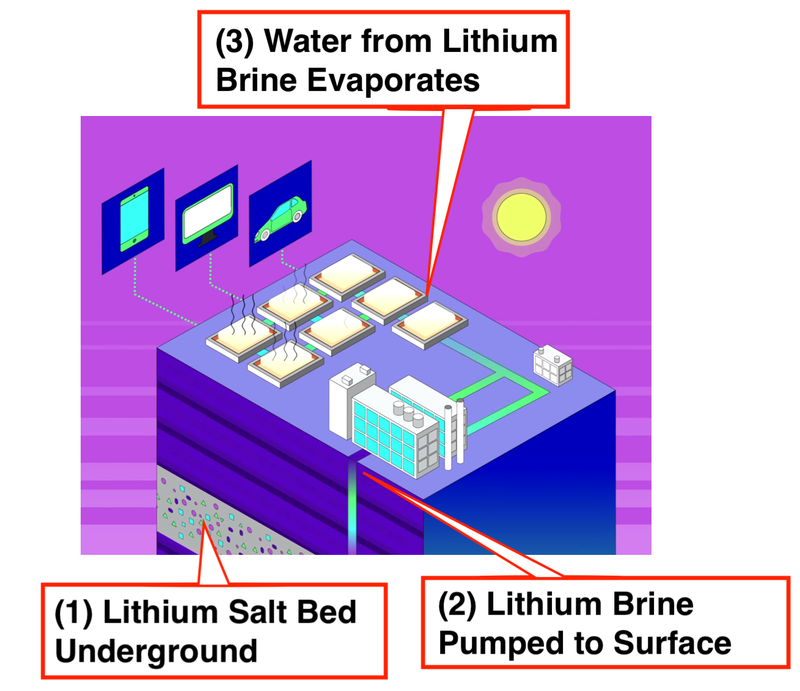

The lithium triangle is made up of lithium brine resources that use evaporation ponds to isolate the lithium over time.

This is different from hard rock lithium resources which use conventional mining methods to extract the valuable lithium from large rocks known as pegmatites.

The lithium triangle is made up of Chile, Bolivia and Argentina.

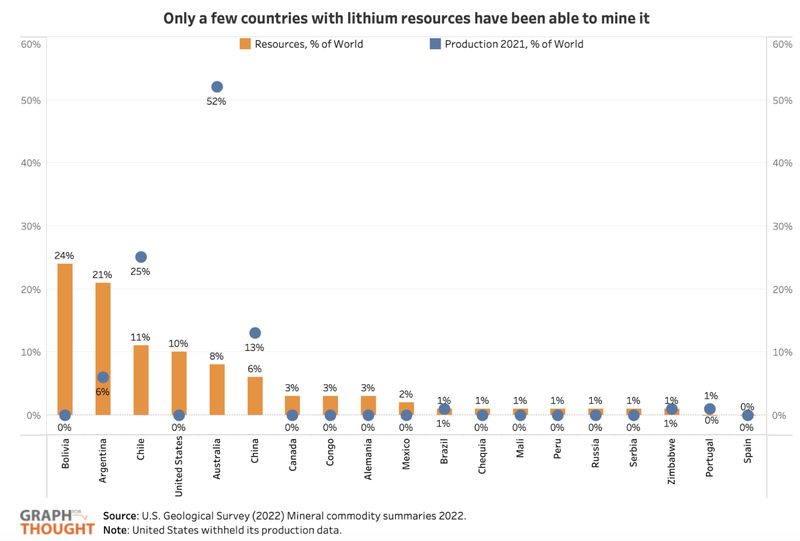

And Argentina is leading as the preferred destination for investors and buyers.

Chile is making some investors nervous by going down the nationalisation route. This puts at risk ~33% of the world's current lithium production.

Meanwhile the Bolivians are struggling to keep up with the pace of the industry.

This leaves Argentina, who holds the second largest lithium reserves in the world.

Argentina is critical if the world is serious about catching up with lithium demand.

The major producers capped in the billions are already all over it - Allkem and Livient in production and POSCO, Gangfeng and Zijin developing projects in country.

Our Investment in the Argentine lithium industry is the $39M capped Pursuit Minerals (ASX:PUR).

PUR is just months away from its first drill campaign - drilling is the big event for small cap explorers that can deliver the share price re-rates we are looking for if drill results are positive.

PUR is following Argosy Minerals lead. Argosy took its Argentinian lithium brine project from maiden resource to production in Argentina in ~5 years.

Argosy is currently capped at $639M, and at its previous peak was capped at over $1BN.

As PUR Investors, we want to see PUR follow the same strategy, and with that we are looking for PUR’s market cap to catch up to Argosy over time - which could be a circa ~ 20x return if PUR can pull it off.

Of course, success is no guarantee here, and past performance of other companies does not give an indication of future performance. This is speculative small cap investing, and assume anything can and will happen.

PUR is at a relatively advanced stage for its current $39M market cap.

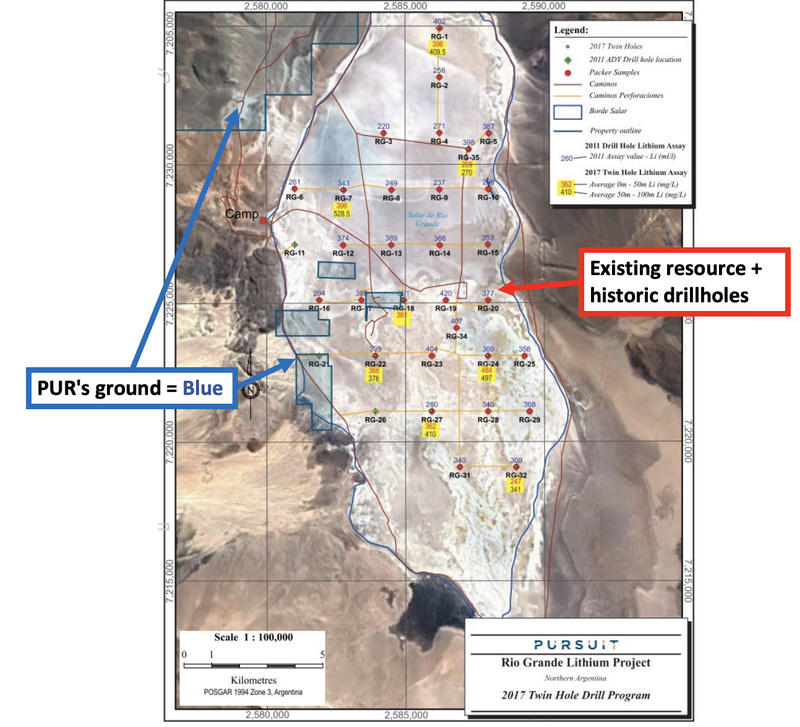

PUR holds ground inside a salt lake that already has a 2.1mt foreign resource estimate, which was generated by drilling down to depths of only 100m, and it's got a pilot plant ready to go.

Here’s PUR’s broad strategy to become a lithium producer and grow in value over time:

- Drill down to depths of 500-600m, which will allow it to try and find more high grade lithium concentrations, and define its own JORC resource.

- Go into production as quickly as possible - using its newly acquired pilot plant.

- Grow production with a larger plant comparable to its lithium brine producing peers (like the $639M capped Argosy).

- Produce larger volumes of battery grade lithium carbonate & start generating larger revenues.

PUR’s timeframe for all of the above is within the next two years.

Today, PUR started TEM (Transient ElectroMagnetic) surveys over its salt lakes.

These surveys will allow PUR to generate its first set of drill targets, with a view to define its JORC resource (Step 1 above).

At a high level, the TEM survey sends currents underground and maps out areas with the highest conductivity - high conductivity is a sign there may be lithium underground and a good indicator of where PUR should be drilling.

As we noted above, so far historical drilling has been limited to depths of 100m (most only down to 50m).

For these current surveys, PUR is trying to detect the potential presence of lithium at depths >250-300m under the salt lake.

We know from other lithium resources in the Lithium Triangle that grade increases with depth. So we are looking forward to seeing what PUR can find deeper on its ground.

PUR’s plan is to combine this work with more geophysical data (CS-AMT) and then drill test the highest priority targets in Q3 2023.

Drilling and the results will be a major catalyst for PUR, as investors will finally get an idea of how much lithium PUR could be sitting on.

Defining PUR’s own lithium resource

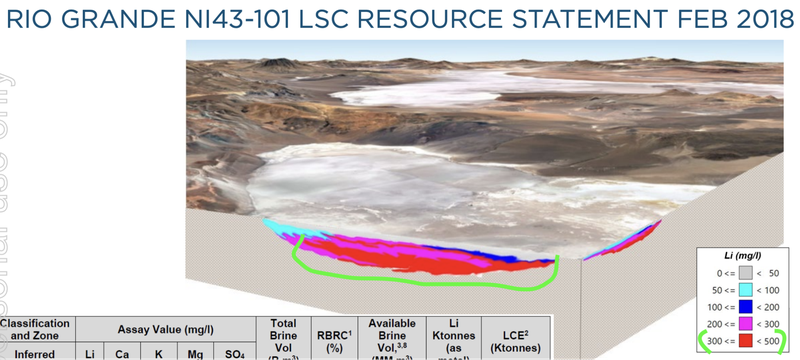

So far, the Rio Grande Salar - where PUR’s ground sits - has a 2.1mt lithium carbonate equivalent resource estimate.

As we noted above, the lithium resource is calculated based on drill holes down to depths of only ~100m.

100m is extremely shallow when talking about lithium brines.

For context, most of the Salar’s across Argentina, Bolivia and Chile have lithium mineralisation down to depths of >800m.

Interestingly, as companies tend to drill deeper into the salt lakes, the lithium concentrations (grades) tend to increase as well.

The image below shows how the concentrations are getting higher at depth in the Rio Grande Salar (the bright red sections are the highest grades).

Another example of higher grade lithium deeper is from the Pastos Grande Basin in Argentina

PUR’s Chief Operating Officer, Aaron Revelle, was the founder of Argentine lithium explorer Centaur Resources, which was sold to Arena Minerals for A$23M in 2020.

Then only two years later the company was bought out for US$227M (A$341M) by Lithium Americas Corp.

At Pastos Grandes, holes drilled down to ~90-180m had average lithium concentrations of 538 mg/l, and holes drilled down to ~365-620m depths had average lithium concentrations of ~641 mg/l.

So as companies drilled deeper in Pastos Grande they hit thicker and higher grade lithium bearing brine structures.

We also note that one of PUR’s neighbours, TSX-listed NOA Lithium Brines completed drilling just off the edge of the same salar that PUR plans to drill.

NOA drilled to depths of ~600m and hit multiple lithium bearing brine units all the way down to ~400m...

So there is a good chance PUR hits more lithium at depth AND finds higher concentrations.

Ultimately, this is what we are hoping PUR finds when it drills in Q3 2023.

Of course it's worth noting that we are just speculating here based on the results of other explorers. Exploration is inherently risky and there is always a risk the program fails to hit any of the expectations set before drilling starts.

The target for PUR is to drill to depths of up to 600m.

The real unexpected upside will come IF we see lithium concentrations also increase at depth.

The Salar’s current resource is based on grades of 374mg/l of lithium, so we are hoping concentrations increase beyond these levels.

In the background, PUR will be looking to fire up its recently acquired pilot processing plant and get ahead of the production testing for its project.

So over the next 3-6 months, we will be watching for newsflow on two fronts:

- Exploration - target generation work and then drilling in Q3 2023.

- Production testing - PUR to produce battery-grade lithium carbonate from its pilot processing plant.

Our PUR ‘Big Bet’:

“PUR increases the size and scale of its lithium project to a level that warrants putting it into production. We are hoping this re-rates the company to a market cap of >$1bn (similar to what peer company Argosy achieved)”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our PUR Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For a high level update on PUR’s progress, check out our Progress Tracker for PUR:

Why lithium brine and why in the “lithium triangle”?

One thing worth noting when looking at lithium projects is the different types of resources and the related exploration methods used.

PUR’s project is focused on lithium brines rather than hard rock lithium.

Hard rock is better understood by investors because Australia produces lithium almost exclusively from hard rock mines, and plenty of Australians have made money from hard rock lithium stocks over the last few years.

BUT most of the world's lithium reserves are in brine projects.

Exploration techniques on brine projects can be compared to oil and gas exploration, where companies try to bring hydrocarbons to the surface before processing them into oil products.

Lithium brines are similar, however it's lithium instead of oil.

(in fact oil major Exxon is having a crack at lithium partly because of the similar exploration methods - read more on that in this recent Wall Street Journal article: “Exxon Joins Hunt for Lithium in Bet on EV Boom.)

PUR will be looking to drill and identify lithium brine reservoirs (big aquifers that exist underground) before pumping the brine to surface for processing (evaporation etc.).

Here is a basic schematic of a lithium brine project:

Once it has identified the high grade lithium reservoirs, PUR will then run tests to evaluate its ability to pump the lithium brine to surface (stage 2).

The easier the brine flows to the surface, the more economical the project.

Depending on the quality of the resource, brine projects can be explored at lower costs and developed with far less CAPEX than hard rock projects.

For context, the image below shows how hard rock lithium projects compare to lithium brine projects from a cost perspective.

In terms of discovery and exploration costs, hard rock projects can cost upwards of $30M, whereas lithium brine projects can cost as low as $2M.

In addition, exploration timelines are typically almost half as long for lithium brine projects.

When it comes to development, brine projects can cost almost one-tenth of the cost of hard rock projects.

Source: A Cost Comparison: Lithium Brine vs. Hard Rock Exploration

The primary limitation of brine projects is that once the brine is pumped to surface companies need to wait for the brines to evaporate away so that the lithium rich salts are ready for processing.

The evaporation process can take time depending on weather conditions.

There are very few places on earth where conditions are right for lithium brine projects to work — South America’s lithium triangle is one of those.

🎓 We recently wrote an educational article on the differences between hard rock and lithium brine projects, to read the full article click here: The different types of lithium projects explained

We should note that it's far too early to tell how much PUR’s project will cost to get into production.

These factors depend on the lithium content in the brine, the presence of contaminants, the ability to pump the water to surface and the evaporation rate in the area.

All of these factors will become clearer as the company gets on the ground and explores.

Why lithium in Argentina?

1) Argentina holds ~21.5% of the world's lithium reserves, second only to Bolivia.

2) Chile looking to nationalise its lithium industry which is making foreign capital nervous...

3) Chilean production gap will need to be filled - Argentina is the obvious choice to bring existing resources into production...

What are the risks?

With exploration underway & the company looking to bring its pilot production plant online the current three key risks that we see for PUR are as follows:

1) Resource risk

PUR’s ground sits inside an area where another company has already defined a foreign resource of 2.1mt lithium carbonate equivalent.

This does not mean PUR will be able to define a resource of its own, there is always a chance that the ground PUR holds is considered uneconomic and no resource estimate is produced.

2) Commercialisation risk

Lithium brine projects are highly dependent on different variables like weather, flow rates to surface and the variability of grades in the brines.

There is always a risk that PUR’s project doesn't meet the levels required for its project to be operated commercially.

3) Funding risk

Like most small cap exploration stocks, PUR is not generating any revenue, and is reliant on capital markets to fuel its growth plans. PUR held $3.8M at March 31st 2023, and whilst that looks like enough for near term plans, we would expect at some stage over the coming months PUR would seek to raise additional capital for bigger cost items, which would dilute current investors.

You can see more on the key risks in our Investment Memo:

Our PUR Investment Memo

Along with the key risks, our PUR Investment Memo provides a short, high-level summary of our reasons for Investing.

The Investment Memo details:

- Key objectives we want to see PUR achieve

- Why we Invested in PUR

- What are the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.