The different types of lithium projects explained

Published 03-MAR-2023 15:14 P.M.

|

8 minute read

Lithium is not a commodity, it’s a specialty chemical. That means bringing new supply to market involves more than just simply mining it out of the ground.

Unlike gold, for example, where a lot of the investment risk is in finding an adequate resource in the ground, lithium requires extracting and then processing a marketable product from the resource.

This makes the particular geology of the lithium resource very relevant to the overall quality of the project.

With lithium prices at all time highs there are a lot of smaller lithium projects cropping up.

This is because lithium is a key component of lithium ion batteries used in electric vehicles.

Lithium is tradeable in three formats, but mostly resources are measured in lithium carbonate (LCE), which is then processed into lithium hydroxide (LH2) for use in batteries.

As the world looks to meet its ambitious sustainability goals, the demand for electric vehicles will increase over time - as will the demand for lithium increase.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

We wanted to provide a comprehensive guide on the different types of lithium projects that you may see, so that you can understand the risks and opportunities involved.

Here is what we will cover today:

- Lithium brines - evaporation ponds

- Lithium brines - direct lithium extraction

- Hard rock lithium - spodumene

- Hard rock lithium - micas

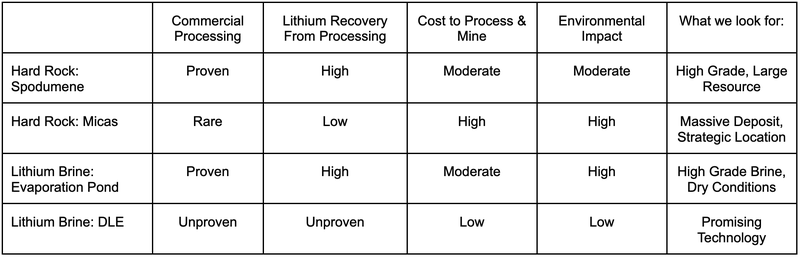

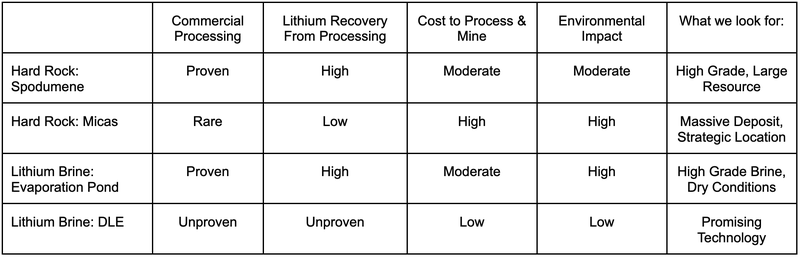

Each of these lithium projects have a different method of extraction and processing, here’s a quick high-level overview:

Lithium Brines Explained

Lithium brines are underground accumulations of saline groundwater that are enriched in dissolved lithium that have collected over millions of years.

A majority of the world’s lithium reserves — 58%, to be exact — are in brines.

However, to be utilised this type of lithium has to be extracted and processed.

Although brines are present throughout the world, lithium brine projects are most commonly found in closed basins in dry conditions.

The “Lithium Triangle” in South America, an area enclosed between the nations of Chile, Bolivia and Argentina, hosts the majority of the world’s lithium brine projects.

Due to having some of the driest conditions on earth, the Lithium Triangle has seen mass extraction of lithium salts from closed basin brines but the region still holds more than 75% of the world’s supply under its salt flats.

Evaporation Ponds Explained

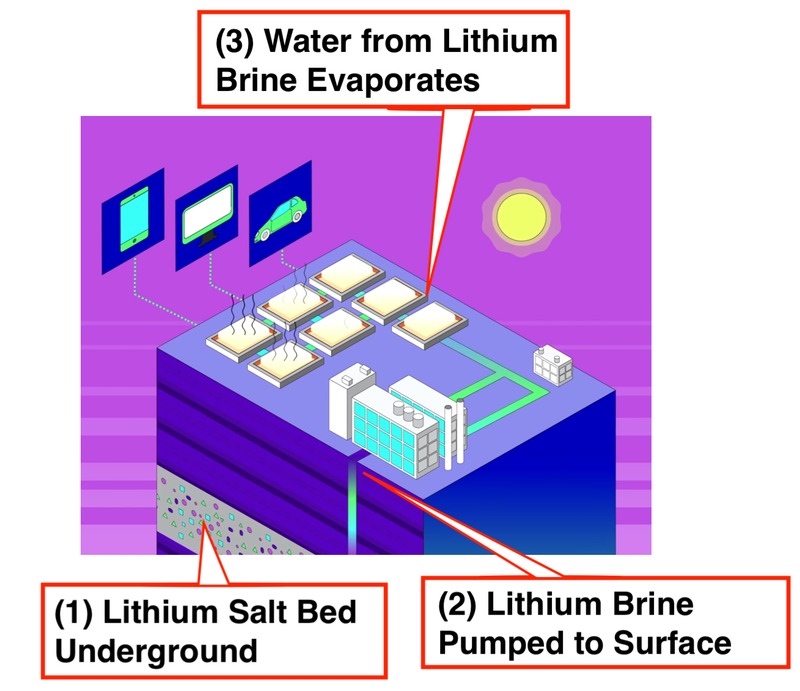

Over millions of years minerals from the mountains have leached into the ground, forming a huge lithium rich salt bed underground.

To extract the lithium, companies will pump the mineral rich liquid up through the beds and store it in large ponds.

The sun then evaporates away the water, leaving the lithium salts behind.

These salts are processed in a facility to create lithium carbonate, then chemically altered to create lithium hydroxide that is suitable for use in lithium-ion batteries.

The benefits of lithium extracted from evaporation ponds include:

- Lower production cost

- Well understood, tried and tested extraction process

- Proven commercial processing

The drawbacks to lithium extracted from evaporation ponds are:

- Long processing times (6-12 months)

- Large amounts of land required (not environmentally friendly)

- Inefficient processing method (lots of brine for a little lithium)

- Narrow conditions for success (brines only work in dry arid conditions)

- Can only produce lithium carbonate, which needs to be chemically altered to lithium hydroxide for use in lithium-ion batteries

How to evaluate these types of projects?

There are four factors in determining the merits of a lithium brine project using a evaporation ponds:

- Lithium content

- Ability of brine to flow (porosity)

- Evaporation rate

- Presence of contaminants

Lithium content

The higher the lithium content, the less volume of brine needed to create the same amount of lithium hydroxide. Think of this in terms of a “grade” measure.

Ability of the brine to flow

In order to extract the brine from underground, it is pumped through the rock structures between the brine and the pumping facility at surface.

The density of these rocks (also known as porosity) which affect the brine flow rate is an important factor in evaluating these projects.

The less dense the rocks, the better the brine flows and the more economic the project.

Evaporation rate

Once pumped to the surface the brine will sit in large pools that bake in the sun. The water evaporates and all that is left are the salts.

The evaporation rate determines the size of the evaporation ponds - the larger the area, the more expensive the project and the more costly to the environment.

Ponds in drier conditions tend to have higher evaporation rates and, therefore, the evaporation ponds can have a smaller surface area.

Presence of contaminants

After the water has evaporated and all that is left are the salts, the contaminants, such as magnesium and potassium, have to be processed out. This is done in nearby processing facilities, so that all that is left is a lithium concentrate.

Greater levels of contaminants will have an effect on the project economics, as separated out contaminants will require more energy and a greater volume of feedstock.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

Direct Lithium Extraction (DLE) Explained

Direct Lithium Extraction, or DLE, also extracts lithium from lithium brines, but “skips” the evaporation pond process.

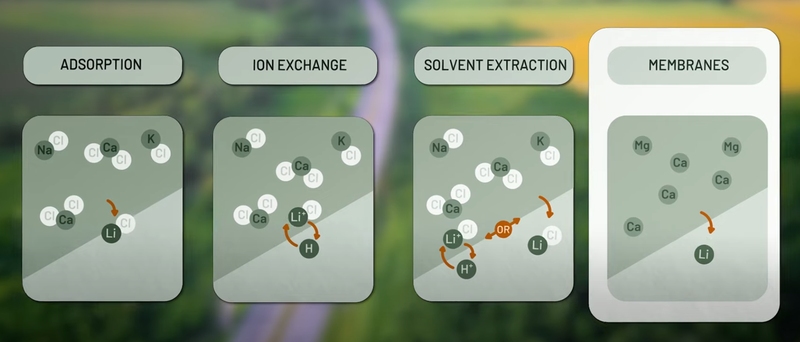

There are multiple ways that DLE technologies directly extract lithium from brines:

- Absorption

- Ion-Exchange

- Solvent Extraction

- Membranes

These are newer technologies — each having its own advantages and disadvantages. Absorption and ion-exchange techniques are being used in pilot and near-commercial scale demonstrations.

The benefits of lithium extracted from DLE:

- Much lower cost

- Significantly less time consuming compared to conventional evaporation

- Wide conditions for success

- Environmentally friendly as the brine is restored in a closed loop

The drawbacks of lithium extracted from DLE:

- Commercially unproven technology - companies testing the various methods

How to evaluate these types of projects?

DLE is more of a technology play than an exploration play, so the main thing that we look out for with these types of projects are their processing technologies.

That means these projects are only as good as the teams behind them.

In particular, we look at processing recovery rates from small scale pilot plants, and technology that has been proven through the scientific method of testing, learning, and scaling up.

Hard Rock Lithium Explained

A majority of the world’s lithium production comes from hard rock lithium mining, with Australia being the largest producer as of 2022.

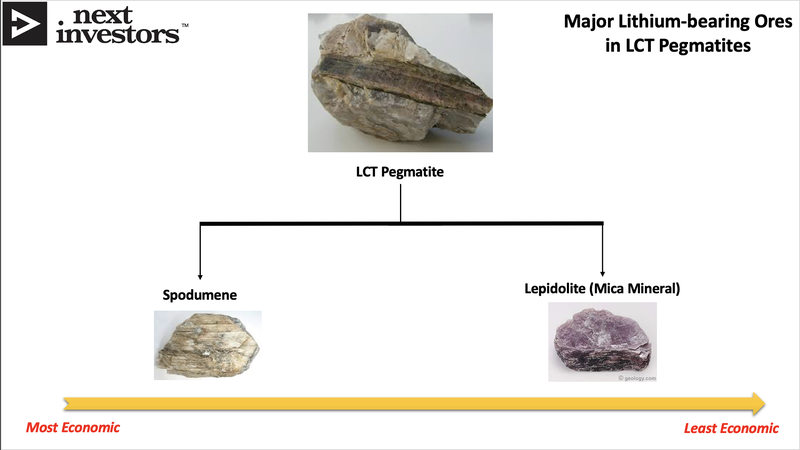

There are two main types of hard rock lithium deposits: Lepidolite (micas) and Spodumene.

Each one of these have properties that support it being processed into lithium hydroxide for use in electric vehicles.

Typically, hard rock lithium deposits are hosted in pegmatites, it is only after drilling that a company will know if any and what type of lithium deposit it has on its hands.

Spodumene

When looking for hard rock lithium, you want to find spodumene as it is a good signal for an economic discovery.

At current lithium prices we want to see grades more than ~1% in greenfields exploration.

For context the world's most profitable hard rock lithium project is the Greenbushes project in WA owned by IGO and TianqiLithium which produces lithium with grades ranging between 2%- 3%.

Micas

Micas are more commonly found than spodumene, however they typically host lower lithium grades.

Micas are found everywhere but don’t contain as much lithium.

These can be thought of as “low grade” deposits.

When evaluating mica projects, the size of the deposit and whether lithium can be economically extracted (processing flowsheet) is most important.

The only known mica processing is done in China, and it is a bit of a mystery to the Western World how it's done economically.

This is because it requires significantly more chemical inputs in the processing phase compared to spodumene processing.

The benefits of hard rock projects:

- Conventional mining is well understood

- Conventional processing methods used

- Success is not dependent on weather conditions

The drawbacks of hard rock projects:

- Exploration risk is more pronounced

- Larger production cost

- Environmental concerns

How to evaluate these types of projects?

The main things we look for are the grade and size of the deposit.

We like high grade lithium deposits, typically those with spodumene, as these are more commercially viable.

We will also like jurisdictions that are “mining friendly”, such as Australia.

What are the effect of new technologies on lithium supply?

Lithium is currently trading at all time highs.

And while there’s a lot of lithium out there, the technologies to unlock the potential are still evolving.

If one of these emerging technologies works, like cheap mica processing or DLE, then more traditional lithium production methods like processing hard rock spodumene or extraction from evaporation pools may be affected.

When investing in lithium projects it is important to understand where the risks are.

The key risks for each type of lithium deposits are:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.