PRM & GLV’s Drilling Equipment has been mobilised - Just a Few Weeks til Drilling Begins

Published 05-MAY-2022 09:56 A.M.

|

11 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,000,000 GLV shares, 49,000,000 PRM shares and 11,833,332 PRM options at the time of publishing this article. The Company has been engaged by PRM and GLV to share our commentary on the progress of our investment in PRM and GLV over time.

Our latest additions to our Catalyst Hunter portfolio, Prominence Energy (ASX: PRM) and Global Oil and Gas (ASX:GLV) are less than a few weeks away from one of the biggest oil and gas drilling events done by an ASX listed junior in decades.

Together, our investments have a 37.5% interest in the Sasanof Prospect - PRM holds 12.5% interest and GLV a 25%.

Today, PRM and GLV confirmed that mobilisation for drilling had commenced. The rig is scheduled to begin moving to the well site on 16 May, ahead of the expected drilling start on 24 May.

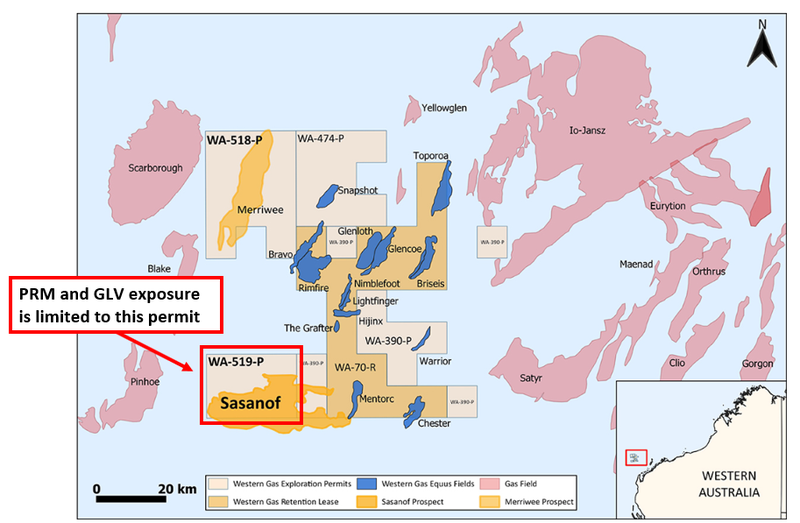

The prospect they are drilling sits on the North West Shelf, offshore WA, home to the biggest ever gas project developed in Australian history - the Greater Gorgon Project owned by a joint venture between supermajors Chevron, Exxonmobil and Shell.

The Greater Gorgon Project (readers in Western Australia will know this one) features the Jo-Jansz discovery which has a resource of 22 Tcf and the Gorgon discovery which has a 16 Tcf resource.

To contrast, PRM and GLV’s Sasanof Prospect has a prospective Resource as follows:

- 17.8 Tcf and 449 million barrels of condensate on a 3U basis (high case)

AND

- 7.2 Tcf and 176 million barrels of condensate on a 2U basis (mid case).

The prospect to be drilled sits on trend and up dip of the liquids rich Mentorc Field which is seen as analogous to the Sasanof prospect sharing similar geological fundamentals.

The prospect will be tested via the drilling of the Sasanof-1 well, which has now been set as 24 May — less than a few weeks away.

It’s not just the sheer size of the prospect that makes it interesting, the project's location also adds to the prospect’s attractiveness.

The North West Shelf in WA is home to ~47mtpa of liquefied natural gas (LNG) processing and some of the single largest facilities ever developed in the entire world.

Having all of this LNG processing infrastructure means that any discovery made here can be exported all around the world in the form of LNG.

So not only does the Sasanof Prospect have the potential to host a resource that rivals some projects owned by oil and gas supermajors capped in the hundreds of billions of dollars, but it is also perfectly positioned to be put into production should a discovery be made.

PRM and GLV, therefore, have exposure to one of the biggest ever drilling events of an ASX listed junior in recent decades and drilling is set to kickoff within three weeks.

We have invested in both stocks.

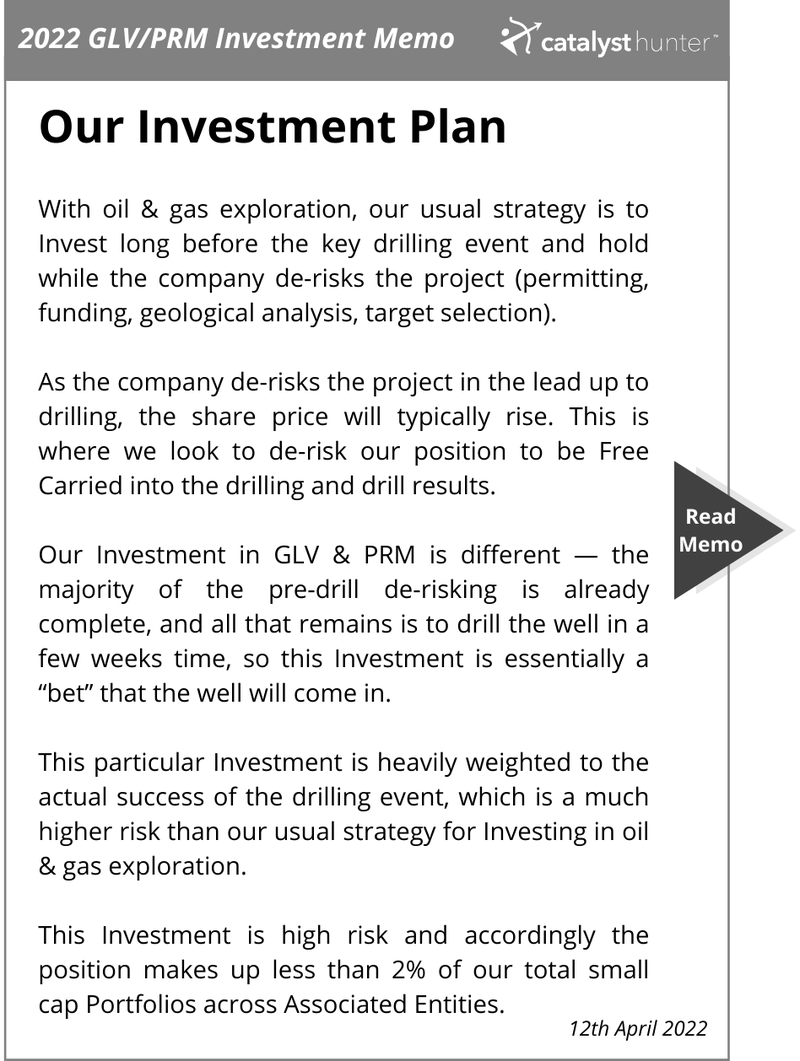

NOTE: Investing in high impact oil & gas exploration wells so close to the spud date is very high risk and the result of drilling will be near term and binary. The result will be known in the next two months, and depending on the result we expect the share price could rise OR FALL significantly.

Rarely do we invest in big drilling events like this so close to drilling. Instead, our investment strategy tends to be more focused on investing years in advance of the big drilling event as the company ticks off the pre-drilling exercises leading up to spudding.

On this occasion, most of the key risks that oil & gas explorers face leading up to launching a drilling program have been addressed.

With today’s news confirming that mobilisation of the rig has commenced, we did a deep dive on the key risks that have been addressed for the Sasanof Prospect and the key risks that are still present.

Whilst a lot of the risks have been addressed to date, the most important risk remains - exploration risk. Which means there is still a chance that the big drilling event returns nothing and no discovery is made.

Below is a screenshot of the key risks we will focus on today from our 2022 PRM/GLV Investment Memo.

Before getting into today’s note, below is a list of our previous coverage of the Sasanof Prospect.

- Introducing our latest Investment - Launch note

- PRM & GLV’s well is ranked amongst the highest impact wells of 2022 - A deep dive on the size and scale of the prospect, highlighting how a successful discovery could bring with it an interest in a takeover of the prospect.

So what risks have been addressed so far?

Getting a high impact oil and gas well ready to drill is no easy task. Targets the size of the Sasanof Prospect can take multiple years to de-risk to the point where a drilling program is possible.

Things like permitting and environmental concerns can take years as companies work through all of the rules and regulations of the particular jurisdiction.

The company then needs to technically de-risk the project by running seismic surveys, mapping out the geology, and assessing whether it is even worth spending the large amounts of capital required to actually drill test a project.

Then comes the funding requirements, which can be a lengthy process and hard to get over the line. After all, the investment proposition to financiers is a risky one.

With oil and gas exploration, explorers will look to spend large amounts of capital chasing a binary outcome — they either make a discovery and a return on the investment is realised OR the capital is written off to zero.

In PRM and GLV’s case the cost of a shot at a discovery is US$20-25M, where the key risk outstanding (exploration risk) still remains.

The Sasanof drilling event is over most of the usual hurdles an explorer faces leading up to drilling. The only thing left now is to drill the prospect and see if a commercial discovery can be made.

Below are the specific risks we highlighted in our 2022 Investment Memo that have already been addressed.

Permitting completed ✅

All of the permitting for the Sasanof-1 well is already in place.

Announcement for the drilling permits: Final regulatory approvals for drilling

Announcement for the environmental permits: Environmental plan acceptance

Funding completed ✅

PRM and GLV have already raised all of the capital required to fund its share of the well with the cash already having been paid into the joint venture (JV) account.

Rig contract signed for the US$20-25M.

Environmental permitting completed ✅

PRM and GLV combined hold a 37.5% interest in the joint venture that solely holds the Sasanof prospect.

This means that the only responsibilities that PRM and GLV have as part of the JV are at the Sasanof prospect level. Any other abandonment liabilities that may be levied on JV partner Western Gas for its other projects are not the responsibility of PRM or GLV.

Technical risk ✅

This one is perhaps the most interesting of the risks addressed as it forms one of the fundamental reasons we invested in PRM and GLV.

The technical risk of a project mostly relates to the target generation works that are completed in the lead up to a drilling program.

If a program doesn't tick enough boxes during technical derisking, companies tend to walk away from drilling these prospects.

In the case of the Sasanof Prospect, the technical information that piqued our interest was as follows:

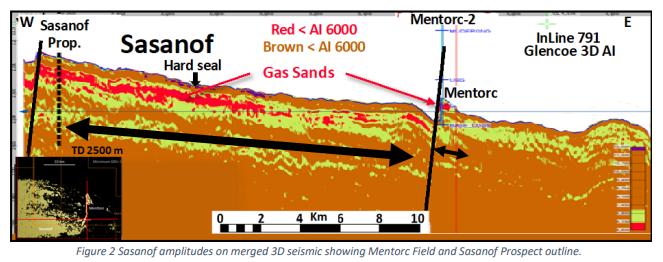

First of all, the Sasanof Prospect sits on trend and up dip from the already confirmed Mentorc discovery.

The Mentorc discovery was made in 2010 after a 3D seismic survey completed by Glencore identified the prospect as a flat spot amplitude anomaly.

After drilling two wells on the field and one appraisal well, the Mentorc discovery was officially confirmed with a 2C resource of 378 Bcf and 16.4 million barrels of condensate.

The Mentorc field sits immediately downdip on the eastern edge of the Sasanof Prospect.

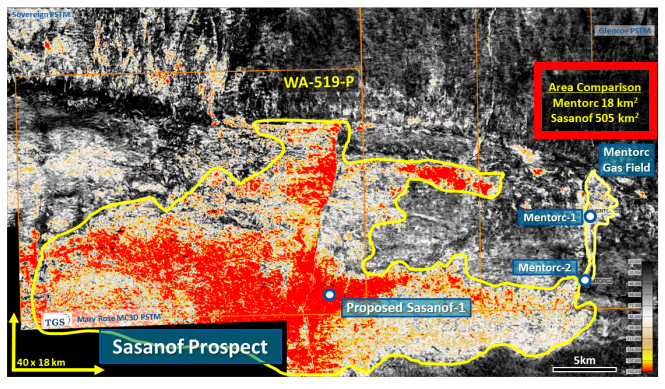

The Sasanof Prospect was identified using the same 3D seismic surveys and it displays similar technical characteristics (flat spot amplitude anomalies) that were found before the Mentorc discovery was made.

On top of these anomalies, the Sasanof Prospect also benefits from the data gathered during the ~$2.5 billion spent on exploration of the larger Equus Project.

Interestingly, the Equus Project has a 88% success rate (15 new gas discoveries out of the 17 wells drilled), for a total discovered resource of 2 Tcf and 42 million barrels of condensate.

The most obvious difference between the Sasanof Prospect and the Mentorc discovery is the sheer acreage size of the two.

Spanning an area of ~505km2, the Sasanof Prospect is ~28x the size of the Mentorc discovery’s 18km2.

While we can’t say that will directly translate to a 28x larger resource, it does point to the potential scope of the Sasanof Prospect.

The prospective resource estimate for the Sasanof Prospect is between 17.8 Tcf and 449 million barrels of condensate on a 3U basis (high case) and 7.2 Tcf and 176 million barrels of condensate on a 2U basis (mid case).

So a discovery this big would not be impossible, of course this is not our base case estimate and we expect that if a successful discovery is made it is more likely to be a lot lower then both of these prospective resource estimates.

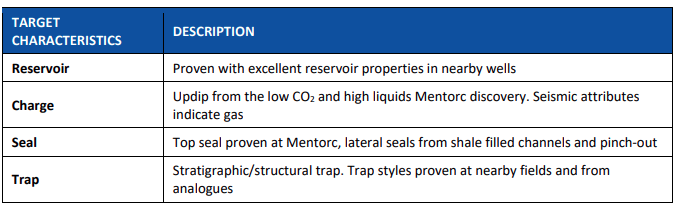

Secondly the Sasanof Prospect has a geological chance of success (GCOS) of 32% for the Sasasnof Prospect.

At first glance this may seem low but the Sasanof Prospect ticks all of the boxes required for a large-scale discovery to be made, and these GCOS figures are fairly common with oil and gas exploration.

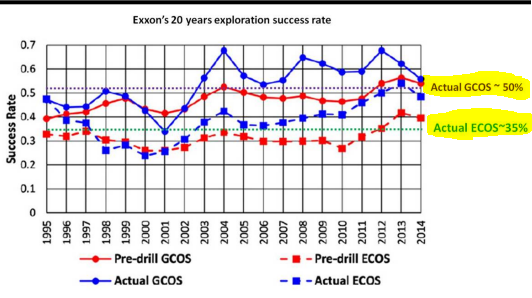

For some context, Exxon Mobil’s GCOS and Economic chance of success (ECOS) over the period 1994-2014 (a period of time when it was a lot easier to make new large scale discoveries) ranged between ~35% and 50%.

Of course this does not guarantee that any discovery will be made — the other side of the equation implies a 68% geological chance of failure.

When calculating the GCOS of a well, four target characteristics are examined:

- The reservoir quality - looking at certain geological characteristics that are a good indicator of whether a reservoir will flow oil and gas commercially.

- The “charge” - basically looking at what may be inside the reservoir.

- Whether there is a seal - a structure on top of the estimated reservoir which acts as a seal for the oil and gas to develop over thousands of years.

- Whether there is a trap - similar to a seal, a way of trapping the oil and gas so that it develops over thousands of years.

For a more in depth understanding of how GCOS calculations are made, check out this article which we found very useful.

The higher quality the characteristics are, the more likely a discovery will be made.

The Sasanof Prospect displays high quality characteristics across all as follows:

The work of de-risking the technicals for the project would normally be extremely expensive to put together and take many years to complete.

And even with all this checked off, the GCoS is still 32%. This speaks to the high risk nature of exploration drilling, even those technically de-risked. We simply don't know for sure what is down there until the target is drilled.

PRM and GLV benefit from the multiple billions of dollars in exploration spending done on the Equus Project and all of the existing Glencoe 3D seismic data that is available over the Sasanof Prospect.

All of this, combined with the modern reprocessing of the data, means the technical risks are fundamentally addressed and the decision to drill the Sasanof Prospect is warranted.

RISK NOTE**Above we mention the key risks addressed but the most important risk with respect to our PRM and GLV investments still remains — “exploration risk”. Below we will touch on the exploration risk in detail.

The key risk remaining - the biggest one of all

As per our 2022 PRM/GLV Investment Memo, the number one key risk identified in the lead up to making our investment in both PRM/GLV is the exploration risk.

This is true of almost all exploration programs but given we are specifically invested in PRM and GLV for its Sasanof exposure, in the event that nothing comes of the drilling program our Investment thesis would be considered a failure.

The Sasanof Prospect currently has a “prospective resource”, meaning there is no proven oil and gas presence as yet.

The JV will be drilling the target to prove there is a working oil and gas system at the project.

There is always a risk that the drilling program fails to find anything and the well is plugged and abandoned without a discovery being made.

In the event that no discovery is made, there is a risk that the share prices of these companies could depreciate significantly and any investment made in these companies could trade at cents for every dollar invested.

The geological chance of success for the well has been set at 32%, which means there is still substantial risk that nothing is found after the drilling is completed.

Knowing all of this, we have an exposure that is <2% of our entire investment portfolio in both PRM/GLV combined.

Having a relatively small exposure means that in the event a successful discovery is made our Investment could become 10% or 20% of our Investment portfolio, giving it a meaningful performance uplift.

But IMPORTANTLY, in the event the drilling program is a failure, we lose less than 2% of our portfolio, which has minimal impact on the performance of our portfolio as a whole.

This is why we have been very specific with our investment strategy when it comes to our Investment in PRM and GLV.

To read our Investment strategy in full, check out our detailed explanation in our launch note here, or alternatively you can view it by clicking the image below and checking out our 2022 PRM/GLV Investment Memo.

Our 2022 PRM/GLV Investment Memo

Below is our 2022 Investment Memo for PRM and GLV where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our PRM/GLV Investment Memo you’ll find:

- Key objectives for PRM/GLV in 2022

- Why we continue to hold PRM/GLV

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.