PRL set to increase landholding at its HyEnergy ZERO CARBON HYDROGENTM Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

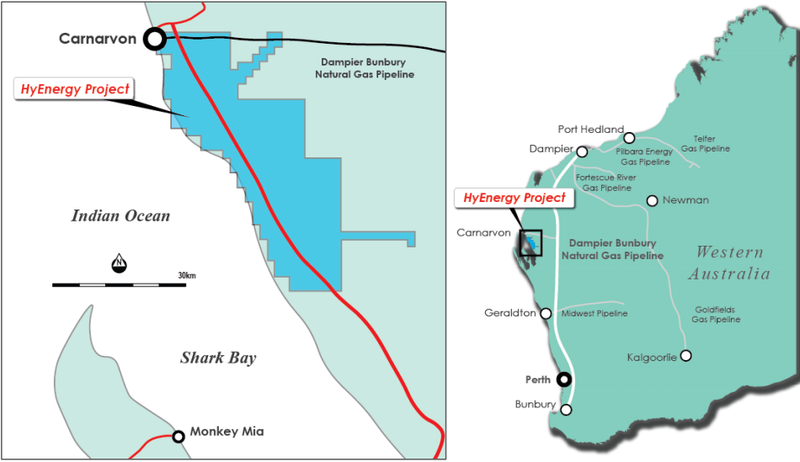

Province Resources Ltd (ASX:PRL) has applied for a further 864 square kilometres in the Gascoyne coastal region in Western Australia.

The extra land could potentially double the potential of PRL’s HyEnergy ZERO CARBON HYDROGENTM Project.

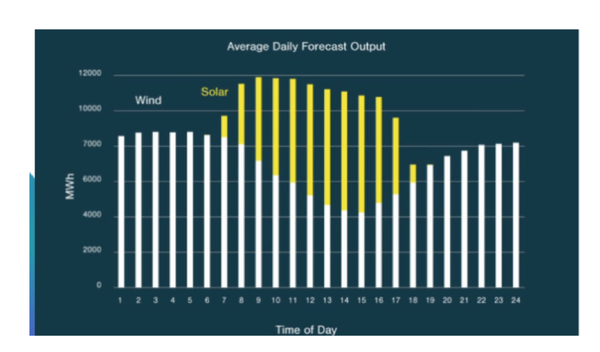

The Gascoyne region in Western Australia has world class solar and wind resources, with high incidence of sun during the day and high wind speeds in the morning, evening and night.

As Finfeed has stated previously, this enables competitively priced predictable and firm renewable electricity output, 365 days a year.

With that in mind, any increase in landholding could significantly improve PRL’s aim to develop Australia’s first truly Zero Carbon Green Hydrogen project.

The company’s ambition is to produce approximately 60,000 tonnes of green “Zero Carbon Hydrogen” or up to approximately 300,000 tonnes of green ammonia using renewable energy.

“The identification of the additional 864km2 of tenure complements the HyEnergy green hydrogen project and importantly, gives us greater critical mass in the region”, PRL Managing Director, David Frances said.

Province’s early mover position in this sector has paid dividends as reflected in its share price which is now sitting at 15 cents, making it a ten-bagger for investors who flocked to the stock in January/February.

Support is growing for hydrogen

The HyEnergy ZERO CARBON HYDROGENTM is in close proximity to a large regional centre and associated infrastructure of Carnarvon, which means the project area is ideal for installation of a commercial scale wind and/or solar farm.

Carnarvon has an annual mean wind speed of 25.5 km/h, making it the fourth windiest location in Western Australia.

The hydrogen industry is in its infancy, however it is fast gaining support, particularly in this area of Western Australia.

While the likes of billionaire mining magnate Andrew Twiggy Forrest cites hydrogen as the solution to the world’s energy problems, it is the support by government that is really eye catching.

Western Australia’s Hydrogen Strategy is to support the renewable hydrogen industry with a goal of 10% mix of renewable hydrogen in the Dampier Bunbury Natural Gas Pipeline (DBNGP) by 2030.

Funding from Government on both a State and Federal level include:

- Western Australian Renewable Hydrogen Strategy – $10M.

- Australian Renewable Energy Agency (ARENA) – $70M.

- Australian Government Advancing Hydrogen Fund – $300M.

- The WA State Government is committing $8M to funding the Denham Microgrid renewable hydrogen project.

- Large scale wind farms are planned in Pilbara's 'Cyclone Alley', where cyclones crossing the coast are prevalent.

All of this supports the Carnarvon region as a preferred lower risk wind farm location in Western Australia and is one of the reasons why PRL is setting up here.

Generally speaking, as 100 countries have pledged to be Net Zero by 2050, there is upside to being a sustainable energy play.

Green hydrogen produced from renewable sources, such as wind and solar energy, looks set to play a significant role in navigating society towards a decarbonised future and meeting the global aim of net zero emissions by 2050.

Key things to know about the HyEnergy Project

Some of the key highlights of the HyEnergy Project are listed below:

Infrastructure – existing Dampier Bunbury gas pipeline is within close proximity giving PRL the potential to provide Hydrogen Feedstock in the DBNGP for domestic or export use.

Export market – room for an offshore Ship Loading Facility in the future to help with export markets.

Wind – the region is ranked 4th in Western Australia for mean wind speeds recorded per annum.

Solar – flat arid area with minimal competing land uses for large solar array network. Furthermore, Carnarvon has a very rich solar resource averaging 211 sunny days per year, with an average solar exposure of 22 MJ/m2 /day (or 6.24 kWh/m2 /day).

Water – potential site to extract water for electrolyser plant.

Supportive Government – The Regional Centres Development Plan (RCDP) is about attracting business, investment and people to support the growth of WA's Regional Centres and Super Towns. This means a stronger economy and a better quality of life for the people in Western Australia.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.