PFE drilling has now commenced in Arkansas - 10 days of drilling with results in the next 6 weeks…

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 11,853,770 PFE Shares and 3,460,950 PFE Options at the time of publishing this article. The Company has been engaged by PFE to share our commentary on the progress of our Investment in PFE over time.

The people have voted, and change is in the air.

Trump is coming to power - and his “America First” policies.

Putting a rocket under various old and emerging US based industries.

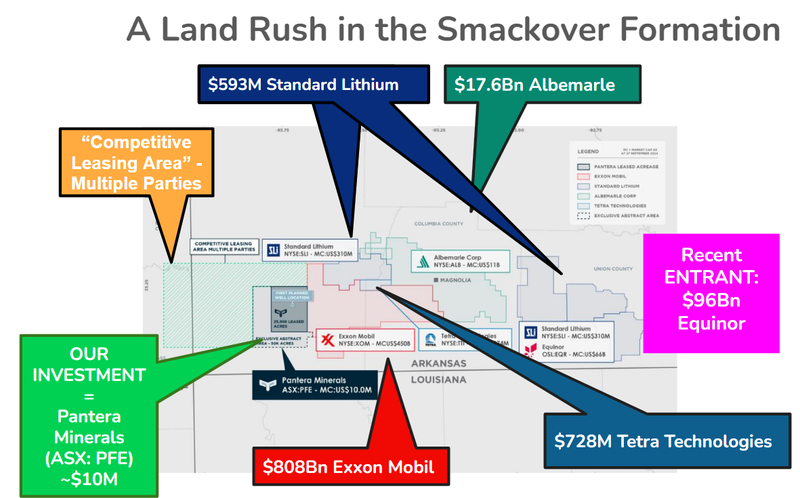

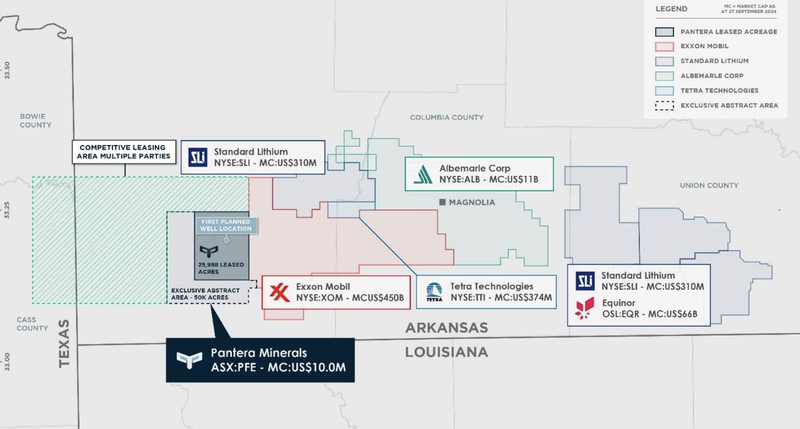

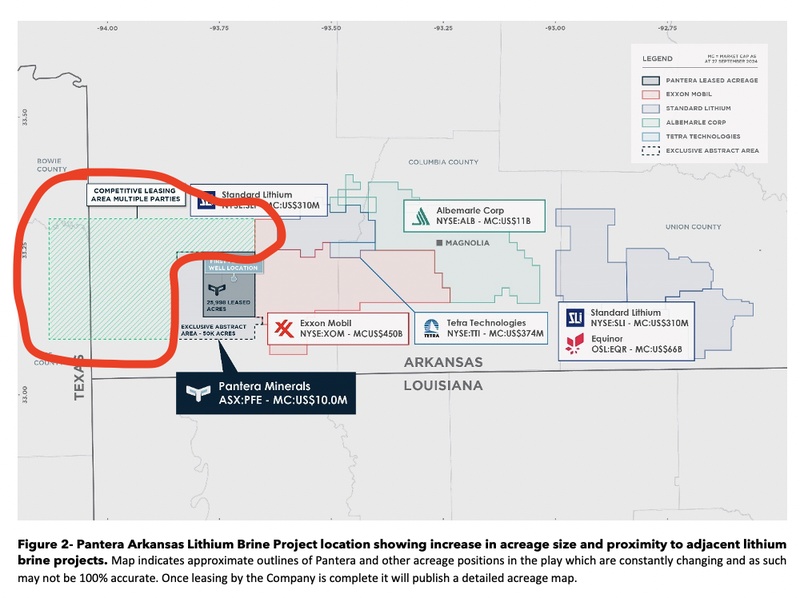

The Smackover region in Arkansas is a lithium brine hotspot that has attracted the likes of billion dollar giants ExxonMobil, Albemarle and Equinor.

The USA needs a local supply of lithium - it doesn't want to depend on China.

Our $9.5M capped Investment Pantera Minerals (ASX:PFE) has built a +26,000 acre land position in Arkansas...

PFE has just started drilling to re-enter a historic oil and gas well and pull out a lithium brine sample.

If PFE can announce a high grade sample in the coming weeks, it will confirm the validity of the project and hopefully deliver a share price re-rate.

The Arkansas governor is pushing hard to grow the local lithium industry.

(we saw her give a speech at a lithium conference in Arkansas back in February)

And she was formerly Trump’s press secretary and helped him a lot in this year’s campaign.

.. in fact she was almost Trump’s vice president pick this year.

It’s good to have friends in high places when trying to kick start an industry in your state...

(especially a friend with a direct line to Elon Musk)

In Arkansas, besides PFE, billion dollar oil businesses are undertaking a “lithium land grab” in the former oil producing Smackover region:

Note: $ figures above are in AUD

$808BN ExxonMobil wants to make this part of the US the centre of its lithium business.

$96BN Equinor (Norway’s energy giant) has farmed into one of PFE's neighbours.

PFEis the only ASX listed company with ground in this part of the world.

PFE is also currently capped at $9.5M, we just put in more cash into the PFE rights issue at 2.2c.

And PFE has just announced they have started drilling.

If PFE can announce a significant lithium concentration (above ~200m/gl) in the next 6 weeks, we think it will get the attention of its neighbours.

PFE is almost completely surrounded by much, much higher market cap companies in the Smackover (see above image).

PFE’s 3D models point to the possibility that PFE’s ground captures a large chunk of the “sweet spot” of the Smackover Formation inside its project area too (more on this below).

But it’s not just big players in the region that matter - PFE is now operating in a state whose governor has a direct line to the incoming president of the US, Donald Trump.

We think PFE stands to benefit from a Trump presidency - as he is also extremely close with Sarah Huckabee Sanders, the governor of Arkansas (where PFE’s project is located).

She was his press secretary and spent two years travelling across the world with him, building an extremely close relationship.

She supported his campaign with many rally appearances and even as a moderator at his Town Hall in Michigan.

Earlier this year we travelled to Arkansas and heard her speak at the Arkansas Lithium Innovation Summit.

Key takeaway: A Trump presidency is a significant positive for the Arkansas lithium industry (and PFE)

(read full coverage of our trip to Arkanasas and PFE site visit here).

At this summit, we heard Governor Sarah Huckabee Sanders say the state government would do everything in its power to make the lithium industry a success in the Smackover - words which clearly carried a lot of weight.

Given Trump's very close personal relationship, we think that the interests of Arkansas will be assured, and the Smackover is one of the most promising developments in the region.

Yesterday, PFE announced that it had kicked off the first well re-entry in the Smackover to extract its own lithium brine samples.

The final results from the re-entry program and Direct Lithium Extraction (DLE) testing is expected before the end of the year.

These results will provide PFE with very important data on the quality and potential of the lithium that sits over its land package.

The exact type of data that PFE’s big neighbours will be looking at.

If there wasn't any competitive tension amongst its neighbours to acquire PFE, there may be after the drilling results are in...

(Of course a lot still needs to go right... this is exploration, and there is never any guarantee PFE finds economic quantities of lithium).

Again, PFE is capped at just ~$9.5M and it has two big catalysts due within the next 6 weeks:

- Results from the well re-entry program (before Christmas)

- DLE Testing Results (before Christmas)

Plus a Maiden JORC Resource due early next year.

We increased our Investment in PFE at the 2.2c entitlement offer.

Our bet is that IF PFE can deliver high grade lithium brines and define a big lithium resource then the company’s valuation could re-rate higher.

Also, we think that data gathered from this well re-entry program could make it an attractive target for one of its neighbours looking to build a land position in the region.

In the last 12 months capital has flooded into the Smackover region (despite lithium being out of favour) - here’s a snapshot of some key events:

- Global energy supermajor ExxonMobil entered the Smackover with ~US$100M acquisition Galvanic Energy.

- Equinor (Norwegian oil giant) did a JV with Standard Lithium and invested more than US$130M to get its hands on a 45% stake in two Smackover lithium brine projects.

- The US Government gave Standard Lithium and Equinor US$225M in grant funding to develop their projects.

- ExxonMobil drilled its first well, and a further seven wells followed.

- ExxonMobil signed an MOU with EV battery maker SK On (South Korean battery giant) to sell them ~100k metric tonnes of lithium from the Smackover, to be used in batteries manufactured inside the US.

- Lithium guru Joe Lowry said the “Smackover is where the US will have brine & DLE success”.

- Arkansas Governor Sarah Huckabee-Sanders launched an annual Lithium Summit in the capitol, Little Rock. That’s the event we attended above.

With Trump now in power and his “America First” policies, we see the Smackover Region becoming a big player on the lithium stage.

Trump elected: What does it mean for PFE?

Donald Trump just won the presidency in the US very convincingly.

And there were rumblings that he almost chose Arkansas’ governor, Sarah Huckabee Sanders to be his VP.

But aside from being best buddies with Trump, Sarah Huckabee Sanders also has an agenda of her own - and that is to rapidly grow the lithium industry in the Smackover region.

Trump’s agenda on the other hand, has three key policies that affect the lithium supply chain within the US:

- Increased tariffs on imported goods = more local production like battery metals, battery plants, car plants

- De-regulation = faster, cheaper and easier to develop resource projects inside the US

- Removing the EV tax credits = good for current market leader Tesla, not so good petrol car manufacturers trying to move into the EV space to compete with Tesla.

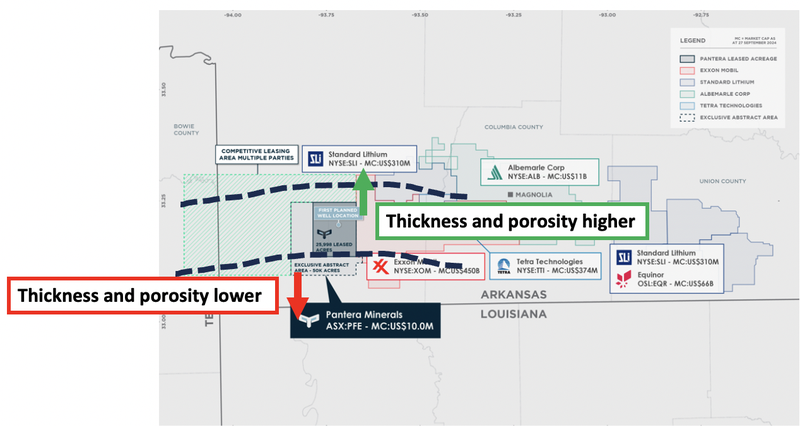

PFE is drilling the “sweet spot”

PFE’s re-entry well is located in the central part of its acreage.

We think that this is the part of the project where the neighbours would be wanting to get data from the most...

If the centre of PFE’s ground is solid, then it could be a signal that the ground to the west and north is also similarly strong.

And if that is the case, then PFE’s ground sits smack in the middle of where someone like an Exxon may want to control.

Just a few weeks ago, PFE put out a new 3D subsurface model for its project. (read more here)

The model was built using data from ~38 historic wells that passed through the upper Smackover formation and some 2D seismic data.

That model showed that the thickness’ and porosities across the Smackover increase as you move toward the north-east

(~50 feet in thickness to the south of PFE’s project and ~280 feet toward the north-east)

Things like reservoir thickness and porosity matter because they determine how big a resource is and how likely it is to flow to the surface.

As mentioned before, that tells us that PFE’s ground captures a large chunk of the “sweet spot” of the Smackover Formation inside its project area.

We think that this area is most interesting from a porosity perspective.

(Source)

Higher porosity usually means bringing lithium to surface is easier - porosity is a measure of the pores between rocks and shows how easily water (in this case brine) moves between rocks.

Results from the well re-entry will confirm or negate this data collected on the 3D subsurface model.

If it is confirmed it could be very positive for PFE.

Bull/Bear/Base cases for PFE

For this well re-entry, what we want to see is high grade, thick intercepts of lithium brine.

- Bull Case - High-grade thick intercepts (~300mg/l or more).

- Base Case - Moderate grade thick intercepts (~150mg/l) or higher grade thinner intercepts.

- Bear Case - Lower grade and or very thin intercepts (~50mg/l or less) OR: no lithium at all.

Standard Lithium attracted a US$160M investment from Equinor in May earlier this year.

As a reference point, Standard’s project has an Indicated & Inferred Resource of 1.8Mt LCE at average lithium concentration of 437 mg/L.

PFE has an enterprise value of A$6.5M.

DLE news could also be a big share price catalyst for PFE

Looking beyond the re-entry results... DLE testing results could also be a big catalyst for PFE.

Direct Lithium Extraction (DLE) tech is the key to unlocking most lithium brine projects - especially those in North America.

As a result, usually when a small cap does a deal with a big name in the DLE tech space - it can be a pretty strong catalyst for a re-rate in the company’s share price.

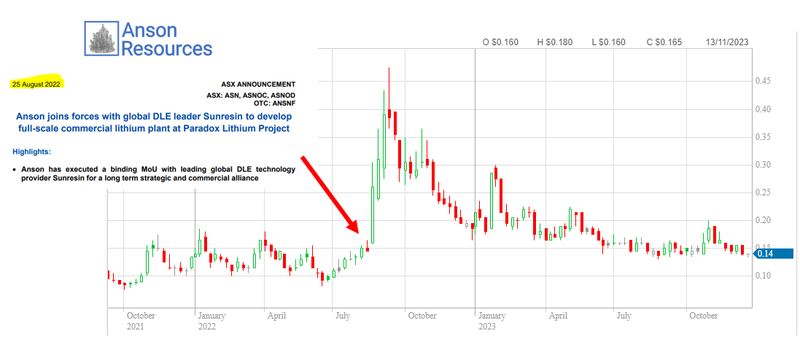

We saw it with another US listed lithium brine player - Anson in 2022.

Back in June 2022, Anson announced an MOU with Sunresin for a partnership on applying DLE to its project.

Following that news, Anson’s share price went from ~14c to just under 50c per share.

At the end of that run, Anson’s market cap peaked at ~$490M.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Of course 2022 was a completely different time for both lithium stocks and the market in general, BUT we think that DLE news is re-rated for a reason...

PFE expects to have samples in labs going through DLE analysis within 10 days...

AND have results out to market before the end of the year.

At any point after that 10 days and before the end of the year there could be a surprise DLE-related announcement from PFE which acts like a short term share price catalyst.

Ultimately however, PFE’s progress at a project level should be what determines whether or not the company can deliver our Big Bet, which is as follows:

Our PFE Big Bet:

“PFE to return 10x by making a discovery and defining a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our PFE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for PFE?

Between now and the end of the year we are looking forward to three major catalysts:

🔲 Well re-entry and results

Now that PFE has re-entered the well, the key things we will be looking for are:

- The lithium concentration (grade)

- The potential impurities

- The porosity/permeability (how easy can the lithium be extracted)

We also noticed PFE is planning a “standalone resource definition well” next.

Ultimately we want to see PFE convert its ‘436Kt to 2.96Mt’ exploration target into a maiden JORC resource.

We think any JORC resource published that sits between those numbers would be an excellent result.

Remember those Standard Lithium figures from above - the company has an Indicated & Inferred Resource of 1.8Mt LCE at average lithium concentration of 437 mg/L.

Standard attracted a US$160M investment from Equinor in May earlier this year.

🔲 Results from DLE testing

The DLE test results are important because it will show whether or not PFE’s brines can be processed into finished battery grade lithium products.

PFE confirmed DLE analysis would start within 10 days of the re-entry finishing. Analytical results are due before the end of the year.

🔲 More leasing to increase project size

PFE’s current focus is on expanding its ~26,000 acre land position with new ground to the west.

It has an exclusive abstract area of 50,000 acres. Beyond that further west, is a competitive leasing area.

We will be watching to see if PFE is able to pick up additional leased acres over the coming months.

What could go wrong?

With the drilling now commenced, the key risk now for PFE is exploration risk.

There is no guarantee that PFE’s re-entry program finds economic quantities of brines or lithium.

If this risk was to materialise we would expect the PFE share price to re-rate a lot lower than where it trades today.

Exploration risk

There is no guarantee that lithium bearing brines are found or the brines are of economic concentrations. Alternatively, if brines are found, they could contain contaminants that reduce or eliminate the value of PFE’s brines.

Source: “What could go wrong? - PFE Investment Memo 4 March 2024

To see more risks to our PFE Investment, check out our Investment Memo here.

Our PFE Investment Memo

Below is our Investment Memo for PFE, which provides a short, high-level summary of our reasons for Investing.

In our PFE Investment Memo, you can find the following:

- What does PFE do?

- The macro theme for PFE

- Our PFE Big Bet

- What we want to see PFE achieve

- Why we are Invested in PFE

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.