PFE announces exploration target… and we are going to Arkansas to see it.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,210,000 PFE shares, 494,167 PFE options, and 7 Daytona Lithium shares at the time of publishing this article. The Company has been engaged by PFE to share our commentary on the progress of our Investment in PFE over time.

An exploration target has just been announced.

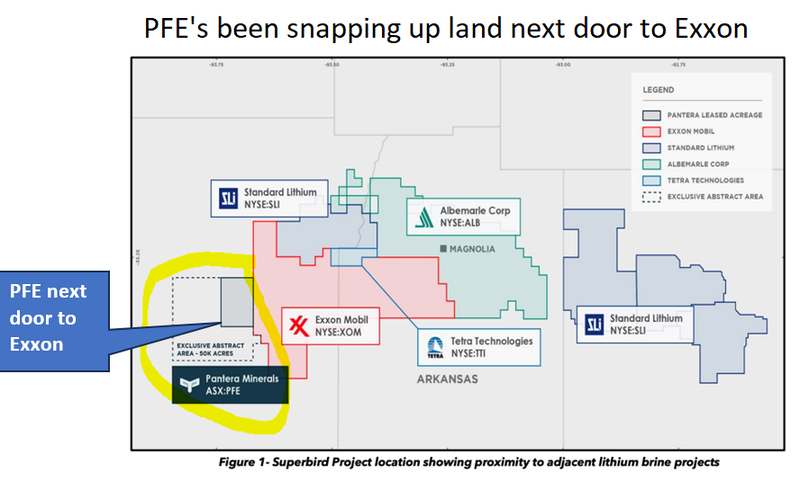

Super-major Exxon is over the fence.

And next month we are heading to the USA to check out the project with our very own eyes.

...and attend a summit with Exxon, Albermale, Standard Lithium and the Governor of Arkansas.

We will report back on what we see and hear.

We are talking about direct lithium extraction from underground brines, from historical oil wells drilled in the Smackover formation in Arkansas, USA.

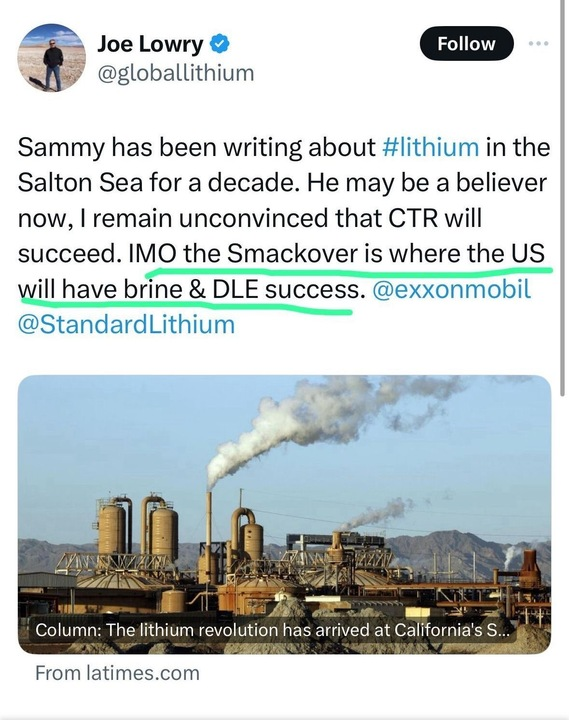

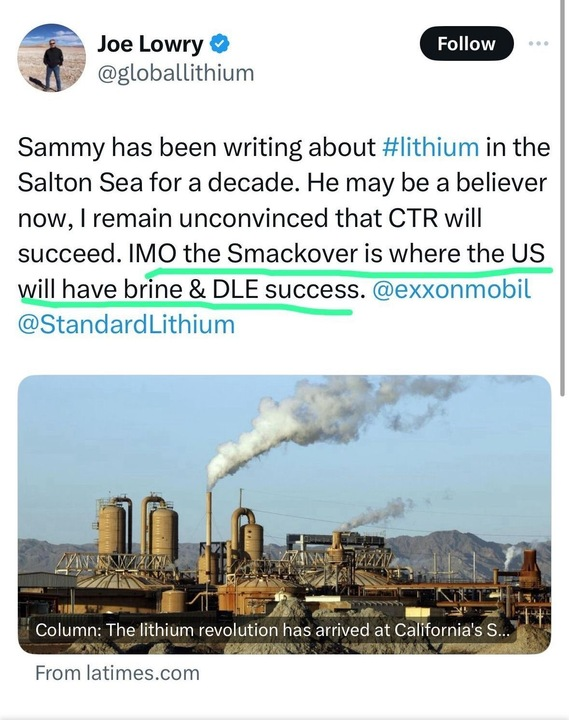

“Mr Lithium” Joe Lowry reckons this area will have success...

(and he is usually sceptical about a lot of things).

Over the last 12 months our small cap Investment Pantera Minerals (ASX:PFE) has been busy, quietly acquiring old oil fields in the Smackover that have no more oil, but are rich in lithium brines.

(And contain lots of oil drillholes that can be cheaply re-entered to extract lithium brines).

We have had a big win in the past with a certain lithium DLE project in Germany that we picked up while the lithium sector was having a breather in 2019 (...it was Vulcan).

(remember past performance is not a future indicator...not saying this will happen again, but we are taking the shot with PFE).

And today PFE released an exploration target.

A big one.

Now to turn the exploration target into a JORC resource.

Today, PFE announced that its exploration target came in at 436,000 to 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE).

This is across their 50,000 acre “exclusive abstract” area which basically means an area where PFE has exclusively engaged a commercial leasing abstract company, which is the only provider in the region.

Of this 50,000 acres so far PFE has leased around ~12,500 acres, with a further 9,000 under negotiations.

Mineral rights in this part of the US are complicated to piece together and PFE has a proprietary database which helps the company fit the land jigsaw together.

Together with the quickly growing land package and now an exploration target, this means that the potential size of the project is almost comparable with much larger capped neighbours, pending successful results from a well re-entry and sampling program.

For context on PFE’s exploration target:

- Smackover neighbour Standard Lithium is capped at $329M and has a Measured and Indicated resource of 2.8 Mt LCE.

- Galvanic Lithium which was bought out by Exxon for at least US$100m had an inferred JORC resource with 4 Mt LCE,

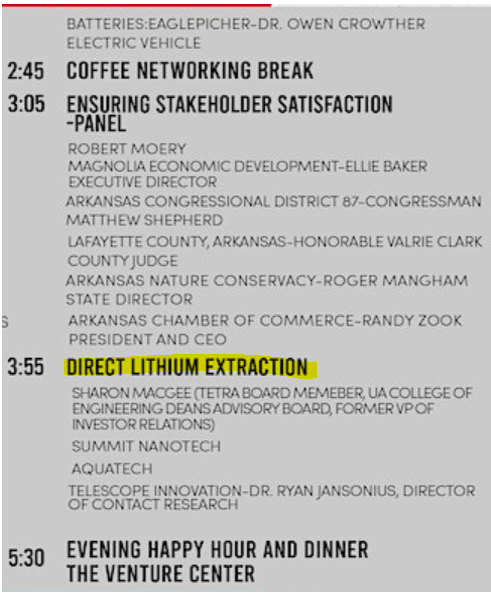

We’ll hear more from Exxon and Standard Lithium at the summit in Arkansas next month.

So far PFE has got ~12,500 acres and is looking to grow it up to 50,000 acres (the exploration target announced today is across the full 50,000 potential acres).

As it sits right now, PFE’s exploration target has the potential to host a lithium resource the size of Standard Lithium's project (capped at $329M).

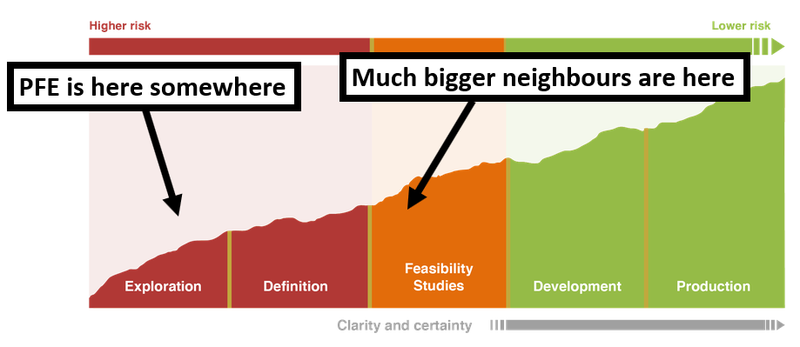

The main point of difference between PFE and its neighbours is that its project is at a far earlier stage in the mining company lifecycle.

While PFE is still at the exploration stage, its neighbours are at the resource definition/feasibility stages:

To get the project to a maiden JORC resource, PFE has already outlined an exploration strategy that starts by acquiring existing 2D seismic/geophysical data and re-entering existing wells over its acreage.

All of that work is planned for Q2-2024 with a view of getting a maiden JORC after all the work is done.

We are heading to Arkansas to see it for ourselves

Off the back of our trip to Indaba in Cape Town this week (where we’ll get the pulse of what’s happening in African mining and exploration), we decided to make a “short” detour on the way home to pay a visit to PFE’s project in Arkansas, USA.

...and to attend a Lithium Innovation Summit where all the major players in the region will be presenting on the latest in lithium extraction from historical oil fields in the Smackover.

Lithium innovation Summit 2024, Arkansas

We’ll put out a full write up of what we learned at the summit and what we saw at PFE’s project.

Exxon backing up its US$100M investment into the Smackover -

The big news for PFE and the whole US lithium brine sector has been Exxon’s entry into the industry.

Exxon entered the Smackover AFTER PFE started leasing ground in the region (through its investment in private company Daytona Lithium).

Instead of starting from scratch and leasing its own ground, Exxon did what a company the size of Exxon’s would do.

Exxon paid US$100M to buy out Galvanic Lithium.

Galvanic at the time of the takeover had a JORC inferred resource of ~4mt LCE and held ~120,000 acres in the Smackover.

Exxon hasn't wasted any time and is already drilling the first of its wells going for lithium.

The plan for Exxon is to become one of the world’s biggest lithium producers by the year 2027.

Ultimately, Exxon wants to supply enough lithium to support the manufacturing of ~1 million electric vehicles annually by 2030.

AND Exxon has earmarked the Smackover as its home base.

Exxon’s president for low carbon solutions, Dan Ammann, talks about Exxon’s ambitions in the following video:

(Source)

We also listened to Joe Lowry's podcast with Patrick Howarth who leads Exxon’s lithium business (ExxonMobil’s Low Carbon Solutions Group).

For anyone wanting to really understand Exxon’s role in the Smackover and US lithium brine industries, the podcast is a must-listen.

(Source)

The whole conversation goes on about how Exxon is coming into the Smackover looking to apply all of its technical know-how to the lithium industry.

For those who don't know, Exxon actually developed the first lithium-ion battery prototype back in the 1970s, so they are no strangers to lithium and the whole battery industry.

(Source)

For decades, Exxon has been pumping hydrocarbons out of the ground, processing them and turning them into saleable products.

For Exxon, it is now about doing the same thing but with lithium brines.

One thing that really stood out to us from the podcast with Patrick Howarth was Exxon’s focus on the Smackover and how the focus in the medium term would be on getting its projects in the region up and running.

What that tells us is that US$411BN Exxon is serious about making the Smackover in Arkansas a base for its US lithium brine business.

With a market cap bigger than the top 5 lithium producers combined and a cash balance of over US$30BN it changes the game for any junior operating in the region.

Just for some context on Exxon’s size - Albermale which is the world’s biggest producer of lithium in the world has a market cap of US$14BN - less than half of Exxon’s cash balance alone....

Our view is that whatever Exxon invests into its Smackover lithium assets will trickle down into success from an industry perspective in the region.

It's a viewpoint shared by Joe Lowry (AKA Mr Lithium), who has previously called Exxon’s move into lithium a “seminal moment for the industry”.

(Source)

PFE is in the right place at the right time - just needs to execute now...

With the entry of an Exxon into the Smackover, all we want to see PFE do is:

- Expand the size of its acreage - bigger acreage makes it more likely that PFE can work up its project to a much larger JORC resource number.

- Move the project through the resource classification stages - take it from exploration target to inferred JORC resource classification and eventually to higher confidence levels.

- Start feasibility studies on a project development scenario...

Hopefully, by the end of phase 2, just as PFE is moving into feasibility studies after building a JORC resource, bigger players in the region start to take notice of PFE.

If, by then, PFE has proven itself a large JORC resource, then the ideal scenario would be to see a major like Exxon show interest in what PFE has to offer.

And fingers crossed this all happens around the time that lithium starts another upcycle...

What’s next for PFE?

Continue leasing more ground 🔄

PFE has a 50,000-acre Exclusive Abstract Agreement (EAA) - we want to see PFE increase its ground position from its current ~12,500 acres to somewhere near the 50,000 number.

Acquisition of 2D Seismic & geophysical data 🔄

PFE plans to acquire existing 2D seismic data over its acreage. The new data will ultimately be used to guide PFE’s drill programs in the future.

Re-enter a well 🔲

The first step toward converting its exploration target into a maiden JORC resource will be to re-enter historic oil & gas wells that sit on its acreage.

The goal for the re-entry programs will be to see how much lithium sits in the ground and at what concentrations.

DLE test 🔲

The re-entry will bring up samples which PFE can then send off to DLE (Direct Lithium Extraction) tech partners.

What could go wrong?

The key risk in the short term is “Deal Risk”.

PFE is currently looking to complete the 100% acquisition of Daytona Lithium which holds the US lithium projects.

At the moment, PFE has a right to own just 35% of Daytona and is in the process of completing a 100% acquisition of the projects.

There is always a risk that the deal isn't voted through at the upcoming shareholders meeting OR that disagreements between the vendors and PFE lead to the deal falling through.

We are hoping none of this occurs but in the short term it is the key risk to our Investment in PFE.

New PFE Investment Memo

At the moment, PFE has the right to own ~35% of Daytona Lithium (which holds all of the US lithium brine assets).

PFE is currently working on completing the 100% acquisition of Daytona with the shareholder vote to approve the deal set for the 15th of February.

After the deal is complete and PFE takes 100% ownership of the project we will release our NEW PFE Investment Memo, where we will cover:

- Why we are Invested in PFE

- Our long term bet - what we think is the upside Investment case for PFE

- The key objectives we want to see PFE achieve over the next 12-18 months

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.