Pantera acquires “Hellcat” polymetallic project

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 2,467,000 PFE shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by PFE to share our commentary on the progress of our investment in PFE over time.

Our early stage exploration investment Pantera Minerals (ASX:PFE) has just made a new asset acquisition while it waits to restart drilling on its iron ore project.

PFE’s new project has nearology to one of the world’s next significant lead/zinc/silver operations expected to go into production.

We announced PFE as an addition to our portfolio in August this year after it listed on the ASX via an IPO at 20c.

We liked that PFE had an iron ore exploration project next door to Australia’s highest grade iron ore operation (and all its existing infrastructure), had the former chief geologist of aforementioned highest grade iron ore operation directing drilling, and appeared cashed up for multiple drill campaigns for the year ahead.

The share price of PFE spiked soon after listing, going from 20 cents to a high of 57.5 cents on day 1 of trading in August.

Trading has since returned to IPO issue price levels of around 20 cents, mirroring the downward trend of the iron ore price (from ~US$180/t in early August to ~US$110/t recently). The initial drilling campaign in October ran into some difficulties, returning only 3 of the planned 6 holes, which didn’t help the company’s share price performance.

So the Iron ore price moving against us combined with some drilling issues on the first campaign means PFE’s share price hasn’t come out of the blocks as fast as we hoped, but 2022 is a new year with plenty of exploration “rolls of the dice” to come for our investment in PFE.

Our longer term investment thesis is that if PFE can successfully go on to delineate a large, high grade iron ore resource at its flagship Yampi project, it might one day attract the attention of a bigger company as a takeover target, as an inexpensive alternative to adding more resources to supplement existing operations. Here is a link to our Investment Memo on PFE.

While PFE waits for the wet season to pass so it can restart its iron ore drilling (expected in Q3 22), it looks like PFE has decided it won’t wait around, and has opportunistically picked up a new asset to explore in the meantime to keep things interesting.

(Our 2022 PFE investment memo includes work on this new asset alongside the iron project we originally invested for).

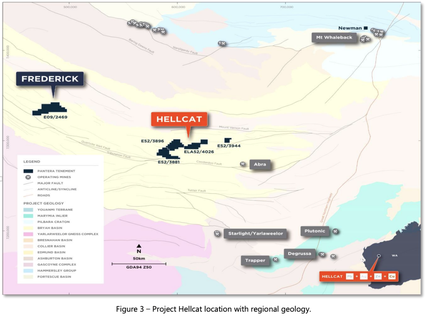

PFE’s new asset is located down the road from one of the region’s most recent metals discoveries - Galena Mining’s ‘Abra’ polymetallic deposit. The project has the same stratigraphic and structural setting, and shares a similar geophysical signature to Galena Minings deposit.

It is also in the neighbourhood of another of PFE’s projects, which would make drilling both of them easier when the time comes.

In order to make the acquisition and have some funds to allocate to the project’s exploration, PFE has raised $1.5M at 20 cents per share - i.e. the same price as the August IPO shares.

First, let’s take a closer look at the newest acquisition.

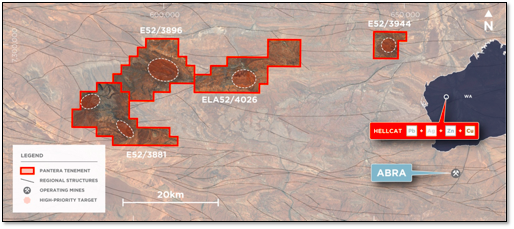

PFE announced today the acquisition of the Hellcat Polymetallic Project, spanning 442 km2 in the Edmund Basin, Western Australia.

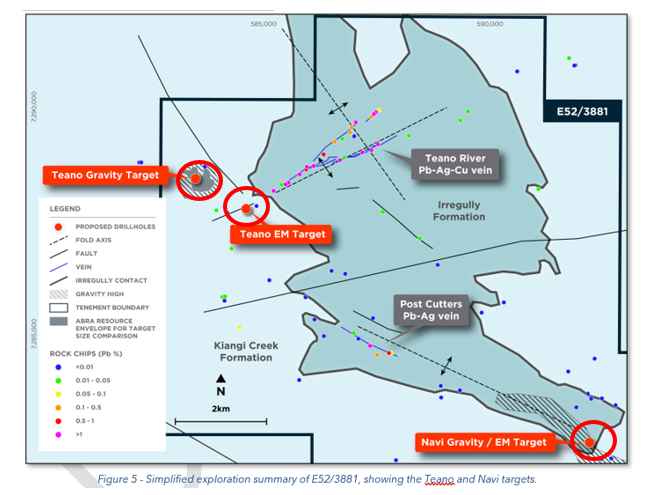

As you can see in the above map, Hellcat is 70km from the ‘Abra’ base metals project - Abra is a 60:40 joint venture between Galena and Japanese smelter Toho Zinc.

Abra has a JORC inferred resource of 34.5mt at 7.2% lead and 16g/t silver, and the mine is expected to operate for an initial 16 years, producing 95 ktpa of lead alongside byproducts.

With funding already in place, Abra is on track to become a globally significant lead/ zinc/ silver operation with first production expected in 2023.

A great regional neighbour to have in the event PFE do find something material.

But it's not just proximity to Abra alone that attracted PFE to the Hellcat asset - it is also that it is within the same stratigraphic and structural setting as Abra - more so, it shares a similar geophysical signature as Abra.

PFE’s new asset also happens to be down the road from PFE’s Frederick project (i.e. their geologists know the region well).

So whilst Hellcat is a greenfields (ie minimal or no previous exploration) prospect, PFE utilised details from Abra (e.g similar gravity signatures) alongside their geological database (high grade Pb/ Zn rock chip samples, geophysical surveys) to already have drill ready targets in place.

An aerial VTEM survey is planned next quarter which provides more information on chargeability, conductivity and magnetic susceptibility of the rocks hidden at depth underground - this allows more fine-tuning of the current drill targets.

What we like about this asset is that PFE can progress it relatively quickly to a maiden drilling campaign, with 3 diamond drill holes planned for Q2 2022 and funding secured.

As a greenfields prospect, it has a high risk/ reward profile, but the presence of Abra down the road points to what the upside could look like with drilling success.

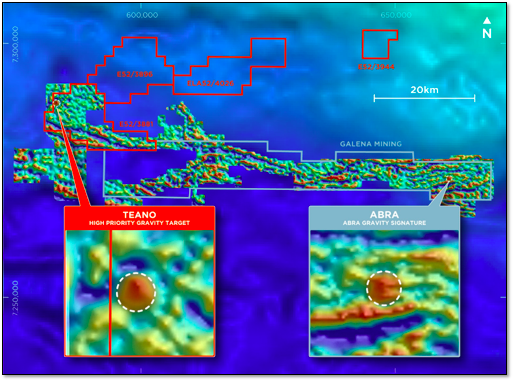

The “Teano Gravity Prospect” is the highest ranked target within Hellcat, sharing several geophysical similarities to the Abra deposit. The most notable similarity can be seen in the presentation the vendors did with Galena in 2019 - see the slide below.

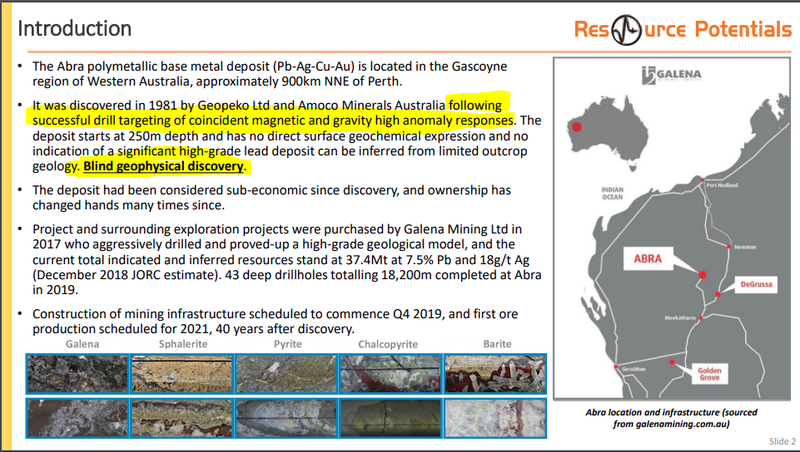

Let’s take a short history trip back to the time when Diana Spencer became Princess Di, Raiders of the Lost Ark ruled the box office... and the Abra discovery was made - the year being 1981:

At the time, the drillers were primarily armed with coincident magnetic and gravity high anomaly responses to target... and so when they hit paydirt at Abra, it was good considered a “Blind Geophysical Discovery”, as there had been no direct surface geochem expressions indicating that there could be high-grade deposit deep below the ground.

An almost identical playbook is now on hand for PFE at the Teano target- except with more information at hand (i.e. not so blind for PFE).

The Teano Gravity Target has a similar footprint at surface to the Abra deposit, but with a higher amplitude gravity anomaly.

PFE have already commenced planning for a 400m diamond drillhole in to test the Teano Gravity target with the EM target being ~260m below surface.

As part of the drilling program PFE is also looking at drilling the Navi Gravity/EM target with a ~600m Diamond drill-hole to test the EM target ~350m below surface.

Whilst the project characteristics are analogous to the Abra deposit, ultimately there is a reason why drill-rigs are often referred to as “truth detectors” and so the proof will be in the drilling.

Abra Deposit - Galena Mining - what happened:

It's all good and well to bring in an asset like this but the most important thing is if the market is interested any interest in an Abra style discovery?

Let's look at the origins of the Abra deposit to try and get a better picture of how a discovery at the Hellcat project can be a source for a PFE re-rate.

Galena listed on the ASX in 2017 at a market cap of ~$9.9M and an enterprise value of ~$5.5M.

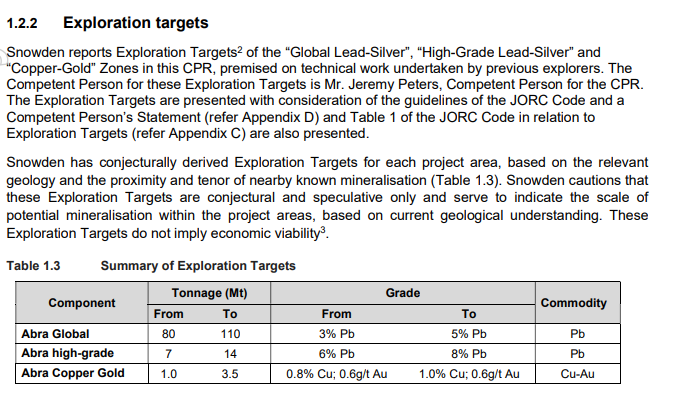

At the time Galena had nothing more than an “Exploration Target” over the Abra project and still needed to do a lot of drilling to delineate the discovery.

In its first drilling program, Galena managed to hit “Mineralisation in every drill-hole”. Within ~3 months after listing, Galena had already re-rated by almost 5x.

So there is a track record of market re-rate upon an Abra-style discovery.

We’re hopeful that any one of the 3 diamond drill holes planned will provide either evidence that there is economic mineralisation in the tenements, or better yet, a discovery can be made (although this is quite rare with the initial holes for greenfield projects).

Hang on, but what about PFE’s iron ore project?

Just because this new asset has been acquired, it does NOT mean that PFE’s Yampi iron ore asset is now relegated to the “Plan B” - the iron ore project is what got us interested in PFE in the first place and why we are still invested.

The iron price has started rebounding in the last few weeks too.

Yampi remains PFE’s flagship asset, and the team are keen to return to site to commence the next drill campaign here once the wet season passes - likely in Q2 22.

This next drill campaign is going to see how far the hematite sandstone extends with some additional drill holes.

We’d like to see both high grades (55% Fe would be a pass mark, and we would consider anything above 60% as a very good result) and width (several metres thickness) in the results of the next drilling here.

However, Hellcat becomes PFE’s next highest priority asset immediately on a prospectivity basis, leapfrogging above other ‘side-bets’ including PFE’s manganese and other base metals projects.

With a large gap between drilling campaigns at Yampi, it makes sense to also progress activities at other projects, and that is where Hellcat fits in nicely.

We can expect updates on both Yampi and Hellcat over the next 6 months, and anticipate a positive re-rating on drilling success at either.

What are the deal terms and who are the vendors?

As with any deal, the most important thing is what is being paid to acquire the opportunity.

Just like when making an investment, the key is to purchase quality assets and then add value to it (in this case by drilling) or simply wait until the market takes notice of the assets/ commodities.

PFE’s acquisition payments are split into a Initial and Deferred component:

Initial:

- Upfront payment of $200k cash and 1 million PFE shares.

- 1 million PFE shares AFTER drilling commences.

- At the raise price of 20c this would mean PFE would make a payment of $200k in cash and $400k in shares between now and the first drilling program commencing.

Deferred:

- Issue of 2 million PFE shares following the announcement of an Inferred (JORC Resource) of 250,000t of contained base metals and/or 500,000Oz silver

- Issue of 2 million PFE shares following a decision to mine

- At this stage the asset would be “company making” and investors would likely be pretty happy - so these further payments to the vendor would justify the 80% ownership in the asset - think of this as the vendors and PFE sharing in the upside of the project.

All up, the total initial consideration is $600k (of which $200k is paid in shares now and $200k in shares paid once drilling begins - this is all assuming a 20c share prce).

The remaining amount payable to the vendors is wholly conditional on a successful discovery being made.

Considering Galena’s ~$100M market valuation derives primarily from its sole asset, namely Abra, the $600k payment (mostly via equity) for a shot at an Abra style discovery seems a decent risk/reward proposition for PFE.

We also like that PFE has managed to weigh the bulk of the payments into the “Deferred” category which means they would only need to make these payments if there is a commercial discovery made.

Lets not forget that the vendors have kept a 20% interest in the project and have agreed to almost all of their payments in shares instead of cash, a really positive vote of confidence in PFE as a vehicle to unlock Hellcat’s potential.

Financing the Deal:

As Hellcat is outside the scope of activities spelt out within the IPO prospectus, PFE could not allocate funds raised during the IPO to this acquisition.

Hence the company has announced a placement along with the acquisition, raising $1.5M through issuing 7.5 million shares at an issue price of $0.20 per share, with a free option exercisable at $0.25.

The dilutionary impact is an increase in total shares on issue to 76.5 million (up ~11%).

The placement received strong support from a range of institutional, sophisticated and professional investors, and is being completed in two tranches.

The first tranche of 4.35 million shares is being issued using the company’s placement capacity (meaning the company doesn't need shareholder approvals for it) and the second tranche of 3.15 million shares together with all of the options requiring shareholder approval.

PAC Partners led the raise, which closed oversubscribed which means it must have been pretty popular.

Who are the vendors?

As with any joint-venture, it is important to understand who is in on the deal.

The vendors here are the guys behind Perth based geophysics/geological consultants “Resource Potential” - led by Ian Shackleton and Logan Barber, who were behind the Kumina Iron ore discovery with BCI Minerals which MinRes recently purchased for $35M.

The exploration team also includes Jason Meyers and David Stannard who were consultants to Galena for the Abra deposit - this is a good sign as they should know what to look for when working on PFE’s assets.

Those that follow the geologist awards circuit closely (we didn't until now) might know David in particular - he was awarded “Best Minerals Paper” at the 2019 AEGC conference for his work on the geophysical characteristics of the Abra deposit.

So, it is fair to say that these guys know this area well and have the technical chops to put PFE in the best position to make a discovery.

Below is a link to that particular presentation the Resource Potential guys did together with Galena Mining:

Basically, this group are specialists in target generation using geophysics and have leveraged all of the work they did on the Abra discovery to put together this tenement package, hoping to replicate their earlier Abra-cadabra magic.

Whilst exploration is very risky, with most activities leading to no commercial success (ie producing mines) - the risk can be mitigated somewhat by having experts (especially those that know the region well) onboard.

The right team provides the best chances of unlocking the potential of any tenement package, whilst also knowing when to walk away without expending too much resources.

So with PFE and the Resource Potential guys, we believe there is a strong team that will put PFE in the best position possible to hopefully emulate an Abra-esque discovery at Hellcat.

What’s next for PFE?

We are now watching out for the assays from the recently completed drilling program at the Yampi Iron Ore project.

We expect that they will be received before the end of the year but almost all of our portfolio companies are mentioning backlogs in assay labs so it wouldn't surprise us if the results come in early 2022.

In the meantime we expect PFE to quickly start pre-planning works leading up to a diamond drilling program over the newly acquired assets.

We are expecting to see the following progress with the newly acquired assets:

- Heritage/Aerial VTEM to further define conductors (Q1 2022).

- Diamond drilling program (Q2 2022).

- Assay results for first 3 holes at Hellcat (Q2-3, 2022)

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 2,467,000 PFE shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by PFE to share our commentary on the progress of our investment in PFE over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.