Pantera about to drill with Heli-portable rig now built and helicopter commissioned

Early stage explorer Pantera Minerals (ASX:PFE) is set to drill for high grade iron ore right next to billion dollar iron ore producer Mt Gibson Iron (and all their infrastructure).

PFE will be using a helicopter to fly a custom built “heli-portable” drill rig to site, which is much faster than trucking it through the hilly, remote terrain.

Today, PFE announced that a bespoke heli-portable diamond drill rig has been built and will be dropped at the exploration site by helicopter within weeks. Now with the final drilling permits expected within a few weeks, PFE says it will begin its first ever drill campaign by the end of the month, with results shortly after.

Here’s what a helicopter delivering a drill rig might look like. This image is from google, it’s not PFE’s, but PFE has promised to share a video of the helicopter landing the rig when it happens:

Milestones being delivered...

PFE has now ticked off commissioning of the heli-portable drill rig and helicopter and says permitting should be in place in the next two to three weeks. The next milestones we are watching out for is the grant of permit and the helicopter flying to the rig to site, then commencement of drilling:

➡️✅ Heli-Drill Rig Commissioned

➡️🔄 [NEW] Permitting

🔲 Heli-Drill Rig Mobilised to drill site

🔲 5 Hole Drill Programme Commenced

🔲 5 Hole Drill Programme Complete

🔲 Assay Results hole 1

🔲 Assay Results hole 2

🔲 Assay Results hole 3

🔲 Assay Results hole 4

🔲 Assay Results hole 5

🔲 New Exploration Targets Announced

🔲 New Milestones Identified and Added

🔲 [FUTURE] Prove Iron ore resource

As an early stage explorer, PFE is high-risk, high-reward. Once drilling starts in late September there is immediate potential for a high value discovery.

We would expect such a discovery (if it happens) to deliver a share price increase, but also expect the share price to creep higher in the lead up to drilling results on speculation of a potential discovery.

But as early stage speculative investors, we know that drilling may deliver NO discovery or NO interesting intercepts. This could see the share price drop significantly. The third possible outcome is something in between. These are the risks in exploration investing.

If you are new to our mailing list OR new to investing in general, make sure to read the footer of this email and our ebook to learn more about our strategy for investing in early stage exploration companies.

To summarise, our investment strategy for minerals explorers is to invest in the quiet periods before speculation around drilling results as we typically see share prices run in the lead up to highly anticipated drilling events. In this case, we have only been invested in PFE since it listed four weeks ago so this is a shorter time frame to drill results than we usually work with.

PFE listed on the ASX over a month ago after raising $7.0M at 20¢ and was the third addition to our portfolio in 2021.

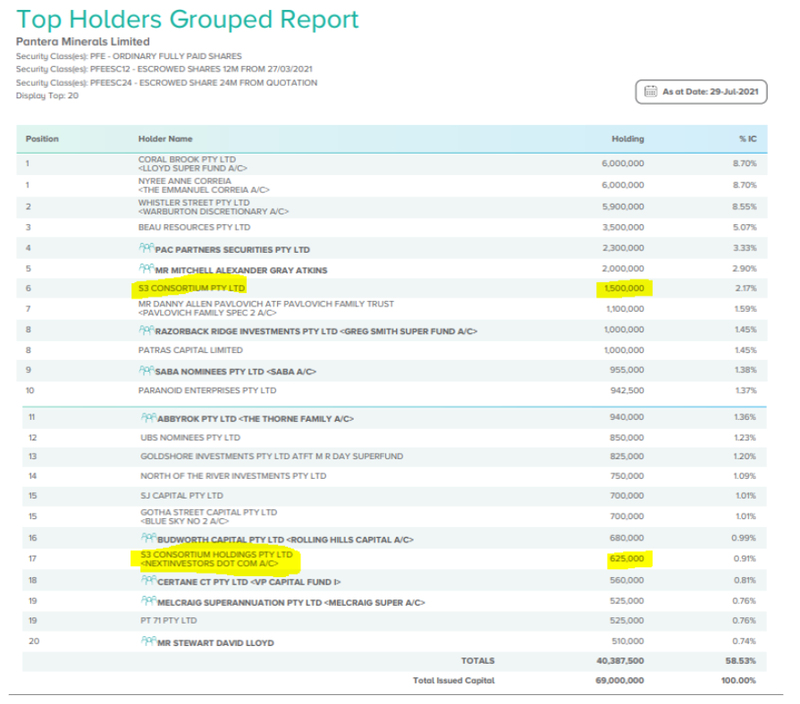

One of the reasons we chose to invest in PFE and add it to our portfolio from the hundreds of companies that want to be added, was its tight capital structure — it has a low number of shares on issue and the Top 20 shareholders hold a lot of the company.

Also, many (~40%) of PFE’s major shareholders (and the project vendors) are escrowed for two years. This means all the big players are locked in, betting on PFE making a new iron ore discovery - as investors we always recommend checking which shareholders are escrowed before investing in a company.

We are in the top 20 shareholders list and the majority of our holding is escrowed for two years, meaning we can’t sell most of our shares until August 2023 and we are locked in to PFE story and its longer term success. We also hold a smaller position that is not escrowed:

With this smaller, non-escrowed holding in PFE, our current plan is to consider partial free carry in the lead up to drilling results... IF the share price has a good run up over the next eight weeks on speculation of a positive result.

Basically, this means we’ll sell a small part of our holding to take back some of the initial investment and be “free carried” into the drill results (our standard plan for small cap explorers).

As always, you can see the progress of our investment strategy on our PFE company page:

✅ Initial Investment: @20c - Majority escrowed for 2 years

✅ Initial Investment: @20c - Non escrowed

🔲 Increase Investment

🔲 Increase Investment

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry - Non escrowed

🔲 Take Some Profit - Non escrowed

🔲 Hold remaining Position for next 2+ years - Escrowed portion

If the share price DOESN’T have a good run up in the next eight weeks as we are hoping, our plan B is to hold our full position into the results. But even if the share price pulls back if the first few drill holes don’t deliver a good result, this should help PFE identify (and later) drill some other high grade iron ore targets on the project.

In the meantime, PFE will be busy drilling on its “side-bet” battery metal, manganese, and poly metals projects. We haven't talked much about these yet, but they do seem pretty interesting .We’ll talk more about PFE’s side bets in a later note.

Yet while side bets are good to have — diversifying a company’s operations and protecting on the downside — we are primarily invested in PFE for its upcoming iron ore exploration campaign.

Again, as an early stage explorer, PFE is high-risk, high-reward. And now that PFE is set to start drilling, there is immediate potential for a high value discovery. But like all early stage explorers, the risk is that there will be no discovery at all.

We aren’t expecting PFE to grow into a major producer itself that would require building expensive infrastructure that’s needed to ship ore. That takes too much time and money to realistically squeeze it into the current hot commodity cycle window.

Our strategy with PFE, assuming they get some good drill hits and quickly prove out a resource, is to see the company acquired by a larger player within a couple of years. There are some natural buyers already producing iron ore in the region - Mt Gibson is the first that comes to our minds.

We believe we are in the midst of a multi year commodities super cycle, in which resources sector mergers and acquisitions ramp up. We have started to see a few majors buy up junior companies that have drilled out decent assets.

Importantly, we like that PFE has strong relationships with the traditional land owners and is one of the only ASX listed companies with a local, indigenous CEO.

PFE has committed to Environmental, Social and Corporate Governance (ESG) reporting which is rare for an early stage iron ore explorer and a big tick for us and many other investors.

Quick take — The 8 reasons we invested in PFE:

- First drilling begins in the coming weeks: Could drive a re-rating in the stock.

- High grade hematite (iron ore): Rock chip samples of 55% to 68% are positive early signs. How much and how high grade will depend on upcoming drilling. High grades are good for beneficiation and direct shipping.

- Right next to export facilities: No stranded deposit. Five kilometres from a deep water port and $1BN capped producer Mt Gibson Iron and its infrastructure.

- Takeover target? We think so, if PFE can successfully identify a high quality iron ore resource.

- Iron ore price: Iron ore has pulled back from 10-year highs in recent weeks, but we remain in the midst of a commodity super cycle... increasing the likelihood of mergers and acquisitions.

- Tight capital structure and low EV: Enterprise Value of $6.95M on ASX listing, with a big portion of stock in escrow (the majority of our holding is escrowed for 2 years). We are not fans of the 31.5 million 25c options on issue, while they do guarantee the next tranche of funding for the company if the share price surges, we would prefer it if they weren’t there.

- One of very few Indigenous CEOs on the ASX: PFE has a strong relationship with the traditional land owners and has ESG credentials.

- Ex Mt Gibson exploration manager: He must know a good iron ore project when he sees one.

This is just a quick summary, a dive deeper into each point can be found in our original article: Our New Portfolio Addition is Here.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.