More on our Latest Investment EIQ

- Commentary: EIQ - our latest Investment

- Quick Takes: TG1, GUE, SS1, MTH

- This week in our Portfolios: CND, EMD, EIQ

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,470,000 EIQ Shares and the Company’s staff own 140,000 EIQ shares at the time of publishing this article. The Company has been engaged by EIQ to share our commentary on the progress of our Investment in EIQ over time.

Yesterday we announced our new Investment in Echo IQ (ASX:EIQ).

This is our 9th new Investment made this year.

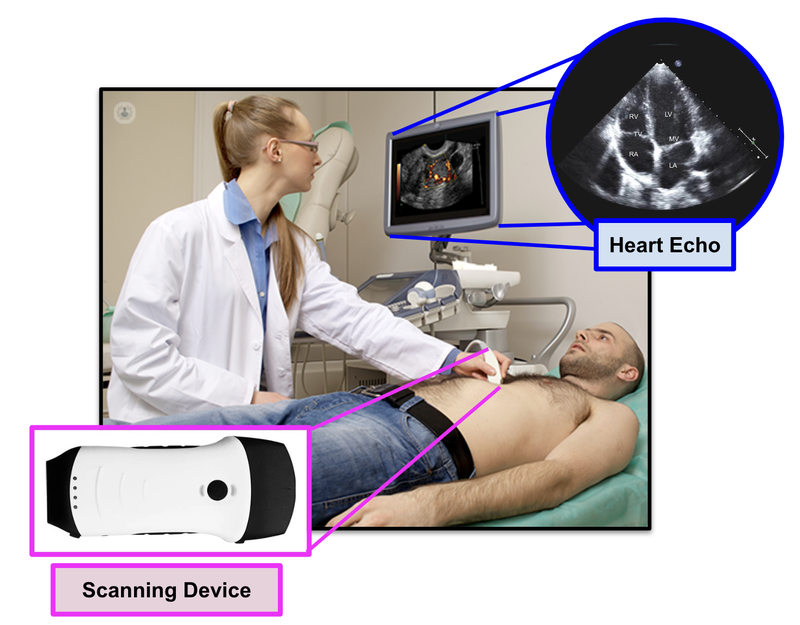

EIQ is developing an AI-powered diagnostics assistance tool that detects adverse heart conditions.

It does this by analysing 3D models of the heart created by echocardiograms, ultrasounds of the chest or “echos” for short.

Clinical studies have demonstrated its potential to dramatically improve heart disease detection, first in the US and hopefully the world.

In the coming months it will be commercialising its technology.

Following on from yesterday’s initiation note, today we will dive into a little more on why we Invested in EIQ.

Before we go on, in case you missed it, you can read our full EIQ initiation note and Investment Memo here:

Our new Investment is Echo IQ (ASX:EIQ)

EIQ just raised $7.1M at 15c per share in an oversubscribed placement, which we Invested in.

Interestingly there were no free attaching options that came with the new shares - usually options are used to attract investors into capital raises, but they weren't required here - that's a good sign.

At 15c per share, post the issue of the new shares later next week, EIQ will be capped at ~$88M.

According to the AFR, demand for EIQ’s placement exceeded $10M.

The raise was open and shut in a matter of hours, and EIQ started trading again the day after its halt - normally companies go into 2 day trading halts for capital raises.

Another good sign in a market where extended halts are becoming more commonplace.

(Source)

This capital injection gives the company a strong cash balance to deliver on a series of pending milestones.

After a few years of tech development and testing its technology in the clinic, EIQ is now moving into its commercialisation / revenue generating phase.

FDA approval for its product on aortic stenosis detection is due in the coming weeks - a significant catalyst for the stock (more on this below).

Down the track will come FDA approval for its heart failure detection solution.

We think the 15c raise is well timed because it gives the company clear air to deliver big catalysts into, and extend the cash runway until commercialisation really kicks into gear.

Instead of good news being sold into because everybody is expecting a cap raise, EIQ is now free to trade over the coming months without the weight of a suspected capital raise following the catalyst...

Hopefully this was the last capital raise before the company kicks some big commercialisation goals and moves toward profitability.

We are long term Investors in EIQ and are looking forward to seeing it deliver over the coming years.

Here are the 8 Reasons why we Invested in EIQ

1. The data shows that the AI algorithm works

EIQ has published very strong data showing that its technology is better than humans at detecting adverse heart conditions.

2. Imminent share price catalyst in potential aortic stenosis FDA approval

A decision is expected at the end of the month on aortic stenosis. FDA approval opens the door for EIQ to commercialise its tech.

3. Multi-billion dollar market target for “heart failure” diagnostics assistant

EIQ is targeting a big market which costs the healthcare system roughly US$60 billion each year. Big markets = big opportunities.

4. Second catalyst for FDA approval on heart failure could be within 12 months

Over the next 12 months we will follow EIQ as it works toward FDA approval for heart failure. We like following catalysts over a period of time.

5. Exclusive commercial access to the world’s biggest heart data repository

This is effectively EIQ’s “moat”. EIQ’s AI is trained on over 1 million echos from the National Echo Database of Australia, which started collecting the data from 2000.

EIQ has an exclusive commercial licence to use this database.

6. Clear pathways to commercialisation in the USA - the biggest healthcare market in the world

The US healthcare industry is set up for EIQ to seek reimbursement payments from hospitals or echo labs that use the product on insured patients (once FDA approval is granted).

There are also opportunities to licence the technology to private industry that have an interest in greater patient diagnosis.

7. SaaS revenue model, potential to rapidly grow revenue and/or secure large licensing deals

Like most technology SaaS platforms, EIQ’s product has a very low operational cost.

If it can demonstrate recurring revenues it could attract larger valuation multiples.

8. Cost savings, 3 seconds until results, removing bias

EIQ’s technology strips out bias and human error.

This saves cardiologists time and assists them in more accurately diagnosing patients.

Click here to read our full EIQ initiation note:

Our new Investment is Echo IQ (ASX:EIQ)

Let’s now dive into some more details about EIQ that we have learnt following our due diligence and Investment into the company.

How exactly does EIQ’s tech work?

EIQ’s technology assists cardiologists with diagnosing patients with serious heart conditions.

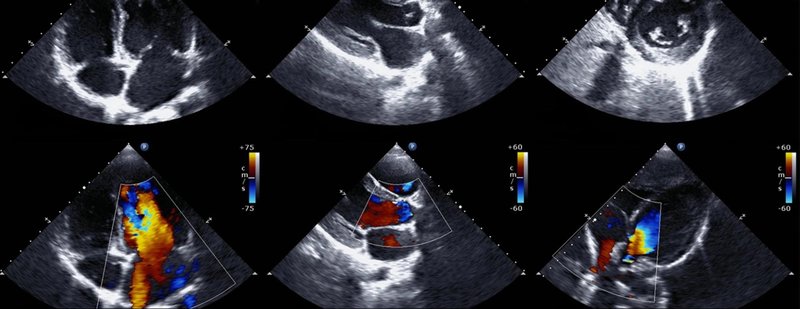

Today, heart issues are identified by cardiologists using an echo machine to look at an ultrasound of a person’s heart in a 2D sliced image:

Then, in real time, the specially trained cardiologist will evaluate if there are any issues... just by looking at the echos:

What the doctors are looking for is signs of heart failure.

Specifically, they are looking at how well the heart can still pump the blood throughout the body.

A healthy heart will pump normally, while the unhealthy heart will not:

The challenge for cardiologists is that most of the information is sourced through a flat 2D echo scan which is relatively complex, but a trained eye can read.

For very damaged hearts, heart failure can be easily detected... but for those hearts that are at the early stages of failure, it can be more difficult.

EIQ’s algorithm is able to take those 2D sliced images and create a 3D model of the patient's heart to assist in better diagnosis outcomes.

Also, cardiologists may be reading echos under conditions of stress, when the patient's heart is failing.

EIQ’s tech strips that out of the equation, delivering results in 3 seconds, and also removing unconscious bias in the interpretation of results.

Think of it like the best assistant a cardiologist could ever have.

How will EIQ make money?

There are a few fairly well trodden paths for healthcare technology like EIQ’s to be monetised.

Here’s a brief explanation of some strategies that we could see EIQ deliver over the coming years, based on recent EIQ presentations.

Again - EIQ is still pre-revenue, so we won't really get a proper understanding of the defined revenue model until they start securing deals.

Ultimately we are Investing to see EIQ to deliver on commercialisation of its tech and with that, hopefully an uplift in the company’s valuation.

Reimbursement Strategy

Whenever a hospital, echo lab or other healthcare provider uses its AI technology, they will charge a fee to an insurance company.

EIQ will take a % of this fee.

The fee is paid by either public or private insurance companies through a reimbursement scheme.

(Assuming FDA approval is granted).

EIQ has already begun partnering with various healthcare providers, offering its technology for free to allow medical staff to get comfortable and used to the product.

EIQ’s strategy is to integrate itself into as many healthcare providers as possible, so that when its technology is used, EIQ gets paid.

If FDA approval is secured, the healthcare provider will be able to charge a fee for using the technology which is covered by insurance.

EIQ’s product will be issued what is called a ‘reimbursement code’ - which really unlocks the revenue.

EIQ still needs to secure reimbursement deals and EIQ has appointed a specialist advisor in the US to help it secure reimbursement funding.

We think that the case for reimbursement is very strong because of the massive burden on the healthcare system.

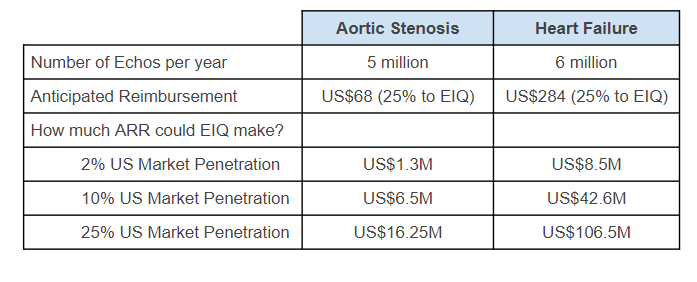

Here is what the economics would looks like for EIQ across its two current primary markets:

Licencing Strategy

EIQ also has a licensing strategy.

The goal is to find specific partners and licence EIQ’s technology so that they can make more sales of their products.

Organisations like medical device manufacturers and big pharma companies all want to make more sales of their product.

More sales is driven by more diagnosis.

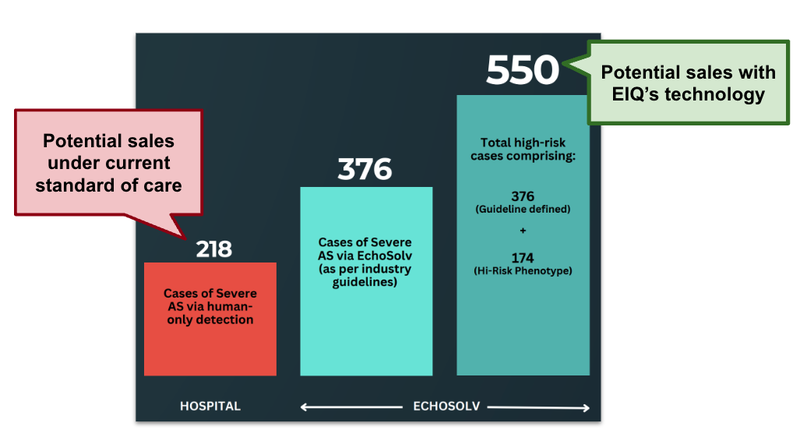

We can illustrate this point using the data from the EIQ aortic stenosis clinical trial with St. Vincent's Hospital.

In that study 9,189 echoes were reviewed.

Humans were able to diagnose 218 patients, whereas EIQ’s AI was able to diagnose 376 patients and in addition another 174 patients with a high-risk phenotype.

A 72% increase in disease detection.

Let’s say EIQ partnered with a company that provided heart valve replacements.

For companies that provide heart valve replacements, this is an extra 232 potential sales that they could make.

(Source)

We have seen these partnership style licensing agreements before.

The key for EIQ is to partner with companies that have genuine synergies and aligned incentives to use the product.

More on the heart conditions that EIQ’s tech detects

There are two key conditions that EIQ’s technology can detect:

- Aortic stenosis

- Heart failure

Aortic Stenosis

Aortic stenosis is a condition where the valve that controls blood flow from the heart to the body becomes too narrow, making it harder for the heart to pump blood.

There are around 1.5 million people in the US that suffer from aortic stenosis.

The direct costs to the US healthcare system are currently $10BN/year and there is a 50% mortality rate within 2 years if left untreated.

EIQ published data that shows its AI product EchoSolve accurately identified 15% more patients with aortic stenosis compared to humans.

In May this year EIQ lodged an application with the FDA for market clearance on its technology for aortic stenosis.

A positive result here will allow hospitals and cardiologists that use EIQ’s technology to get a reimbursement for insured patients under the US healthcare system.

A decision is expected before the end of this quarter.

Heart Failure

Heart failure is a condition where the heart can't pump blood as well as it should, causing tiredness, shortness of breath, and swelling in the legs.

These symptoms are not specific to heart failure alone.

This makes it incredibly difficult to diagnose, and current diagnostics tools only rule in or out heart failure in 40% of cases.

This is a pretty alarming stat when you consider it is the leading cause of hospitalisations for those aged 65 or older.

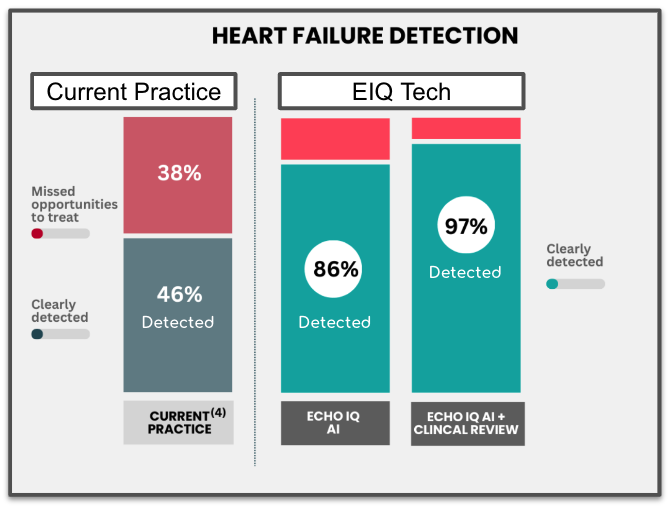

Earlier this week EIQ also published data that its technology detects 86% of heart failure cases.

But combined with clinical evaluation, diagnosis accuracy reaches 97%.

This is a huge number when compared to just 46% of cases were detected under current standard clinical practice.

(Source)

We also went and saw EIQ present at two cardiologist events...

Those groundbreaking results you can see above were recently presented at the European Society of Cardiology Congress in London last week following peer review and an invitation to participate in two “late breaking” science presentations.

We managed to get into this event, hear some presentations, and go for a wander around - a lot of Big Pharma and technology names were present:

We also caught up with EIQ in Perth presenting at CSANZ.

More on our time with cardiologists and EIQ in a future note...

Click here to read our full EIQ initiation note from yesterday:

Our new Investment is Echo IQ (ASX:EIQ)

What we wrote about this week 🧬 🦉 🏹

Condor Energy (ASX: CND)

Our 2023 Energy Pick of the Year Condor Energy (ASX:CND) has just finished re-processing legacy 3D seismic data across its giant Peruvian offshore oil and gas block.

The tedious (but essential) work is pretty much done now.

Could a giant prospective gas resource emerge from this corner of the globe?

TotalEnergies is lurking nearby...

Read: 🛢️ How big is it? CND resource estimate due - TotalEnergies next door

Emyria (ASX: EMD)

This week Emyria (ASX:EMD) published interim results for its first 8 patients on its MDMA-assisted therapy trial for PTSD.

It’s been a rocky few weeks for the psychedelic therapy space, with industry leader Lykos Therapeutics application rejected by the FDA.

But when one door closes another one opens.

And an opportunity emerged for EMD to publish its results that showed a dramatic reduction in PTSD symptoms and big quality of life improvements.

Read: 🧬 Data shows EMD’s PTSD program is working, Australia leading the US

New Investment - Echo IQ (ASX:EIQ)

We have announced our newest Investment - as you can see above.

It’s an ASX healthcare technology stock just a few weeks from a major share price catalyst.

After months of due diligence, we have now found another ASX tech stock that fits our investment criteria, and we have decided to Invest.

Read: 💻 Our new Investment is Echo IQ (ASX:EIQ) (nextinvestors.com)

Quick Takes 🗣️

TG1: TG1 lays out antinomy exploration plan

GUE: High grade uranium in the US

SS1: SS1 hits 605g/t silver outside of existing resource

GUE: GUE upgrades large USA U Resource, Scoping Study to Come

SS1: SS1 in final application stage for US$60M tax credit

SS1: US Approves Antimony Mine, SS1 waiting in the wings?

MTH: US$1BN deal for a Mexican silver project?

Macro News - What we are reading & listening to 📰

Battery Metals:

US-Australian government bankers ink critical minerals funding pact (AFR)

- US and Australia partner to fund critical minerals, reducing reliance on China.

- New financing system gives streamlined access to joint US-Australia funding.

Biden administration considering price support to backstop critical minerals projects (Mining.com)

- The Biden administration is considering setting a price floor for US-produced critical minerals, including lithium, to counter oversupply from China.

- This policy aims to boost US mineral production for clean energy while reducing reliance on China, but its cost and details are still being discussed.

Energy:

Exxon Almost Walked Away From $1 Trillion Guyana Oil Discovery (Bloomberg)

- Exxon’s gamble on high-risk drilling in Guyana led to the world’s largest oil discovery in a generation, with 11 billion barrels of recoverable oil.

- Guyana’s oil reserves have transformed the nation and boosted Exxon’s post-Covid recovery, with production costs as low as $35 per barrel.

Geopolitics:

Xi Courts Africa With $50 Billion Pledge

- President Xi Jinping pledged $50 billion in financial support to Africa, including increased credit lines and military aid, to deepen China's influence in the region.

- Some African leaders expressed a desire for more balanced economic ties, highlighting issues like trade deficits and seeking more sustainable investments.

Are you a s708 sophisticated investor?

If you qualify as a sophisticated investor and would like to see “s708 only” sophisticated investor opportunities: Subscribe to Next Cap Raise.

You will need to send us a valid certificate from a qualified accountant confirming you qualify as a sophisticated investor.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.