NHE high impact drill event getting closer: Targets announced, Share price finally moving.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,166,307 NHE shares and 2,437,037 options, and the Company’s staff own 64,339 NHE shares and 4,000 NHE options at the time of publishing this article. The Company has been engaged by NHE to share our commentary on the progress of our Investment in NHE over time.

We have observed that small cap gas explorers’ share prices run in the lead up to big drilling events.

Generally the bigger the potential prize, the bigger the speculative run.

We Invest early and patiently wait for the run and the drilling result.

We try to partially de-risk before the result then hold the majority of the position for the outcome.

Sometimes it works. Sometimes it doesn’t.

After a quiet sideways period prior to drill preparation, the share price run usually starts to build slowly in the months before drilling begins.

It starts as the company announces tangible progress towards the all important drilling event...

Big potential prize

Noble Helium (ASX:NHE) has a giant unrisked mean prospective resource of 176 bcf in Tanzania - which according to NHE is the “best untested helium system on the planet”.

NHE is now less than 6 months away from drilling.

The mean prospective resource is 5 times the size of the now depleted US federal helium reserve.

In Q3 NHE is going to drill test its prospective resource via two high impact wells - together they comprise a 16.5 bcf unrisked mean recoverable helium volume.

NHE’s two drill targets are independent of each other and were chosen for their high probability of discovering gas-phase helium.

Either well could deliver a “company making” result in their own right.

NHE share price finally waking up?

NHE’s pop out of its long term range started a few weeks ago.

It finally kicked out of the ~15-16c range in which it has been trading for the last five months.

As we get closer to Q3, we expect NHE’s newsflow to increase - that started last week when NHE revealed its two first drill targets.

Hopefully this is finally the start of the pre-drill run we have been waiting for since we first Invested in NHE nearly 18 months ago. Our Initial Entry Price 16.3c.

What happened in other pre-drill price runs

We have been investing in oil and gas explorers for many years now, and generally expect a pre-drill result share price run as part of our investment strategy.

The ultimate objective is to be Free Carried with a majority of the position held into a (hopefully) successful result.

It worked for us back in 2013 when Africa Oil Corp ran from ~$1.50 to a high point of $11.35 - and they successfully made a basin opening discovery.

It worked with Invictus Energy, which over two years ran from ~5c to touch a high of 41c in the lead up to drilling. Invictus delivered a successful drill campaign with all but a “discovery” declared, and settled back 3x above our Initial Entry Price.

88 Energy provided a wild ride back in early 2021 with its Merlin-1 well spiking the pre-result share price from 1 cent to 9 cents, then settling back down post drill result - this was a pretty extreme example.

IMPORTANT: Past performance is not an indicator of future performance. Remember that gas exploration is very high risk. While this Investment approach works for us, it may not be suitable for everyone. Only invest what you can afford to lose when it comes to speculative small cap stocks, and always seek financial advice before investing.

It’s also really important to note that sometimes a pre-drill price run does NOT happen. We experienced this with Prominence Energy and Global Oil & Gas drilling the offshore Sasanof-1 well last year. We held our entire position as there was no pre-drill run on which to de-risk. We took a big paper haircut on a duster... and we still hold those stocks today.

While we are conscious of the risks and unpredictability of the small cap markets, with NHE recently popping its head above its ~16c trading band, we are hoping this will be the start of a gradual build up in the lead up to drilling in Q3 this year.

In macro news, the price of helium has surged 200% in the last two years, with helium now selling on long-term wholesale contracts at a minimum US$450 per thousand cubic feet, or 50 times the price of LNG.

A recent short term contract with NASA was for over US$1,100 per thousand cubic feet.

This is big frontier exploration, just the kind of Investment we like.

Quiet period over? Upcoming NHE newsflow

NHE’s drill rig is expected to be secured soon.

NHE’s first non-binding farm-in offers are due at the end of this week.

This morning NHE released its latest investor presentation, which is actually one of the better ones we have seen from a small cap explorer.

It's definitely worth a 90 second scroll to get an idea of the NHE story and helium macro theme.

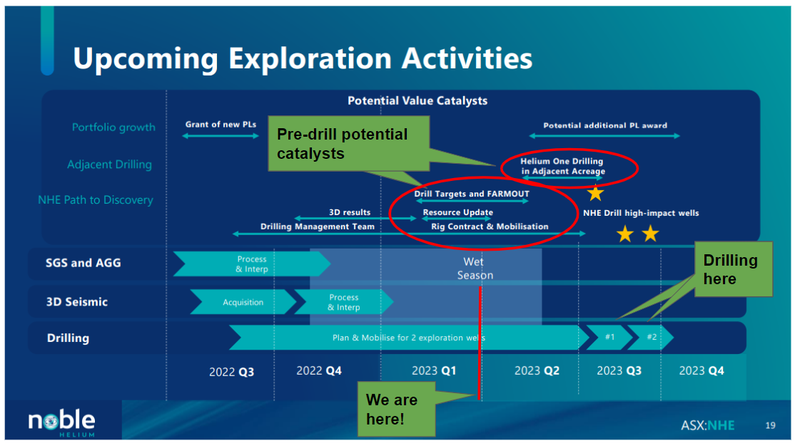

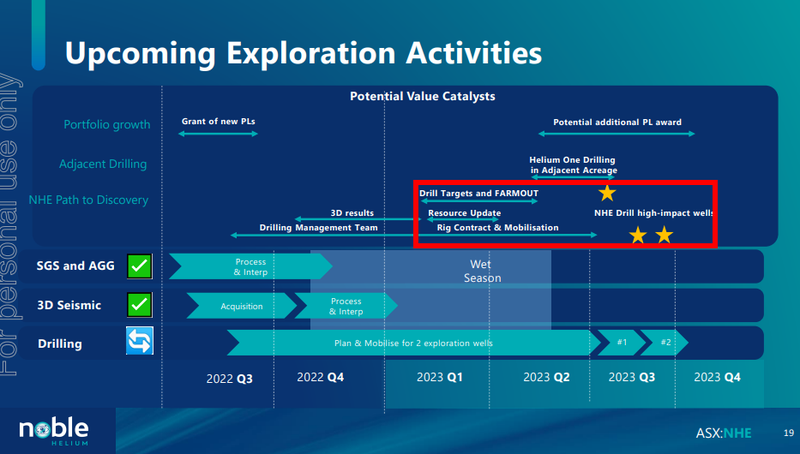

The presentation covered what's in store for investors over the coming weeks and months:

- Secure drill rig

- Complete a farm out - which will mean the high impact two well drill program in Q3 will be funded

- Sign contract for drill rig

- Watch neighbour - Helium One will be drilling next door to NHE, likely before NHE drills.

And that's all before NHE starts drilling:

Our ‘Big Bet’

“NHE discovers the world’s largest helium reserve held by a single company and is strategically acquired by a major company OR a state owned enterprise to secure supply (USA, China, Qatar).”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list in our NHE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor NHE’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following NHE “Progress Tracker”:

Click to see our NHE Progress Tracker here:

More on NHE’s drill targets

Just last week NHE finalised the two drill targets it plans on testing this year.

Two highest priority drill targets selected ✅

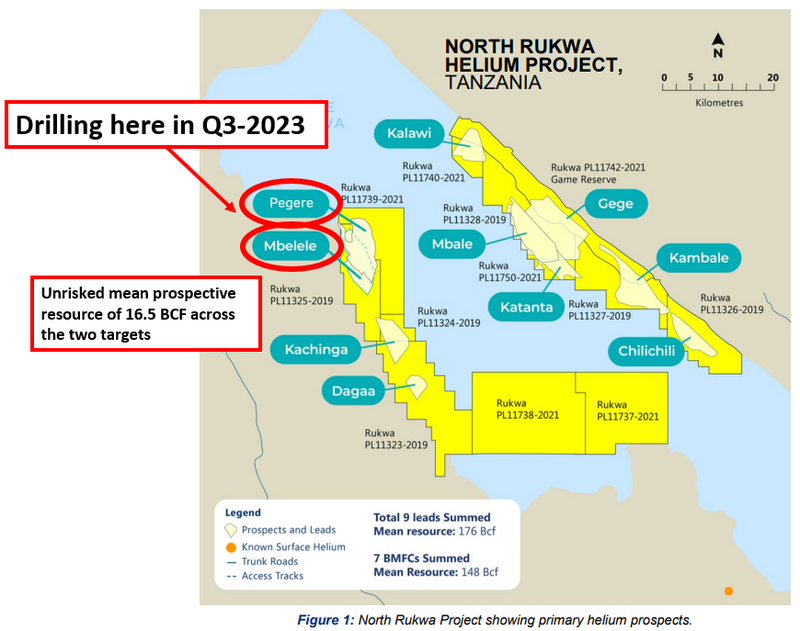

The two targets are called Mbelele-1 and Pegere-1 which can be see on the map below:

Together these are two independent play types that have a combined unrisked mean recoverable helium volume of 16.5 billion cubic feet (Bcf) - which is less than 10% of the overall project's 176Bcf unrisked mean helium resource.

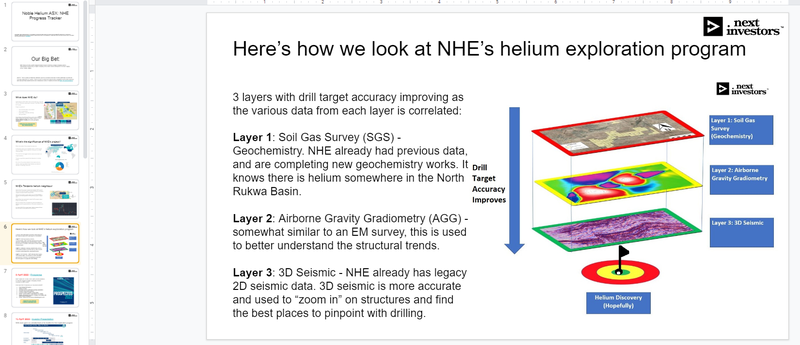

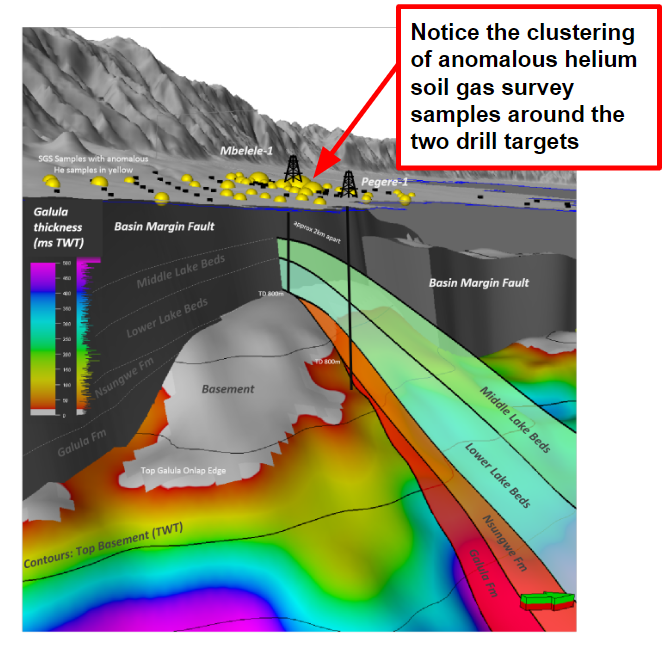

NHE provided an excellent 3D image of what these two targets look like, with both the soil gas survey samples at surface and the below ground mapping of subsurface structures:

We take it as a good sign that there is a clustering of anomalous helium soil samples around the two proposed helium wells. This is what we were referring to when we previously said there was helium literally leaking out of the ground on NHE’s project.

What’s more, the two wells will be “near-vertical” onshore wells, which means no strong deviation and decreases the risk the drilling operation could go awry.

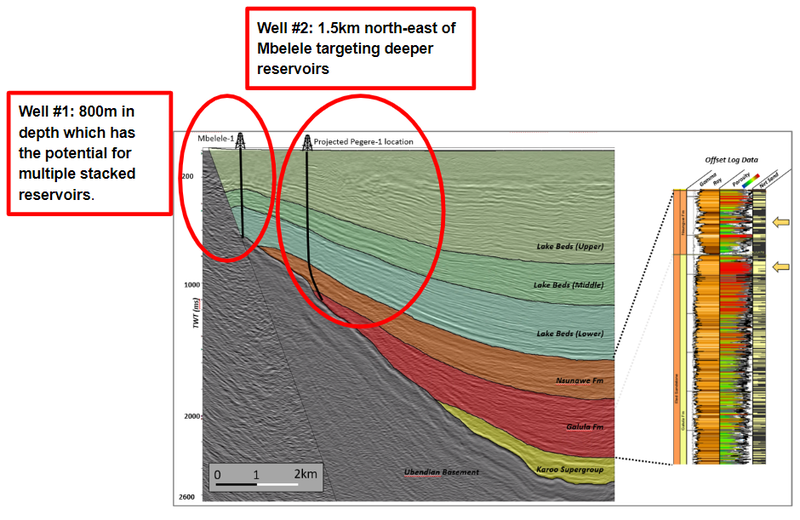

Below you can see how these “near-vertical” wells would look like digging into the ground matched up against the seismic data:

It makes sense to drill lower risk wells in NHE’s first drill campaign to get the ball rolling - the first goal here is to show there is a working subsurface helium system.

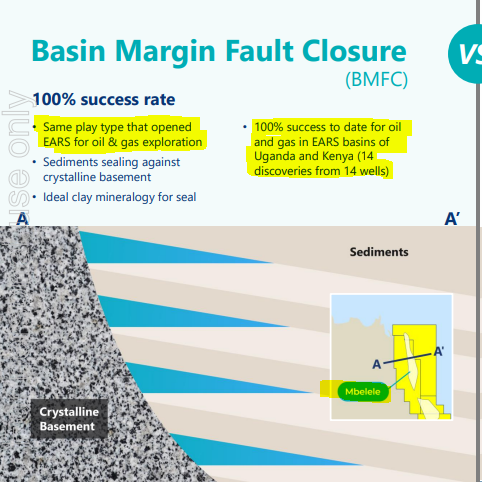

NHE Managing Director Justyn Wood is trying to emulate his 2006 success with Hardman Resources (~2c to $2.50) targeting Basin Margin Fault Closures (BMCFs). NHE’s two drill prospects are largely similar to those used in the Ugandan oil discoveries.

NHE’s Mbelele-1 well will reach a depth of around 800m and Pegere-1 will go to around 1,200m.

That is not particularly deep, which we hope reduces operational risk and lowers the eventual drilling costs.

NHE has flagged that Mbelele-1 in particular has the potential to hit multiple stacked reservoirs - something which could increase the total helium recoverable from this prospect.

Mbelele-1 will be drilled close to the Basin Margin Fault while Pegere-1 will be drilled approximately 1.5km north-east of Mbelele to target deeper reservoirs that are not reachable with the vertical Mbelele well.

Mbelele-1 will come first and Pegere-1 second.

We think this is the right approach - lowest risk well first, slightly higher risk well second.

Both wells have roughly the same mean Prospective Helium Resource, 8.1 Bcf at Mbelele-1 and 8.4Bcf at Pegere-1 but are slightly different types of plays.

As mentioned earlier, the key differentiator between the two wells is the fact that Mbelele-1 sits right over the basin margin fault closure.

This means it is the same play type that opened the East African Rift System (EARS) and led to discoveries in Uganda and Kenya.

For some context, this type of target has had a 100% success rate for oil and gas across Uganda and Kenya with 14 discoveries to date from 14 wells.

Ultimately we hope this success rate translates to NHE’s Mbelele-1 well.

(Source)

A discovery, or even better, two discoveries is the ideal outcome for us here (bearing in mind the risks we discuss further on in this note).

As an added bonus - NHE used its announcement last week to reiterate that it is going after a helium resource that is associated with nitrogen as opposed to hydrocarbons.

95% of the world’s helium is produced as a by-product of fossil fuels, so a nitrogen associated helium discovery could further add to NHE’s ESG credentials.

It is possible that helium end users could one day pay a premium to secure green helium - in excess of the already high helium prices. Click here to see our rundown on a recent NASA contract which included forward helium contract prices.

What’s next for NHE?

As we highlighted above, NHE has a slew of important announcements in the pipeline, each of which is essential to its goal of drilling its two highest priority targets in Q3 of this year.

With each positive step towards drilling, we hope that this unlocks a pre-drill share price re-rate as it gives the market more confidence in the below timeline:

Given the size of the unrisked prospective resource on offer and if drilling is successful, we think that in the future this drilling could be considered historically significant in the context of the helium market.

Here’s the detailed rundown on what we are looking for in NHE’s upcoming newsflow.

Resource update 🔄

NHE recently completed 3D seismic surveys across parts of its acreage.

The surveys, along with all of the other pre-drilling works the company has completed, will likely lead to a resource update by the company.

NHE’s resource is already giant at 176 bcf (unrisked mean prospective basis), but a resource update should get the market more interested ahead of NHE’s drill program.

The updated resource is expected between now and the end of second quarter.

Farm out partner secured 🔄

NHE has two drill targets selected and NHE is in discussions with potential farm out partners to de-risk the project from a funding perspective.

NHE has previously flagged that non-binding bids are due by the end of this quarter (31 March), just days away.

NHE would be showing these potential partners the data it has collected and the projected payback on a discovery.

LAB Energy Advisors Ltd has been appointed to manage the farm out process, so we’ll be looking for an announcement around this relatively soon, as signalled in the investor presentation released today.

Rig contract executed 🔄

With the previously discussed cooperation agreement with Helium One, we’re hoping NHE secures a rig towards the end of this quarter (ending 31 March) or early in Q2. Both companies will be keen to have this locked away.

Rigs are not always easy to come by in this part of the world, but with an experienced drill manager appointed in Dermot O’Keeffe we’re hoping the NHE team can secure the right rig at the right time and for the right price.

Any delay here could impact the company’s timeline (see risks section).

⚠️The big one: Drilling⚠️ 🔄

NHE expects to be drilling two wells in Q3 this year.

Across the two wells NHE will be targeting a ~16.5 bcf (billion cubic feet) unrisked mean recoverable helium volume.

The two targets represent <10% of NHE’s overall resource which sits at an independently certified Mean Unrisked Prospective helium resource of 175.5Bcf - enough to secure a part of the world’s supply of this finite gas well into the future.

NHE has previously referred to a benchmark of 6Bcf recoverable helium as a “company maker”.

Closer to the drilling event, we intend to outline our bull/bear/base cases for NHE’s drilling.

All going well, we’d be looking for a proven helium structure, commercial helium grades and a commercially viable flow rate.

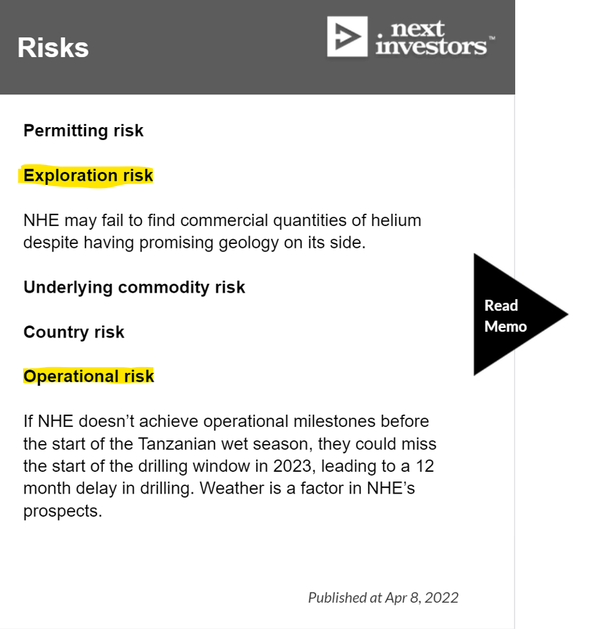

Risk for NHE

Below are the two key risks we are focussed on ahead of drilling, with more detail provided as per our NHE Investment Memo:

With the current newsflow, operational milestones such as executing a rig contract could hamper NHE’s ability to deliver a drilling program in the necessary timeframe.

As an addition to the risks listed above, if a farmout partner is not secured, we would also note that funding risk could materialise or precipitate a capital raise in order to fund the two wells.

Our NHE Investment Memo

Click here for our Investment Memo for NHE, where you can find a short, high level summary of our reasons for Investing.

In our NHE Investment Memo, you’ll find:

- Key objectives for NHE

- Why we are Invested in NHE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.