New Kid on the Blockchain Takes on $150BN Crypto Market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Bitcoin is now bigger than Netflix.

In the first week of August, the cryptocurrency powerhouse hit a record high, giving it a market value of US$74 billion. That tops Netflix’s US$72.7 billion market cap.

Following this surge, the once-obscure Bitcoin now also tops a whole crop of major industry leaders, including PayPal, Adobe and FedEx.

All of this makes for crystal-clear evidence that the cryptocurrency and blockchain space may currently be in the throes of an epic explosion.

With the emergence of thousands of new digital currencies and tokens , and as much as US$6.6 billion in digital tokens changing hands every day, what we’re now looking at is a US$150 billion global cryptocurrency market.

Tech heavyweights like Amazon, Microsoft and IBN are now investing in blockchain, the underlying class of technology that started with Bitcoin.

Even mainstream financial institutions like Goldman Sachs are finally beginning to realise what forward-focused venture capitalists have known for some time: that investors should be paying attention to the rapidly burgeoning cryptocurrency ecosystem.

One company that’s positioned itself right in the thick of this crypto renaissance is ASX fintech junior, DigitalX Limited (ASX:DCC) .

DCC is the only listed digital currency company in Australia.

It’s focused on the global digital payments industry, developing fintech products and services and could benefit from the Australian regulatory environment as contrary to the US, Canada and even Singapore, the Australian regulators have made positive noises that suggest they will be unlikely to seek to regulate ICOs in the same manner as those other countries.

Although, it should be noted here that this is a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The company has leveraged blockchain technology and the secure ledger system to create patent pending technology called AirID.

This forms the backbone of the transaction system for DCC’s award-winning AirPocket, a remittance application designed to enable users to securely and cost-effectively make cross-border payments.

Beyond its use in AirPocket, AirID also has a range of applications in invoice factoring, supply chain management, academic and professional credentials management, micro-lending, real-time AML compliance and anti-fraud monitoring, and trade finance.

DCC recently added a couple of crucial divisions to its business model: its blockchain and ICO consulting services, drawing on an extensive body of blockchain technology expertise.

ICO stands for ‘initial coin offering’ – it’s a way for startups to raise money by selling investors tokens in exchange for equity.

With the amount of money raised via ICOs recently surpassing early stage venture capital funding for internet companies, DCC will be providing expert advice on what has been called a ‘gold rush’.

As announced this week , the newest company in its ICO consulting portfolio is the high-profile Bankera. As Bankera launches its ICO, DCC will provide a range of industry-specific, technical, corporate advisory and marketing services.

Racking up a string of significant accolades, DCC is emerging as a leading voice in the Australian marketplace.

This fintech junior is currently valued at a modest AU$11.26 million. Yet given the rapidly expanding crypto space, especially in light of where Bitcoin is today, it may not be long before DCC’s micro-cap days become a distant memory.

Catching you up with...

DigitalX Limited (ASX:DCC) is a blockchain-enhanced software solutions group set on critically disrupting the payments industry. But as will become clear in a moment, it also has a lot more up its corporate sleeve.

We last caught up with DCC back in February with the article, DCC Now Days Away from Launch of the World’s First Blockchain Money Transfer App , where we looked in depth at AirPocket’s USP and key demographic.

Since then, DCC has continued to ramp up its game, adding ICO and blockchain consulting to its expanding CV.

DCC is quickly transforming itself into a multi-faceted business operating at the centre of the digital currency and blockchain space, optimising shareholder value by leveraging years of industry expertise and technical capabilities.

Within this underlying strategy, DCC focuses on three core business areas:

- AirPocket – DCC’s blockchain-enhanced, award-winning remittance application;

- Blockchain consulting — drawing on an extensive body of blockchain technology expertise;

- ICO consulting – providing consulting services in the fast growing ICO market.

We’ll walk you through each of these facets in more detail, but first, let’s take a look at its latest addition, ICO consulting.

Expert advice for booming ICO scene

ICOs have been described as a kind of digital gold rush.

These ‘initial coin offerings’ are a way for start-ups to raise money by allowing investors to buy a stake. In return, the user receives a token, usually cryptocurrencies like bitcoin and ethereum, which are equivalent to shares in the firm.

It’s similar to crowdfunding and it’s also been compared to the more traditional IPO.

Intriguingly, ICOs entirely circumvent the private venture capital and public equities markets that have traditionally served as their financiers.

One of the main attractions of ICOs is its ease and availability to potential investors. The fact that no middle men or syndicates and brokers are necessary is also a considerable selling point.

Being able to directly raise capital also greatly reduces the amount of time required to fundraise, which can accelerate innovation.

ICOs are highly popular among cryptocurrency and blockchain start-ups, and 2017 has been a very good year for them.

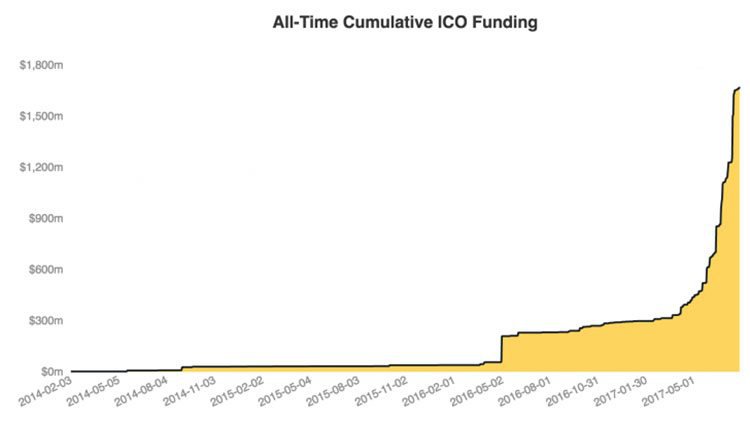

Over US$1.6 billion has been raised around the world through ICOs this year so far.

In fact, the amount of money raised by start-ups via ICOs has recently surpassed early stage venture capital funding for internet companies.

To get a handle on the magnitude of the ICO scene, consider the sentiment in headlines like these...

While the ICO explosion is clearly big news for investors and cryptocurrency alike, as that final headline suggests, this is still a largely unregulated industry

...Which is where DCC’s ICO advisory services come in.

With its expertise in the mining, trading and development of cryptocurrency and blockchain products, DCC is also working as a trusted adviser to companies looking to conduct token sales.

Moreover, given its experience and status as the only listed digital currency company in Australia, it’s also impeccably placed for involvement in discussions on public policy and regulation of this new, growing market.

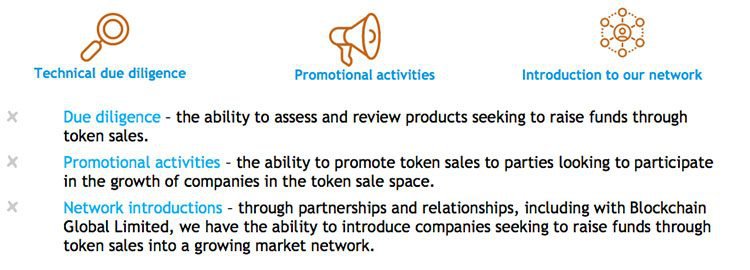

DCC brings a range of key components to ICO consultation:

These consulting services can be broken down into three main areas that ‘ICOing’ companies will need to get pitch perfect:

As lead advisor, DCC will receive a percentage fee of the total funds raised in liquid digital currency, plus a promoter’s percentage fee of free tokens native to the ICO.

The typical timeline for projects is 4 months from whitepaper to launch.

DCC has already been approached to provide services on token sales being undertaken by companies developing products in the eSports, advertising, decentralised computing and AI/robotics industries.

Its latest advisory engagement is the high-profile Bankera , as announced this week:

DCC will provide a range of industry-specific, traditional corporate advisory and promotional services to Bankera for its upcoming ICO (with a pre-ICO currently in the works), leveraging its expansive knowledge and experience in the crypto/blockchain space and it now has the funds to push this angle further.

New funding secured, making ASX history

In June, DCC announced that it has secured investment of about AU$4.35 million from Blockchain Global.

This seemed to pique investor interest, having a positive effect on DCC’s share price.

Of course, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

BGL has been a major player in the blockchain industry since 2014, providing bitcoin mining, software and consultancy services. It has established many successful companies through blockchain technology commercialisation projects, and has also successfully supported crowd-sourced blockchain token sales and ICOs.

...Clearly a good match for DCC.

According to the terms of the agreement, BGL will invest the sum at 2.7 cents per share to acquire an interest of circa 40% of DCC. The investment represents a 28.5% premium on the volume-weighted average price (VWAP) of DCC’s shares over the past 5 days.

DCC has received AU$300,000 by way of a convertible loan in bitcoin – the first funding of this kind secured by an ASX-listed company.

BGL will subscribe for or procure subscribers for shares, convertible notes and options in DCC for up to further AU$4.05 million.

Demonstrating long-term shareholder commitment, BGL will voluntarily escrow its shareholding for a period of 12 months from the date of issue. To provide additional industry expertise, BGL will have the right to appoint up two directors to the DCC board.

Due diligence is now done and dusted , and DCC has this week announced that AU$2 million has been received in bitcoin from BGL, priced at the TradeBlock reference price.

TradeBlock’s XBX Index represents a real-time spot rate for bitcoin. The bitcoin are securely held in the CCZ’s multisignature wallet.

BGL associated investors are currently finalising the balance of the transfer of the investment of approximately $2 million, which will be made via a combination of cash and bitcoin.

The incoming capital and new directors will enable DCC to hone in on its ICO and blockchain consulting services, as well as continuing to sharpen up its marketing strategy around AirPocket and drive shareholder growth.

Promising prospects for blockchain consulting services

While it’s undeniable that blockchain is a highly promising emerging technology, the execution of blockchain-based solutions is still in a state of infancy.

As blockchain products and services continue to grow in tandem with the increasing level of understanding around its benefits and potential uses, DCC is using its deep knowledge and experience to consult on these matters.

DCC generates revenue here from fees charged for access to its expertise and solutions.

The company is currently involved in a number of projects across a diverse range of fields, including supply chain, digital currency exchange, ATMs and fund management, illustrating the broad scope for blockchain technology applications.

Initially, DCC has partnered up with Lateral Communications to source clients and opportunities in this area. A notable highlight of this partnership so far has been the launch of a proof of concept app at the 2017 Blockchain Summit on Sir Richard Branson’s Necker Island.

Which brings us to...

AirPocket, the world’s first blockchain money transfer app

We have covered

AirPocket

previously, but to refresh your memory it is a mobile app for international remittance payments that provides irrefutable proof of transaction through blockchain technology.

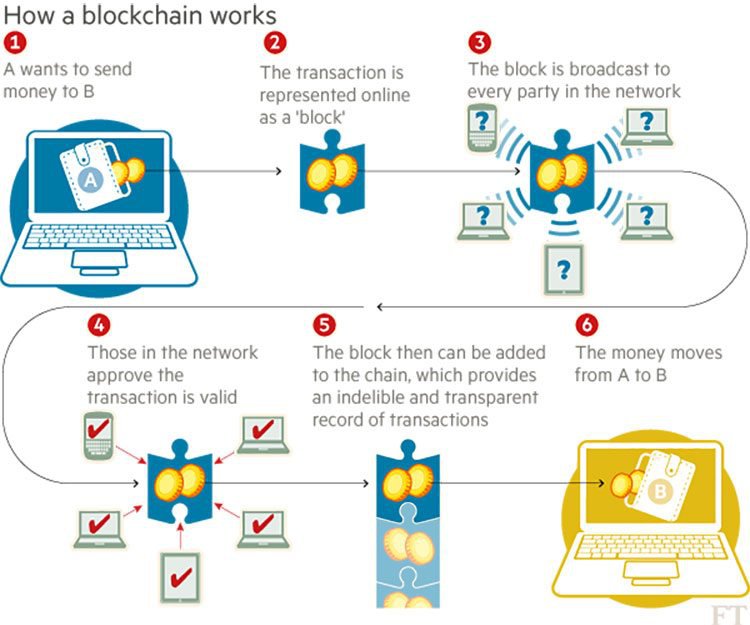

Let’s backtrack slightly at this point and explain in more detail how blockchain technology works.

A blockchain is a type of shared digital ledger that uses encryption to store permanent, tamper-proof records of transaction data. The data is stored via a peer-to-peer network using a ‘consensus’ principle to validate each transaction.

Because the blockchain infrastructure is decentralised, there’s a lot less friction and time wasted than traditional, centralised processes.

This video does a good job of explaining blockchain basics:

And the process is simplified further in this infographic:

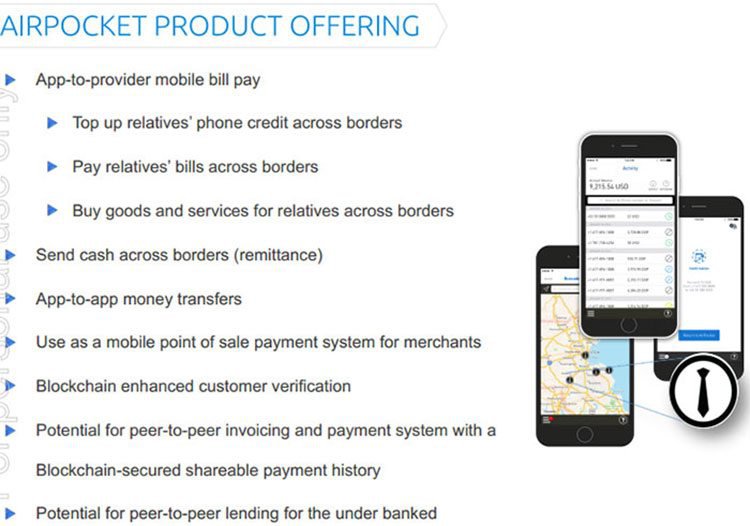

DCC’s app uses this technology to offers US users the ability to make low-cost international money transfers to 14 countries across Latin America. AirPocket stores users’ transactions and allows them to share their credit histories.

That’s far from all of its capabilities, though. Here’s a snapshot of what AirPocket can do:

Being a cloud-based platform, AirPocket is run at low operating costs, and also means that the tech is infinitely scalable.

Launched in February, AirPocket is the first blockchain-enhanced mobile remittance application. It went on to receive a Social Inclusion Award at the Remittance Technology Awards events this year, adding to the clear overall impression that DCC is emerging as a serious contender in the global crypto space.

Following the launch, DCC’s focus has shifted from consumer marketing towards seeking out partners with regional experience and a ready-made customer base. It’s also using its expertise in developing this technology to advise other companies...

The crypto future

Bitcoin’s emergence from obscurity into the Netflix-busting, US$74 billion-capped household name that it is today is testament to the enormity of the crypto and blockchain space, which is set to continue growing.

The global cryptocurrency market has grown from only $20 billion at the start of the year to over $150 billion, driven by a surge in ICOs.

And while early growth has been intriguing, notable market commentators like Ronnie Moas, founder of Standpoint Research, are expecting a $2 trillion market to emerge over the next decade.

You can read about the underlying logic behind Moas’s bullish prediction in

this Coindesk article:

DCC is coming into maturity at what seems like a highly salient time for the crypto market.

Although how much of the market, DCC can attract remains to be seen so investors should consider all publicly available information and take a cautious approach to their investment decision.

On a more micro level, new taxation rules for digital currencies in Australia also spell out good news for DCC. As of July, digital currency like bitcoin is now treated just like regular money for GST purposes.

Before these new taxation rules came about, consumers using digital currencies had to bear GST twice: once on the purchase of the digital currency and once again on its use in exchange for other goods and services subject to the GST.

As well as boding nicely for businesses which revolve around digital currencies like the ASX-listed DCC, these legislative changes also reinforce the increased acceptance of the crypto space in the mainstream.

On the horizon

Blockchain technology has the potential to revolutionise everything from billing systems and contracts to supply chains and even electronic medical records.

So in reality, Bitcoin could be just the tip of the iceberg when it comes to blockchain deployments. According to analyst reports, usage is predicted to grow at a CAGR of 61.5% until 2021. This means total transaction values are estimated to rise from $US210.2 million in 2016 to $US2,312.5 million by that year.

DCC could therefore deploy its blockchain technology and extensive industry knowledge in a whole gamut of applications, with its award-winning remittance application only being the start.

As it moves forward in building up a strong network of crucial partnerships, developing its consulting services, and firming up its marketing strategy around AirPocket, DCC might have within its reach a very sizeable slice of this multi-billion-dollar (or even trillion-dollar) cryptocurrency pie.

Currently valued at a tiny $11.26 million, this fintech micro-cap could be a highly strategic entry point for investors that still want a seat on the crypto bandwagon.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.