MOZ Confirms High Grade Jumbo Flake Graphite

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

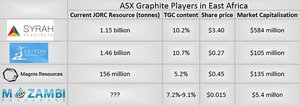

Tanzanian graphite company Magnis Resources is now capped, fully diluted, around the $200M mark, while its share price has risen 95% since over the past month:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This is on the strength of its progress on its world-class project in the Nachu province in Tanzania, which has already attracted offtake partners for its planned graphite production of 250,000 tonnes per annum over a 30 year mine life.

While this goes on, little Mozambi Resources (ASX:MOZ) is progressing with their own graphite tenements in the same neighbourhood, with some tenements literally next door to Magnis in Tanzania...

Whilst there is potential in MOZ, its still a tiny company, and there is no guarantee MOZ can grow to Magnis’ stature.

MOZ are itching to get drilling in Tanzania soon, and at that stage we would expect a lot more eyes to be on the company.

There is every possibility that the same graphite structure that Magnis has discovered extends onto MOZ’s ground...

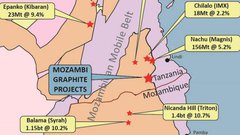

Mozambi Reosurces (ASX:MOZ) is currently running two parallel graphite exploration projects in East Africa.

Tanzania – where they hold strategic ground next to and near Magnis, which may hold the same graphite structure that this much bigger company has uncovered.

Mozambique – MOZ also holds strategic tenements in the Cabo Delgado region, which holds the most abundant source of graphite in the world. Here, MOZ holds two key tenements (6040 and 6042) which are currently at the permitting stage. MOZ estimates that these tenements could be highly lucrative due to their close proximity to industry giants, $579MN-capped Syrah Resources and $107MN-capped Triton Minerals.

Since our last coverage of MOZ, the explorer has raised a further $926,000 from existing investors and due to a shortfall in the amount of shares within its Rights Issue, MOZ shares have been snapped up by institutional and sophisticated investors, through brokers Taylor Collison and Alignment Capital.

For more detailed information on the MOZ story, take a look at our previous articles:

$3M ASX Nano-Cap Next Door to the Biggest Graphite Resource Known to Man

Graphite Whales Joined by Minnow MOZ

$4M MOZ Continues to Take On Graphite Majors: This Time in Tanzania

East African Graphite: MOZ Pushing Ahead with Exploration

This article is going to focus more on the Tanzanian tenements, appropriate timing given the market attention Magnis is currently receiving.

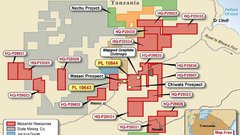

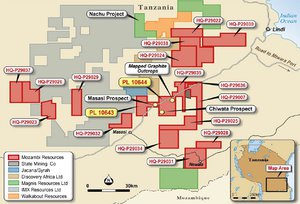

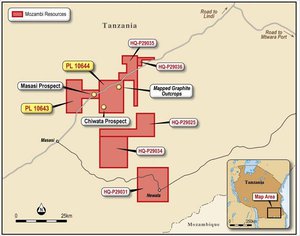

MOZ intends to acquire 7 out of a possible 18 tenements in Tanzania

Since announcing the option to acquire 18 tenements in May, MOZ has been busy selecting which of those 18 are worthy to be developed further.

Over the last 3 months or so, MOZ geologists have cherry picked the following tenements based on priority outcropping graphite targets covering 1,000km 2 . Just to give you some frame of reference –that’s roughly the same area as Hong Kong.

It’s early days, but MOZ is gradually moving closer to a maiden JORC resource and Feasibility Studies thereafter. From the visual results already in, it seems graphite outcropping is visible in all of MOZ’s chosen tenements, and the next stage will be drilling to confirm the visible signs.

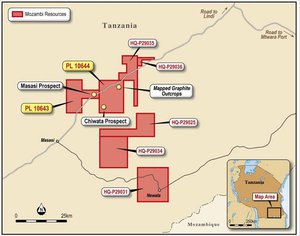

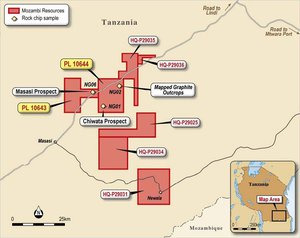

As we mentioned in our previous MOZ update, the priority target has an outcropping width of 180m with a strike length of around 1,000m on PL 10644.

PL 10643 and PL 10644 are clearly the focus tenements at this stage, covering a total area of 352.55 km 2 with a third prospect (HQ-P29031) also showing significant potential where outcrops of graphitic schist ranging between 20-30m thick were found.

Aside from quantity of land, when it comes to quality; here too MOZ is coming up trumps.

MOZ has been cherry picking the best tenements from the 18 it had available. The only way to go about picking cherries is to quality check each one before picking them...

That’s exactly what MOZ has done by assaying graphite samples from the 3 locations at the heart of their 7 tenement portfolio package.

Here’s a map showing where MOZ sourced material for preliminary testing indicated as NG01, NG02 and NG06.

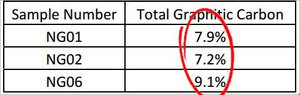

As you can see, all the samples have been taken from the very heartland of MOZ’s tenement package. And here’s the results of those tests, carried out by SGS – a top-tier laboratory in the world of Mining .

The samples assayed by SGS showed NG01 at 7.9% Total Graphitic Carbon (TGC), NG02 at 7.2% TGC and NG06 at 9.1% TGC.

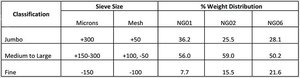

What MOZ’s latest batch of results mean is that its prime tenements in Tanzania are by in large likely to deliver 300+ micron flake graphite when MOZ does in fact begin mining.

More specifically, between 25.5%-36.2% of MOZ’s graphite occurs as 300+ microns therefore falling into the ‘Jumbo’ flake category while 80-90% has a flake size greater than 150 micron...

Therefore MOZ has almost certainly done a good job of picking its cherries because jumbo flake graphite typically attracts the highest premium when sold at market.

Assuming MOZ can back up these preliminary assay/test results are a sign of further mineralisation via drilling, future development of a resource is likely. However, MOZ is still a speculative stock, its early days and there is no guarantee of success.

With one third of its graphite in the Jumbo category and the majority of its graphite in the Large/Medium categories, MOZ is on course to potentially build up a serious graphite arsenal that could rival its much bigger peers:

MOZ and the Graphite Hype

Graphite is quickly becoming the hottest commodity on the planet because of its unique properties and high-end applications courtesy of graphene.

For anyone not aware about the graphene story and how graphite explorers from across the globe are scurrying to supply the largest likely source of future graphite demand – lithium batteries, click here for a refresher...

In a nutshell, graphene is a derivative of graphite first developed in 2004. Its break onto the world stage earned its developers the Nobel Prize in 2010 .

Despite being a relative infant in the commodities space, graphene has roused excitement amongst investors, speculators, engineers and possibly most importantly, amongst consumers.

What average people are most excited about is the sci-fi applications of graphene...

Can you imagine television screens that can be rolled up into a poster, hung on a wall and transported in your pocket after being folded multiple times?

Can you imagine solar panels made from paper that can also be folded and transported in your pocket?

The possibilities are literally endless because graphene facilitates efficient applications of existing technology.

The headlines may be grabbed by electric cars and lithium batteries although this is only a small slice of the graphene pie.

Graphite is on course to go from being synonymous with pencils to being seen as the revolutionary mineral of modern times – the only question is when it will go mainstream, hopefully taking explorers like MOZ with it.

What’s on the Horizon for MOZ?

The prospect of uncovering additional graphite is already a positive development but the kicker for MOZ is that Tanzanian deposits are generally known for predominantly ‘Jumbo’ and ‘Super Jumbo’ flake which is most preferable for the production of high-end graphite products and graphene.

If forthcoming drilling can confirm the existence of commercial quantities of graphite, these new tenements could diversify MOZ with high tonnage of lower grade graphite in Mozambique in tandem with lower tonnage at higher grades in Tanzania.

MOZ looks likely to fast-track further exploration and focus its Tanzania drilling programme on the following 7 tenements.

MOZ remains a small-cap stock, currently capped at around $6M...

... but considering how its exploration path has gone so far, if MOZ can hit strong graphite mineralisation via drilling, this explorer is likely to leave its previous share price behind. At the same time, success is no sure thing here.

Neighbouring graphite explorers are all much bigger than MOZ, and a few years more advanced in their exploration efforts.

We should find out of the coming months just how much MOZ can catch up on their larger peers...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.