MNB: US$10M subscription agreement signed - mine construction to commence

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 11,954,999 MNB shares and 4,069,999 MNB Options at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our Investment in MNB over time.

The US$10M subscription agreement has finally been signed.

$46M capped Minbos Resources (ASX:MNB)’s phosphate mine is forecast to deliver a ~US$55M in EBITDA per year (base case, on average) mine, over a 20 year mine life.

The market has been waiting to see if MNB can get the funds secured to finish the build.

Delays in the funding and MNB running low on cash has seen MNB’s share price get beaten down to sub 5c...

Today MNB announced final investment documents have been signed for the US$10M investment by the Angolan Sovereign Wealth Fund.

(The US$10M is for a 22% interest in MNB’s project, equating to a total MNB asset value of US$45M - or $70M AUD. Remember MNB was capped at $46M at last traded price.)

First funds are expected to hit the MNB bank account “in the short term”.

Construction will commence as soon as the first tranche of funds land in MNB’s bank account.

At this point, MNB can execute its Civils Contract to commence building earthworks, access roads, drainage and concrete foundations.

(Source - today's MNB announcement)

Previously, MNB’s CEO Lindsay Reed has mentioned that there is a Portuguese group lined up for construction on the plant.

We expect this Civils contract execution to be a formality once the money lands in MNB’s bank account.

So, in the next few weeks we could see “funds clear bank account”, “construction contractor selected”... and the final one “construction commenced”.

We are looking forward to seeing photos of the construction work going on.

Importantly, today’s US$10M investment is a key precondition to unlocking a FURTHER US$14M loan from IDC (Industrial Development Corporation of South Africa).

Now only two final pre-conditions remain to unlock the $14M IDC loan and MNB can be fully funded to build its mine and enter production:

- TODAY: Secure US$10M equity funding (COMPLETED)

- Finalise a US$10M term loan (IN PROGRESS) - MNB is well advanced with Banco BAI, one of Angola’s largest banks.

- Convert an existing offtake MoU into a formal offtake agreement (IN PROGRESS) - MNB now has two MoU’s in play to convert into a binding offtake.

MNB just now needs to deliver 2 and 3 above to unlock the $14M IDC funding and be fully funded to build their mine and processing plant to start producing phosphate.

(our take is that extra funding above US$24M is to move straight into phase 2 expansion of the project)

Financing a mine is one of the hardest parts of the mining company lifecycle.

A lot of hard work and years of relationship building are needed to get there.

Here is a more detailed update on the remaining two pre-conditions for MNB to unlock a further $14M from IDC.

2 IN PROGRESS - Finalise a US$10M term loan

MNB is well advanced with Banco BAI, one of Angola’s largest banks.

As per the latest MNB half yearly report, this potential term loan from Banco BAI will “go before the credit committee shortly”:

(Source, MNB Half Yearly Report, 13 September 2024)

Prior to this Half Yearly, MNB Managing Director Lindsay Reed said they had a US$15M term loan in the final stages of negotiation with Banco BAI at the Africa Down Under conference in early September:

(Source, link at 3:30 of video)

3 IN PROGRESS - Convert an existing offtake MoU into a formal offtake agreement.

MNB now has two potential offtake partners waiting in the wings, which both have MoUs with MNB for future production.

The first MoU is with Grupo Carrinho which is the largest agro-industrial group in Angola - this MoU has been in place since 19 July 2023.

(Source MNB Announcement 19 July 2023)

The second MoU is with a South African company called Foskor which owns a phosphate mine in Phalaborwa (in Limpopo Province) and a phosphoric acid-based fertiliser plant located in Richards Bay (Kwa-Zulu Natal), both in South Africa.

(Source)

Foskor is looking to supplement its existing product with MNB’s product which appears to be part of MNB’s thinking around Stage 2 of production ramp up (which will be incorporated into construction from the start) at the project:

(Source)

We think it’s good that MNB now has two potential MoUs ready to progress to binding offtake.

We also like that with Stage 2 expansion appears to now be included as part of initial construction.

MNB appears to be going big (phase 1 and 2) at the start which could yield additional financial benefits as production ramps up.

The next big news events we are waiting for from MNB are:

- The Sovereign Wealth Fund’s money hitting MNB’s bank account

- Civils contract executed and construction commenced

- Update on Banco Bai loan completion

- Formalised offtake agreement

- Completion of IDC loan pre-conditions and finalisation of IDC loan

Construction on the horizon for MNB

Now that the $10M subscription agreement is signed with the Angolan Sovereign Wealth Fund, MNB is funded to start construction of its phosphate plant.

Once built, MNB’s phosphate mine is forecast to deliver a US$55M in EBITDA per year (base case, on average) over a 20 year mine life.

This is based on Stage 1 production figures.

In 2023 we visited MNB’s project in Angola to tour the phosphate deposit and where the processing plant will be built.

On the Ground in Angola: Our MNB Site Visit

Long lead items and key processing equipment have already been purchased and are waiting in a warehouse for the earthworks to be completed so they can be transported and assembled on site.

We also saw key plant parts arriving in port (note that these photos are from early last year - February 2023):

Once construction starts, there are no lead times for all these parts and equipment.

(they were literally stored in a facility less than 15 minute drive from where the construction site was).

MNB’s processing plant is NOT a big complex set up, so we could see MNB make progress very quickly.

(MNB’s proposed plant - Source)

We are hoping MNB gets its project into production as was planned by the middle of next year.

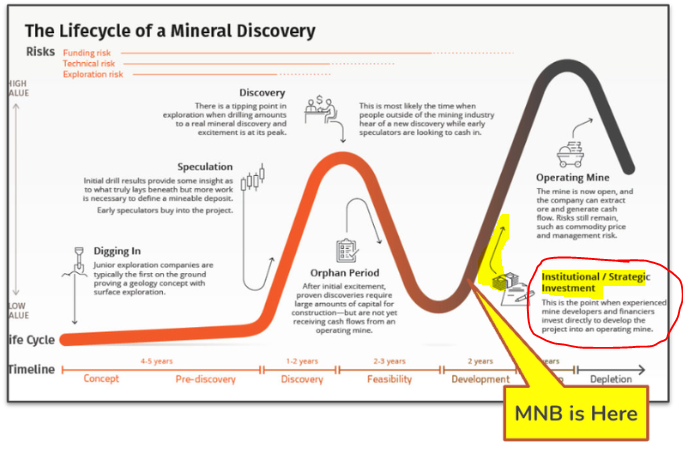

Where MNB sits on the ‘Lassonde Curve’

The Lassonde Curve was designed by Canadian mining billionaire Pierre Lassonde, demonstrating the typical ‘value cycle’ for a mining discovery transforming into an actual mine.

After today’s news here is where we think MNB sits:

The Lassonde Curve broadly shows how company valuations generally respond to the different stages of a mining project’s lifecycle.

The first peak is usually post discovery, however the “all time highs” tend to occur when the project is put into production (assuming it makes it through the trough - developing projects is hard, even after an amazing discovery, and a lot don't make it).

We think MNB went through that first peak phase in 2021-2022.

Then the company went into the "orphan period” - running feasibility studies, permitting, technical studies and finalising project financing.

We think that the 2023-2024 period coincides with the bottom of that feasibility/development stage on the Lassonde Curve.

Now we think MNB’s project is moving into the phase where the Lassonde Curve signals a second run in a company’s valuation.

(MNB will be a interesting to watch if they can deliver this full finance package)

We are hoping that MNB’s project moves into production and the company’s valuation follows the trajectory implied in the Lassonde curve...

Here’s MNB’s share price chart:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Ultimately, seeing MNB’s asset move into production and generating revenues forms the basis for our Big Bet which is as follows:

Our MNB Big Bet:

“MNB delivers a 10x return by building a profitable phosphate project AND progressing its green ammonia project to construction phase.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our MNB Investment Memo . Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for MNB’s Fertiliser Project?

- The Sovereign Wealth Fund’s money hitting MNB’s bank account

- Civils contract executed and construction commenced

- Update on Banco BAI loan completion

- Formalised offtake agreement

- Completion of IDC loan pre-conditions and finalisation of IDC loan.

What are the short term risks to MNB?

The main risks right now are “project financing risk” and “delay risk”.

Financing risk

MNB needs to complete the entire funding package and IDC loan to build its mine and processing plant.

There is a risk that the final funding package takes longer than expected to finalise OR it isn't secured at all, which forces MNB to pivot in its development strategy.

Any delays from a funding perspective could impact the time it takes for MNB to get to first production (and revenues) from the project.

Delays with construction could also further hurt the MNB share price. MNB has faced delays before and the market may punish MNB if further delays happen.

Construction Delays

Meeting construction timelines is hard.

MNB only has only anticipated for so much capital to be allocated to the construction of the project.

If there are any unforeseen issues it may cause delays to construction and as such issues for the company.

The biggest risk for MNB is if the company runs out of capital before the project is constructed and needs to do an emergency cap raise.

MNB already has had issues with its first EPCM contractor, we are hoping that this new contractor is better.

Our MNB Investment Memo

Our Investment Memo provides a short, high-level summary of our reasons for Investing. We use this memo to track the progress of all our Investments over time.

Below is our MNB Investment Memo , where you can find the following:

- What does MNB do?

- The macro theme for MNB

- Our MNB Big Bet

- What we want to see MNB achieve

- Why we are Invested in MNB

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.