MAN uranium samples rejected by assay laboratory for being “too radioactive”

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,860,000 MAN shares at the time of publishing this article. The Company has been engaged by MAN to share our commentary on the progress of our Investment in MAN over time.

Radiation levels so high the lab refused to assay it.

Our Investment Mandrake Resources (ASX:MAN) sent six rock chip samples to the lab for testing of uranium content...

The response from the lab was that three of the rocks had such high radiation levels that they needed to be treated as “Hazardous materials”...

Put into a lead-lined container AND shipped to a lab that is able to test the higher radiation rocks...

Usually when a company goes looking for uranium, radiation levels are a decent guide for where to expect uranium mineralisation.

So it will be interesting to see what comes from the assays once they are safely stored and a suitable lab gets its hands on them.

We should get the assays from the first three rocks “Shortly”, and then the rocks with the higher radiation after.

A bit of searching reveals that a similar thing happened back in 2021 with a company called Delecta.

Like with MAN, Delecta’s rock chips were too dangerous for a standard testing lab.

Once the “too radioactive for the lab to handle” samples were safely stored and eventually tested, the assays came back at .53% uranium - a strong grade. (Source)

While the assays didn’t do much for Delecta’s share price at the time due to a number of factors (this was also back in 2021 when no one cared about uranium), it's possible that the market might like MAN’s uranium rock chip results more given the current heat in the uranium space.

Compared to the 2021 market, this market is different and uranium remains strongly elevated - near 16 year highs at ~US$100/lb.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

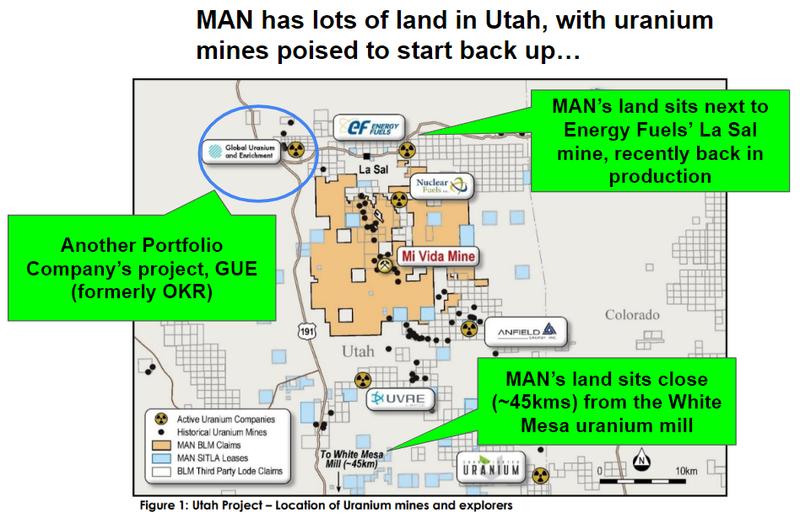

MAN holds 93,755 acre’s of ground in Utah USA.

MAN initially entered Utah looking for lithium brines...

We are still very interested in the lithium project (we think lithium will eventually bounce back).

...but given the lithium price weakness and strength in the uranium price, we are happy to see MAN put some of its $16M cash pile towards exploring its ground for uranium in the near term.

Here’s why:

A few weeks back MAN kicked off its first uranium focused exploration program - a pivot that we think is worthwhile considering:

- The uranium price is ripping - Uranium spot prices are at near 16 year highs and could be about to explode even higher... just like we have seen with the last two uranium spot price cycles.

- Utah is the third biggest uranium producing state in the USA - between 1949 and 2019 the Lisbon Valley in Utah (where MAN’s project is) produced ~8% of all US uranium supply.

- MAN’s project has ~20 historic uranium mines/occurences - a 16 mile long strike area with ~40 different uranium occurrences runs through MAN’s project area...

- Much bigger companies are active in the region - US$1.2BN Energy Fuels & TSX listed Consolidated Uranium capped at A$225M.

While MAN’s focus has been on lithium for a large part of the last year, much bigger companies have been actively building out there uranium projects in the area.

Energy Fuels for example - which is capped at US$1.2BN - owns the White Mesa Mill which is the only fully licensed, operational conventional uranium-vanadium mill in the US and the La Sal uranium mine which is ~5km away from MAN’s project area.

Energy Fuels project has a 4.3m lb resource with grades at ~0.26% uranium...

Just recently, Energy Fuels announced the restart of that project.

(Source)

So MAN’s project is in a part of the US where a new discovery could have some relatively strong value considering the proximity to an existing mill and a multi billion dollar owner.

What we want to see from MAN’s Uranium project:

It’s still early days so for us it will be about going through the typical pre-discovery steps:

- Sample the rock chips taken from the first pass field program - the highest grade rock chips will represent potential drill targets.

- Potentially run some geophysics/geochem - look to do some mapping/geophysical surveys.

- Put together a drill program - Permitting & ranking of targets.

- HOPEFULLY make a discovery...

At every stage of the exploration process we will re-evaluate the results MAN is getting and see how the uranium potential for the project stacks up...

If the results are really good we will look at revisiting why we are Invested in MAN.

At this stage, we are still primarily Invested in MAN for its lithium exposure but are taking a wait and see approach with the uranium potential of its project.

The latest on the lithium front -

After delivering samples from a wireline logging program (click here to read our previous MAN note).

The next step is to re-enter old wells - which is one of the key catalysts we are looking for from MAN.

We are just waiting for the lithium price (and sentiment) to come back a bit after what we think is an overshoot downwards in the last few months.

This should help firm up MAN’s knowledge of its potential resource base and, we hope, re-confirm the presence of lithium on the project area.

Aiding MAN’s timeline here is the fact the company recently received permits for a two-well re-entry program testing for lithium.

The permits mean MAN is now ready to go in and re-enter two old oil and gas wells and test them for lithium brines.

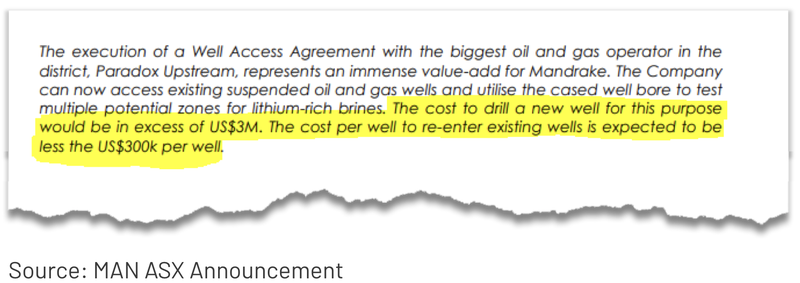

MAN doesn't need to drill new wells and so gets to do all of this work at a fraction of the cost a conventional drilling program would cost.

MAN already has a well access agreement signed, meaning the re-entry program will cost ~1/10th of what it would cost drilling a new well.

MAN expects to be drilling as soon as it has announced a maiden JORC exploration target and the results from Direct Lithium Extraction (DLE) testing for its project.

MAN expects both those catalysts to be delivered “imminently”.

So over the coming weeks we expects to MAN deliver three big catalysts for its lithium project:

- ☐ Sampling results - MAN has permits in place for a two well re-entry program. We are hoping MAN can get similar (and we hope better) results to its neighbour Anson Resources whose resource has an average grade of ~127mg/Li.

- 🔄 Maiden JORC resource - MAN expects to publish an exploration target soon. After that we want to see MAN put together a maiden JORC resource for the project.

- 🔄 Direct Lithium Extraction (DLE) partnership - This was a major catalyst for Anson and was a key reason that led to its market cap reaching ~$490M in mid 2022 in the middle of the lithium bull market. MAN expects to put out two sets of DLE test results imminently.

We think the DLE news will be especially interesting considering it is usually the major catalyst the market looks for with lithium brine projects in places like the US.

We wrote about why we think DLE is a game changer for US lithium brine projects in our weekend note last week - check that out here: Arkansas Lithium Summit - lithium come back?

We are hoping the three catalysts move MAN closer to achieving our Big Bet which is as follows:

Our MAN Big Bet:

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

What’s next for MAN?

US Lithium project -

- Re-entry program to commence ☐

- Direct Lithium Extraction (DLE) test results 🔄

- JORC lithium exploration target 🔄

Rock chip sample results testing for Uranium potential at US project 🔄-

Assay results from six different rock chip samples.

What are the risks?

In terms of the uranium potential at MAN’s project we arent attributing any risk to our MAN Investment Thesis - at this stage the results from MAN’s uranium work is just an added bonus IF anything comes of it.

In the short term the two key risks we see for MAN in the short term are “Exploration risk” and “Processing risk”.

Exploration risk is relevant because there is always a chance the company finds uneconomic quantities of lithium in the wells it re-enters.

Processing risk is also a factor because, even if MAN does find a decent amount of lithium, there is no guarantee that any of that lithium can be extracted and processed at rates that make MAN’s project commercially viable.

DLE technology has yet to be proven across US lithium brine projects at scale and there is a chance that MAN’s new technology partners are unable to make the process work with MAN’s brines.

To see all of the key risks to our MAN Investment Thesis, check out our MAN Investment Memo.

Our MAN Investment Memo

In our MAN Investment Memo, you can find:

- MAN’’s macro thematic

- Why we Invested in MAN

- Our MAN “Big Bet” - what we think the upside Investment case for MAN is

- The key objectives we want to see MAN achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.