MAN lands more lithium land as Exxon unexpectedly enters exploration

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,150,000 MAN shares and staff own 35,714 MAN shares at the time of publishing this article. The Company has been engaged by MAN to share our commentary on the progress of our Investment in MAN over time.

The US has a critical minerals supply chain problem.

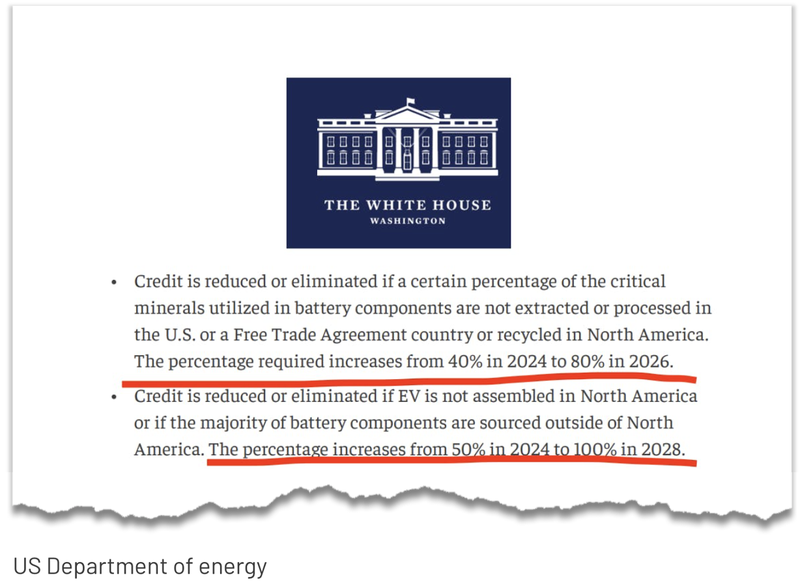

An attempt at fixing the problem is the USA’s Inflation Reduction Act (IRA) which aims to have ~80% of the critical minerals found in Electric Vehicle (EV) batteries to be sourced from inside the US or countries with which it has free trade agreements.

The critical mineral most sought-after right now is lithium.

The US produces less than 3% of the world's lithium, and China is responsible for ~60% of all processed lithium supply globally.

Such is lithium's importance to the US, oil and gas supermajor Exxon just paid US$100M for a lithium project in Southern Arkansas, chasing underground lithium brines.

Our US based lithium Investment Mandrake Resources (ASX:MAN) is looking to develop its lithium project in Utah, USA.

Basically MAN has acquired ground where potential lithium was present in underground brines from historically drilled oil wells.

This was before the great lithium boom when nobody cared about lithium, and the old oil wells had been abandoned...

MAN has acquired the land and permits to re-enter these old oil wells to try and extract the now valuable lithium - at about 1/10th of the cost of drilling new wells and taking months/years off the permitting time.

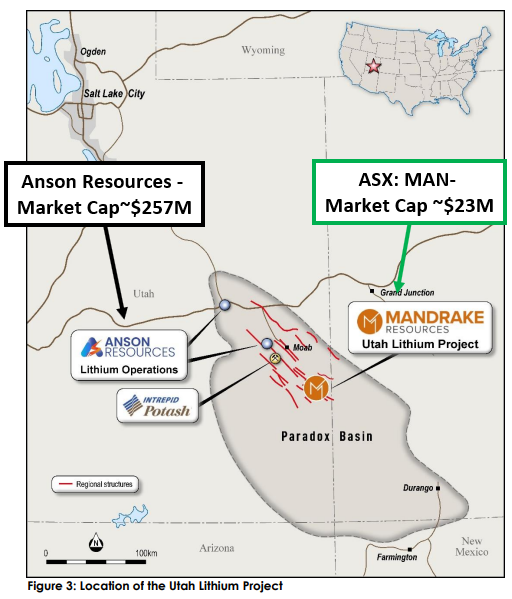

This is the same plan as being executed by $257M Anson Resources next door.

MAN is trading with a market cap of $23.3M and has $18.3M in cash (on 31 March 2023), giving the company an enterprise value of ~$5M.

MAN holds ~88,092 acres of ground only ~16km away from Anson Resources.

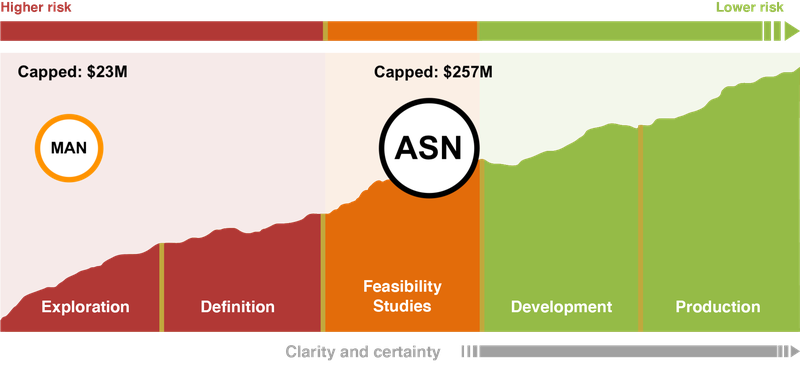

Anson is the current marker for a successful lithium company in Utah, and is a bit further along in the resource company lifecycle than MAN.

Ultimately MAN is looking to emulate Ansons success by:

1) Staking as much ground as it can to increase its project size

So far, MAN has managed to increase its project size from 56,000 acres to 88,096 acres (~356 km^2) - an increase of ~57% since February.

The bigger MAN’s project size is, the more likely MAN is able to put together a large resource estimate.

For context on size, Anson’s project sits on 214 km^2 of ground.

2) Put together a lithium resource through exploration

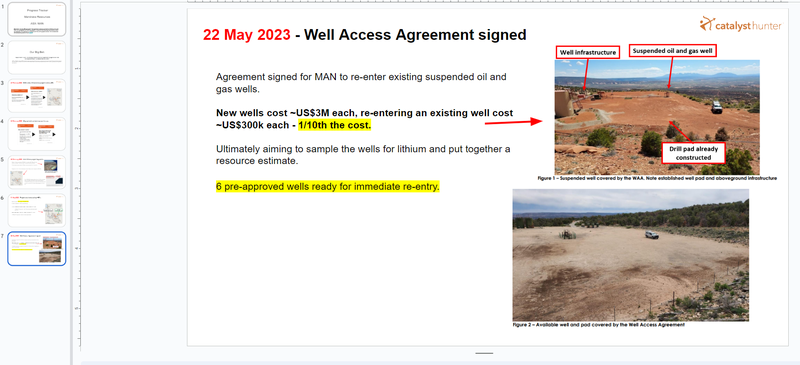

Today, MAN signed a well-access agreement and is ready to work towards its maiden lithium resource.

The well access agreement gives MAN access to existing suspended oil and gas wells drilled to depths of up to ~8,000 feet.

MAN’s theory is to re-enter these existing wells, and instead of looking for oil & gas, sample for lithium rich brines.

These wells are located in the Paradox Basin, which hosts significant concentrations of lithium rich brines.

MAN already has pre-approvals to re-enter ~six wells immediately.

MAN’s approach removes the permitting lead times (months, if not years) and the need to spend millions of dollars on new wells.

Instead, MAN can re-enter these existing wells at a fraction of the cost.

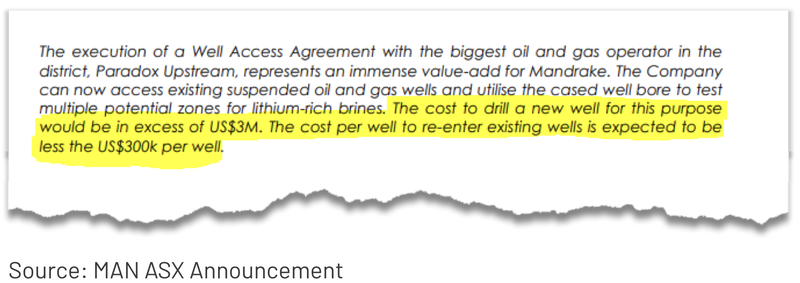

For context, each new well would have cost MAN ~US$3M, whereas re-entering the wells would cost ~US$300k.

1/10th of the cost per well...

This doesn't even include the time saved permitting and doing all of the drilling works.

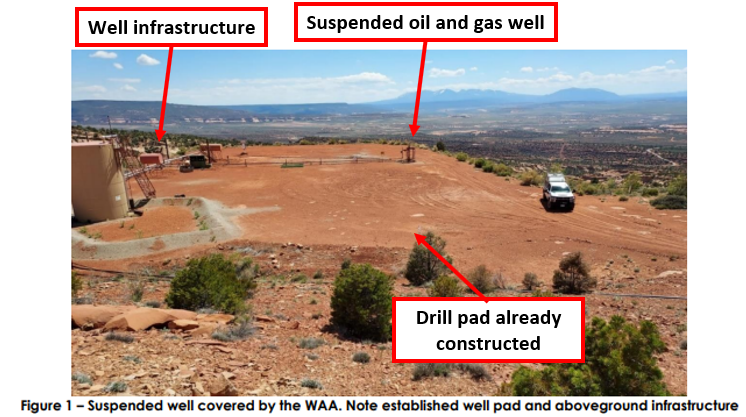

The image from today’s announcement puts into perspective cost and time saving from this strategy.

The drill pads, the well and all of the other associated infrastructure would have taken months and months to permit and then heaps of capital to drill.

But, MAN gets access to all of this straight away.

MAN has already identified six existing wells that are the highest priority for re-entry.

Ultimately, the target will be to take lithium brine samples from the wells and build a resource model.

The yardstick in the region is Anson Resources, who has a Mineral Resource Estimate of 1Mt of LCE (lithium carbonate equivalent).

This is the target that MAN is currently chasing.

MAN is trading with a market cap of $23.3M.

This compares to Anson’s market cap which is ~$257M - ~11x bigger than MAN.

**The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Interestingly, Anson put together its resource estimate by also re-entering old oil and gas wells in the region.

As long as MAN can deliver a resource of size/scale comparable to Anson, then we think the company can deliver on our Big Bet, which is as follows:

Our Man Big Bet:

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

For a high level update on MAN’s progress, check out our Progress Tracker for MAN:

More on the Well Access Agreement (WAA)

What is MAN getting?

At a very high level, MAN gets access to all the existing suspended oil and gas wells inside the entire ~88,096 acres that MAN’s project sits on.

Any other ground MAN stakes will also be included in the agreement.

MAN will have pre-approvals to re-enter ~six wells immediately.

Access will mean MAN can re-enter those existing wells and test for lithium rich brines.

In simple terms, re-entry is when a company opens up a previously drilled well and samples it again for the desired product, in this case lithium.

The goal is to test the quality of the brine and in particular the lithium concentration.

Most of the wells MAN is getting access to have been drilled to depths of ~8,000 feet, and MAN will test four different independent zones where the company expects to find lithium.

Ultimately MAN is getting access to wells that would cost ~US$3M each to drill and take several months to complete, all at an expected cost of ~US$300k per well.

What is MAN paying?

- US$180k upfront.

- US$40k for the first three wells that are pre-approved for re-entry (total of US$120k).

- 2% royalty to Paradox for all lithium extracted and sold from the re-entered wells.

Our take:

MAN effectively pays US$300k and a 2% royalty for access to the existing wells.

If we look at the six wells MAN already has approvals to re-enter and then multiply it by the replacement cost (which MAN says is US$3M/well), then MAN is saving itself months in time and ~US$18M in drilling costs.

MAN is getting access to US$18M in existing wells (at replacement cost) for ~US$1.8M.

This should mean MAN is able to define a resource estimate a lot quicker than the market expects and for a lot cheaper.

Breaking News🚨: Exxon to enter the lithium race

Last night the Wall Street Journal published an exclusive report last night that Exxon had joined the race for lithium.

Exxon bought 120,000 gross acres in the Smackover formation of southern Arkansas (in the US) for ~US$100M.

Although this is a small change for the oil and gas major, it is an indicator that Exxon is looking to gain a foothold in the lithium space.

Our take is that more and more major oil companies will utilise the super-profits generated from years of oil and gas dominance towards the next frontier of commodities - battery metals.

US-based commodities are one of our favourite macro thematics for 2023.

Lithium is listed on the critical minerals lists of the US, EU, Japan, India and Australia.

The biggest producer of lithium is Australia and the biggest processor of lithium is China.

The US accounts for less than 2% of the world's lithium production, and the country as a whole has basically no processing capacity.

The US introduced the Inflation Reduction Act to combat this supply chain dependency on export partners.

As part of the IRA, for Electric Vehicles (EVs) to be eligible for tax credits, ~80% of all supplies used in the battery cells must come from inside the USA or countries with free trade agreements with the US.

We expect companies with US based critical minerals exposure to perform strongly over the coming years especially considering the IRA incentives are staged to be in full effect by ~2026.

Our only US-based lithium pick across our portfolios right now is MAN.

Last week we put out an update on what we think is happening in the lithium sector right now.

In our note, we touched on the following:

- Why the lithium spot price is down.

- What the major lithium producers are selling their lithium for.

- The medium-long term demand/supply outlook.

- How the major lithium producers are spending all of their cash.

- What we are doing right now.

See the full note here: What is going on in the lithium market right now?

What are the risks?

Given that the next stage of work for MAN will be focused on exploration, the two key risks we see for MAN in the short term are “Exploration risk” and “Processing risk”.

Exploration risk because there is always a chance the company finds nothing in the wells it plans on re-entering.

Processing because, even if MAN does find lithium, there is no guarantee that any of that lithium can be extracted and processed at rates that make MAN’s project commercially viable.

We hope the exploration programs derisk both of these, but for now, we are conscious of these being the most important risks to look out for.

To see all of the key risks to our MAN Investment Thesis, check out our MAN Investment Memo here or by clicking on the image below:

Our MAN Investment Memo:

Along with the key risks, our MAN Investment Memo provides a short, high-level summary of our reasons for Investing.

The Investment Memo details:

- Key objectives we want to see MAN achieve

- Why we Invested in MAN

- What are the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.