KSN’s Gold Exploration in Elephant Country Delivers Promising Results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Early stage gold junior, Kingston Resources (ASX:KSN) has today delivered promising news coming out of its flagship 2.8 million ounce Misima Gold Project in Papua New Guinea (PNG).

You may remember we previously said KSN should be up the top of your watch list.

That’s because Misima has a production history of over 3.7 million ounces, as well as outstanding potential for additional resource growth through exploration success.

“This is big, it’s got scale. It’s got multiple potential targets in addition to the current known Resource. It’s in elephant country, the right real estate for monster projects,” said KSN’s MD, Andrew Corbett when we last caught up.

KSN has been working hard over the last few months to bring Misima back online as a large scale and low cost open pit gold mine.

Today’s results put it one step closer to achieving this aim.

Assays from drilling at Ewatinona have confirmed the potential of the resource, as well as indicating it is open in all directions.

Drilling highlights included 20 metres at 1.8 g/t gold from 78 metres and 6.6 metres at 1.9 grams per tonne (g/t) gold from 7.5 metres.

We will look at Ewatinoa and the overall Misima project in more detail shortly, but there is still more news to come with drilling continuing on a second target in the Quartz Mountain area at the Waipuna prospect.

Suffice to say, there should be plenty of newsflow leading up to the September quarter.

The existing 2.8 million ounce Misima resource may already be of sufficient scale to support a potential long-life mining operation.

That is reason in itself to keep an eye on this stock.

However, there may be further gold to be found as current exploration targets have been prioritised with a view to delivering new near-surface mineralisation. These targets are likely to have the largest impact on project economics as access to near surface ounces can boost cash flow in the early years while access to the main Misima resource is established.

With gold still hovering around the US$1400/oz mark, there is plenty of upside for KSN at present.

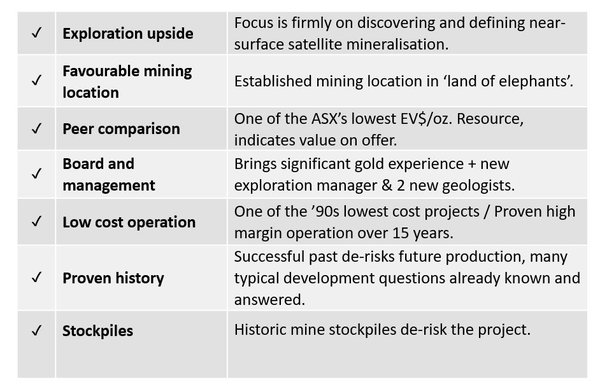

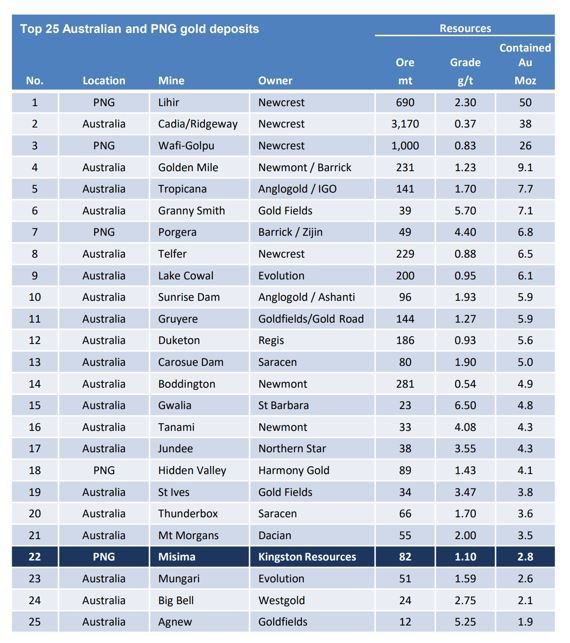

The potential for mine expansion and regional exploration, coupled with the gold price, and being named one of the top 25 Australian and PNG gold deposits alongside Newcrest Mining, Anglogold/Ashanti, Barrick Gold, and Gold Fields, would suggest this $20 million capped gold junior is undervalued.

With that in mind, let’s take another look at:

Share Price: $0.013

Market Capitalisation: $20.4 million

Here’s why I like it...

A quick re-brief?

You can read Kingston Resource’s (ASX:KSN) full story in our previous article: Advanced Gold Exploration Project Back on the Cards in Elephant Country.

In that article, we explained how KSN has interests in two gold projects: the Misima Gold Project in PNG and the Livingstone Gold Project in WA. We examined how the Misima Gold Project ceased operations in the early 2000s when the gold price was sub-US$300/oz.

We looked at the existing 2.8Moz Resource, multiple expansion targets, plus stockpiles left over from historical mining.

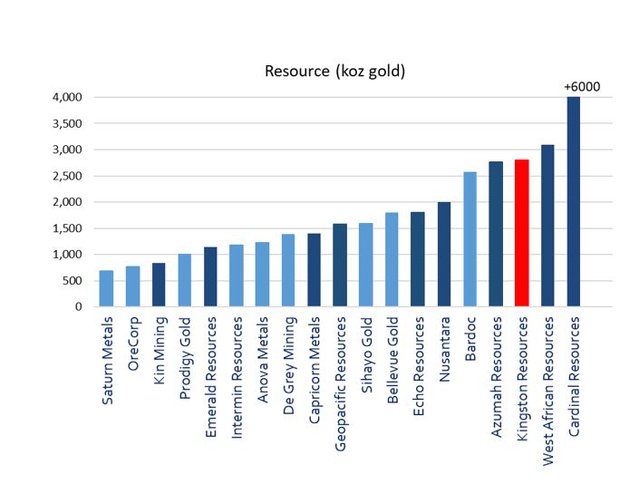

Essentially, we came to the conclusion that KSN is an advanced exploration story which appears undervalued compared to its peers. Its closest peer being capped at close to $500 million.

In fact, KSN is in the top 25 Australian and PNG gold deposits, on a contained ounces of gold basis.

Here’s MD Andrew Corbett talking about KSN’s assets.

The company completed its earn in at the Misima Gold Project in August last year, upping its ownership of the project from 49% to 70%, in partnership with Nippon Metals and Mitsui.

And it has been full steam ahead since.

Today’s results are promising

As mentioned above, drilling at Ewatinona confirmed the potential of the resource, as well as indicating it is open in all directions.

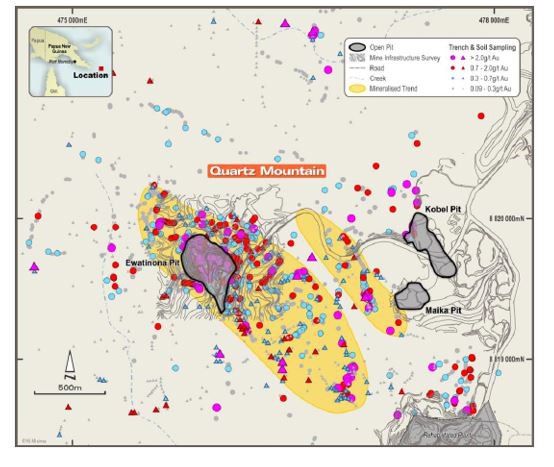

Ewatinona currently contains a resource of 220,000 ounces and it sits within the Quartz Mountain area of the Misima Gold Project, as seen below.

The area was historically mined by Placer, with gold and silver from the Ewatinona, Kobel and Maika pits producing a combined 147,000 ounces at 1.8 g/t gold.

The current Ewatinona resource is less than two kilometres from the historic mill location and the highly encouraging assay results confirm the potential of the resource which remains open in all directions.

Data evaluation and further drilling at Waipuna

KSN will complete a review of all current and historic data in the September quarter. This review includes Leap Frog modelling of the resource before the next round of Ewatinona drilling.

Meanwhile, drilling continues on a second target in the Quartz Mountain area, the Waipuna prospect, which was recently identified by a modern reinterpretation of historic geochemical data combined with geophysics and LiDAR information.

You can read more about it in this Finfeed article...

The Quartz Mountain area is one of a number of such targets Kingston plans to drill over the balance of 2019.

“The Quartz Mountain area is certainly shaping up to be a high priority target,” said Corbett.

‘’In addition to Ewatinona there are number of prospects that have been identified within the Quartz Mountain area.

‘’These targets are all exciting opportunities for Kingston, with outstanding potential to deliver additional near surface ounces.

‘’Our current exploration strategy is firmly focused on establishing sufficient ounces from these targets to commence mining studies.”

Looking back and looking forward

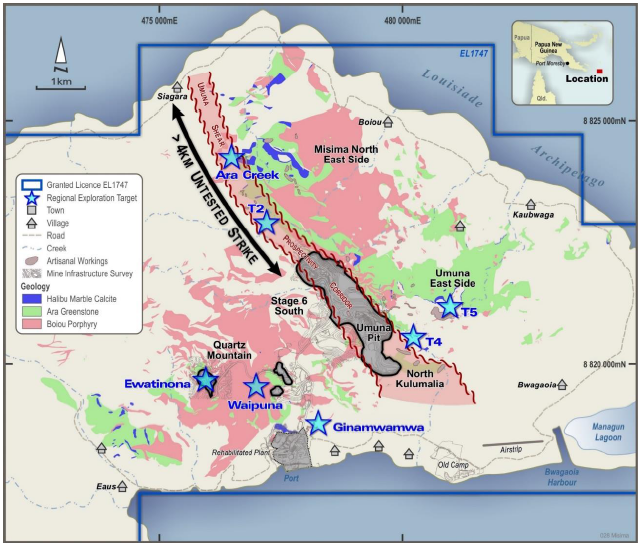

KSN has been focusing on testing the regional exploration targets it identified in its geochemical program carried out through 2018.

Having drill tested a range of locations along the Umuna Shear beneath the old pit, KSN’s exploration strategy is now firmly focused on discovering and defining near surface satellite mineralisation at prospects including Umuna East Side, Quartz Mountain, and Misima North.

Drilling has most recently been focused on the Quartz Mountain area. This area already contains a 220,000oz inferred resource.

There are a number of exciting geochem targets in the area and structural interpretations from the LiDAR survey carried out in 2018 has also provided further drill targets. KSN expects to be able to release further results from this initial program over July and August, just weeks from now.

Historic drilling and geochemical work in the area includes some impressive results that are well worth following up on:

- Historic drilling at Quartz Mountain includes

– 10m @ 3.06g/t Au from 108m

– 12m @ 4.13g/t Au from 116m

– 14m @ 2.28g/t Au from 76m

– 60m @ 2.29g/t Au from surface.

- Historic channel samples at Quartz Mountain includes

– 115m @ 1.47 g/t Au

– 113m @ 1.50 g/t Au

– 49m @ 1.04 g/t Au

The combination of an existing Resource at Quartz Mountain, the presence of extensive surface mineralisation and proximity to the mill site make it an ideal target for the surface exploration program.

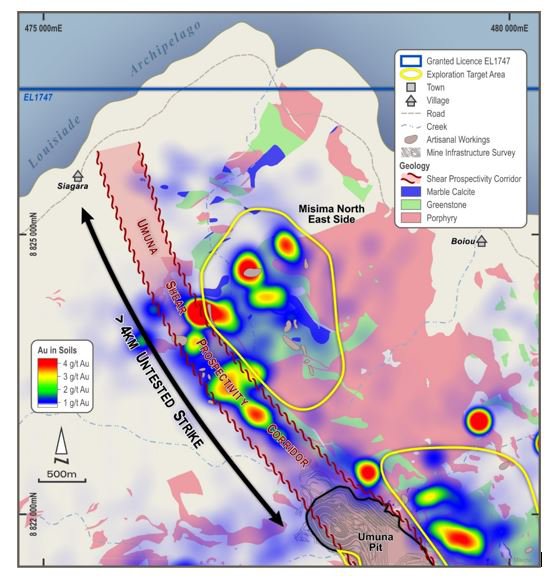

After Quartz Mountain, the next target for KSN will be Misima North. This is exciting for two reasons. There is extensive surface anomalism, providing potential for the small scale, shallow starter pit that KSN’s exploration program is focused on.

But there is a bigger, potentially transformational target here also.

The main Umuna Shear Zone continues through to the north of the island. The southern 3km section of this shear zone hosted the bulk of the 4Mozs Placer mined from 1989 to 2004. The shear extends for a further 4km to the north and it has never been drilled.

Encouragingly, the geochem footprint in the north appears to closely match the geochem footprint that Placer identified on top of the shear zone in the south. It was this geochem footprint that lead Placer to drill and identify the original Umuna Resource.

It is also worth noting that there was extensive historic activity in the north including a number of small scale underground mines running relatively high grade.

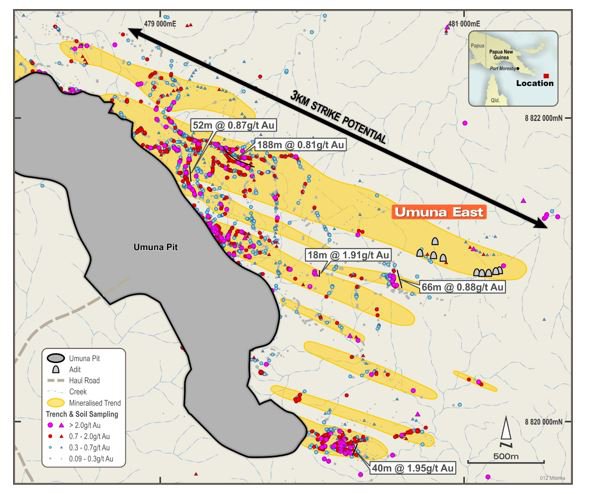

The third area Kingston is aiming to drill in 2019 is Umuna East. This area hosts a series of mineralised structures splaying southeast off the Umuna Shear.

These areas have been identified through structural mapping and followed up with geochemical testing. They also were host to a number of historic small scale undergrounds and adits and continue to host artisanal mining activities.

The structures are significant with strike lengths typically in excess of 1km long, and given the nature of the structure would represent easy access low strip tonnes.

Peer comparisons match up

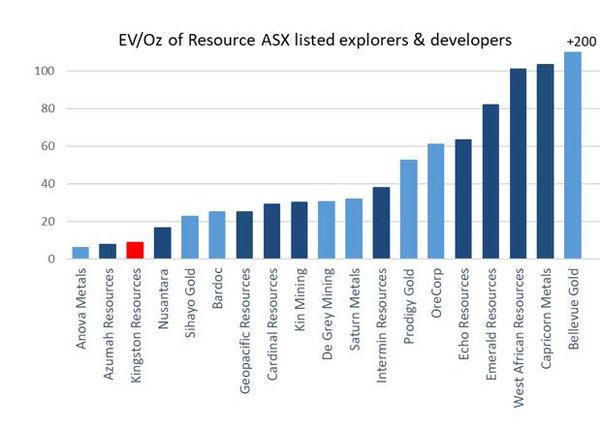

Also worth repeating in this article is that KSN remains capped at less than $25 million and is trading on a very low Enterprise Value per Resource ounce (EV/oz) basis (below), right at the lower end of gold exploration peers, at around $10/oz of Resource, relative to an average of around $40/oz or so.

The company has scope to increase the total Resource in a relatively short period.

Current market metrics suggest there could be a valuation uplift as the works program at Misima progresses.

KSN compares exceptionally well to its smaller ASX peers on a Resource/ounce basis, which suggests there’s scope for a valuation lift.

In effect, KSN’s peers have double the market cap, at half KSN’s known Resource.

This is the reason why several brokers have initiated coverage of the stock with Buy recommendations. These include Acova Capital which stuck a ‘Buy’ rating on the stock, along with a 12-month target price of 8.4 cents — well up on the current share price.

Patersons Securities has a 12-month target price of 6.0 cents.

A quick note on Livingstone

KSN owns 75% of the Livingstone Gold Project in Western Australia, which it is developing as a stepping stone for Misima, either optimising a potential sale price through drilling, or retaining and developing the to deliver cash flow.

It is a highly prospective project, which KSN plans to enhance with an RC drilling program on priority targets in the coming months.

Where to from here?

Today’s results put KSN once step closer to bringing Misima back online as a large scale and low cost open pit gold mine, which could be in production by 2023.

This timeline tells you all you need to know about the coming work program.

That’s a lot of work to do, meaning a lot of results anticipated.

When you factor that Misima has an existing Resource that measures up well against its peers, there’s a lot to like about this company.

KSN’s aim is to become a low cost, large scale gold producer and it seems to be well on its way to achieving this.

Should it take the right steps on the way to reaching this goal, it shouldn’t be too long before the market takes notice.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.