Advanced Gold Exploration Project Back on the Cards in Elephant Country

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you’re after an early stage gold junior, this one should be up the top of your list.

“This is big, it’s got scale. It’s got multiple potential targets in addition to the current known Resource. It's in elephant country, the right real estate for monster projects.”

That’s the kind of project today’s company’s MD, Andrew Corbett, believes he has on his hands.

The company is looking to bring its historically profitable flagship project in PNG back online as a large scale and low cost open pit gold mine.

The mine ceased operating in the early 2000s when the gold price was sub-US$300/oz, and comes with an existing Resource of 2.8Moz, multiple expansion targets, plus stockpiles left over from historical mining.

And now, with gold up around the US$1300/oz level, development is back on the cards, with the potential for mine expansion and regional exploration — a much welcomed bonus on top of the known Resource and newly identified stockpile.

While capped at less than $25 million, the company offers an advanced exploration story, making the list of the top 25 Australian and PNG gold deposits along with the likes of Newcrest Mining, Anglogold/Ashanti, Barrick Gold, and Gold Fields.

Coming in at number 22, with a 2.8Moz Resource, it’s fair to say the company appears undervalued, with the next on the list capped at close to $500 million.

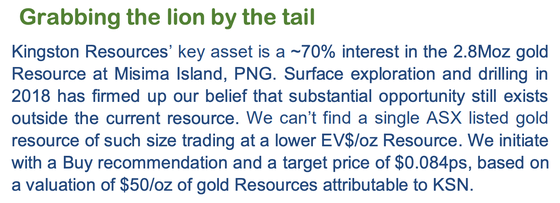

The opportunity has been recognised by at least one analyst, who, along with placing a ‘Buy’ recommendation on the stock, claimed, “we can’t find a single ASX listed gold resource of such size trading at a lower EV$/oz Resource”.

This one’s certainly worth a closer look...

Share Price: $0.019

Market Capitalisation: $24.5 million

Here’s why I like it...

What’s the story?

Kingston Resources (ASX:KSN) has interests in two gold projects, its flagship Misima Gold Project in PNG, plus the Livingston Gold Project in WA.

Back in August last year, KSN completed its earn in at the Misima Gold Project, upping its ownership of the project from 49% to 70%, in partnership with the highly credible Nippon Metals and Mitsui. (It also finalised sale of its lithium tenements at that time due to there being greater opportunity on offer at Misima).

As confirmed with Managing Director Andrew Corbett, its share of Misima is still rising, with an updated estimate expected to be made available in April.

The Misima Gold Project is located in Papua New Guinea, a well-established gold mining location, with a number of big players operating mines in the country.

The project is on PNG’s Misima Island, which sits about 300km east of Port Moresby. The island itself has a long gold mining history dating back to 1888 and the industry is well supported by the local community, who are keen to see the project come back online.

Misima’s history

The Misima Gold Project has an impressive history.

Canada’s Placer Dome operated the project for 15 years from 1989 to 2004, during which time it produced 4Moz of gold. At its peak it produced 370,000oz, while it averaged 230,000oz per year over its life.

Those 15 years were profitable and successful, with operating margins averaging 37%, and remember this was at a time when the gold price was fluctuating around US$300/oz.

The extensive history and success, significantly de-risks Kingston’s plans for bringing the operation back into production..

To help deliver on those plans, there remains a Resource of 2.8 million ounces, from 82.3Mt of ore grading 1.1g/t and 5.3g/t of silver.

The Resource remains because the incentive wasn’t there at the time for Placer to continue the operation. At the time the decision to close the mine was made the gold price was in the range of just US$250-US$300/oz.

Now, with gold selling for around US$1300/oz., it is a whole different story.

Add to that the fact that the soft, easy to process ore at Misima means costs are significantly lower than in Australia, and the margins on offer make that 1.1g/t grade look all the more attractive.

It is worth noting that Placer finished mining in 2001, with a remaining 32Mt of stockpiles that it continued to process for four years. However, it didn’t feed the whole 32Mt through, leaving stockpiles at the project that KSN is now trying to find.

Stockpiles found

KSN confirmed today that it had found the first of the stockpiles, identifying the location of a large stockpile of gold mineralised material at Misima.

The stockpile contains 3.6Mt of low-grade material, averaging 0.5 to 0.7g/t Au. While the grade is modest, it represents loose rock, at surface and close to the likely location of a future processing plant — meaning lower mining and processing costs which make it an excellent early feed source for any future development plan.

Note that this near-surface stockpile, which was confirmed by a LiDAR (Light Detection and Ranging) survey, is not accounted for in the current 2.8Moz gold Resource at the project.

Also, it doesn’t need to be mined and is sitting there ready to be processed, meaning there will be minimal costs involved and therefore quite high margins despite the lower grade.

By my estimates, and considering current prices, this could translate to $50-$60 million of cash flow...something that will certainly help de-risk the project at this early stage.

There are likely other stockpiles to be found, although these are more of a bonus. The company’s primary focus is squarely on exploration, above and beyond the known deposits.

For more details, here’s Corbett speaking at the 2018 International Mining and Resources Conference (IMARC) in February discussing the Misima Project:

The real upside here and what’s drawing investor interest is not what’s already known, but what’s still to be discovered...

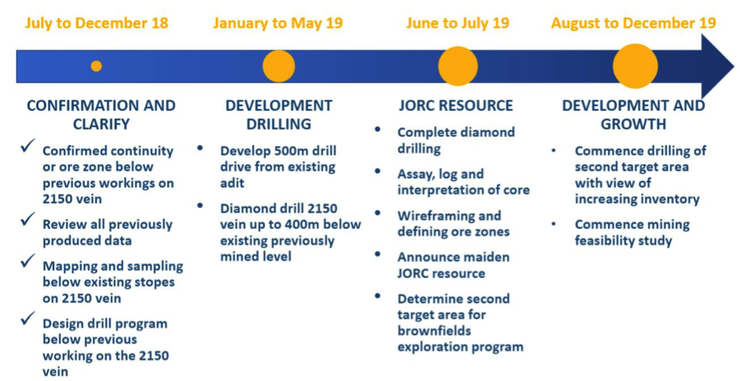

KSN’s exploration strategy is now firmly focused on discovering and defining near-surface satellite mineralisation at prospects. Adding near-surface resources is important in these early stages of this future potential mining operation.

Here’s a snapshot of the exploration targets with simplified geology:

I think there’s a good chance of success here, with limited historical exploration due to the low gold price, and early exploration results are promising.

Up until recently Kingston was targeting extensions to the main Umuna orebody under the old pit. The best intersection of 40m at 3.17g/t Au in hole GDD013, was announced last November

But KSN is now focusing on testing the regional exploration targets it identified in its geochemical program carried out through 2018.

It has moved the rig down to the first of these targets, the Ginamwamwa prospect, where a range of holes are being drilled to test underneath the high-grade supergene gold that was identified at surface through during the successful 2018 exploration program.

After completion of the Ginamwamwa program the rig will move to Quartz Mountain.

The company has plans for a second rig to accelerate exploration at Misima — a small RC-Diamond combination to more rapidly test these and other satellite targets.

So having tested a range of locations along the Umuna Shear beneath the old pit, KSN’s exploration strategy is now firmly focused on discovering and defining near surface satellite mineralisation at prospects including Ginamwamwa, Quartz Mountain, and Ara Creek.

Kingston’s Misima a top tanking opportunity

Listed below are the companies that own the top 25 multi-million ounce gold deposits in the Australia-Pacific region... you'll note that KSN comes in at 22, right behind some very well known gold companies.

What’s not apparent here is that every other company is worth north of $400 million market capitalisation, while KSN still remains capped at less than $25 million.

KSN is trading on a very low Enterprise Value per Resource ounce (EV/oz) basis (below), right at the lower end of gold exploration peers, at the discount price of around $10/oz of Resource, relative to an average of around $40/oz or so.

Additionally, KSN has scope to increase the total Resource in a relatively short period, plus current market metrics suggest there could be a valuation uplift as the works program at Misima progresses.

As you can see here, KSN compares exceptionally well to its smaller ASX peers on a Resource ounce basis:

This clearly suggests there’s scope for a valuation lift.

As put simply by Corbett, it comes down to peers having “double our market cap, half our Resource”.

Keep in mind those figures only take into account the known resource, with no consideration of the significant exploration and expansion potential of Misima and its historically proven location as a top mining destination.

Analysts say ‘Buy’

A number of brokers have recently initiated coverage on the stock, itself an endorsement of the company and its assets, as the vast majority of ASX listed companies with a market capitalisation of this size attracting non analyst interest at all.

And with ‘Buy’ recommendations and target prices at significant premiums to the current share price, it seems that the market could be missing something here, although any broker recommendation is speculative.

Avoca Capital

In March, Avoca Capital stuck a ‘Buy’ rating on the stock, along with a 12-month target price of 8.4 cents — well up on the current 1.9 cent share price.

Avoca, confirmed that the bigger picture here – and what could deliver the real payoff for investors – is not the known Resource, despite it comparing so well to that of its peers, but the exploration upside potential. Already, say Avoca, recent surface exploration and drilling in 2018 has “firmed up our belief that substantial opportunity still exists outside the current Resource”.

It’s this drilling at new prospects that could provide compelling share price catalysts...

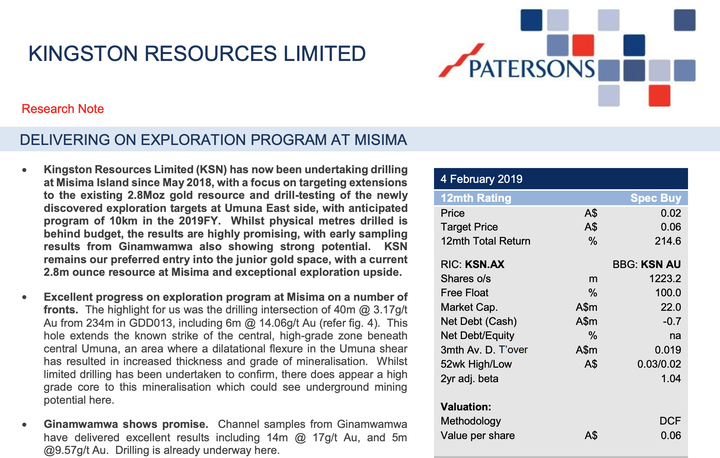

Patersons Securities

Backing that position is Patersons Securities, which has a 12-month target price of six cents.

Analyst, Cathy Moises, declared “KSN remains our preferred entry into the junior gold space, with a current 2.8m ounce Resource at Misima and exceptional exploration upside.”

She highlighted the excellent progress on the exploration program to date at Misima, reiterating the still underappreciated exploration potential at the project.

The full Patersons’ report is available HERE on Kingston’s website.

Strengthening Management Team

Adding to its existing experienced and well regarded team, KSN has appointed Stuart Hayward as Exploration Manager.

Hayward is a highly credentialed geologist with more than 30 years’ experience in mineral systems exploration and evaluation including epithermal Au-Ag and porphyry Cu-Au deposits.

He was with Newcrest Mining Ltd (ASX:NCM) for more than 15 years as a Mineral Resource Manager and Principal Geologist covering their Asia Pacific and PNG projects, including time on Newcrest’s Lihir and Wafi Golpu projects.

Hayward will have a particular focus on the 2019 drilling program which seeks to advance the targets identified during 2018 towards resource definition.

He will be working alongside Charles Yobone and an expanded team of geologists. Two new local geologists have been appointed as regional exploration activities ramp up on the island.

Managing Director, Andrew Corbett, had good things to say about the new team, “During my recent site visit to Misima it was particularly pleasing to see the expanded geological team carrying out field work on both Quartz Mountain and Ara Creek while we are drilling in a third location at Ginamwamwa”.

Livingstone Gold Project, WA

While the focus of this report has been on KSN’s flagship Misima Project — a reflection of the company’s current focus — KSN also owns 75% of the Livingstone Gold Project in Western Australia.

The project is located 140km Northwest of Meekatharra, in a highly prospective location within the Bryah Basin.

KSN’s strategy at Livingston looks to involve optimising a potential sale price through drilling, while retaining the potential to hold.

Kingston last year extended its land holding at the project with the application to add a further 170km2 to its existing 220km2 tenement area.

The project is a highly prospective one which Kingston plans to continue to enhance with an RC drilling program on priority targets in the coming months, while it’s already seen a number of high grade drilling results delivered through early stages of near surface exploration.

“Livingstone is our stepping stone and Misima is our priority. We look at Livingstone as potential for near-term cash flow or as an asset to build up. But Misima is our main focus,” explained Corbett.

Where to from here?

With a focus on the Misima Gold Project, the company is eyeing production by 2023, while KSN will continue its exploration and kick off the mining studies late on this year.

Considering the existing Resource and historical operating data, plus ongoing exploration activity and considering industry comparisons, there’s little reason to question why KSN can’t progress the Misima Gold Project to being a low cost, large scale gold producer.

As drilling results continue to roll in, it seems it’s only a matter of time before the market fully grasps the potential that is on offer. From here, we’ll be keeping an out for further drilling results in the near term which could prove to be compelling catalysts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.