KAU: Gold drilling commenced at never before mined depths of one of Australia’s highest grade historical gold mines.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,665,000 KAU shares and the Company’s staff own 35,000 KAU shares at the time of publishing this article. The Company has been engaged by KAU to share our commentary on the progress of our Investment in KAU over time.

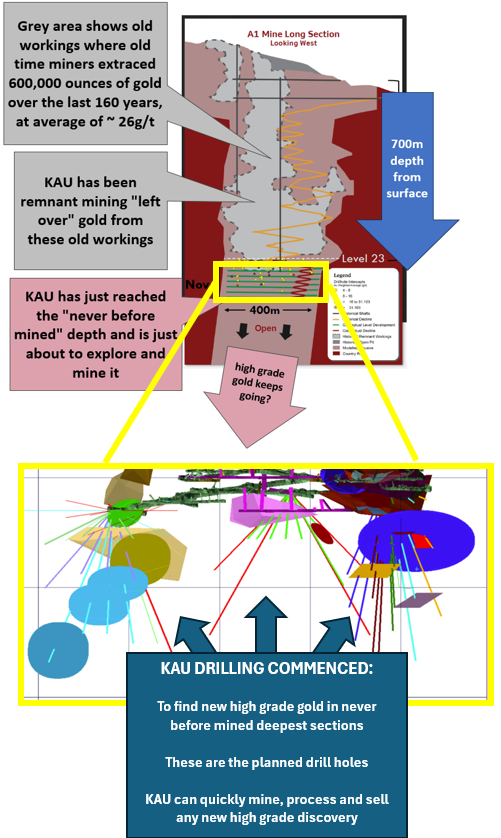

Discovered in 1861, the A1 gold mine in Victoria has produced over 600,000 ounces of gold.

That’s ~$2.6 Billion worth of gold at today’s gold price...

(which was up again overnight - marching back towards new all time highs)

The average historical grade out of the A1 mine was 25g/t gold.

This is extremely high grade.

But the old time miners couldn’t reach the deepest levels with the technology of the time...

Our Investment Kaiser Reef (ASX:KAU) now owns the A1 mine.

KAU has put in years of work to reach the deepest and never before mined levels of the A1 mine....

And get an exploration drill rig down there...

Today KAU announced drilling has commenced to test if the high grade gold continues deeper than the old time miners were able to reach...

And IF KAU finds more high grade gold, they can quickly mine, process and sell this gold using their operating gold processing plant.

Which has processing capacity of ~250,000 tonnes of ore per annum.

All while the gold price is the near highest it has ever been.

(this is basically the thesis for our Investment in KAU)

For the last 30 years, mining at this project was “remnant mining” from areas that had already been mined out by the old time miners, who had extracted the “easiest to get to” high grade ore.

(but left behind the lower grade ore)

KAU has also been remnant mining the project for the past few years.

(and still managing to generate $10’s of millions in revenues from it).

Now for the first time in decades KAU is about to go mining in virgin parts of the A1 mine.

High grades and a record gold price could mean revenues for KAU going forward are a stepchange higher from what we have been seeing over the past few years.

(high grades means more grams of gold per tonne - so you get more gold for the same cost to process the one tonne of ore)

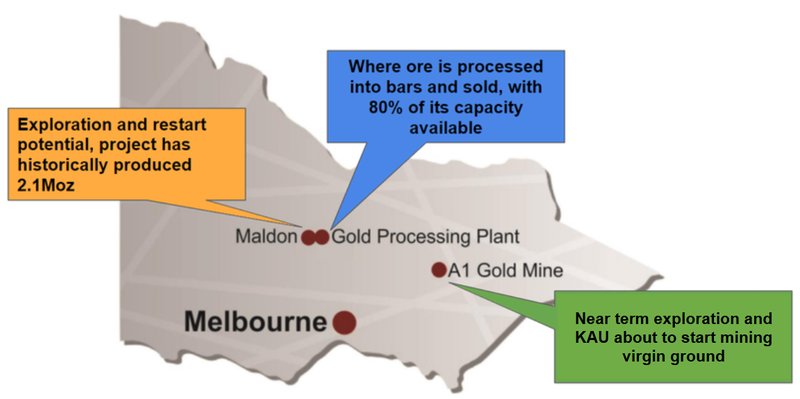

KAU owns 100% of a processing plant that is able to process ore mined out of the A1 mine.

So KAU can monetise its projects quickly.

While the gold price is near all time highs:

We saw both the A1 gold mine and the processing plant when we visited the site back in March and again in October.

A1 gold mine - find and mine high grade gold ore at the deepest, never before mined levels:

Gold processing plant - process the gold here. Higher grades means more gold for the same cost of processing.

Produce and sell the gold bars - while gold prices are at a record:

Check out our notes from our site visits here: Our New Investment is Kaiser Reef (ASX: KAU)

For KAU over the next 6 months it’s all about getting A1 ready to be mined and turned into $$.

KAU recently raised ~$8M at 15c per share so it has the cash runway to deliver these catalysts too.

First though, from this drill program we want to see KAU confirm that the high grade gold reefs continue at depth.

We think that high grade hits from this program will make it easier for the market to appreciate what KAU is looking to do.

IF we see high grade hits anywhere near those historical grades, then things could get very interesting and the market can start speculating about potential cash returns to KAU in the near term.

(IF the remnant mining was getting KAU close to being breakeven then imagine what much higher grades can do...)

With gold prices at record highs, you don’t even need to produce that much gold to get into truly big numbers.

25,000 ounces of gold these days is over A$100M.

We have been eagerly waiting for KAU to commence this drill program since we first Invested back in October.

Next we want to see the drill results start rolling in ideally with some ultra high grade gold hits, quickly progressing to mining, processing and selling the gold into record gold prices.

Reasons we are Invested in KAU

In our last KAU note we detailed the 11 key reasons why we Invested in KAU, here is a reminder:

(Keep in mind these were first published on 21 October 2024, some things like gold prices and market caps may be slightly different now)

- The gold price is surging

Gold is up almost 35% against the USD in 2024 making it one of the best performing commodities this year AND it is trading at all time highs against just about every currency in the world.

At the time of writing this, gold is at AUD ~$4,050 per ounce (US ~$2,700), up nearly 100% from 2021 lows (we track the gold price here).

UPDATE: After a little post US election breather the gold price has been back on the rise over the last few weeks, particularly running over the last few days. - KAU 100% owns the prolific, historical A1 gold mine in Victoria

Discovered in 1861, this mine has produced over 600,000 ounces - that’s ~$2.4 Billion worth of gold at today’s gold price.

The average grade was 25g/t gold which is extremely high grade (considering most mines today operate at ~1-2g/t of gold). - KAU 100% owns an operating gold processing plant

It's a 250,000 tonne per annum capacity plant within trucking distance of KAU’s operating A1 mine AND the Bendigo goldfields.

The plant means KAU is able to produce and sell gold to the market straight away.

It also means KAU holds a “hard to replace” bit of infrastructure that is valuable to pre-production gold companies nearby wanting to turn their projects into gold (and cash).

KAU recently spent ~$5M on plant upgrades which should improve gold recoveries. - KAU is already producing and selling gold

KAU is already producing and selling gold (and has been for the last few years) by mining the “remnant ore” in the A1 mine that was left over by old time miners who extracted the “easy to get to” high grade ore.

KAU is making around $23-30M revenue per year for the last two years, flirting with break even. A rising gold price means rising revenue for KAU by just doing what they are already doing. - High grade gold exploration upside

Drilling about to start at never before reached depths at the A1 mine.

KAU has already spent ~$23.5M in development and upgrade capital to reach, explore and start mining at these virgin, new depths that the old time miners were not able to access.

New higher grade ore discoveries means higher margins when processing.

UPDATE: this drilling has commenced today - this is what we have been waiting for - KAU also 100% owns the Maldon Mine

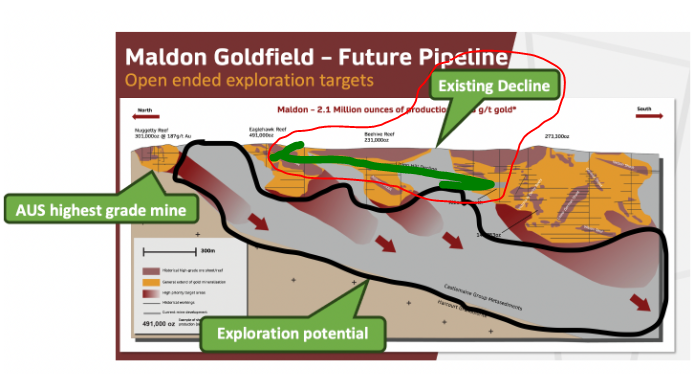

The Maldon mine started operating in 1854, and has historically produced 2.1Moz ($8.5 Billion of gold at today’s gold price). The Maldon Mine contained Australia's highest grade gold mine (Nuggety Reef) which produced 301k ounces of gold at whopping grades of 187g/t gold. This project has been on care and maintenance since 2018 but we think any exploration success could bring the project back to life.

UPDATE: Last week KAU put out a “mine restart study” on this asset (more on this later in today’s note). - Processing plant only operating at ~20% capacity

KAU’s plant was originally built in the 1980s to bulk process lower grade ore from a different mine. This means that in the event of a new high grade discovery at the A1 mine and/or restart of the Maldon Mine, KAU can ramp up production immediately. With the extra capacity KAU could even “toll treat” ore from other nearby gold companies to make some extra revenue. - Visited all sites, spent time with management

We had been looking at KAU for over a year now. We visited the KAU’s projects in March and again in October, and spent time with management, board members and the plant and mine operations teams, and were impressed. - Unhedged gold producer

Some gold producers commit to sell future gold production at a fixed gold price - which means they do not benefit from rising gold prices (or suffer from falling prices).

KAU is NOT hedged, meaning the more the gold price goes up the better off KAU will be. - KAU has a $38M market cap which we think is well below the replacement cost of its assets.

We think KAU’s processing plant and its two gold projects (the operating A1 Mine & the Maldon Mine) are worth a lot more than $38M.

Our view is that just the processing plant on its own would cost more than KAU’s current market cap to replace. - Previous investors/owners have done all the heavy lifting for KAU

KAU’s assets have had years of work and tens of millions of dollars spent getting them to where they are today. KAU is now in a position to benefit from all that sunk capital.

Check out our full KAU Investment Memo to see the key objectives we want to see KAU achieve, risks we have identified and accepted and our Investment plan.

Ultimately, we hope that a combination of the above reasons contribute to KAU achieving our Big Bet, which is as follows:

Our KAU Big Bet:

“KAU re-rates to a market cap greater than $300M by increasing gold production at its A1 Mine and/or making new discoveries at either of its two gold projects (A1 or Maldon)”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our KAU Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

What else has KAU been up to since we Invested?

Our note today so far has focused on KAU’s A1 mine...

But A1 is just one of KAU’s three key assets.

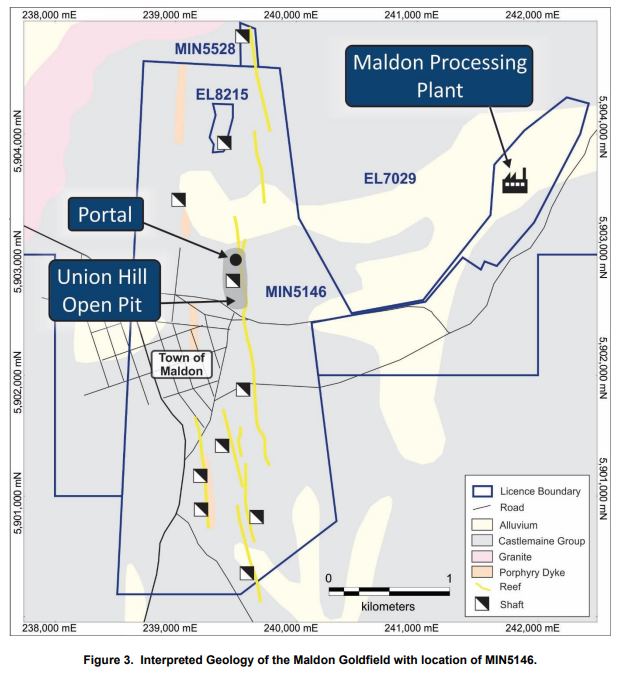

KAU also owns 100% of the KAU owns the Maldon gold project which is only a few km away from its processing plant.

(distance matters... more on this later).

Over the last two weeks, KAU had newsflow from both those assets.

Mine restart study released for KAU’s Maldon gold project

First some context...

The Maldon Mine, started operating in 1854, historically produced 2.1Moz at very high grades...

($8.5 Billion of gold at today’s gold price).

The Maldon Mine includes Australia's highest grade gold mine (Nuggety Reef) which produced 301,000 ounces of gold at grades of 187g/t of gold.

Here KAU also has a huge decline (tunnel) that could be accessed to mine any new discoveries.

We went down the decline at Maldon during our last site visit:

The Maldon project has been on care and maintenance now for ~6 years (since 2018).

At the time the gold price was AU$1,650 per ounce... now gold prices are over ~$4,200 per ounce.

With gold prices much higher, the incentives to restart the mine would surely be a lot stronger now, especially because of how close the project is to KAU’s processing plant and because the project is already fully permitted sitting on mining licenses.

Just last week KAU put out a “Mine restart study” for its Maldon project.

The study laid out a two stage plan (stage 1 to take 8 months and stage 2 to take 15 months) to get Maldon back online.

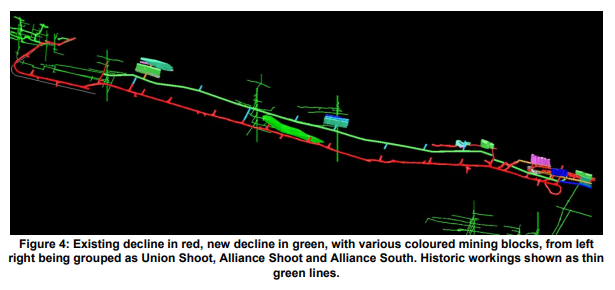

Here is what the development work would look like - (red = existing decline, green = new decline and the coloured blocks would be where KAU mines).

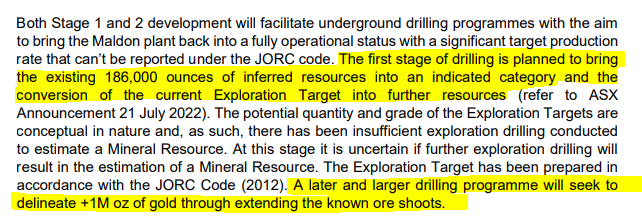

One thing that stood out to us was how much the plan centred around exploration success.

With its first round of drilling KAU would look to convert the inferred 186,000 ounce gold resource into indicated and also bring some of the exploration target into the resources category.

(KAU’s current exploration target is for between 165k & 345k ounces of gold)

The later stage would be where KAU tries to get to +1M ounces of gold...

(Source)

KAU’s ground position here is massive, and any meaningful discoveries that get the project up to that 1M ounce threshold would be a game changer for the company.

With KAU’s plant only a few km’s away any meaningful discovery could be produced quickly and with very little transporting costs.

(Source)

Speaking of KAU’s processing plant... KAU put out a pretty important announcement for that last week.

KAU’s plant ready to toll-treat third party ore now

As mentioned earlier, KAU also owns 100% of the Maldon gold processing plant.

KAU’s plant currently has the capacity to process ~250,000 tonnes of ore per annum.

At the moment, the plant is operating at ~20% of that capacity.

The spare capacity is because KAU is about to start developing never before mined parts of its high grade A1 gold mine also in Victoria.

(once the development work is done and A1 is being mined, we expect KAU to feed its own ore through its plant).

While all of that happens, the processing plant can be used to process third party ore.

Last week KAU confirmed that the first batch of “trial ore” had been delivered from a third party for “toll milling”.

We think that's a pretty strong milestone for the plant - especially considering the spare capacity the company has.

What is a toll treating deal and why is it important?

At a very high level - it's when a miner provides ore to the owner of a processing plant, who then processes it on their behalf based on pre-agreed deal terms.

Sometimes, the deal terms are for straight cash payments, sometimes they are for a share of the gold that is produced.

The deal terms can change, but these types of deals are good for both cash strapped explorers with resources in the ground & for a company that owns a processing plant with spare processing capacity (like KAU).

We also noticed in last week’s announcement that KAU is currently “in discussions with other potential toll treatment parties” as it looks to fill up the spare capacity at its mill.

Our view is that processing plants with spare capacity are most valuable when the underlying commodities are trading at record highs.

(just like gold prices are today).

A lot of projects that may not have been economically viable in the past can now start to look interesting BUT the owners of the projects need to get the ore mined and processed as quickly as possible to lock in current prices.

That means the processing plant owner has more demand from operators looking for a plant then it would have when prices are low.

Especially in Victoria where getting a new plant permitted and built could take years...

Anyone who follows the junior gold space, over the last 12 months we have seen a bunch of smaller companies with existing gold deposits start to “fast-track mining approvals” and “start discussions with potential toll-treatment partners”.

We are hoping KAU is able to capitalise on this environment with multiple new deals over the coming months.

(what a great time to own a gold processing plant with spare capacity...)

What’s next for KAU?

Over the next 3-6 months we are most interested in seeing KAU drill out and develop its A1 mine.

Here are the two objectives we will be tracking in the short term:

Exploration drilling at A1 Mine:

We want to see KAU drill out the never tested sections of the A1 mine and make high new grade discoveries.

Milestones:

✅ Drilling commences

🔄 Drilling results

Increase production from the A1 Mine:

We want to see KAU mine out the never before touched sections of the A1 gold mine.

Milestones:

🔄 Decline construction progress

🔲 Mining of virgin ground commence

🔲 Increased average gold grade processed

What are the risks in the short term?

The two key risks for KAU in the short/medium term is “exploration risk” and “development/delay risk”.

Exploration risk because the company is now drilling at its A1 mine.

If the drilling fails to deliver high grade gold hits then it could impact KAU’s development strategy.

The market may also start to discount the potential of the development strategy which we think could impact the share price in the short term.

Exploration risk

There is no guarantee that KAU’s upcoming drill programs are successful and KAU may fail to find economic silver-gold deposits.

Source: What could go wrong? - KAU Investment Memo 21 October 2024

Development/delay risk because a big part of KAU’s valuation is centred around the company being able to turn dirt from its A1 mine into gold (and then revenues).

There is always a chance that decline development at A1 takes a lot longer than the market expects which would push back these revenues.

Big delays could mean the market starts to get impatient with KAU which may impact the company’s share price in the short/medium term.

Development/delay risk

Should any or all of the above risks materialise, KAU could wind up stuck in “development purgatory” where newsflow dries up and the project remains stagnant for a prolonged period of time, hurting the share price. Additionally, if delays occur in terms of material newsflow, the market could turn on KAU.

Source: What could go wrong? - KAU Investment Memo 21 October 2024

We list more risks to our KAU Investment Thesis in our Investment Memo here.

Our KAU Investment Memo:

You can read our KAU Investment Memo in the link below. We use this memo to track the progress of all our Investments over time.

Our KAU Investment Memo covers:

- What does KAU do?

- The macro theme for KAU

- Our KAU Big Bet

- What we want to see KAU achieve

- Why we are Invested in KAU

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.