How to cash in on the accelerating shift to green energy

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The transition to electric vehicles (EVs) is a much documented development. It has not only triggered discussions around the environmental benefits of these types of vehicles, but also which companies are best placed to take advantage of the production of input metals through to green applications outside the EV.

There have been some interesting industry changes in 2020 which may have implications for companies that are active in the various sectors that stand to benefit from the production of battery materials and end products.

Arguably the most notable trend that has emerged in the last 12 months is the acceleration in electric car sales in Europe, a region that is now outstripping China and other Asian countries that have been active in developing batteries for EVs.

This has been accelerated by European regulations forcing automakers to reduce the carbon footprint of their fleet offerings.

As reported by The Washington Post: "Market share is important because carmakers will be judged by their fleet average under tough new limits on carbon dioxide emissions that come fully into force next year (2021). The new limits, aimed at combating global warming, mean that carmakers must make and sell more low-emission cars. Carbon dioxide is the main greenhouse gas blamed by scientists for global warming."

The Post goes onto report that, "market share of electric cars in Europe increased during and immediately after the worst of the pandemic lockdowns".

According to the European Automobile Manufacturers Association, the share of chargeable cars rose to 7.2% percent in the April-June quarter from 6.8% in the first quarter of 2020.

The changing landscape in Europe, coincides with a scaling down of subsidies in China. Sales of EVs in Europe are projected to exceed one million units in 2020 and to grow rapidly in the years to come.

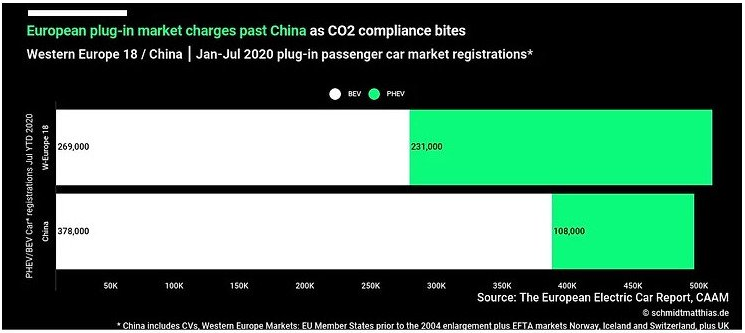

A recent article published by The Driven, referenced Matthias Schmidt in relation to his European Electric Car Report for the seven months to July 2020.

Schmidt noted that during that period there were more plug-in electric car sales in Western Europe than in China, a country that in previous years had been considered the world’s largest electric car market by volume.

The following chart produced by Matthias Schmidt tells the story.

As alluded to above, COVID_129 has also played a role in this shift.

COVID - short-term pain, long-term gain

Many industries has veen impacted by COVID-19, and the EV sector is no exception, but this hasn’t affected the China/Europe metrics.

Moreso, it is the medium term impact that investors should be focused on as the electric vehicle industry is seen by countries such as France and Germany as being central to a multi-billion Euro economic recovery.

It was recently reported in ‘Renew Economy - Clean Energy Use and Analysis’ that French president Emmanuel Macron will seek to jump-start the local auto industry decimated by the coronavirus pandemic with an €8 billion ($A13.2 billion) plan that includes a major boost for electric vehicles.

Harking back to Schmidt’s observations, he highlighted that the increase in sales in Western Europe means that the region is on target to achieve 1 million electric vehicle sales with a large push expected in the second half 2020 to meet stricter CO2 compliance regulations.

He expects that increased availability of Tesla electric cars, as well as the release of the Volkswagen ID.3 electric hatch will be behind the escalation in sales.

Tesla’s Elon Musk recently unveiled the first image of his planned giga-factory in Germany which will be situated near Berlin.

From a broader perspective, the increased focus on the renewable energy industry has been highlighted even further with the European Union unveiling a €750 billion ($A1.2 trillion) plan for a climate-led economic recovery from COVID-19 that puts investment in renewable energy, clean transport, smart energy and emissions reduction at front and centre.

Suppliers of materials should be proximal to Europe

Given this backdrop, it makes sense for Australian investors looking to gain exposure to the trend to focus on companies positioned within Europe, particularly those with ready access to the large automotive manufacturing hubs.

With regard to some input materials, that is easier said than done.

For example, the majority of the world’s cobalt supply comes from Africa with most areas falling under the ‘’sovereign risk’’ banner, another reason to opt for a company operating in a safe jurisdiction.

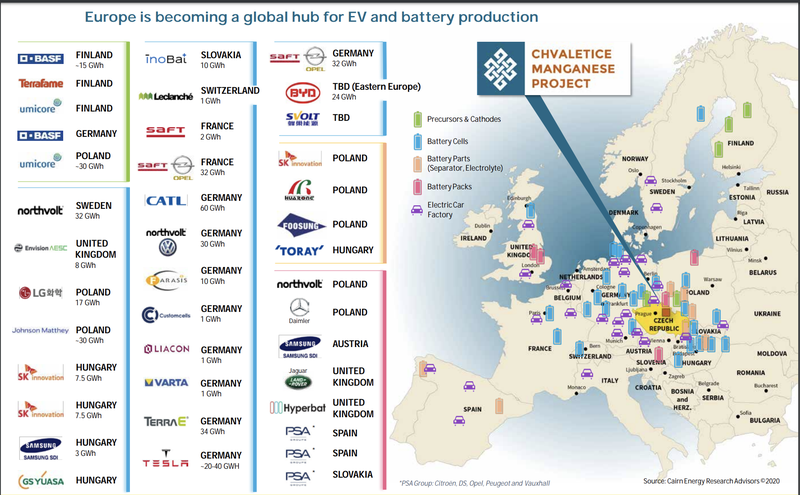

High profile battery manufacturers are already ahead of the game as they have either established mega-factories or are in the process of building plants to service the industry.

The following map shows the proliferation of battery plants and the extensive network of automotive manufacturers in mainland Europe.

The above shows the location of the Chvaletice Manganese Project (CMP) in the Czech Republic.

It is in the process of being developed by Euro Manganese Inc (ASX:EMN; TSX-V).

Euro Manganese could dominate supply of high-purity product

Lithium is one of the commodities most frequently referenced when discussing electric vehicles, but depending on what type of battery is being manufactured there are other metals that are required in large quantities.

While nickel, copper and cobalt readily come under the microscope, manganese is a metal that tends to fly under the radar.

A White Paper published by deep.green estimated that an electric vehicle with a 75KWh battery and NMC 811 (nickel-manganese-cobalt) chemistry needs 56 kilograms of nickel, 7 kilograms of manganese, 7 kilograms of cobalt and 85 kilograms of copper for electric wiring.

This is where Euro Manganese Inc. comes into contention.

The company’s principle business and current focus is the evaluation and potential development of the Chvaletice Manganese Project (CMP), which involves the re-processing of a manganese deposit hosted in historic mine tailings in the Czech Republic in order to produce high-purity manganese products in an economically, socially and environmentally-sound manner.

Through its subsidiary Mangan, EMN has entered into an option agreement to acquire the equity of EP Chvaletice s.r.o., a small Czech steel fabrication company that owns a 19.9 hectare parcel of land.

This land is located immediately south of the highway and rail line that bound the Chvaletice tailings deposit.

This strategic land parcel encompasses the intended site of its proposed high-purity manganese products processing plant.

Prospective customers for high purity manganese products

In terms of location though, the most important factor revolves around the electric vehicle revolution occurring in Europe.

EMN noted that 30 battery and battery precursor and cathode factories, with no fewer than 25 electric car factories are already operating, under construction or have been announced in Europe recently. Europe currently imports 100% of its manganese requirements

Europe is expected to become the second most important centre (after China) of the global electric car and battery industries.

Six large battery factories that will consume manganese inputs are located between 200 kilometres and 400 kilometres of the Chvaletice Manganese Project.

Several prospective customers have expressed interest in procuring high-purity manganese products from the Chvaletice Manganese Project, and in testing and qualifying the products of the proposed Chvaletice demonstration plant.

These parties have included manufacturers of electric vehicle batteries and related chemicals who aim to design precursor and cathode formulations, in combination with available nickel, cobalt and lithium products, as well as chemical, aluminium and steel companies.

A mining project that would deliver positive environmental outcomes

The proposed environmental aspect of the CMP development is an important factor as EMN’s plans not only involve the production of a commodity but also environmental rehabilitation and recycling.

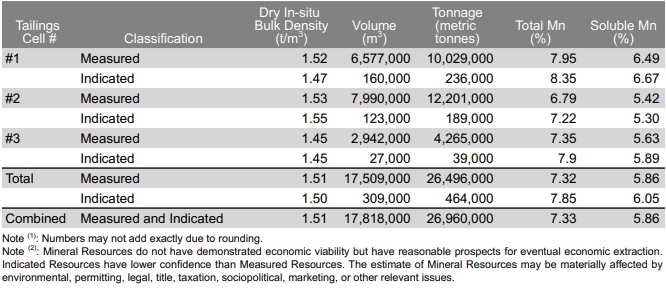

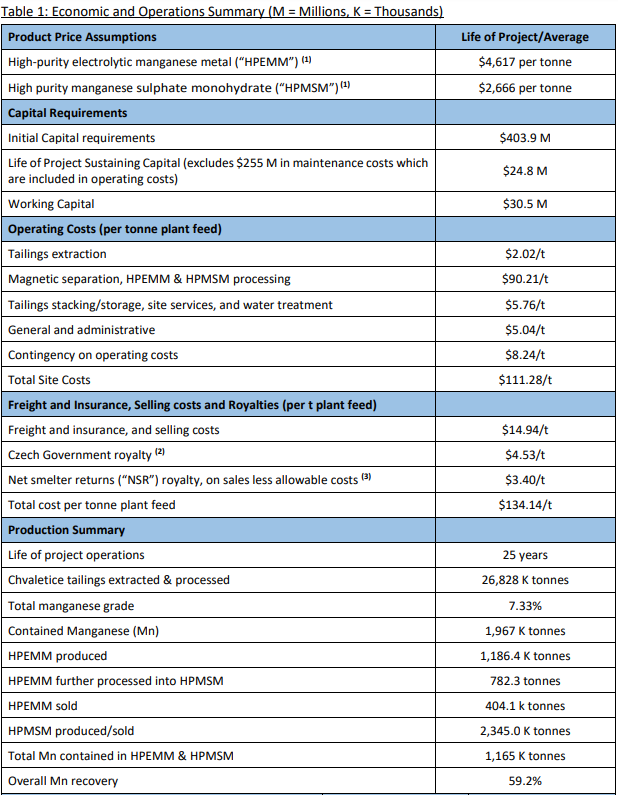

In 2019, EMN filed a Technical Report prepared by Tetra Tech Canada Inc., which reported an updated Mineral Resource Estimate and the results of a Preliminary Economic Assessment (PEA) for the Chvaletice Manganese Project.

CMP is targeting production of ultra-high-purity electrolytic manganese metal (HPEMM) with specifications exceeding 99.9% manganese and ultra-high-purity manganese sulphate monohydrate (HPMSM) with a minimum manganese content of 32.34%, both of which exceed typical industry standards.

These products will be selenium and chromium-free and are designed to contain very low levels of deleterious impurities.

Only European Union producer of high-purity manganese

EMN sees the Chvaletice Manganese Project as becoming an important and environmentally-sustainable part of the international and European lithium-ion battery supply chains.

Management is also of the view that EMN will become the only primary producer of high-purity manganese in the European Union, where 100% of manganese requirements are currently imported.

Given the large scale of the project and its capacity to generate substantial earnings, one would normally expect long lead times.

However, management expects construction of the full-scale facility would be between 18 months and 24 months.

EMN’s high purity product is a key differentiator.

The company has demonstrated the suitability of the Chvaletice tailings for the production of HPEMM and HPMSM in extensive bench and pilot-scale metallurgical tests.

Electrolytic Manganese Metal is produced through an electrolytic process using manganese sulphate solutions that contain ammonium sulphate.

In contrast, EMD solutions do not contain ammonium sulphate, and the resulting product is a ‘conventional’ EMM of 99.7% purity when selenium is added to the solution.

Increased performance and recharging benefits

High grade, high purity manganese is used as a primary cathode material in lithium-ion manganese batteries or NCM batteries, and research has indicated that it increases performance and recharging capabilities.

High-performance NMC Li-ion batteries are being increasingly used in electric vehicles and other energy storage applications.

The manufacturing processes and formulations for Li-ion batteries require reliable, high-purity sources of manganese and other battery raw materials to ensure that the batteries meet increasingly demanding performance, safety and durability standards.

The high-purity manganese materials for the precursor cathode materials of NMC batteries can be supplied in the form of HPEMM and HPMSM.

As a result, demand for high purity manganese is growing rapidly around the world, driven by the growth of the electric vehicle and Li-ion battery industry.

Analysts highlight accelerated growth and potential ‘price run’

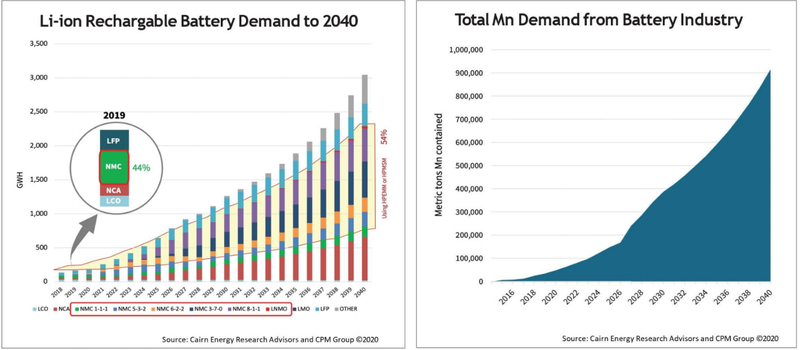

In 2020, Cairn ERA updated its forecast of total rechargeable (or secondary) Li-ion battery demand as expected to grow 23-fold between 2018 and 2040, representing a cumulative annual growth rate (CAGR) of 15%, and demand for high-purity manganese for batteries is forecast to grow 42-fold between 2018 and 2040 (CAGR of 18.5%).

Analysts at moore-australia.com.au have demonstrated an ability to understand the fluctuating nature of the mining sector and the dynamics that drive trends across various commodities.

The group has run the ruler across the emerging market for both high purity and lower grade manganese.

An excerpt from the paper produced by the group is shown below.

‘’With steel demand being a sustained driver of baseline manganese pricing and demand, there is no question that manganese has a role to play.

This could mean increasing demand for higher grade manganese products, resulting in increased profits for high grade manganese producers.

This would see producers in the high purity manganese battery space directly competing with the steel industry on high grade manganese ores suitable for battery production.

The increased competition for high grade ores could result in two classes of ore being created on the market.

The first being lower grade ores that would still be suitable for ferroalloy and steel production, and the second class being the higher-grade deposits which would be utilised within both steel and high purity manganese products.

The latter could see high grade deposits suitable for battery cathodes being caught in a price run as steel and battery producers look to create a competitive marketplace for the ores, both deriving utility from the higher grade.’’

Compelling metrics for long life project

EMN’s Chvaletice manganese tailings deposit is western Europe’s largest known manganese resource, with about two million tonnes of manganese contained in the tailings.

Although the 27 million tonne mineral resource grade is only 7.33% manganese, EMN has reported that mining or milling is not required to liberate the manganese minerals prior to leaching the tailings, as the primary ore from which they were made was crushed and finely milled when it was originally processed.

Management envisages a 25-year project operating life producing 1.19 million tonnes of HPEMM, two-thirds of which is expected to be converted into HPMSM.

The saleable product includes 404,100 tonnes of HPEMM and 2.35 million tonnes of HPMSM, focusing principally on Europe's rapidly emerging electric vehicle battery industry while remaining flexible to supply either product to suit customer preferences.

Note the significant uptick in demand from around 2026, indicating that production from CMP will be well and truly in train when demand surges.

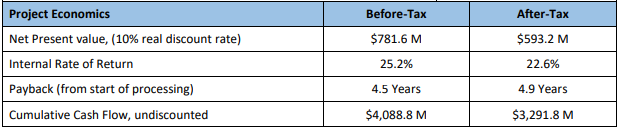

PEA indicates the net present value after-tax of nearly $600 million

The metrics from the PEA were impressive, particularly in terms of highlighting the project’s low-cost, premium product, long life features.

These factors all contributed to outstanding headline numbers as featured below.

The PEA is targeting production of ultra-high-purity electrolytic manganese metal with specifications exceeding 99.9% manganese and ultra-high-purity manganese sulphate monohydrate with a minimum manganese content of 32.34%, which exceeds typical industry standards.

Based on these metrics the project is valued at $593.2 million on an after-tax basis with an implied discount of 10%.

Given EMN’s market capitalisation is hovering around $10 million, it isn’t difficult to mount a case that the company is extremely undervalued.

From an operational perspective, this is a summary of the PEA that provides a snapshot of the proposed development.

Commenting on the market dynamics for manganese and Euro Manganese’s strategic benefits in servicing the fast growing battery industry EMN’s president and chief executive Marco Romero said, "The PEA demonstrates the compelling potential of the Chvaletice Manganese Project.

“Euro Manganese is in a unique position in the battery industry, with its 100% holding of Western Europe’s most significant and strategically-located manganese deposit.

“What makes this project even more significant for an automotive industry focused on making our world greener, and for other consumers striving to secure sustainably produced raw materials, is that these products would be produced by recycling waste.”

Key milestones that could provide share price momentum

Environmental studies, planning and project permitting are highly advanced for the Chvaletice Manganese Project with extensive baseline and other environmental studies having been completed since 2017.

The EIA Notification describing the project is a significant milestone as it initiated the EIA (environmental impact assessment) regulatory review process which was filed on June 30, 2020.

EMN has completed planning and design for the construction and commissioning of a demonstration plant in the Czech Republic in order to provide bulk, multi-tonne finished product samples for customer evaluation.

The plant is intended to replicate the entire process flowsheet proposed in the PEA and to produce the equivalent of 100 kilograms per day of manganese sulphate monohydrate.

The demonstration plant will also enable process optimisation and testing for final product development and serve as a testing and training facility for future operators.

In December 2019, the company entered into a fixed-price, turnkey contract with CRIMM for the supply and commissioning of a technology, equipment package for the demonstration plant, which includes performance guarantees, as well as commissioning services and an operator training program.

Management estimates that the cost, including fabrication, delivery, commissioning, laboratory set-up and an operator training program, as well as the cost of operation for one year, will be approximately US$5 million (A$7.0 million).

Subject to financing, the company is targeting the completion of the demonstration plant construction in calendar 2021, followed by the delivery of the first finished product samples to potential customers.

Once permitted and offtake agreements have been entered into with EMN’s potential customers, the company expects to turn its attention to project financing in order to commence construction of the full-scale commercial Chvaletice processing plant and related infrastructure.

Management believes that the capacity for project financing is likely to compare advantageously to the majority of mining projects given its safe jurisdiction, quality of offtake agreements, environmental benefits and strategic position within the European battery supply chain.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.