GTR uranium drilling now - to confirm previous mineralisation

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 20,232,084 GTR shares and 746,615 GTR options at the time of publication. S3 Consortium Pty Ltd has been engaged by GTR to share our commentary on the progress of our investment in GTR over time.

Our investment GTi Resources (ASX:GTR) is chasing uranium across its two projects in the USA.

Today GTR confirmed it has launched its maiden drilling programme in Wyoming - the uranium capital of America where over 80% of domestic supply is produced.

GTR is going to be peppering circa 100 holes in a ~ 15,000m campaign, to confirm the grade and tenor of uranium mineralisation that was previously identified in the 1980s.

With uranium prices at near 10-year highs, we think it is a pretty good time to be looking for uranium.

Driven by growing political support for nuclear as a viable option to reduce carbon emissions, GTR is aiming to find the fuel (uranium) that makes the US nuclear industry tick.

The US has over 91.5GW in installed nuclear capacity from 93 reactors across 30 states making it the world’s largest producer of nuclear power.

And yet the USA’s domestic production has ground to a halt, in part due to foreign competition and domestic political inertia.

However, the US is quickly realising that securing domestic supply is a strategic priority.

Which is why we like that GTR is exploring for uranium in the US right now.

Earlier in the year, GTR completed the acquisition of a set of uranium projects in the USA, one of which is in Wyoming’s Great Divide Basin.

GTR acquired its Wyoming uranium assets well before interest in uranium companies started to ramp up, notably with Sprott’s Physical Uranium Trust purchasing over $1.8B in physical uranium.

Combine Sprott’s move with US political momentum behind shoring up the domestic uranium supply chain, and GTR has what we believe is a fairly compelling macro theme behind it.

Aside from our investment GTR, there are pretty big household names doing some pretty interesting things in the uranium and nuclear space in Wyoming - it's the same state that Bill Gates and Warren Buffets’ Terra Power is aiming to build its first nuclear reactor:

Now, with the uranium price at a level not seen for nearly 10 years, we believe GTR is in the right place at the right time to potentially identify a new uranium discovery.

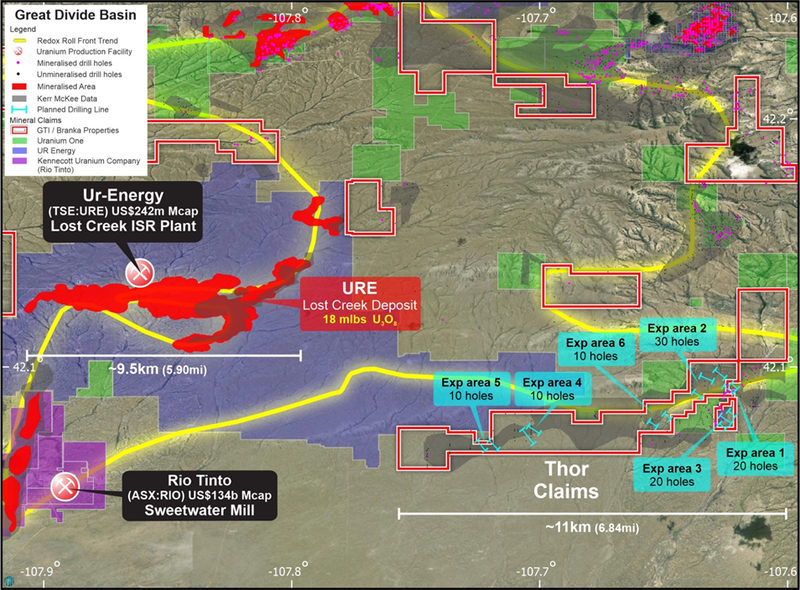

The drilling program that launched today is focussed on the “Thor Claims” - which sit ~5km to 30km away from both UR-Energy’s (US$333M market cap) Lost-Creek ISR uranium facility & mining giant Rio Tinto’s (A$141B market cap) Kennecott Sweetwater uranium deposits and mill.

The current drill program is designed on the historical data available to GTR based on drilling works done by a previous owner (Kerr McGee).

The ultimate aim for GTR’s current drill program is to accurately identify the depth, thickness, grade and width of mineralisation over the project area & to either:

- announce an initial maiden ISR uranium resource, or;

- put together an achievable exploration target which will form the basis for future exploration programs.

What do we want to see from drilling?

GTR is drilling in an area where they expect to find uranium mineralisation. As a result the current drilling program is more so focussed on putting together a database of drill results that confirms the uranium grade + tenor (and ultimately resource size).

In today’s announcement, GTR set some expectations for the drilling program mostly based around their neighbour UR-Energy’s Lost Creek project.

GTR is hoping to return intercepts that mirror those received at the Lost Creek Project which are considered to be above the general economic cut-off criteria for the type of Sandstone hosted ISR uranium projects in this part of Wyoming.

The Lost Creek ISR uranium deposit has a 13mlbs (Measured/Indicated resource), at an average grade of 0.048% Uranium with an average Grade Thickness (GT) of 0.2.

The focus for GTR’s drilling program won't only be the grades but a combination of the sandstone thickness and the grade which will make up the “Grade Thickness” (GT) measure.

So, GT is a measure of the grade x thickness:

- If we have low grade uranium mineralisation then we want to see thicker intercepts.

- If we have higher grade uranium mineralisation then the intercept size can be of lower thickness.

In-line with the expectations GTR have set, we will want to see the following:

- Grade greater than 0.02% Uranium

- GT greater than 0.2 (GT= Grade x Thickness, i.e 3m @ 0.02%)

- Width of mineralisation above cutoff nominal 50 feet (15 meters)

- Nominal GT of 0.4

We think that a successful outcome for GTR would be if the company can put out an economic maiden resource estimate.

This could put GTR on the map for any potential consolidation of uranium assets in the region.

More on today’s announcement:

GTR has now started drilling at the first of three priority target areas at its ISR uranium project in Wyoming.

The first target area being drilled now is the “Thor” Project, which as we mentioned above, sits ~5-30km away from both UR-Energy’s Lost-Creek ISR uranium facility & Rio Tinto’s Kennecott Sweetwater uranium deposits and mill.

The map below shows just how close GTR is to its uranium neighbours in Wyoming:

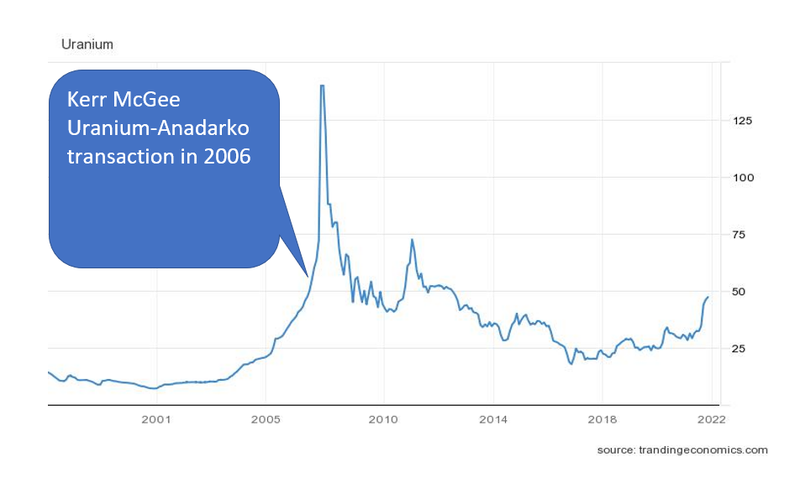

GTR’s Thor project sits over a ~11km strike zone which in the 1970’s & 1980’s had been drilled extensively by Kerr McGee Uranium, a US based major at the time - which was later acquired by Anadarko petroleum (Now Occidental Petroleum) for US$19.1BN in 2006.

That $US19BN transaction was at a time when the previous uranium bull market was near its peak - in fact it kept going longer and stronger:

This gives a sense for the potential that we think could be under the surface for GTR, should things go well. Of course there is a fair bit of luck at play here in timing exploration success with a broader commodity bull market, and success is no guarantee.

Another aspect to consider is how GTR plans to extract the uranium from whatever it finds.

You see, GTR’s projects are “In Situ Recovery” style uranium mining projects.

ISR mining is the lowest cost uranium mining method and has lower environmental impact than hard rock mining.

In the 1970-80’s ISR (In-Situ recovery) mining methods were not as common a mining practice for the recovery of uranium as they are now, and so most of the historical exploration was focused on shallower mineralisation with open-cut mining potential, with no emphasis being placed on the ISR potential for a project.

To learn more about In Situ Recovery mining methods for uranium - read our detailed breakdown here.

Interestingly the mineralisation encountered at GTR’s project decades ago was all located between 102-180m from surface - which is the depths GTR will be targeting.

The bulk of the drilling data was held confidentially by Kerr McGee however GTR do have access to the locations & maps detailing where the drilling occurred.

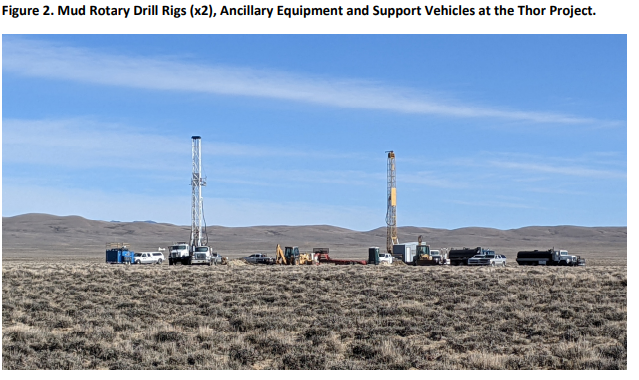

GTR’s 15,000m drilling program that began today is taking place over ~100 holes and is designed mostly to test the areas where there is known mineralisation based on the historical data available.

Essentially GTR are aiming for some quick exploration wins here - drill testing areas where they expect to find uranium mineralisation.

The drilling program's key objective is to accurately identify the depth, thickness, grade and width of mineralisation across it’s Wyoming project.

After confirming the grade & tenor we are hoping GTR can put together a maiden ISR uranium resource or at the very least put together an estimate for an exploration target that GTR thinks can be reasonably achieved.

With 2 mud-rotary drill rigs active on-site GTR is expecting drilling to take <30 working days to be completed with initial drilling results expected in Q1-2022.

Following initial results, the final interpretation of all of the results will be available to GTR around ~July 2022.

What are the risks?

We have cautioned in the past with respect to investing in high risk junior exploration companies like GTR. Junior explorers don't have any revenues to fall-back on & are generally volatile.

There is always a risk that the drilling results are below expectations or simply return nothing, there is also a risk that for whatever reason the drilling program is stopped or cant be completed.

When investing in the exploration space, readers should always manage risk carefully and never invest money that you can't afford to lose.

We think the uranium macro theme is just getting started

We believe there are three aspects to the underlying macro theme behind GTR’s prospects.

These are:

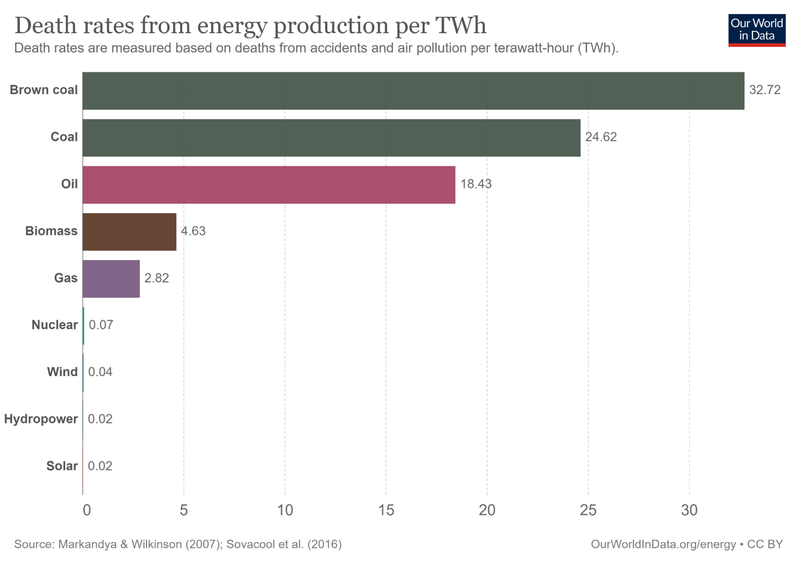

- Decarbonisation: Uranium is needed to power nuclear power plants - nuclear is one of the lowest carbon emission energy supplies that the planet has available right now.

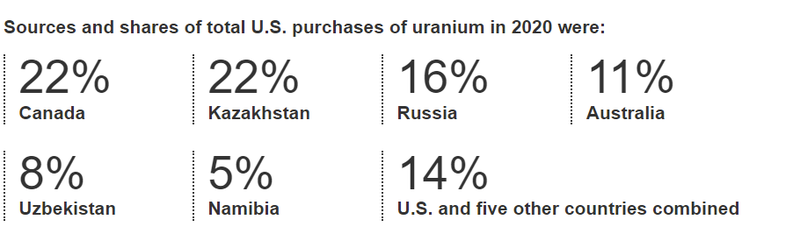

- Geopolitics: China is investing over $500B in nuclear power over the next 15 years - something which could spark a scramble for uranium supply. The US currently gets a large portion of its uranium from countries like Kazakhstan, Russia and Uzbekistan (which it doesn’t get along well with) and is increasingly focussed on improving its domestic supply chain.

- Internal uranium market dynamics: This includes a forecast supply/demand divergence due to nearly a decade of low uranium prices and mine closures. This is part of the reason Sprott made major purchases of uranium.

Let’s unpack these one by one.

Decarbonisation:

We believe nuclear is going to have to be part of the energy mix if developed countries are to meet their decarbonisation goals.

Part of this is down to the fact that nuclear power can operate in a wide range of weather conditions unlike wind and solar. In other words, nuclear power can provide a base-load to the grid.

It is also incredibly low carbon compared to other energy sources.

The World Nuclear Association says that:

‘On a life-cycle basis, nuclear power emits just a few grams of CO2 equivalent per kWh of electricity produced. A median value of 12g CO2 equivalent/kWh has been estimated for nuclear, similar to wind, and lower than all types of solar.’

The common retort to pro-nuclear arguments is that it is a dangerous activity, which we believe is an unjustified position given the following data:

We think it’s a bit like people’s fear of flying - scary to think about but the actual statistical risk of something going wrong is incredibly small.

Geopolitics:

As you can see the US imports a big chunk of its uranium from Kazakhstan, Russia and Uzbekistan:

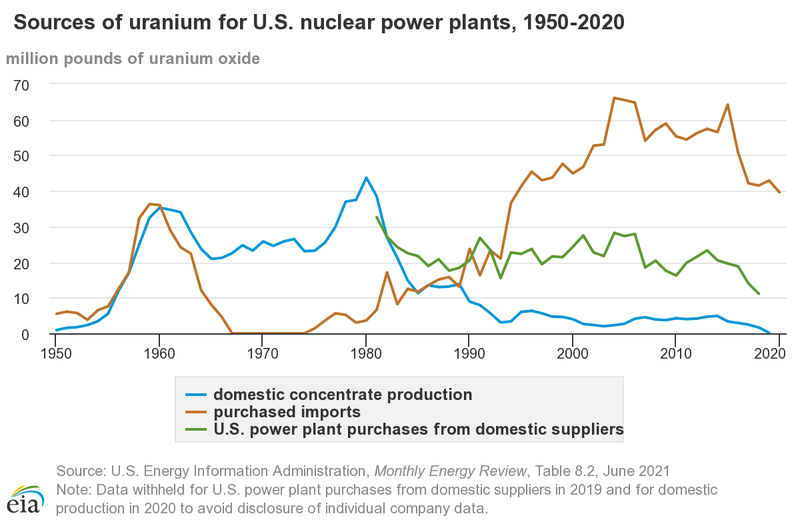

And importantly, has virtually no local production:

Meaning that the US is increasingly looking to up its domestic production.

This comes after the Trump administration launched a review into US uranium production in 2019.

Meanwhile, China is planning to build 150 new nuclear reactors over the next 15 years.

All of this combines with internal uranium market dynamics...

Internal uranium market dynamics:

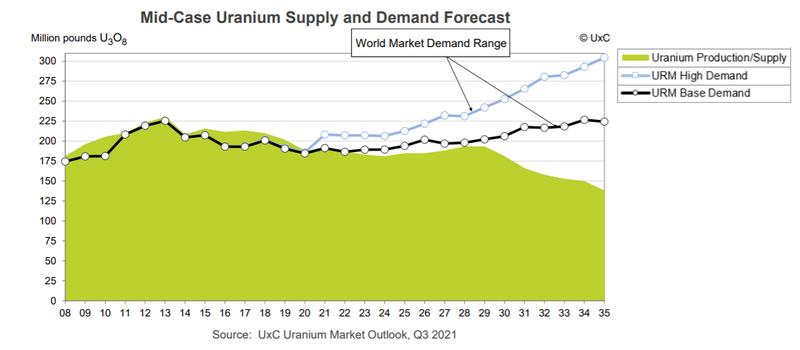

Below you can see a supply-demand divergence is expected some time in the mid-2020s:

A slump in uranium prices over the last decade and depleted resources forced a number of mine closures - notably the Ranger mine in NT, Australia.

Low prices generally lead to a lack of investment in new mines as the resources are not deemed economically viable.

Throw in the big purchases by the Sprott Physical Uranium Trust and we believe the macro pieces are in place for GTR to be successful, pending the results of the drilling announced today.

Our GTR Investment Strategy:

We have been invested in GTR since April 2020 when the share price was around 1.2c.

At the time the Uranium price had just moved to a high of US$35/lb before retracing back to US$27/Lb.

We remained patient throughout all of the Uranium price volatility & even added to our position at 3.3c & 1.5c. So far our patience has been rewarded with the Uranium price now trading at US$46.50/lb & GTR well above our average entry price.

Our GTR investment is a good example of having patience, where we held while waiting for a sector to fire up.

GTR Investment Milestones

We have been holding GTR for 16 months and increased investment twice.

As with all our early stage exploration companies we invest in our strategy is to achieve free carry - with GTR we have partially achieved free carry and are going into this drilling program holding ~67% of our total investment.

✅ Initial Investment: @ 1.2¢

✅ Increase Investment: @ 3.3¢

✅ Increase Investment: @ 1.5¢

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Some Profit

🔲 Hold remaining Position for next 2+ years

GTR Company Milestones

✅ Next Investors Portfolio Launch

🌎 Support for Domestic Uranium Produces in the US

✅ $1.8M Cap Raise @ 3¢

✅$4M Cap Raise @1.5¢ ($2.6M Placement + $1.548m Rights issue)

🔲 Unexpected Announcement 1

🔲 Unexpected Announcement 2

🔲 Funding 1

🔲 Funding 2

Wyoming Projects: Uranium, U.S.A

✅ Project Acquisition Announced

✅ Project Acquisition Complete

✅ Drilling Permits Secured (Q4 2021)

🔄 Initial Drilling (Thor, Q4 2021)

🔲 Drilling Results (Thor, H1 2022)

🔲 Initial Drilling (Odin & Loki, H1 2022)

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 20,232,084 GTR shares and 746,615 GTR options at the time of publication. S3 Consortium Pty Ltd has been engaged by GTR to share our commentary on the progress of our investment in GTR over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.