GTR to double its Utah uranium project size — extends trend to 5.5km

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX:GTR) has entered into a binding agreement to acquire 100% of two mineral leases from Toronto-listed Anfield Energy Inc. (TSX-V: AEC), in a significant expansion of its uranium ambitions in Utah, USA.

The two strategically located mineral leases serve to connect the company’s current ground positions in the area and would more than double the size of GTR’s contiguous land position by conjoining its most prospective projects at Jeffrey and Rats Nest.

GTR’s land position has now been expanded to over 5.5 kilometres along the interpreted strike of the mineralised trend with significant exploration upside within untested areas under cover.

This news comes on the back of a successful drilling program at the Jeffrey project where the results of the downhole gamma logging returned high in-situ assay values up to 3,535ppm eU3O8.

In addition, field screening of the drill core with a handheld XRF has yielded results up to 26,388 ppm vanadium.

GTR also announced today that it has started raising just over $1.8M via a placement at 3c per share and will be launching an underwritten Share Purchase Plan (SPP) to raise a further $978,000 at the same price.

Whilst the company plans the next phase of its uranium exploration in Utah, it looks to be also keeping a close eye on the surging gold price and level of interest in WA gold explorers.

The company plans to allocate some of its new funding toward the near term drilling of its Niagara (Kookynie) gold project in WA, spurred on by the recent success of its neighbours.

GTR’s Kookynie project is approximately 1km from tenements held by Nex Metals (ASX: NME) and being explored in a JV with Metalicity (ASX: MTC).

MTC is currently valued by the market at $40 million on the back of recent exploration success.

Currently capitalised at less than $20 million, it appears the market has not fully priced in GTR’s WA gold project yet, and with upcoming drilling on the horizon, it will be something investors will be keeping a close eye on prior to the next phase of drilling in Utah.

Utah Drilling confirms mineralised trend

The completed uranium exploration drilling has confirmed the projected geometry of the mineralised trend, with the trend remaining open in both directions along strike.

Laboratory assay of the drill core is pending, and those results will be released when available.

The next exploration phase is expected to entail a larger drill program, targeting potential development of a shallow JORC Mineral Resource, and would ultimately inform future production studies.

The shallow nature of the mineralisation supports continued low-cost, rapid exploration advancements.

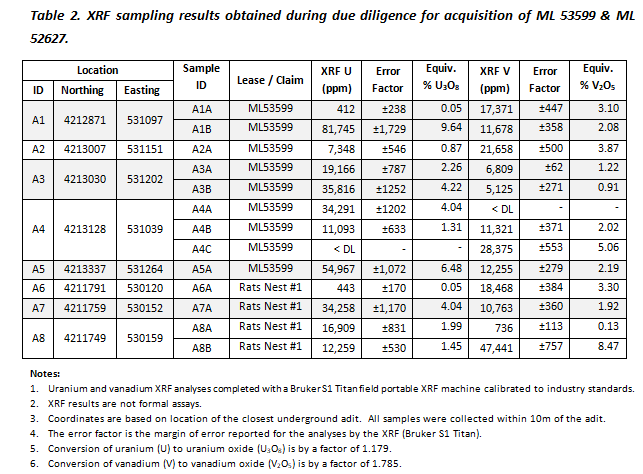

Harking back to the leases under acquisition, they contain historical underground production workings and are prospective for uranium and vanadium as evidenced from recent sampling conducted during acquisition due diligence which yielded in-field XRF measurements of up to 81,745ppm U and 28,375ppm V.

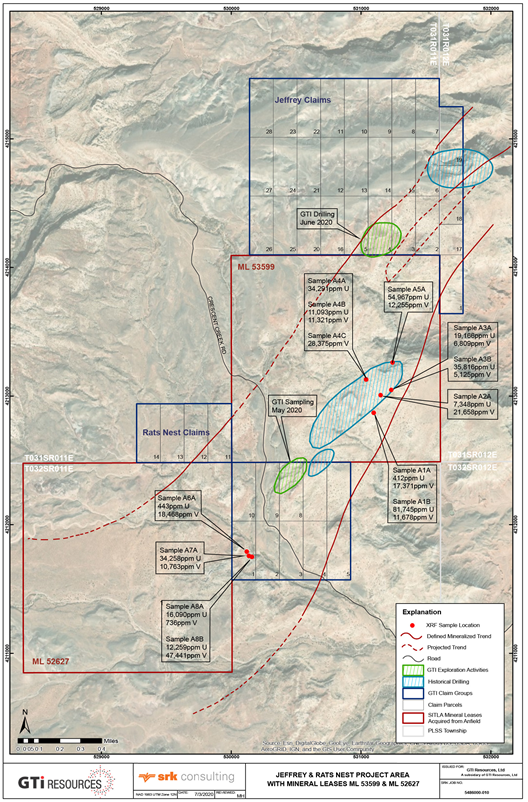

The following map shows the location of GTR’s existing tenements including drilling areas to the north, as well as the XRF sample locations (red dots) at the acquired mineral leases.

Timing is right as uranium soars

All of these events are very timely given that the uranium price is hovering in the vicinity of US$33 per pound, a level it hasn’t traded at since early 2016.

Consequently, there should be robust support for a capital raising of approximately $2.8 million announced today, at a price of 3c per share.

GTR is in the process of raising just over $1.8 million via a placement, as well as a further $978,000 through a Share Purchase Plan which is underwritten by CPS Capital Group.

Links between Jeffrey mineralisation and lease under acquisition

The recent initial small-scale exploratory drill program at Jeffrey targeted known shallow mineralisation in a near-surface sandstone unit of the lower Salt Wash Member of the Morrison Formation, and explored slightly deeper (to circa 20 metres from surface) sandstone units within the fluvial depositional sequence.

GTR successfully identified uranium mineralisation of economic interest in a second, slightly deeper sandstone unit, thereby substantially increasing the potential of the Jeffrey project to host meaningful uranium and vanadium resources, similar to that historically produced.

The mineralised trend is clearly open to the south, with known mineralisation on the property line between the Jeffrey project claims and ML 53599, one of the leases GTR is in the process of acquiring.

Commenting on this development, executive director Bruce Lane said, “These new properties have helped GTI Resources secure a significantly enhanced ground position by securing the prospective ground between our Jeffrey and Rats Nest claim groups.

‘’The new ground substantially increases the interpreted mineralised strike zone within GTI’s land package and materially enhances the opportunity to define an economic resource in the area.

‘’The mineralised trend which was confirmed during our recent round of drilling at Jeffrey remains open in both directions and in particular to the south which runs into the new leases.

‘’The initial sampling conducted on the new leases shows prospectivity for commercial grade ores and the possibility that exploration and development could be relatively quick and inexpensive.”

Providing management with further confidence is evidence of a second deeper mineralised horizon in the southern area of the Jeffrey group adjacent to the neighbouring property.

The mineralisation in the newly acquired property appears to be consistent with the historically mined mineralisation within the Salt Wash Member across the Colorado Plateau.

GTI is consolidating its understanding of the local mineralised system and planning the next phase of exploration.

This should lead to the group expanding the scope of its drilling activity as quickly as possible to include the newly acquired property.

Due diligence completed

GTR has completed technical due diligence on the two mineral leases including collection of a number of XRF analyses in the field to characterise exposed uranium and vanadium mineralisation.

The XRF data covers in-field analysis on underground exposures on mineralisation within Mineral Lease ML 53599 and Rats Nest Claim #1.

The XRF analyses as outlined below represent the nature of mineralisation and estimation of grade, but do not represent formal assays and have not been verified by an independent laboratory.

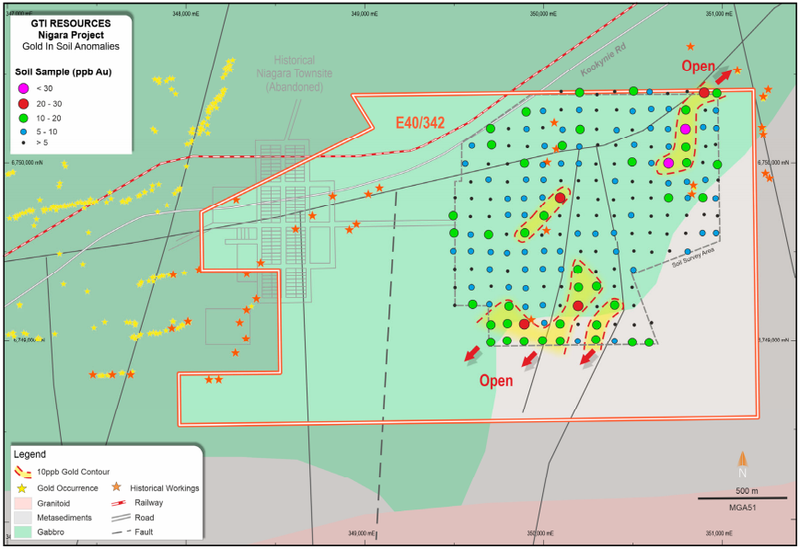

Niagara Gold Project shaping up as nearology play

The company is planning further work at its Niagara (Kookynie) Gold Project to follow up on anonymous soil sampling results from its exploration licences E 40/342 reported in May.

The Niagara project is located approximately six kilometres south-west of Kookynie in the central goldfields of Western Australia.

Recent successful exploration work conducted by Metalicity Ltd (ASX:MCT) in joint venture with Nex Metals Exploration Ltd (ASX:NME) on ground about one kilometre to the north of GTI’s Niagara Project (E40/342) has demonstrated the highly promising potential of the Kookynie Belt.

GTR’s project comprises one granted exploration licence, E40/342 and four prospecting licence applications, P40/1506, P40/1515, P40/1516 and P40/1517 which were recently pegged and applied for.

Access to the project is provided via the Goldfields Highway from the town of Menzies and the sealed Kookynie Road which bisects the northern part of exploration licence E40/342 and the southern part of P40/1506.

The project is situated within the central part of the Norseman‐Wiluna greenstone belt, and the geology of the area is characterised by large rafts of semi‐continuous greenstone stratigraphy.

Numerous historical workings occur within and to the north of the project area with a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Mine which produced approximately 360,000 ounces of gold at an average grade of 15 g/t gold from underground mining between 1895 and 1922.

The following map shows the anomalies identified by GTR.

Metalicity’s success has encouraged GTR to accelerate the next phase of gold exploration drilling, targeting the prospective Niagara Project in the interim period whilst finalising the next phase of drilling in Utah.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.