EIQ: First US revenue with this code?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,470,000 EIQ Shares and the Company’s staff own 140,000 EIQ shares at the time of publishing this article. The Company has been engaged by EIQ to share our commentary on the progress of our Investment in EIQ over time.

Now we have a clear pathway to first revenues in the USA.

And the numbers mentioned today are a step change higher from the market guidance only a few months back...

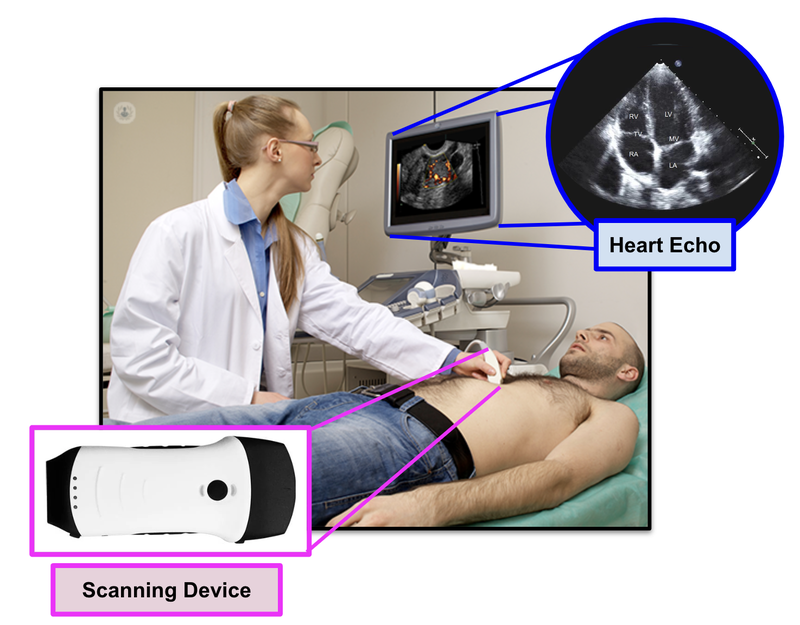

EchoIQ (ASX:EIQ) has an FDA cleared, AI-powered algorithm that helps cardiologists detect heart diseases.

It does this by analysing 3D images of the heart created by “echocardiograms” - ultrasounds of the chest or “echos” for short.

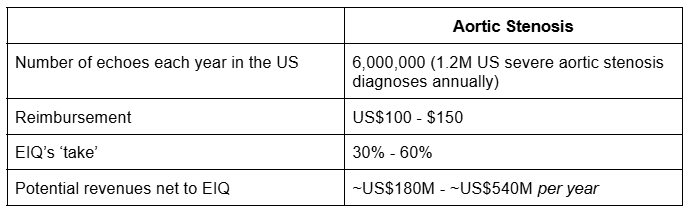

Today, EIQ announced it has identified a “reimbursement code” that will provide US$100 to $150 per echo that uses EIQ’s tech on a fee per use basis.

(Private insurance companies or public health programs will reimburse hospitals that use EIQ’s product.)

This fee is just to test for Aortic Stenosis - one of many heart issues.

This is materially higher than the expected reimbursement value of US$68 per echo that EIQ guided the market on in September.

That fee per echo is materially higher than the expected reimbursement value of US$68 per echo that EIQ guided the market on in September.

(we like it when news exceeds expectations).

EIQ expects to receive between 30-60% of that US$100-150 amount every time its tech is used.

(the hospital shares the rest - encouraging the adoption of EIQ’s tech by hospitals)

There are 6 million echoes completed in the USA per year - for a range of reasons.

1.2 million people are diagnosed with aortic stenosis (the disease EIQ now has a reimbursement code for), with an additional 1.5 million ‘mild to moderate’ diagnoses.

How much of that market can EIQ capture?

Will EIQ’s reimbursement be closer to US$100 or US$150?

How much % can EIQ really earn between 30 and 60%?

That’s the back of the napkin calculations that investors will likely be doing this morning on EIQ.

The assumptions made will depend on how conservative or bullish you are.

Over time we expect numbers to firm up when expectations start to turn into reality.

Based on the reimbursement code mentioned today, for Aortic Stenosis alone, our own calculations for EIQ’s addressable market is ~US$180M to US$540M just in the US.

(EIQ is also looking at the European market...)

Here are our “back of the napkin” calcs based on the higher reimbursement number, and crudely assuming all echoes include the test for aortic stenosis:

(full 100% takeup is unlikely, and EIQ has not earned any revenue yet, the above is just a basic projection calculation to illustrate max potential revenue)

IF EIQ can crack just 10% of those numbers, it would be “company making” for EIQ - US$18M to US$54M a year in revenues...

(This is just for EIQ’s first FDA approved product (Aortic Stenosis), EIQ is also looking to get its Heart Failure product cleared by the FDA within the next 12 months)

As we said above, those are very rough, back of the napkin calculations, but it shows just how quickly EIQ can go from where it is today, to revenues.

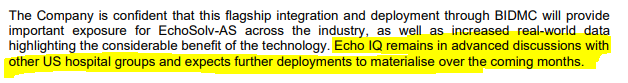

EIQ has been working on signing up hospitals across the USA already.

A few weeks back confirmed it is integrating its technology with Beth Israel Deaconess Medical Center - a leading Harvard Medical Teaching Hospital - and they undertake ~30,000 per year to assess a range of conditions...

Plugging in the numbers for EIQ’s most recent partner - Beth Israel Deaconess Medical Center (‘BIDMC’) which performs ~30,000 echoes a year.

As a rough example, assuming all 30,000 echoes receive reimbursement, Beth Israel would receive US$3M to US$4.5M.

Of that US$3M to US$4.5M, EIQ would receive 30-60% assuming all echos use EIQs tech

(again, full 100% takeup is unlikely, this calc is just to illustrate max potential revenue from this one hospital)

So from that one partnership alone, EIQ could receive between US$900k to US$2.7M in revenues per annum...

To date, EIQ has been “pre-seeding” the market with deals, even before the FDA clearance news a few weeks back.

So there are already a few different integration partners that EIQ can rapidly switch into revenue generating deals.

EIQ has:

- 4x hospital networks signed up through its Core Sound Imaging deal - Core Sound plugs into 700 cardiovascular facilities in the US.

- Ongoing negotiations with Mayo Clinic hospital network - three major campuses in Rochester, Minnesota; Jacksonville, Florida; and Phoenix/Scottsdale, Arizona. It is widely considered to be one of the best hospital networks in the US, and perhaps the wider world. (Source)

- A strategic partnership with a leading US medical Enterprise Cardiovascular Information Systems (CVIS) provider, Scimage, which has over 2000 sites in the US

EIQ has also mentioned it has got “other additional integration agreements” in the pipeline.

So we think the integration partners and subsequent reimbursements can scale quickly...

(Source)

Our expectation is that integration partnerships could really start to go exponential when EIQ receives a full category III CPT code.

The Cat III code will create a specific code for EIQ’s tech which will further streamline the reimbursement process and make it a lot easier for users to get reimbursed for using the software.

EIQ expects to submit that in “February 2025 and anticipates approval by mid 2025”.

All of this is for Aortic Stenosis alone.

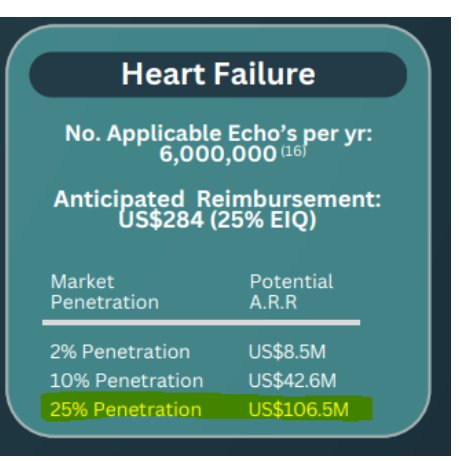

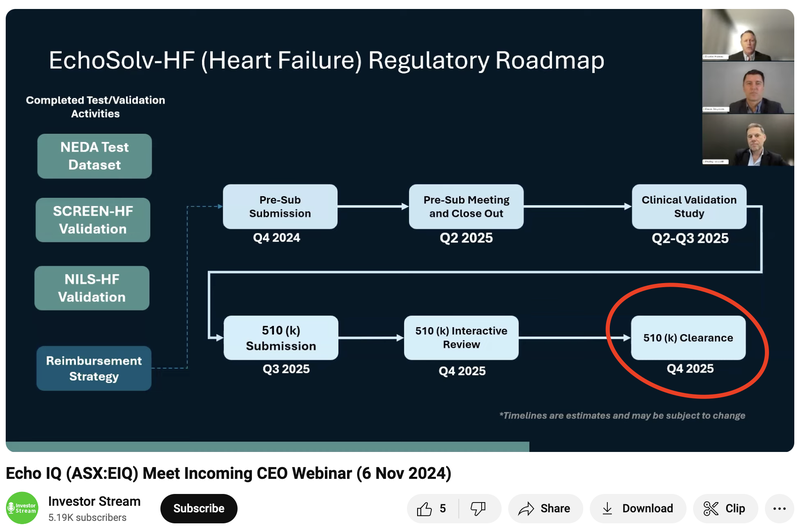

EIQ is also working on FDA clearance for its AI algorithm that detects Heart Failure...

Heart Failure is the leading cause of death among people aged over 65.

EIQ’s “anticipated reimbursement for Heart Failure is expected to be almost 2x higher than the number EIQ quoted today for Aortic Stenosis.

EIQ expects its Heart Failure tech to get FDA clearance in Q4 of next year.

(Source)

Between now and then, we are looking forward to seeing EIQ grow its Aortic Stenosis revenues as much as possible.

Recap: Here are the 8 key reasons we Invested in EIQ...

Here is a list of the 8 key reasons we first Invested in EIQ, first published on the 6th of September 2024 here. We also provide updates to material changes in the reasons since it was published.

- The data shows that the AI algorithm works.

EIQ has published three studies since it acquired the technology in 2021.

For the first target condition aortic stenosis, the technology has been shown to accurately identify 100% of severe aortic stenosis patients.

For the second condition, heart failure, the technology has been shown to accurately identify 97% of patients in conjunction with a cardiologist (compared to 46% as the current standard of care).

These are incredibly strong results and underpin the technology's potential. - Imminent share price catalyst in potential aortic stenosis FDA approval.

We expect the FDA is set to make a decision on EIQ’s first target condition, aortic stenosis by the end of September based on our interpretation of typical review timelines.

FDA approval opens the door for EIQ to commercialise its tech. FDA approvals for algorithms related to health have dramatically increased over the last few years.

EIQ’s FDA approval shapes as a key near term catalyst for the stock.

UPDATE: EIQ successfully received FDA clearance for its product in October of this year. - Multi-billion dollar market target for “heart failure” diagnostics assistant.

Over 64 million people suffer from heart failure each year across the world. And in the US, heart failure costs the US healthcare system roughly $60BN because many of these patients wind up back in hospital within 30 days.

The reimbursement cost for heart failure is US$284 per patient, and at 25% market penetration, EIQ could earn up to ~US$100M in ARR.

There is still a long way to go, given EIQ has not started generating revenue yet - but we like the size of the prize. - Second catalyst for FDA approval on heart failure could be within 12 months.

EIQ recently published very promising data on its AI detection algorithm targeting heart failure. This data will be used, along with potentially another study, to secure FDA approvals within the next 12 months. - Exclusive commercial access to the world's biggest heart data repository

EIQ has exclusive access to a database of over 1 million echocardiographic records from NEDA (National Echo Database of Australia).

NEDA is the largest echo database in the world and data stretches back to January 2000 and has a replacement cost north of US$300M.

This data is not easily replicable or acquired. EIQ Chief Research & Strategy Officer, Professor Geoff Strange, is the creator, Director and Chief Investigator of the National Echo Database.

This means EIQ has the right personnel to work with this exclusive data. Also, considering it took NEDA 24 years to reach this point, we think this gives EIQ a significant moat and competitive advantage over any new market entrants. - Clear pathways to commercialisation in the USA - the biggest healthcare market in the world.

There are two ways that EIQ can make money, one is reimbursement, one is licensing.

Each pathway opens up new avenues to monetisation and can work hand in hand. Reimbursement involves the acquisition of specific codes which allow hospitals and echo labs (physical location health providers) to claim for reimbursement from US insurance companies.

Licensing on the other hand targets echo machine makers (like Phillips and GE) or Big Pharma (which would be interested in a wave of new patients that EIQ’s tech picks up).

UPDATE: EIQ has hired a new US CEO to drive the commercialisation in the US. Today’s news on securing a reimbursement code opens up the first pathway, with more progress ahead on this front as EIQ looks to secure a full category III CPT code. We’re also curious to see what EIQ can do now on the licensing pathway, as the company starts to generate revenue traction. - SaaS revenue model, potential to rapidly grow revenue and/or secure large licensing deals.

EIQ is a cloud based platform that will likely operate on a Software as a Service (SaaS) model when initially commercialised. SaaS tech companies with demonstrated recurring revenue growth over time attract large valuation multiples.

EIQ’s tech platform is already built, meaning software development costs should be low, leading to higher margins on sales.

An ongoing “soft launch” has the product in the hands of an end user via a strategic partnership with a leading US medical Enterprise Cardiovascular Information Systems (CVIS) provider, Scimage, which has over 2000 sites in the US.

We expect this to provide an early opportunity for revenue growth under US reimbursement codes if EIQ secures FDA approval. - Cost savings, 3 seconds until results, removing bias

Health practitioners are under immense stress, and the current method of Trans-Thoracic EchoCardiogram (ultrasound on your chest, or “echo”) takes time.

These echos may be performed and interpreted in suboptimal conditions.

EIQ’s tech strips that out of the equation, delivering results in 3 seconds and also removing unconscious bias in the interpretation of results (for certain conditions, women are more frequently misdiagnosed than men).

Check out our full EIQ Investment Memo to see the key objectives we want to see EIQ achieve, risks we have identified and accepted and our Investment plan.

Ultimately, we hope that a combination of the above reasons contribute to EIQ achieving our Big Bet, which is as follows:

Our EIQ ‘Big Bet’:

“EIQ re-rates to a >$1BN market cap on successful commercialisation of its heart disease detection technology and/or an acquisition at a multiple of our Initial Entry price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EIQ Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

How does EIQ’s tech work?

EIQ’s product “EchoSolvTM” is a machine learning, AI-based decision support software that, when used together with a cardiologist, is able to detect heart diseases at a much better rate.

Cardiologists are specially trained doctors that are able to interpret heart conditions from 2D images that are presented from an ultrasound (known as an echo):

EIQ’s EchoSolv product can provide an actual 3D interpreted image of the heart, and provides assistance to the cardiologist in detecting heart related issues.

You can check out a short video overview of how the technology works here:

(Source)

EIQ’s business model

EIQ is trying to plug its tech into the existing imaging process for the heart (echocardiograms).

The aim of the game is to try and get cardiologists to use EIQ’s tech - every time it's used, EIQ would hope to get paid on a “per use basis”.

There are two key ways EIQ gets paid...

First, reimbursement (relates to today's news)

Private insurance companies or public health programs will reimburse healthcare providers (like hospitals) that use EIQ’s product.

This is done through a reimbursement scheme of which EIQ receives a % of funds reimbursed.

Whenever EIQ’s product is used by a hospital the cost is not paid by the patient, but rather the health insurance pays the hospital and EIQ splits the revenue.

Think of this like a “sale”.

In order for EIQ to be eligible for payment it needed to secure FDA clearance (EIQ already has this for aortic stenosis) and a reimbursement code (EIQ has made progress on this today).

After those two are secured, for sales to grow EIQ just needs more hospitals using its tech.

Before today’s news EIQ was partnering with hospitals on a ‘try before you buy’ model.

This means offering the EchoSolv product for free, so that cardiologists can grow accustomed to using it...

Now with a pathway to reimbursement locked in, EIQ can try to switch those deals into revenues.

EIQ’s Chief Commercial Officer, Deon Strydom covers this in more detail in this video at 38:40.

The second way to monetise EIQ’s tech is licensing.

EIQ’s second commercialisation strategy is to secure licensing partnerships with various organisations that provide services to patients with heart issues.

Organisations like medical device manufacturers and big pharma companies.

The type of companies we think would be most interested in EIQ’s tech are the ones that rely on diagnosis to be able to treat heart diseases.

EIQ’s tech is built around improving diagnosis rates - so using EIQ’s tech means more patients are diagnosed with conditions that require treatment.

More people that require treatment = more revenues for the organisations treating those patients.

It's positive at both a human level (more patients accurately diagnosed and treated) and a business level (more revenues for treating those patients).

EIQ says it is at “advanced stages” with pharma companies and device manufacturers.

We think these deals could be major catalysts for EIQ’s share price.

The market loves medtech software companies... just look at Pro Medicus

EIQ is developing software where margins are usually really high (up around 100%).

The bulk of the costs when developing software happen upfront.

Once development is finished, the maintenance costs are usually a nominal amount (hence the high margins).

A software product is also extremely scalable - i.e. you can sell to 100 customers or 10,000 with minimal capital requirements.

Because of the high margins, the ability to scale quickly, and the recurring revenues, the market tends to love medtech stocks like EIQ... especially once first revenues are earnt, there’s some early traction in the market, and analysts at big firms can start running financial models and price targets for stocks.

Valuations for these types of businesses can sometimes go beyond normal market conventions...

The biggest medtech name on the ASX right now is Pro Medicus (capped at $28BN).

Pro Medicus’ business model is slightly different to EIQ.

EIQ’s tech helps detect heart diseases whereas Pro Medicus’ tech is used by the companies doing the imaging services.

Regardless, we think that Pro Medicus sets the benchmark for how the market values med tech companies that are revenue generating.

Pro Medicus at today’s valuation trades at 161x revenues...Here’s their very impressive 10 year price chart:

Past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As Pro Medicus grew sales for its technology, its market cap re-rated exponentially.

We are hoping EIQ is re-rated in some form as it grows its revenues over time.

How today’s news impacts our EIQ Investment Memo:

Today’s news directly relates to Objective #2 of our EIQ Investment Memo.

Reimbursement was always a big part of the commercialisation story.

Today, we get to tick off that milestone...

Objective #2: Commercialise aortic stenosis product

Milestones

✅ Reimbursement approvals (Ticked off today)

✅ First partnership from aortic stenosis product

🔲 [NEW] Second partnership with hospital network

🔲 [NEW] Third partnership with hospital network

🔲 Deal with healthcare provider (Pharma company)

🔲 Licensing deal (medical device manufacturer/imaging company)

What's next for EIQ?

In the most recent investor presentation, EIQ announced a number of different short term catalysts that the company expects including:

- Commence Australian pilot program with leading device manufacturer - this will advance EIQ’s licensing revenue pathway and be a “proof of concept” study that EIQ can take into the US.

- Heart Failure validation study with US based Group - the indication from the most recent webinar is that the US based group is the Mayo Clinic, we think that the outcome of this study will be a big coup for EIQ.

- Partnership with European re-seller to broaden market exposure

- CE Mark and TGA applications (so that EIQ can sell into Europe and Australia).

What could go wrong?

At this stage of EIQ’s journey a big risk for the company is sales risk.

Today’s news de-risks this slightly, but we are conscious of the reimbursement process being relatively technical.

For EIQ’s tech to be widely adopted it will need to have access to the far more streamlined reimbursement process.

At the moment, EIQ is having to do a lot of educating for its integration partners which is expected this early into commercialisation, but we are conscious that this may cause revenue growth to be slower than expected in the short term.

Sales/Commercialisation risk

EIQ is reliant on its partners, both under the licensing and reimbursement strategy, to use EIQ’s product. If EIQ’s product is not used (because it doesn’t add value back to the provider), then it won’t be able to generate revenue. There is no guarantee that EIQ’s product will be used by its partners and, therefore, no guarantee of revenue.

Source: “What could go wrong” - EIQ Investment Memo 6 Sept 2024

There is also an element of “regulatory risk” as well.

EIQ has a second product being developed.

There is no guarantee that the product receives FDA clearance which would impact the company’s future growth prospects.

There is also no guarantee that EIQ receives any further approvals with its application for “full category III CPT code”. This could slow down adoption from potential users of EIQ’s tech.

Regulatory Risk

EIQ has applied for FDA clearance under the 510(k) pathway for aortic stenosis and will apply for FDA clearance for heart failure. There is no guarantee that the FDA will provide clearance, and the application may be rejected. Also, EIQ’s strategy is reliant on securing reimbursement for its product. If EIQ is not able to secure a reimbursement deal then its commercialisation strategy may need to pivot.

Source: “What could go wrong” - EIQ Investment Memo 6 Sept 2024

Our EIQ Investment Memo:

In our EIQ Investment Memo, you can find the following:

- What does EIQ do?

- The macro theme for EIQ

- Our EIQ Big Bet

- What we want to see EIQ achieve

- Why we are Invested in EIQ

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.