TechGen Metals has just acquired TWO new copper exploration projects in WA.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,115,714 TG1 shares and 1,133,929 options at the time of publishing this article. The Company has been engaged by TG1 to share our commentary on the progress of our Investment in TG1 over time.

TechGen Metals (ASX:TG1) has just acquired TWO new copper exploration projects in WA.

We have been looking and asking around for copper projects for over a year now.

Based on our prediction that the copper price would have a run on a supply squeeze from copper's use in the green energy transition...

(electricity is transported using copper wires)

Copper is now up nearly 30% in the last 3 months:

In addition to TG1’s new copper projects, we are weeks away from knowing the results on TG1’s drill program at its Ida Valley lithium project.

TG1’s lithium project is in the same region as $228M Delta Lithium and $3.3BN Liontown Resources.

Assays from the lithium project are due in ~4 weeks time.

So before the end of the financial year we should know whether or not TG1 has a lithium discovery on its hands.

While we wait for those drill results we have been looking closely at the copper projects TG1 has been picking up over the last week or so.

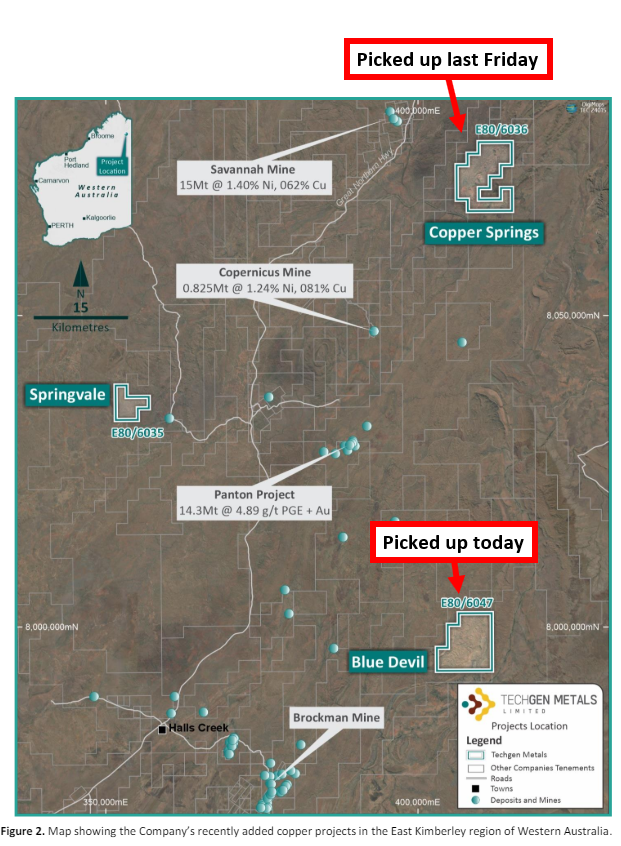

Last Friday TG1 picked up a new copper project in WA’s Halls Creek region.

The market liked the pick up - taking TG1’s share price back above 4c.

Today TG1 has added ANOTHER copper project, again in the Halls Creek region in WA.

Both projects have high grade copper rock chips, the project picked up today has grades up to 50.5%.

Next across both projects TG1 will be running geophysical surveys to identify potential drill targets.

We think it’s a great time to pick up a couple of copper exploration projects with the copper price running and copper making headlines in mainstream media.

In addition to TG1's new copper projects, TG1's lithium assays are due in ~4 weeks time, so with lithium sentiment turning and lithium stocks off the canvas it would be a great time to announce a lithium discovery.

We will be watching TG1 closely over the coming months.

More on the new copper projects

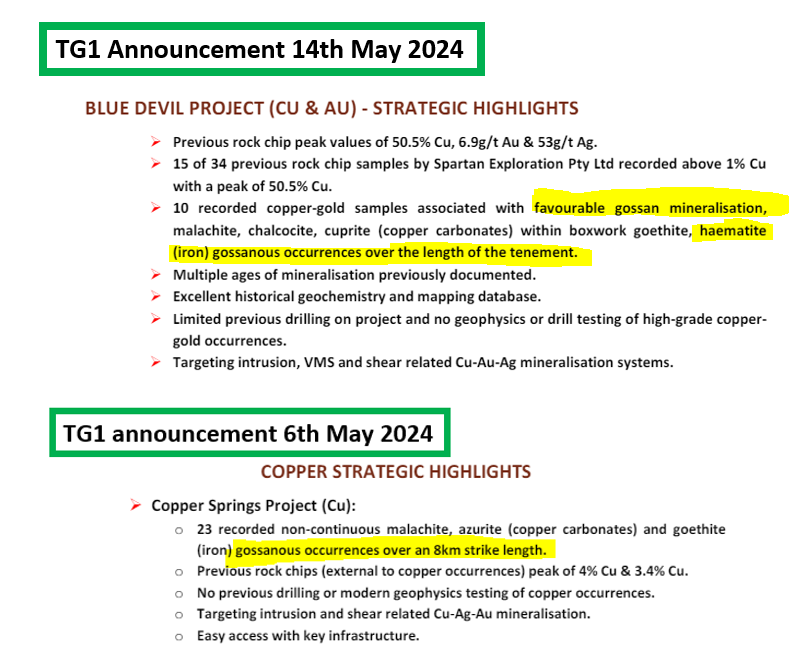

First, on the project TG1 picked up last Friday (Copper Springs).

For a large part of its history, the project had been explored for diamonds, nickel and PGE’s.

Which makes sense considering the project is ~12km NW of the Savannah nickel mine and ~75km away from the Argyle Diamond mine

In fact the project has never been explored with a focus on copper which is surprising given the rock chip samples that show copper grades up to 4%.

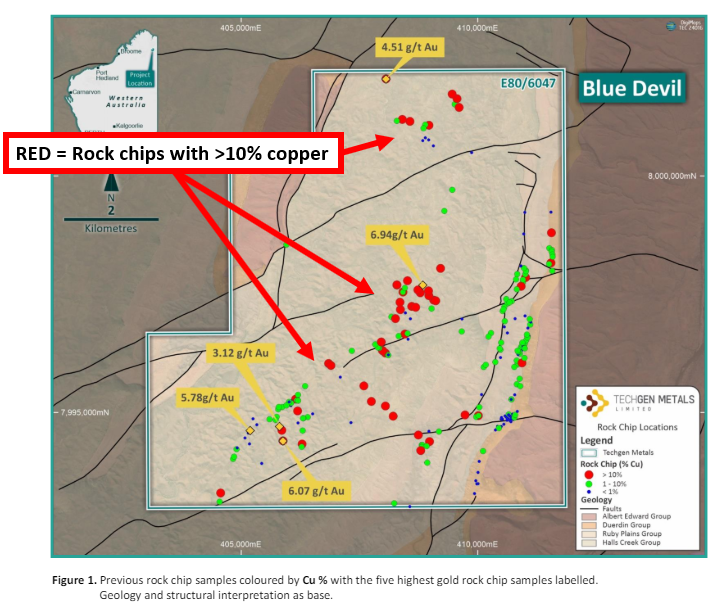

Today, TG1 added another copper asset to its portfolio (Blue Devil)

This new project has even higher grades on old rock chips - up to 50.5% copper and 6.9g/t gold.

15 of the 34 previous rock chips taken from the project all had grades above 1%.

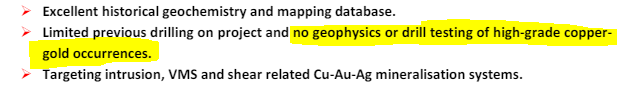

The big upside we see is the lack of any geophysical work done on the project.

With some geophysics overlaid on all the existing rock chip data, TG1 could find what others may have missed in the past.

At this stage, both the copper assets are fairly early stage.

TG1’s plan is to run EM/gravity surveys (geophysical surveys) to try and work out the best parts of the project to drill.

That’s where we can expect to start seeing big colourful blobs that may be worth drill testing.

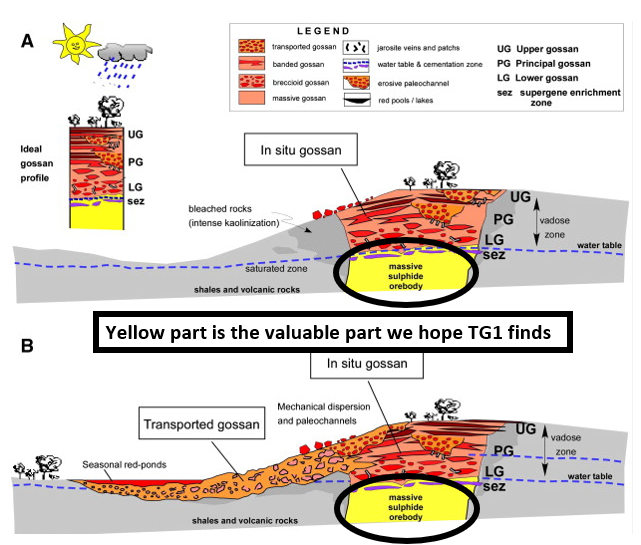

“Gossannous minerealisation” - what is it?

Both of TG1’s announcements talk about gossanous outcrop on both new copper projects.

At a very high level, gossans tell us a lot about the type of discovery TG1 could make and what is sitting underground.

Gossans at surface are the weathered rocks which could be an indicator for the sulphides sitting at depth.

The idea is to hone in on where the sulphides are, drill and hopefully find mineralised rocks.

It can get very techincal but we have always referred to the following image when looking at projects with this type potential:

At this stage, we want TG1 to show that underneath those Gossanous outcrops are big geophysical anomalies.

The geophysical anomalies will ultimately determine if its worth drilling deeper.

Why copper?

When it comes to the whole battery metals/critical materials thematics we think copper has been the most underappreciated.

Between 2017 and 2023 while most battery metals prices rallied hundreds of percent.

Copper prices on the other hand stayed relatively neutral, trading in a US$3.50/lb to US$5/lb range.

All of this has happened even though copper is the single most important material for the electrification/decarbonisation thematic.

US investment bank Goldman Sachs has for years been calling for a copper bull market and a few years back said the copper price could eventually go exponential.

The reasoning was that the demand coming from the electrification thematic coupled with underinvestment in new copper mines would lead to a once in a generation tightness in copper supply.

Copper is unique because it’s already the second most used industrial commodity AND its demand could increase significantly over the next ~5-10 years...

We actually remember listening to a podcast back in 2022 when Goldman Sachs was talking about the issue:

(Source)

The key topics touched on in the podcast are as follows:

- Why the copper deficit is going to get so big — 5:35

- Why total demand is going to boom — 8:15

- Where will the copper come from? — 11:30

- It takes longer and longer to build a new mine — 14:22

- Peak production is on its way — 22:13

- The copper bear case — 30:06

- Why copper $100K is possible — 35:19

While the podcast is a little outdated now, all of what the analysts were talking about is now playing out...

Copper prices are on the up and the market more broadly is starting to understand just how bad a copper shortage there might be in the years to come.

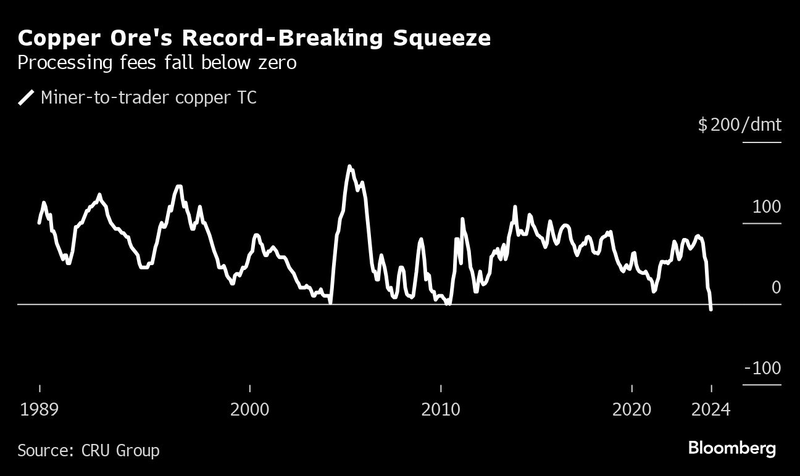

Recently we even saw copper refineries for the first time in decades paying to get ore into their factories...

Refineries that usually ask to be paid for processing, going out into the market with a willingness to pay for supply gives a good sense of the supply/demand issues building in the background..

(Source)

We were recently at the RIU conference in Sydney where we noticed a fair few copper companies with advanced stage assets BUT where valuations were relatively modest...

Valuations in the copper space are nothing like the ones we saw in the lithium boom times when companies with rock chips were capped at $50-100M.

As a result we think the higher risk, higher reward early stage explorers are even more attractively valued in the current market.

AND they are hard to find...

That's why we like TG1’s recent pickups and will be watching with a keen eye to see what comes of the assets.

Ultimately, whether it is TG1’s gold/lithium or copper assets we are Invested in TG1 to see it make a discovery and re-rate off the back of that news.

A discovery forms the basis for our TG1 Big Bet which is as follows:

Our TG1 Big Bet:

“That TG1 will return 10x by discovering and defining a significant enough deposit to move into development studies for one of its projects.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our TG1 Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for TG1?

Lithium drill results 🔄

In today’s announcement, TG1 mentioned that assay results are due in ~4 weeks.

Going into the assay results from TG1’s Ida Valley project we have set the following expectations:

Below are our expectations for the assay results from TG1’s first pass drill program:

- Bull case = >1.5% lithium grades from 5m+ intercepts

- Base case = >1% lithium grades from 5m+ intercepts

- Bear case = <1% lithium grades from <5m intercepts

For context, Delta Lithium’s discovery ~50km away has an average grade of 1.2%.

The general rule of thumb when it comes to lithium projects is that grades of ~1% are considered economical.

The shallower the mineralisation, the lower the grades can be - the deeper the mineralisation, the higher the grades will need to be.

🎓 Learn more about expectation setting for drill programs here: Expectation setting leading up to drilling programs

Timelines and clear a plan for geophysics on copper projects 🔄

TG1 made mention of running geophysics programs on its new copper projects but we don't have any timelines on that yet.

Next we expect to see TG1 release a clear plan on the proposed geophysics programs.

🎓 Learn more about geophysical surveys here: Electromagnetic (EM) Surveys Explained

What are the risks?

Exploration risk

With assays now a few weeks away, the key risk will be whether or not TG1 hits any lithium mineralisation of interest.

There is always a risk TG1 finds nothing and in that scenario we would expect a sell off in TG1 even though its market cap is already relatively low.

As for TG1’s new copper projects, there is always a risk that the geophysical surveys turn up nothing which would make the projects far less interesting.

This is part and parcel of high risk high reward junior explorers like TG1 and so we always make sure that we are comfortable with our position size even if things go wrong.

We listed some more risks as part of our TG1 Investment Memo here.

Our TG1 Investment Memo

In our TG1 Investment Memo, you can find the following:

- Our TG1 Big Bet

- Key objectives we want to see TG1 achieve

- Why we are Invested in TG1

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.