CropLogic sowing the seeds of success

Published 21-MAY-2019 15:19 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

CropLogic Ltd (ASX:CLI), the award-winning global agricultural technology company has provided a promising update on the company’s Industrial Hemp Trial Farm in Oregon, while also pointing to advancements with new technologies and commercial opportunities that could emerge from interest in its agtech devices.

The Hemp Trial Farm project is operated by CropLogic’s wholly owned subsidiary, LogicalCropping, and is designed to apply the group’s technology and agronomy expertise to improve production and cannabidiol (CBD) yield.

As hemp biomass is sold based on CBD content, any increase in CBD yield increases CropLogic’s client’s bottom line.

Commercial discussions ahead of planting season

CropLogic’s proven ability to optimise yields across a wide range of crops, along with developments surrounding the hemp trial farm have brought the company under the spotlight, with some discussions potentially a forerunner to signing commercial agreements.

Following announcement of the hemp trial farm project, management said that CropLogic had been approached by nearby growers regarding its agtech capabilities, including its drone technology which has recently been enhanced.

These discussions are progressing well and management expects to have early take-up of its technologies, providing a gateway for CropLogic’s agronomy and agtech business into the emerging hemp market in Oregon.

CropLogic confirmed that the timetable provided for the hemp trial farm remains, an outstanding effort given the farm’s size only increased recently by more than 300% to 500 acres.

All leases for the expanded areas have now been signed.

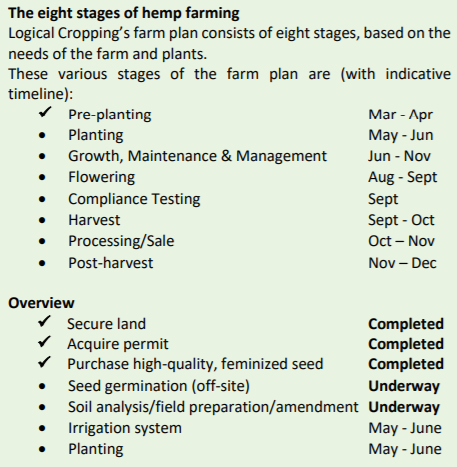

As indicated below, there are multiple share price catalysts for the group with planting about to commence, and other milestones such as growing, maintenance and management spanning the months between June and November.

The latter is a period when the company can showcase its range of technologies that assist in decision-making processes around crop management.

Of course, the harvesting and crop sale stage between September and November will allow the company to put a fine point on its revenue generation, margins and profitability.

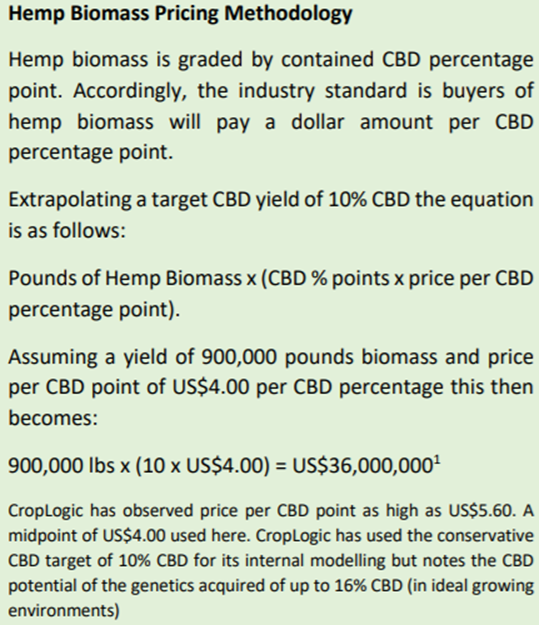

The following provides some back of the envelope numbers for the number crunchers, remembering that US$36 million equates to about $52 million based on the current AUD:USD exchange rate.

Supply/demand dynamics couldn’t be better

Based on recent pricing movements there appears to be upside to management’s early estimates which definitely reflect a base case scenario.

Prices in the March quarter increased by roughly 6% quarter on quarter, and some analysts are projecting a further 15% increase by the September quarter.

This doesn’t appear to be a stretch given the extent of regulatory changes which have quickly opened up substantial demand for the commodity.

Because the increase in demand has virtually happened overnight, growers haven’t had a chance to bring on sufficient new supply, creating a perfect pricing environment for a company like CropLogic.

Not only will it benefit from income generated from its Oregon farm, but as new production is brought on stream there will also be increased demand for its technology.

The hemp trial farm has generated a considerable amount of interest in both capital markets and the hemp industry.

On this note, CropLogic chief executive, James Cooper-Jones said, “CropLogic has moved quickly to secure superior genetics that have a history of producing superior CBD grades.

“The rapid development of CropLogic’s hemp trial farm in Central Oregon continues to garner interest both regionally and by industry participants generally.”

On the score of genetics, management has settled on three different seed varieties.

High-quality resilient seeds secured for Oregon

These varieties which include T2, Midwest and Berry Blossom are known for their resilience, CBD compliance and have a proven record of production in Central Oregon and similar growing environments.

Procured from a well-regarded Oregonian seed company, T2 is noted for high terpene production coupled with CBD yields consistently above 11% and reaching 16% under optimal growing conditions.

Management noted that the plant has tremendous structural integrity that can withstand the elements.

The terpene profile is fruity with overtones of cedar and pine trees.

T2 was grown across the US last year from Oregon and Nevada to Wisconsin and New York.

All seeds come off fields/plants tested by the State of Oregon and verified as being under 0.3% tetrahydrocannabinol (THC).

From a technical perspective, the Midwest strain shows both indica and sativa landrace traits, features large dense flowering, a very robust plant structure for large biomass production, and exceptional mould resistance.

It showcases intense terpenes, yielding a strong sweet earthy pine scent, ideal for botanical extracts.

Management expects approximately 14% CBD, peaking around week 5 and stabilizing to around 12.5% for weeks 6 to 9.

Procured from an experienced seed company out of Colorado, a state that joins Oregon as one of the top three hemp producing states, Berry Blossom is a cross of two earlier varieties, Cherry Kandahar S1 (in house selection) and Chardonnay.

Berry Blossom is noted for its extremely floral smothered in exotic overtones of candied raspberries and acai berries and consistent yields of 13% CBD and THC in the 0.2 to 0.3% range.

LogicalCropping hemp specialist, Jason Peterson said “Central Oregon’s climate, soil types and clean environment presents an ideal growing environment to produce premium high quality CBD producing hemp biomass.

‘LogicalCropping has selected genetics that are designed to capitalize on this growing environment.

Coupled with CropLogic’s agronomy and agtech expertise, this should optimize our biomass production and grade this year”.

Enhanced drone capability

On the technology front, CropLogic has enhanced its drone capability ahead of the 2019 North American growing season.

The company has a long history of effectively using drone technology to provide aerial imagery to growers and developing these capabilities with New Zealand government owned Callaghan Innovation.

CropLogic uses drones as delivery systems for, amongst other things, its infrared imagery technology that allows early detection of plant stress.

The company has further enhanced its drone capabilities with the appointment of specialist staff with unique skills in imagery interpretation.

CropLogic western territories manager Scott Barclay pointed to the complementary benefits between the group’s drone and on-ground technologies in saying, “The flexibility and deployment ease of drone technology makes it ideal for servicing fields of high value crops such as CBD producing industrial hemp.

“With our agronomy expertise and our other agtech products such as CropLogic realTime, infrared aerial imagery provides the ideal technology stack to assist growers in optimising yields.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.