Cashed up LCL delivers more results. 16c Option pressure on share price ends on Monday.

Los Cerros’ (ASX:LCL) giant gold system in Colombia’s prolific Mid-Cauca Porphyry Belt just keeps on getting bigger.

The region, dotted with many multi-million ounce gold deposits, has already delivered LCL significant gold hits at its Quinchia Project, where it aims to deliver a maiden Mineral Resource at the Tesorito South prospect at around the end of the year.

We first invested in LCL in April 2020, before it first found evidence of a big porphyry gold system last September. Its share price tripled in response to that initial announcement.

Since then, the company has delivered no fewer than 12 outstanding drill results. Yet for a few reasons, the market is yet to price in these what would otherwise be “company making” finds.

There currently are 50 million 16c LCL options that are expiring THIS Monday, and we believe the last few weeks of downward pressure on the share price is coming from existing holders selling LCL shares to fund the exercise of the options. Large investors also may generally exercise slightly out of the money options to build a position that they can’t achieve by buying on market without pushing the price up.

We expect this share price pressure should finish up this week, and assuming the gold price regains some strength and LCL keeps delivering big drill results we think the LCL share price should finally be free to move upwards.

LCL yesterday announced further broad zones of gold porphyry mineralisation had been identified as it continues to expand the Tesorito South porphyry discovery and open up new areas for exploration.

The company also reported that it has secured a fourth diamond drill rig to accelerate drilling.

That’s 4 diamond drill rigs working overtime to prove the size of LCL’s gold deposit.

Having completed a $20M cap raise last month, LCL is well funded to progress its exploration programs. The raise also saw the addition of two high profile North American gold funds, including the resources fund of top tier investment company, Franklin Templeton, which manages US$1.53 trillion in assets.

LCL’s Chairman tipped in an additional $160,000 on top of the $20m Placement — another encouraging show of support to existing shareholders.

Let’s take a closer look at the latest drilling results...

ASX:LCL

Drilling further expands Tesorito South

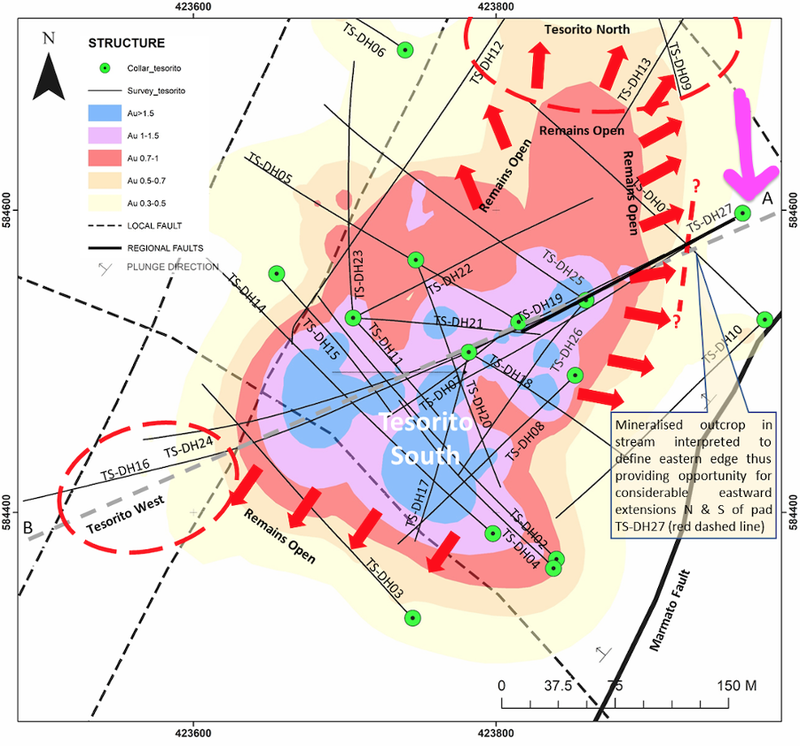

LCL’s latest drill hole (TS-DH270, “hole 27”) has delivered further broad zones of gold porphyry mineralisation as it continues to expand the Tesorito South porphyry discovery and open up new areas for drilling.

LCL struck gold mineralisation at depth, with assay results from drill hole 27 featuring:

- 36m @ 1.01g/t Au from 116m; and

- 72m @ 1.00g/t Au from 188m; including 6m @ 2.05g/t Au from 254m.

This indicates that the deeper envelopes of gold mineralisation are still open and the system is much larger than previously thought.

However, given that high grade shallow mineralisation is not evident, it appears that after no less than ten months of drilling, LCL have finally found one edge of the near surface resource in what is proving to be an absolutely massive system.

As you can see on the map below, hole 27 (pink arrow) is the furthest step out hole drilled to date at Tesorito as LCL searched for the edge of the porphyry system to the east.

LCL suspects that all the previous drilling has been concentrated in the south of the system, which it had believed to be the centre of the system.

Having now found the eastern edge, LCL has a reference from which to extrapolate north and south (red dashed line) to define areas of further likely extensions (red arrows). The north-eastern edge still remains very much open.

Given that the previous hits have all been the bottom half of the system, LCL has all the system to the north-east to go still.

LCL also reported yesterday that it has secured a fourth diamond drill rig, which will soon be on site ahead of the start of drilling at Quinchia in early September, bringing it another step closer to its planned five active diamond rigs.

Additional rigs accelerate drilling and help LCL find out quicker how big of a system they are dealing with here.

As mentioned, despite the massive size of this high grade gold system, there are a few things keeping the share price from fully reflecting the project’s significance.

The first being that the upcoming options expiration which we believe is depressing the share price. With the options set to expire on Monday, their 16¢ strike price appears to be holding down the share price. But once these expire, we expect much of this pressure to be lifted.

Plus, it seems that LCL’s predominantly Australian retail shareholder base is not fully recognising the potential of gold exploration in Colombia.

However, the result of the recent capital raising reveals that those in the know recognise the opportunity here...

High profile gold funds join the register

The company’s exploration success over the past 18 months has placed it on the radar of some of the most significant, influential, and experienced investors in the mining sector globally.

Leading that list is none other than Franklin Templeton Investment’s Franklin Resources, Inc, who after last month’s institutional Placement are now a >5% shareholder.

Franklin is a top tier investment company with more than US$1.53 trillion in assets under management (A$2.08 trillion), and widely considered one of the top five resources-centric funds globally. Its addition to the register, which already includes US$7 billion AngloGold Ashanti Limited (NYSE:AU), is a major endorsement of LCL and its projects.

In addition to Franklin, LCL attracted the interest of a second high profile North American gold fund, which LCL says is of equal importance to Franklin, although having invested just under 5%, its identity remains undisclosed.

Collectively, the pair invested ~$10 million. The raise was also well supported by Australian, Asian, and UK institutions, bringing the total amount raised to ~$20 million.

The joint lead manager on the Placement was renowned gold investors Sprott Capital Partners, alongside Euroz Hartley.

On top of the $20M, LCL’s Chairman tipped in an additional $160,000 — another encouraging show of support to existing shareholders.

Furthermore, LCL could be adding up to another ~$8 million to the treasure chest if its listed options get exercised on Monday. The options have a strike price of 16¢ — slightly above the current share price, but given the recent raise, there’s no strong need for these to convert.

As long term investors in LCL, we welcome the injection of new capital and hope to see the LCL price trading back above 20¢ soon after the downward pressure is released when the options expire.

LCL clearly has more than enough cash to continue its exploration plans and reveal just how large of a project it has in its hands....

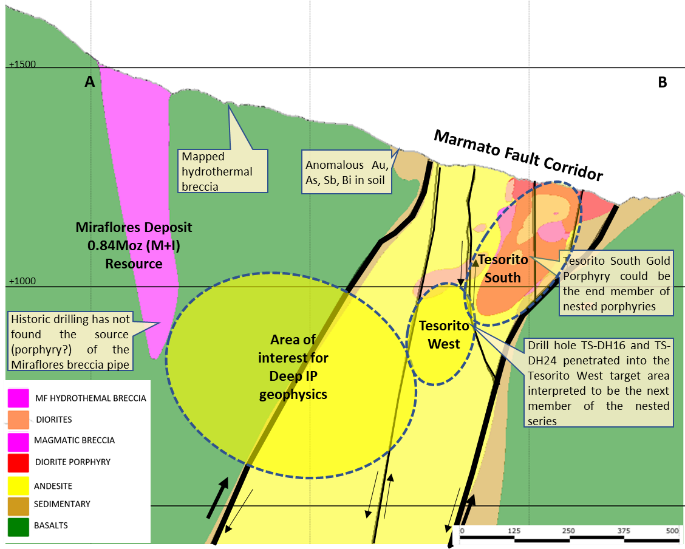

To get an idea of just how big of a system LCL has on its hands, in the east side of the map below, you can see Tesorito South where all the drilling of the past year has been done.

LCL has now drilled right through that and out the other side ... yet it is still in porphyry (porphyry copper-gold deposits are large volume, low-grade disseminations formed by precipitation of copper and gold).

This is a second porphyry, Tesorito West. LCL has drilled through Tesorito West twice now, so it knows that it is there. (LCL intends to find out more as part of its drilling program later this year).

What’s really interesting here is that LCL believe they have found a “nested porphyry” series, with Tesorito East and Tesorito West part of a bigger regional story.

The third assumed porphyry in the series, marked as the large “Area of interest for Deep IP geophysics”, is further to the west. Tying in with that theory is the Miraflores Resource (in pink), a breccia pipe. The source of Miraflores — a porphyry that caused the breccia pipe — has not yet been found and we expect that it may sit in the highlighted ‘area of interest’.

So while the known porphyry at Tesorito South continues to grow... and already looks like a multi-million ounce discovery, it might just be the bookend of a much larger system. No doubt that is something that Franklin and LCL’s other new institutional investors are interested in.

Given that we are shareholders, we hope to see LCL’s share price soon re-rate in order to more accurately reflect the project’s significance and the potential here.

What’s next?

Now with ~$24 million available, further expansions of field activities are planned, including drill programs and adding another active drill rig.

LCL intends to calculate a maiden Mineral Resource at the Tesorito South prospect — expected around the end of the year — a move that could certainly drive further institutional interest or a strategic partner.

In the lead up, we can expect to see continued near term news flow from ongoing drilling across Quinchia, metallurgical studies for the Tesorito South prospect, the completion of magnetic and deep penetrating IP geophysical surveys, and progress in regards to Miraflores mining approvals.

This year is slated to be LCL’s biggest year yet of exploration drilling with a continuous, multi-rig drilling program supplemented by other exploration programs across the extensive exploration portfolio.

And with the options overhang lifted next week we hope there is share price re-rate on the cards for LCL soon.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.