Bod Australia achieves quarter-on-quarter sales growth of 61%

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

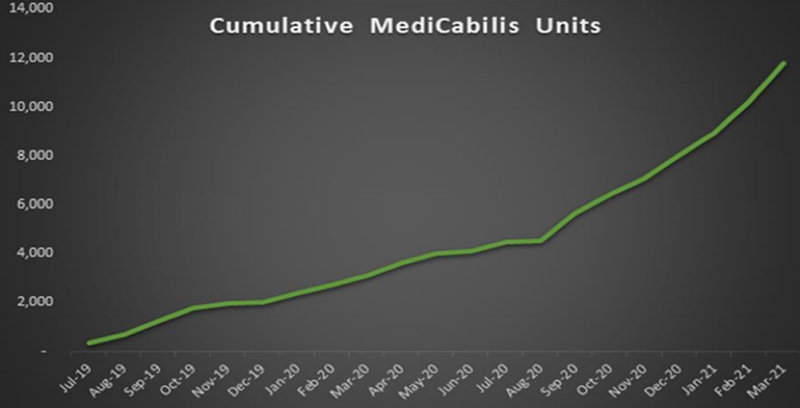

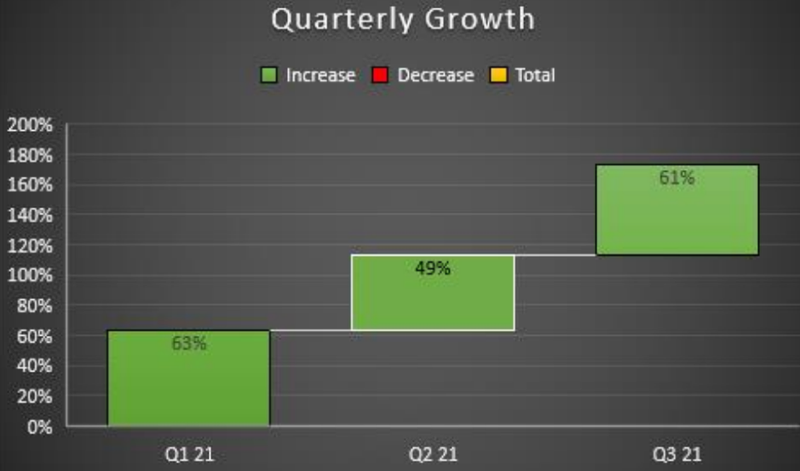

Medicinal cannabis and CBD and hemp healthcare products company, Bod Australia Limited (ASX:BDA) achieved record medicinal cannabis sales growth during the March quarter of fiscal 2021, filling 3789 MediCabilisTM prescriptions.

This represents a 61% increase on the previous quarter (Q2 FY2021: 2360), a major achievement for Bod as it takes the total volume of MediCabilisTM units sold during fiscal 2021 to 7730, a 93% increase on total fiscal 2020 volumes when prescriptions were in the order of 4000.

Bod is a cannabis-centric healthcare company with a global focus on product innovation with a view to transforming the lives of people through various means of improving health and well-being.

In these endeavours the company provides support to healthcare professionals on cannabinoid applications through education, research and trials.

Bod has now sold a total of 11,810 MediCabilisTM products since first prescriptions in January 2019.

Repeat business an encouraging sign for the future

It is worth noting that 62% of quarterly sales were repeat prescriptions, reflecting a strong endorsement from physicians and patients alike.

Management said that the growing volume of repeat business provided a platform for future growth.

Underpinning Bod’s robust growth has been its strong relationships with approved prescribers, educational initiatives with physicians and the company’s Australia-wide clinical study to test the efficacy of MediCabilisTM when prescribed for conditions including anxiety, insomnia and Post Traumatic Stress Disorder.

Recruitment for the trial remains ongoing, and relevant background for potential patients can be accessed through the company’s website.

The upward trajectory in MediCabilisTM prescription volumes will add to the company’s growing revenue profile.

Bod anticipates that sales will continue to increase over the coming quarters in both Australia and the UK.

Bod to benefit from established operations in Australia and the UK

Discussing some of Bod’s competitive advantages and commenting on the group’s outlook for the remainder of the year, chief executive Jo Patterson said, “MediCabilisTM is commonly prescribed for a range of chronic conditions including chronic pain and anxiety.

"These conditions are widespread and will always require a GMP pharmaceutical grade, standardised and consistent product, which is one of the key strengths of Bod’s offering.

"This competitive advantage is also one of the major reasons we continue to achieve strong prescription growth and maintain a significant share of the highly competitive full-plant high CBD market in Australia.

"We expect that medicinal cannabis will gain further traction in the Australian and UK market.

"Bod has established operations in place in both of these territories, so we expect our prescription volumes to continue to trend upwards, and this will add to the company’s growing revenue profile across the coming months.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.