Blockchain Technology on the ASX:RFN Makes Strategic Acquisition

Published 20-DEC-2017 09:17 A.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you’ve been tracking the progress of ‘blockchain’ — the tech that makes Bitcoin and the like possible — you might know that this cutting-edge FinTech is improving the lives of financiers and online e-commerce customers.

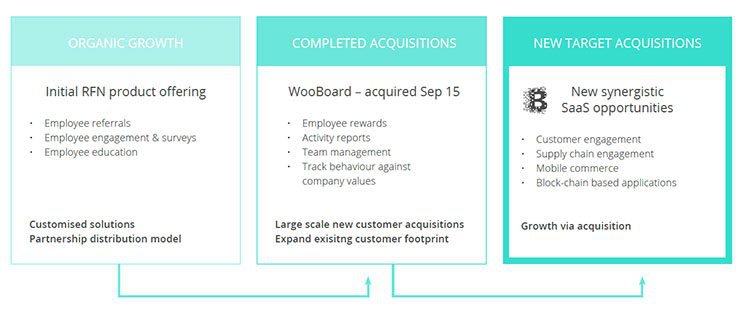

Software as a Service (SaaS) solutions provider, Reffind Ltd. (ASX:RFN) doesn’t want to miss out on the next big thing. The company is actively pursuing major opportunities for its core product offerings in the ASEAN and Asia-Pacific markets in the cloud-based enterprise SaaS and Blockchain-as-a-Service (BaaS) sectors.

RFN wants to maximize these opportunities by accelerating the adoption of its existing products and by pursuing complementary value accretive SaaS and BaaS opportunities.

Having carried out a strategic growth review earlier this year, and raising in excess of $6 million in the process, RFN now has its sights set on several acquisitions and investments in the blockchain/crypto space. With a solid management team fully-focused on taking this company forward, and supported by a key industry figurehead that has achieved results at previous tech stocks, RFN is a reasonably-priced entry into cutting-edge technology that has the world talking.

One of the key blockchain experts alluded to above is Matthew Hamilton, who has extensive industry experience in the blockchain sector and brings valuable expertise including assessment of product offerings and territorial licensing opportunities to RFN.

Hamilton heads up the six nation GCC region for Loyyal Inc. Loyyal is a universal rewards platform built with blockchain and smart contract technology. RFN has recently announced a strategic investment and licensing deal with Loyyal as another key step in its accelerated growth strategy.

However, it should be noted that RFN is an early stage company and investors should seek professional financial advice for further information if considering this stock for their portfolio.

RFN is led by another recently appointed blockchain expert in new CEO Tim Lea who will help guide the company through this transformative time. Combined with Non-Executive Chairman David Jackson who has a strong tech business building and blockchain leadership track record and Anthony Dunlop from ASX listed technology and blockchain investment company Chapmans Limited, Reffind looks to have what it takes to build a substantial and compelling blockchain led business giving investors exposure to a highly qualified and compliant blockchain growth story.

RFN is one of only a handful of emergent blockchain/DLT companies and it is looking to grow rapidly being on the hunt for strong early-stage companies to make snappy acquisition.

RFN plans to identify and acquire one or more entities and pursue blockchain commercialisation via one of three avenues: Architecture, Platforms and Customer-focused products. It plans to actively evolve the current SaaS free-for-all, into a higher calibre solution, capable of serving a wider range of customers and enterprises.

Blockchain technology has opened the floodgates to an ensemble of functionality, that’s making waves in several business sectors.

Crowdfunding, asset digitisation, higher-grade security and greater efficiency-as-standard are just the first smattering of new tech solutions to be unleashed into the market over the coming years.

In our last article , we delved into the details behind RFN, and why it could make some early blockchain-powered dollars.

Now we’re here to update you of its progress, as RFN has brought in a new CEO and raised more cash to propel its Blockchain-as-a-Service into global markets.

New CEO

RFN is now at a crossroads with the next few months likely to yield significant business changes that will likely affect the company for years to come.

Progressing a business in a relatively new market requires nous and extensive expertise. It’s no wonder then, that RFN has acquired a blockchain veteran to drive RFN’s market positioning.

RFN has installed Tim Lea as its CEO, effective as of the start of December. Lea brings 20 years of senior executive and corporate leadership experience with a focus on banking and commercial finance in the UK and Australia. His past exploits with the likes of GE Capital, HSBC and Lloyds Bank were followed by hands on experience building web and blockchain based solutions in Australia. With him at the helm, it’s widely expected RFN will gravitate towards key international markets, right from the get-go.

Lea is also a director of film and digital media based blockchain platform Veredictum which he helped establish using the immutable providence properties of blockchain to help solve the US$20 billion film piracy problem by enabling video content producers to protect their copyright and to track derivatives of their content as they are uploaded to the major video platforms such as Facebook and Twitter.

RFN’s new CEO is also a published author and a regular International speaker, and trainer on the strategic applications of the Blockchain. He wrote Down the Rabbit Hole , a blockchain book designed to simplify the game changing proposition presented by blockchain.

This appointment of Lea follows that of Matthew Hamilton as Blockchain Industry Advisor (another key person in RFN’s strategy).

Loyyal to blockchain

The appointment of Hamilton is significant for RFN. As mentioned above, he has expertise as an advisor, investor and operator for blockchain solution providers and industry stakeholders.

He is one of the rare breed who deeply understands the legal, accounting and regulatory framework behind this growing phenomenon. He backs that up with extensive commercial relationships.

His relationship with Loyyal is even more important, now RFN has agreed to a strategic investment in this US company.

RFN has agreed to enter into a binding term sheet with San Francisco-based Loyyal Corporation (Loyyal) for a strategic substantial equity holding in Loyyal of up to 14.8 per cent. The move gives RFN, exclusive performance based licensing rights to Loyyal’s advanced blockchain based loyalty and rewards platform.

The investment of up to US$2.3 million will be split into two tranches. The first tranche will consist of a subscription for US$ 800,000 in two year convertible promissory notes, convertible at RFN’s discretion at an enterprise value of US$16.5 million. Details of the second tranche are yet to be released to market.

Not only will the investment make RFN the largest shareholder in Loyyal and give it board representation, it could also open up the market across the Asia Pacific region. That is a 4.5 billion population that RFN could have access to through Loyyal’s technology.

Of course, how much of this market RFN is able to attract remains to be seen, so investors should take all publicly available information into account and a cautious approach to any investment decision in this stock.

The deal is set to be completed by January 15, 2018, just a few weeks from now.

Loyyal has been widely reported to be transforming the loyalty industry in a payments industry that has remained relatively stagnant.

This investment could open up a wealth of opportunity for RFN as it continues, as mentioned above, to look at ways to increase its core offering.

RFN progressing its WooBoard brand

RFN’s WooBoard is a key offering aimed to meet growing enterprise demand.

Lea’s valuable blockchain based Software-as-as-Service solutions experience, combined with a proven track record in business development is crucial to WooBoard becoming a success. He is ideally suited to execute RFN’s strategic growth plan through expansion of its existing enterprise customer base and acceleration of new customer growth.

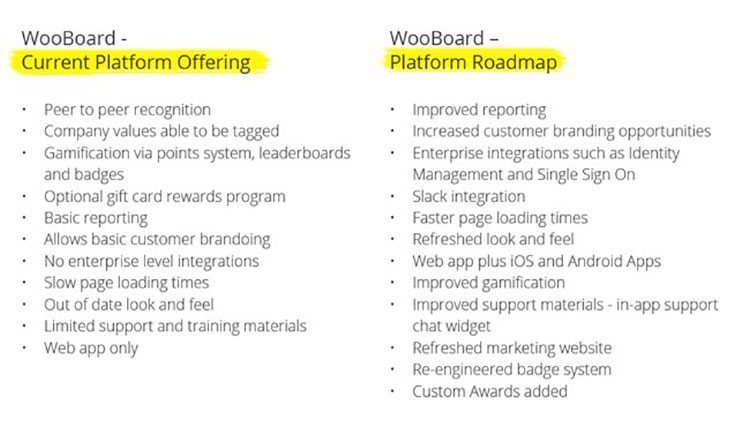

Source: Reffind

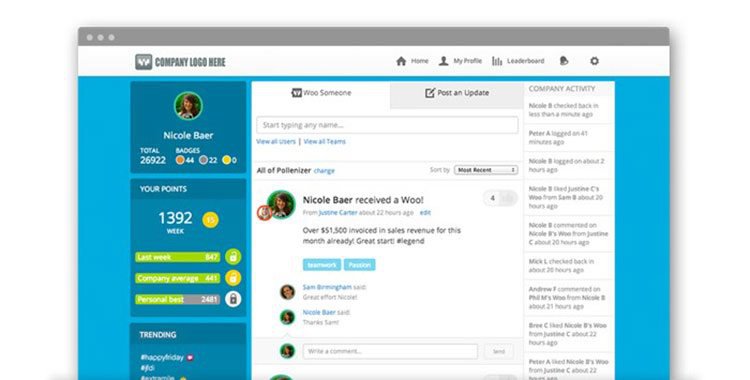

WooBoard is a peer-to-peer recognition platform which encourages employees to acknowledge and celebrate great work by their colleagues. It is social, interactive and uses gamification to boost user engagement and improve company culture. The opportunity is now there to improve upon archaic CRM systems and deliver better ways to engage and retain employees.

Here is a mock-up of the WooBoard product:

Source: Reffind

Through further development supported by investment in synergistic blockchain based technology, the WooBoard platform could soon become a significant player in the BaaS space.

With internationally recognised and critically acclaimed big-hitters joining RFN’s ranks, we think RFN is well on its way to raising its circa A$13 million market valuation in the near term.

RFN has raised over A$6 million in total over the past year

In order to progress its blockchain-powered market mission RFN needs ample funding.

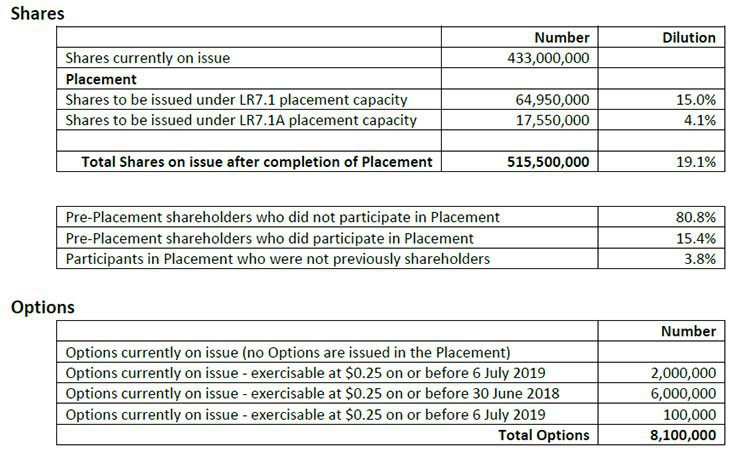

Just last month, it successfully raised A$2 million in a placement to new and existing investors, through issuing 82.5 million ordinary shares at $0.0243 per share. RFN will use the funds for additional working capital and for technology investment, in order to create a uniquely placed BaaS company offering bespoke services for a range of corporate clients globally.

Here are the details of RFN’s recent cap raise:

Source: Reffind

The capital raised will be directed towards Customer Relationship Management (CRM) systems are a simple example of the first wave of functionality we could see from blockchain-powered tools aimed at the retail consumer. Other services such as peer-to-peer lending and online payments are also likely contenders.

Source: Reffind

RFN is buying into a multibillion dollar industry

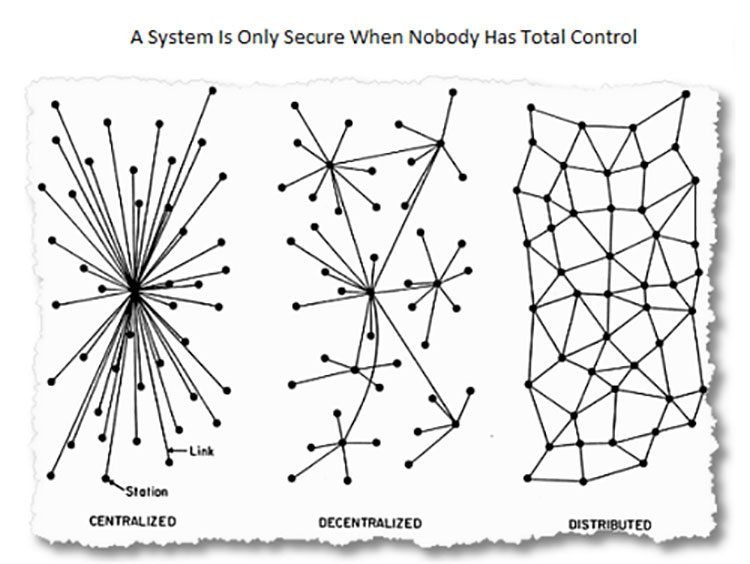

Blockchain is a distributed ledger technology that records real-time data into blocks and stores them for later recall. Each time a block gets completed, a new block is generated. The blocks are linked to each other in proper linear, chronological order like a chain, with every block containing a hash of the previous block. Each block containing the data is cryptographically hashed, using complex mathematical algorithms. The idea is to check the entire record for any sign it has been compromised in any way each time a new layer or addition is made. This ensures that the entire record cannot be tampered with or manipulated via technical arbitrage.

To give you an example of where distributed ledger technology is coming from, take a look at the following illustration:

The entire premise behind the technology is decentralisation.

Through decentralisation, networks tend to be more secure, they’re more accessible and less prone to unforeseen failures. Nothing is ever perfect, but ledger technology is a huge improvement on previous architecture and is already rolling out across various sectors.

RFN want to enter the market with a slew of value-accretive acquisitions to hit the ground running regarding the commercialisation stakes in the new year.

The dawn of Blockchain-as-a-Service (BaaS)

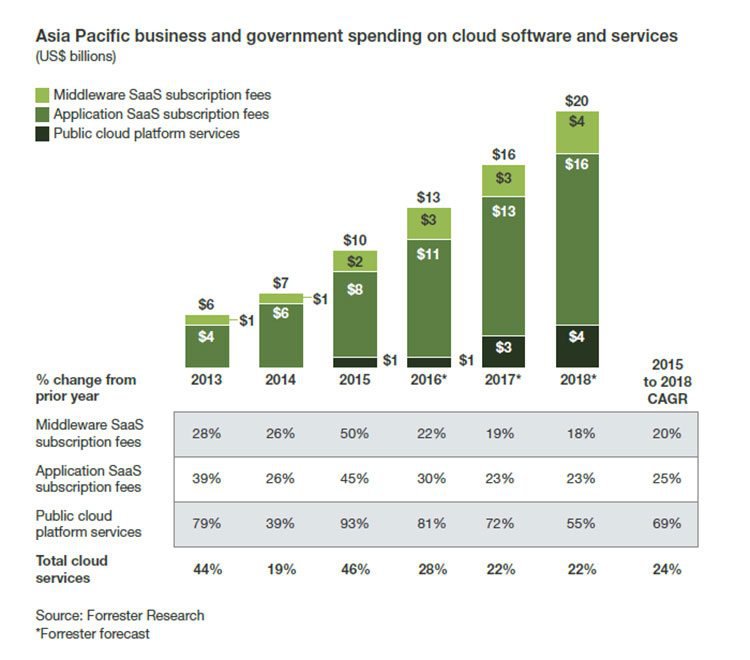

Software is now the third-largest tech market spend (after computer equipment), so it makes complete sense to expect software and tech consulting services (RFN’s core market) to be the fastest-growing categories over the next decade. The anticipated software spend in 2018 is around US$129 billion — all while the industry remains in its infancy.

In the US and Europe, software and tech consulting services are two of the largest and fastest-growing tech spends. Asia Pacific has not reached this point but is gaining ground. The region’s tech market is forecast to grow by 6% in 2018.

The Asia Pacific software market is experiencing three trends:

- Applications becoming a large component of company software spend

- SaaS taking over from licensed on-premises software

- Custom-built software spend is flattening out

These core factors have conspired to create a lucrative market for RFN:

Source: Reffind

Blockchain potential

For the uninitiated, a ledger is simply a record of something, whether it be trades executed by traders, or financial transactions to buy goods and services. As the amount of data produced grows at parabolic rates, people’s ability to use and understand that data is lagging behind.

What’s needed is an efficient way of pooling data, and a way to call up any single bit of data as quickly as possible (and securely). These three requirements — speed, security and functionality — are notoriously difficult to get right, but blockchain makes it all the more easier.

Take a look at how some folks may already have one foot in tomorrow’s world:

With the world accelerating towards a future with decentralisation as its principle and digitisation as its bedrock, adding blockchain exposure to investment portfolios could be one of the most forward-looking investment decisions you can make.

Think AOL in the early 1990s or Google in the early 2000s. It was the Internet that put the fire under these businesses, and RFN hopes it can repeat the feat with blockchain in the 21 st Century.

Moving into Blockchain, one block at a time

Blockchain is a major paradigm shift, alongside the PC, the internet and social media.

It will transform the way we conduct business, especially within the financial services and large enterprise space.

RFN has now secured what it needs to lead the business through its next stage of organic and investment based growth, leveraging existing and Blockchain software. This is a significant milestone in its ability to expand organically and rapidly grow in key international markets.

The company does, however, remain a speculative stock so investors should seek professional financial advice before making an investment decision with regard to this stock.

Blockchain, or distributed ledger technology, has the ability to generate unprecedented opportunities to create and trade value in society. In the same way the internet facilitates direct exchange of information, blockchain facilitates direct exchange of value, without the need for a centralised intermediary, or a centralised server swamped with too many requests.

Notwithstanding the technology is still in its early stage of wide scale implementation, as infrastructure and enterprise adoption continue there is potential to drastically impact industries as diverse as finance, energy, media, gaming, real-estate and logistics. Global IT consulting giant Capgemini estimated Blockchain could be responsible for USD$15-$20 billion dollars of savings by 2022 in the banking industry alone. If you though Software-as-a-Service (SaaS) was a step in the right direction towards better collaboration and efficiency synergies on every corner, then Blockchain-as-a-Service (BaaS) promises to take this journey to the next level in terms of scalability and application. Think hospitals, infrastructure projects, telecoms and even mining. All these functions and industries stand to be the first to benefit from what BaaS has to offer.

Given the overburdened state of government coffers, combined with the fact that organisations are facing rapidly growing data-handling issues due to a digital overload of content and metadata — it ultimately means that with more digital records being generated, comes a growing problem of keeping it all accessible and secure.

As blockchain technology gradually moves from peripheral beta-testing to mainstream acceptance, RFN’s blockchain-enabled strategy of acquiring strong companies in the DLT space, and incubating them all the way to generating revenues could be a great value-driver for early investors.

Blockchain/DLT have matured as marketable FinTech and RFN is jumping in at just the right time, especially when you consider it is one of only a handful of listed Aussie companies active in this sector.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.