AOU Commences Copper Zinc Drilling in the Land of the Giants

Published 19-MAY-2017 10:29 A.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Auroch Minerals (ASX:AOU) has just begun drilling for copper and zinc in one of the world’s most expansive and significant mining districts – the Iberian Pyrite Belt.

Renowned for its poly-metallic (copper-zinc dominant) deposits, this district is home to over 80 known deposits and resources totalling more than 1,700 million tons of mineralised ore.

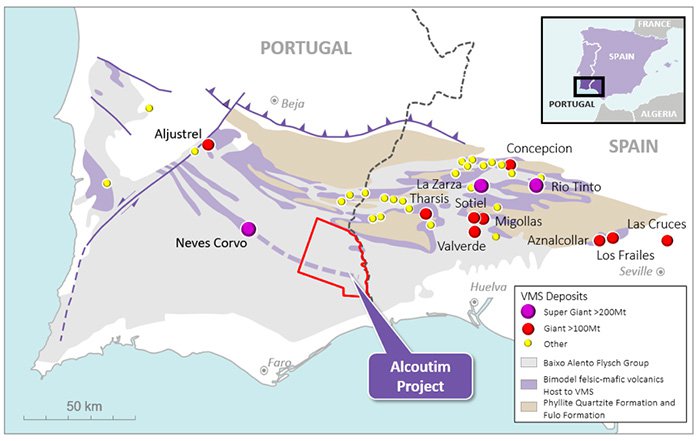

The region has been labelled the Land of the Giants by Auroch CEO Dr. Andrew Tunks, owing not only to the presence of nine giant (>100Mt) and three super-giant (>200Mt) volcanogenic massive sulphide (VMS) ore deposits, but also to the fact that Rio Tinto (the second largest mining company in the world) was formed in 1872 to mine copper at the village of Rio Tinto in the central Iberian Pyrite Belt.

Some say it is amazing that mine is still operating.

The Iberian Pyrite Belt is some 250km, stretching east-west across the Iberian Peninsula, from Portugal to Spain, with a mining history that extends back to ancient Roman times.

Now AOU has begun drilling at its Alcoutim Project in the hope of repeating history, with the first lot of results due shortly.

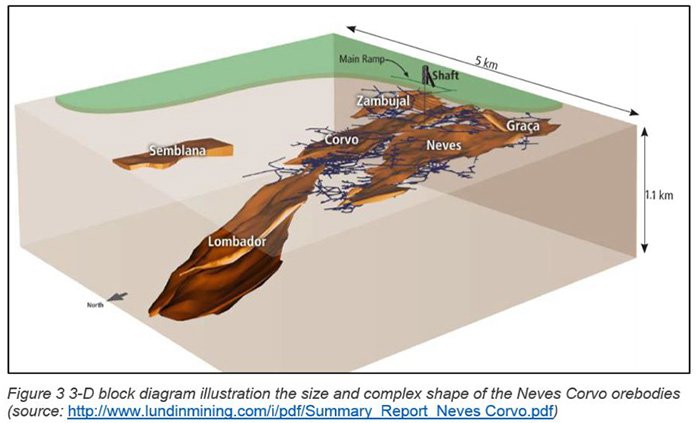

The tightly held AOU is spending ~AU$1.4 million to earn a 65% interest in the Alcoutim Project, a 576 km 2 area immediately along strike and down plunge from the $5.4 billion capped Lundin Mining’s giant Neves Corvo deposit, located in Southern Portugal — one of the world’s greatest minerals deposits, containing over 200 Mt of ore.

However, it should be noted this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Nearby are the super-giant deposits of La Zarza (8 Mt contained Cu+Zn metal) and the original Rio Tinto mine (>3 Mt contained Cu+Zn metal).

AOU has identified 22 targets via geophysics with coincident gravity and magnetic anomalies. Comprising five diamond drill holes for a total of 5,600m, the current drilling program, which commenced on May 12 th , is aiming to identify the source of these anomalies.

Currently capped at a tiny $15.4M, and with over $7.8M in cash and receivables at last count, this company could now be on the verge of another giant mineral discovery.

Without further ado, we catch up with:

Auroch Minerals (ASX:AOU) is a Perth-based exploration company with a focus on global renewable energy markets, looking for copper and zinc in Portugal.

With demand for these commodities steadily increasing as we move from fossil fuels to renewable energy sources, AOU is poised to capitalise on several burgeoning intertwined markets (more on that in a moment).

AOU is spending ~AU$1.4 million to earn a 65% interest in the aforementioned Alcoutim project, and just began drilling last Friday on May 12, which means its first assay results are just around the corner.

The company has in fact commenced drilling ahead of schedule as a sign of the expertise and hard work of the team AOU has assembled in Portugal.

You can watch CEO Andrew Tunks talking about this project here.

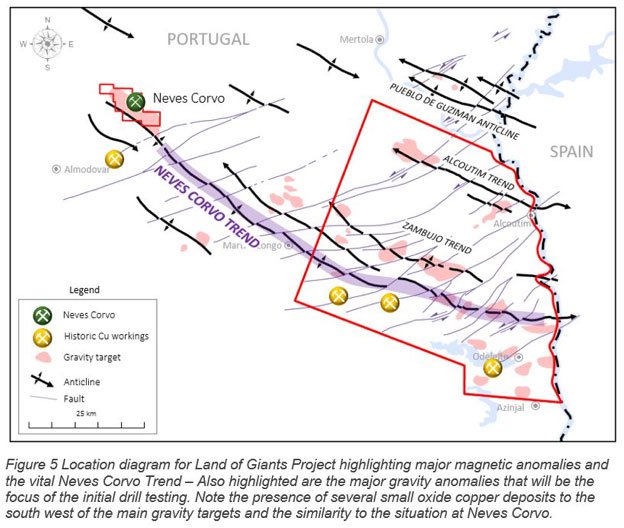

Given the multiple coincident magnetic-gravity-EM anomalies, and bearing in mind that the site is along strike to the super-giant Neves Corvo mine, AOU’s commencement of its drilling program could mean some giant pluses for shareholders.

Of course any success AOU may experience is speculative at this stage, so investors should take a cautious approach to any investment decision they make with regard to this stock.

To see just how closely AOU is rubbing shoulders with this cluster of giants, this map shows the location of the Alcoutim project in relation to Portugal, Spain, major neighbouring towns, and especially its proximity to the Neves Corvo deposit:

As we’ve mentioned, of particular interest here are the two super-giant discoveries, La Zarza (8 Mt contained Cu+Zn metal) and Rio Tinto’s original mine (>3 Mt contained Cu+Zn metal). As the map shows, there is also a continuation of the Neves Corvo Volcanics dashed line into the Alcoutim Licence covered by the younger rocks of the Baixo Alento Group.

Neves Corvo is infused with a potent injection of metals, including copper, zinc and silver, and AOU’s Alcoutim project sits just 20km down the road on the same geological structure.

Lundin Mining’s most recent estimations for their copper zones at Neves Corvo include a 91 million tonne resource grading 2.5% copper and 1.1% zinc with 116 million ounces of silver grading 43 grams per tonne.

The zinc zones are similarly impressive, with the latest resource estimate of 118 million tonnes grading 5.9% zinc and 0.3% copper with around 216 million ounces of silver grading 57 grams per tonne.

With all that in mind, it is little wonder that AOU’s share price has increased as much as 39% since the start of 2017.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The company is currently capped at $15.4 million and is in an optimal position to make good in the IPB. Now drilling in a region full of major minerals discoveries, it could be on the cusp of another.

Let’s look at the drilling that has just commenced in more detail.

Phase One: Drilling

Auroch’s initial drill program comprises three to five holes targeting geological environments similar to Neves Corvo combined with significant geophysical anomalies along the Neves Corvo trend.

Drilling will initially target the source of the EM anomalies (likely sulphide rich volcanic or sedimentary rocks), the nature of the massive magnetic anomalies (likely mafic magmatic rocks, which may have triggered VMS mineralisation), and hitherto unexplained anomalies beyond primary target areas.

At this stage, an early success supporting the potential of the project for AOU would be if the drilling intersects with sulphide mineralisation.

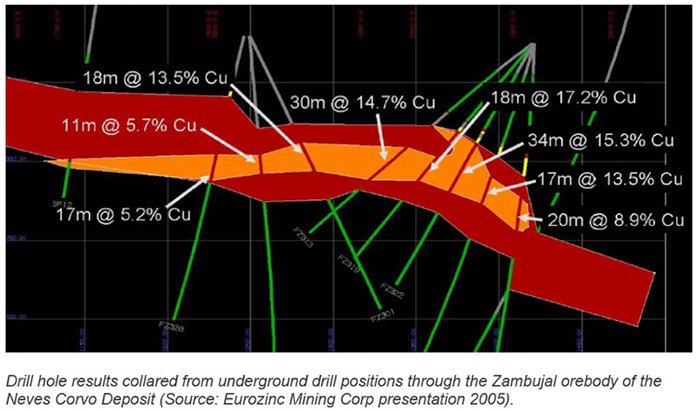

When it comes to VMS, this mineralisation can be in the form of a stockwork of sulphide veins, as was the case with Rio Tinto, disseminated sulphides in black shales, or a massive sulphide mineralisation, such as with Zambujal at Neves Corvo.

Here’s a cross-section of a drill hole through the copper-rich, massive-sulphide Zambujal orebody within Neves Corvo:

Using the results of this initial phase as a guiding foundation, the next exploration phase will prioritise vectors towards geophysical and geochemical targets that are acquired during the first phase.

A budget of ~A$1.4M has been finalised for the first phase of exploration, after which AOU will hold 65% of the Alcoutim Project.

Copper — an indispensable commodity in the renewable energy mix

AOU isn’t just drilling in one of the most prospective districts in the world — it’s also beginning its exploration program at a time when copper is being posited as the next major ingredient in the proverbial renewable energy soup.

Copper is the highest rated thermal and electrical conductor among engineering metals, with all power systems employing this metal to generate and transmit energy to maximise efficiency and minimise environmental impact.

Admittedly, copper can sometimes be forgotten amidst all of the interest in cobalt and lithium stocks. However, since lithium and cobalt are crucial elements of the battery technology for electric vehicles, this red metal is also becoming an essential input for the clean/green energy sector.

And there is hope that copper prices are soon to climb.

Today, an average car on the road will use a combustion engine, which requires around 25kg of copper. Electric vehicles, on the other hand, use 300% more copper than petrol-fuelled cars — around 75kg of copper per car.

With the movement towards greener energy and greener transport being more pervasive than ever, possibility of demand for copper dropping seems unlikely.

Which would suit AOU nicely as it firms up its copper play.

Zinc, or the battle of supply & demand

There’s no getting around it — zinc is the highest performing commodity on the market. Headlines like this say it all:

Zinc was one of the best performers of 2016, surging 75% year-on-year.

This greyish metal used primarily for galvanising steel is now up another 12.5%, owing to one of the most fundamental tenets of economics – supply and demand.

Zinc supply has been falling hard, with two of the largest zinc mines in the world — the Century zinc mine in Queensland and the Lisheen mine in Ireland — having closed in the last couple of years due to ore repletion, removing ~4% of world supply.

Zinc demand has therefore steadily tightened throughout the last few years and is expected to increase by 2.1% to 13.85 million tonnes in 2017.

Of course commodity prices including zinc and copper do fluctuate and caution should be applied to any investment decision here and not be based on these prices alone. Seek professional financial advice before choosing to invest.

What does all this mean for AOU?

It means, they are exploring for two potentially high demand commodities in a region flush with exploration and mining success.

Is AOU destined for gianthood?

Despite the initial mining work carried out by the Phoenicians and then developed by the Romans in Portugal, there are still considerable expanses of land that remain largely underexplored.

Portugal is eminently mining-friendly, with well-developed infrastructure, modern roads, efficient power, and easily accessible ports and airports. It was also ranked 26 th out of 160 countries by the World Bank in their 2014 Logistic Performance Index. The country has significant and favourable European Union and Portuguese government financial incentive programs, which can be benefited from as projects advance towards development and production phases.

AOU’s strategic location puts the company in a ripe position for potentially obtaining ‘gianthood’ status. Over the coming weeks, this tightly held stock could move rapidly on drilling success.

AOU’s Alcoutim license, which is valid for three years, with two possible one-year extensions, covers 576 km 2 and encompasses the right to explore for mineral deposits of gold, silver, copper, zinc, lead, tin, tungsten, antimony and associated metals.

At this stage in the game, the key to AOU’s early success may be determined by its ability to hit sulphide mineralisation, and we’re watching with baited breath to see what happens next.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.