$8M Capped ARN Set to Drill Next Door to $98M SPX’s Deposit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

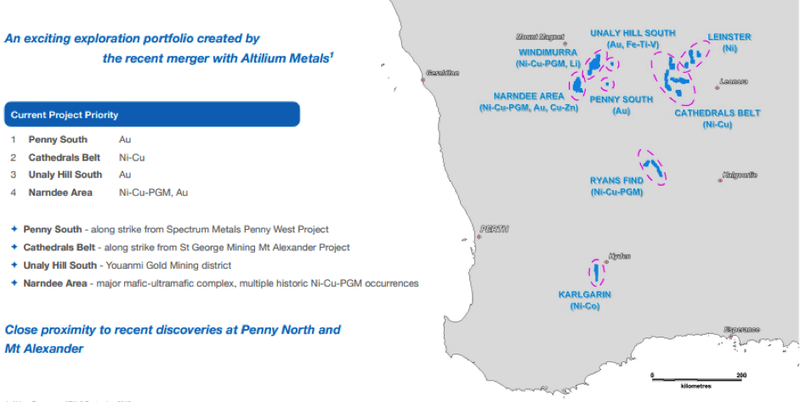

Aldoro Resources Ltd (ASX:ARN) has completed the acquisition of Altilium Metals.

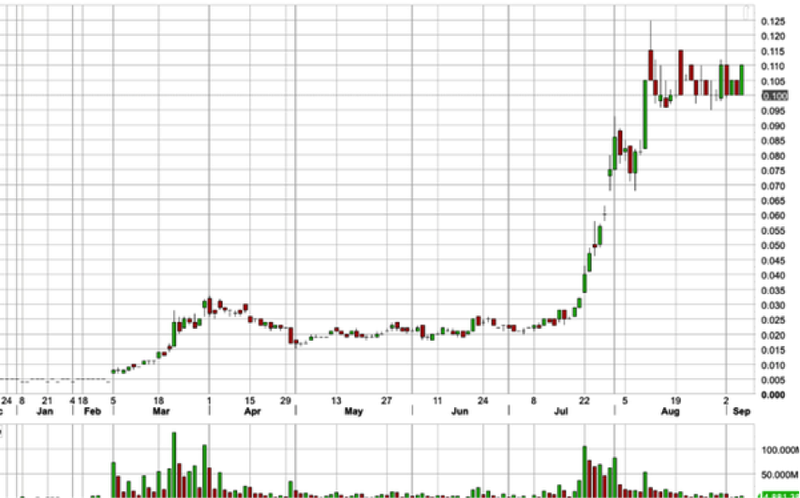

Completion of the acquisition was well received by investors with the company’s shares rallying more than 10%.

However, there could be more upside to come given the quality of Altilium’s assets and the potential to add shareholder value through exploration.

Altilium’s assets include the Penny South Gold Project in the Youanmi gold province of WA, and are situated right next door to Spectrum Metal’s Penny West project. Penny West shares the same shear which continues south into Penny South.

With the acquisition done and dusted, Aldoro has hit the ground running and has already completed initial exploration and targeting work at the Penny South Gold Project.

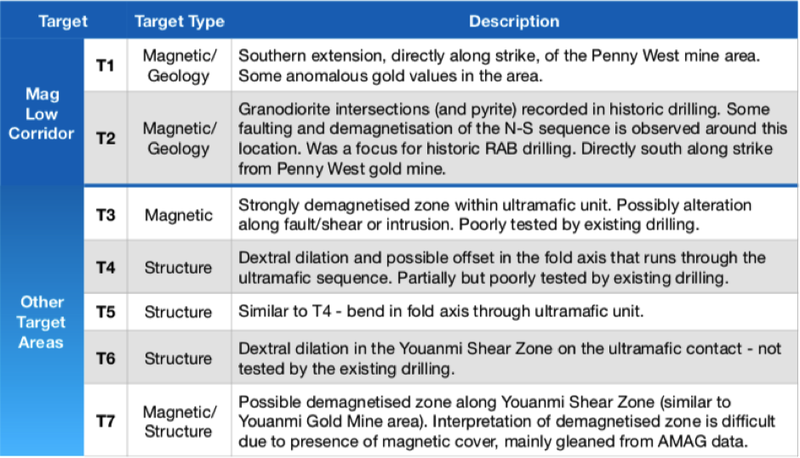

Aldoro has seven target areas within the Penny South tenement (E57/1045), which have little to no historic drilling attached.

Identified targets include over 2km strike continuation of the magnetic low corridor known to host the neighbouring Penny West and Penny North deposits.

Aldoro has lodged a Program of Work (POW) for a 5,000m air-core (AC) drilling program for first pass drill testing of these highest priority targets. Drilling will star as soon possible.

The Penny South Gold Project is shaping up as one of the company’s prime opportunities following the acquisition.

However, there have been some other significant developments since we last caught up with Aldoro in September that have also buoyed the company, in particular progress at their Cathedrals Belt Project and the Leinster Nickel Project.

While commodity price fluctuations can provide unwanted volatility, they can also throw up buying opportunities and Aldoro’s spread of commodities should put it clearly in the sights of investors looking for a diversified company.

With Aldoro having considerable exposure to nickel and gold, it is worth taking a deep dive into its likely near and medium-term drivers as this will help bargain hunters in identifying the difference between short-term blips and long-term weakness.

Fortunately, in Aldoro’s case, the outlook for both of its key metals appears extremely strong and this is supported by both macroeconomic factors and analyst forecasts, which we will go on to discuss.

Catching up with...

Last week, Aldoro Resources Limited (ASX:ARN) advised that conditions precedent to the acquisition of all outstanding shares of Altilium Metals Limited had been satisfied.

The company also completed the placement of $650,000 at 15 cents per share which was carried out in conjunction with the acquisition.

This means Aldoro not only has a new asset with a great deal of potential, it also has cash in the bank to get its new project rolling.

The acquisition provides Aldoro with 100% of the prime Penny South Gold Project, which is shaping up as one of the company’s prime opportunities.

When we last caught up with the company in the article Youanmi Gold Explorer Rockets 2200%: $7.5M ASX Stock Secures Coveted Ground Next Door, we examined how this tiny now $8.3M capped ASX stock trumped a hot field of contenders to secure sought after ground in the Youanmi gold province of WA.

Here is a look at its asset portfolio following the acquisition:

Youanmi is where Spectrum Metals (ASX:SPX) set up shop. It was a a shell, priced at half a cent nine months ago, today it is capped at just under one hundred million.

For those lucky early investors that held on, the company has delivered a 2200% return.

The past performance of these products is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Spectrum Metals put the region on the map this year delivering stellar returns as it extended the mineralisation present on its ground.

As mentioned, that mineralisation flows into Aldoro’s recently acquired Penny South Gold Project.

Penny South becoming a hot spot for gold

Aldoro, through its acquisition of Altilium, holds a series of advanced exploration projects in the Murchison Region of Western Australia including the Penny South Gold Project in the Youanmi Gold Mining District and the multi-commodity Narndee Project Area.

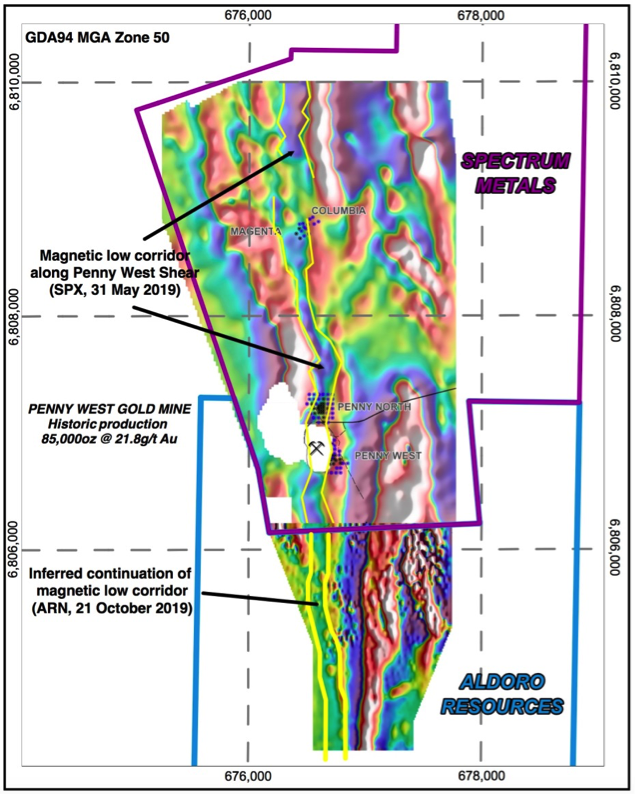

The Penny South Gold Project lies directly to the south of the Penny West Gold Project owned by Spectrum Metals and as indicated below contains over 2.5 kilometres strike extension of the Penny West Shear that hosts the historic high-grade Penny West Gold Mine.

Historic drilling within tenement E57/1045 (southern extent of the above map) has encountered various significantly anomalous intersections of gold mineralisation including 2 metres at 34 g/t gold and 6 metres at 1.3 grams per tonne gold.

Like the Penny West area, tenement E57/1045 contains limited outcrop and is overlain by up to 30 metres of sand and sedimentary cover.

The average depth of historic drilling within the Penny South Gold Project is less than 40 metres down hole.

Spectrum has reported outstanding recent exploration success at Penny North and at the southern end of the Penny West pit within deeper drill holes beneath cover.

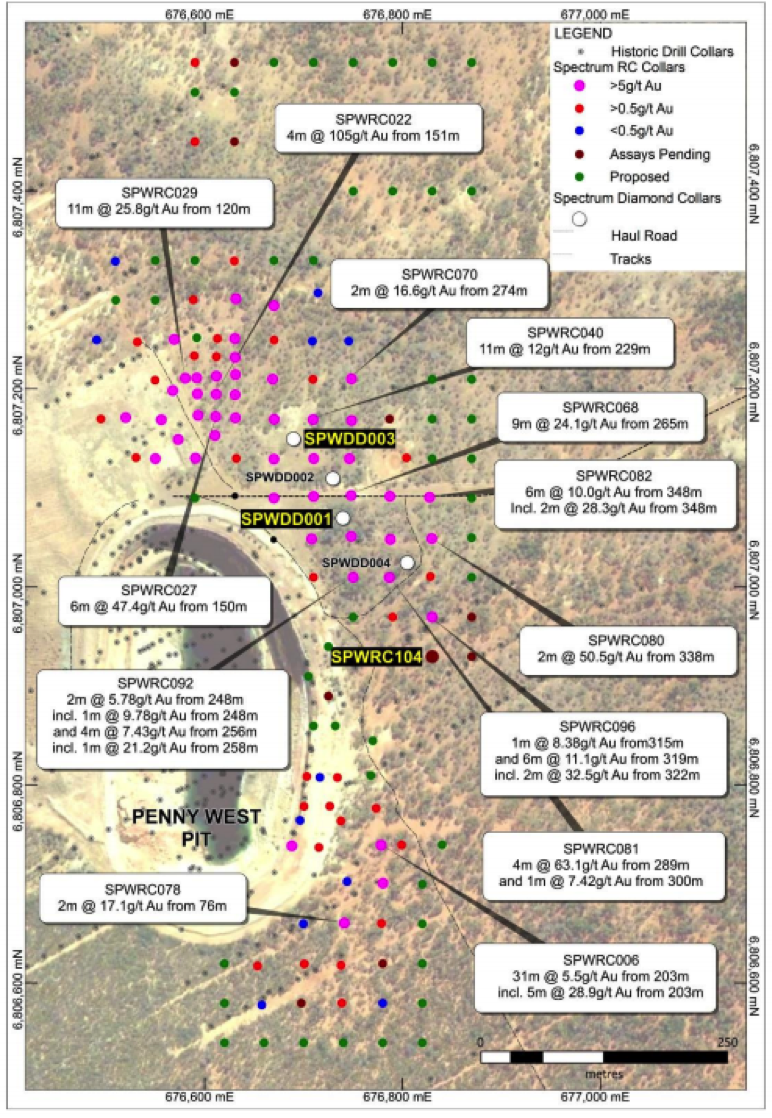

In mid-October, Spectrum announced drill results at Penny West of 6 metres at 11 g/t gold from 320 metres, including 2 metres at 32 g/t gold from 322 metres.

The following map shows the consistently outstanding grades returned from numerous drill holes in the Penny West area where Spectrum has been drilling at depths between about 200 metres and 350 metres.

It was just in the last month that Spectrum declared a maiden Mineral Resource Estimate for the Penny West project of 799,000 tonnes at 13.8 g/t gold for 355,500 ounces.

It is important to note that Spectrum has been able to quickly establish a maiden resource at a very economical cost of $10 per ounce, as this indicates the potential near-term upside for Aldoro which intends to utilise a similar exploration strategy to test surface anomalies at depth.

Drilling to commence soon

As stated, Aldoro has identified seven targets.

Targets T1, T2 and the adjoining greenstone unit containing granodiorite occurrences within the magnetic low corridor are the highest priority targets for immediate follow up.

Aldoro will shortly begin a 5,000m AC drilling program as a first pass along this target trend. The program will test the entire strike length of the target magnetic low corridor, with approximately 100 holes of 50m depth on 100m x 25m spacing.

This first pass program aims to identify potentially shallow, previously unidentified gold mineralisation and/or equally as important, occurrences of granodiorite with associated pathfinder elements, indicative of a mineralised system, that would warrant deeper follow up drill testing.

A POW for this drill program has been lodged and Aldoro intend to start drilling as soon as possible.

The other target areas show similarities to the Youanmi Gold Mine area further to the north. These too, are either untested or poorly tested by historic drilling.

Further work is planned to interpret and prioritise these as potential drill targets also.

Highly prospective gold assets

Aldoro is going through a period of transformation. The addition of gold assets is a real plus for the company.

While base metals tend to perform well when markets are robust and global economies are cranking, a reversal of those conditions often places downward pressure on the commodity prices of industrial metals.

Conversely, during periods of volatility and/or economic duress, investors often opt for gold as a safe haven investment.

Consequently, Aldoro’s diversification makes it a company for all seasons.

Gold was all the rage when it was up around US$1550 per ounce, but it really only stayed at that level for a short period of time, and for the best part of the last five months it has traded in the vicinity of US$1500 per ounce, and isn’t far short of that mark at the moment.

However, gold is just one commodity in this company’s arsenal.

Aldoro has multiple nickel assets

Aldoro completed a maiden drill program at the Firefly Prospect of its Leinster Nickel Project in WA in early October.

It tested three high priority nickel sulphide targets delineated in the company’s 2018 electromagnetic survey.

Importantly, this ground had not undergone prior drilling, and with assay results imminent there could be further share price catalysts in the wind.

Drilling at the Firefly prospect encountered a mixture of minerals with only trace sulphides associated with the ultramafic units.

Given this backdrop, the company is likely to focus on future exploration on geochemical and stratigraphic targets.

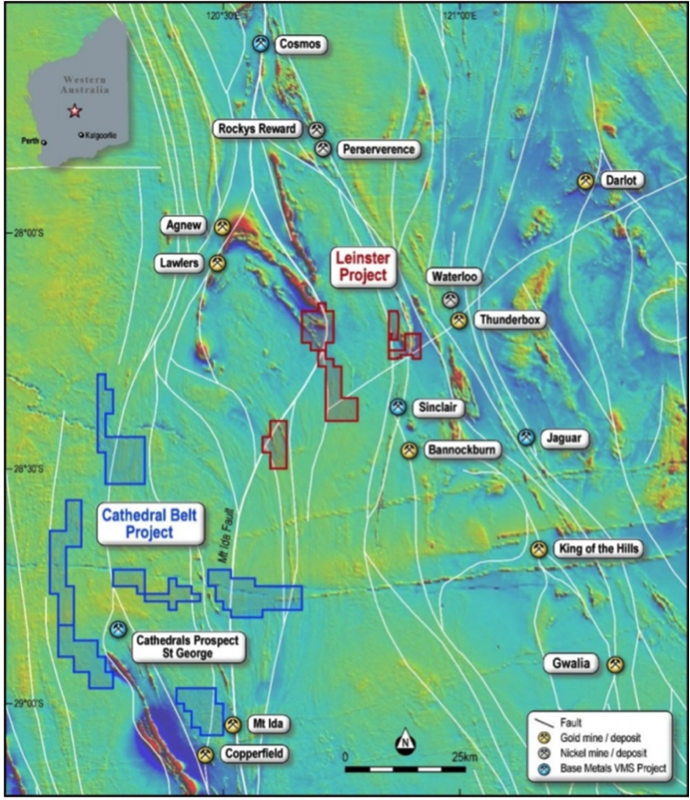

It should be noted, the broader Leinster Nickel Project covers mapped and interpreted ultramafic units located along strike from Talisman Mining’s Sinclair Nickel Project and BHP’s Leinster Nickel Operations, which include the Perseverance, Rockys Reward and Venus deposits as shown on the aeromagnetic image below.

You can read more about the Talisman relationship in the following Finfeed article:

Aldoro also provides strong exposure to nickel through its established Leinster and Cathedrals Belt projects, as well as opportunities such as the Narndee Igneous Complex (nickel-copper-platinum group metals) and the Windimurra Igneous Complex which is also prospective for nickel, copper and platinum group metals, as well as lithium.

It is Cathedrals Belt that could be the jewel in the crown

Could Cathedral be a temple of boom?

Aldoro is highly focused on the nickel sulphide potential of the Cathedrals Belt Project, 250 kilometres north-west of Kalgoorlie, adjacent to nickel sulphide discoveries made by St George Mining Ltd at the Cathedrals, Strickland and Investigators prospects, within their Mt Alexander project.

Aldoro’s interpretation based on its own high resolution aeromagnetic survey is that the ultramafic units hosting St. George’s nickel-sulphide mineralisation may extend into Aldoro’s tenure.

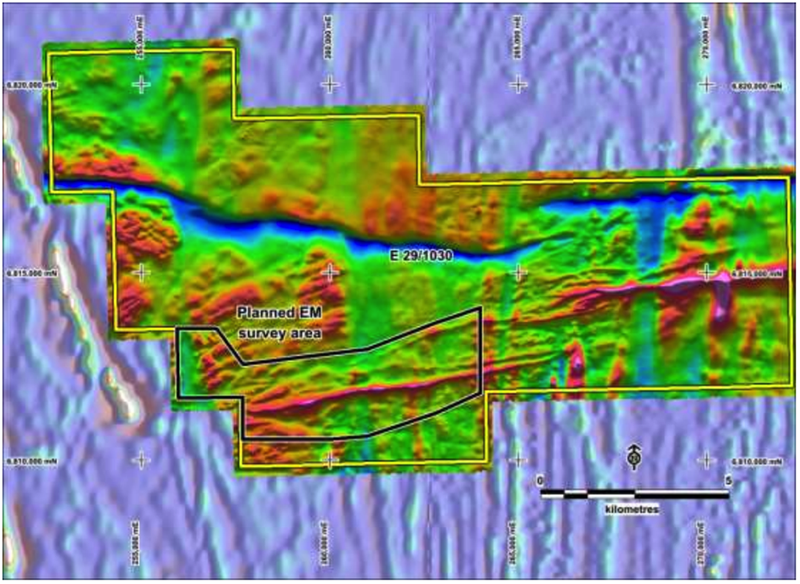

The company’s tenement E29/1030 lies directly along trend to the east of St George’s Mt Alexander project, and aeromagnetic images show a discrete east-west magnetic feature in the south-west portion of E29/1030 as shown below.

Aldoro is in the process of conducting a ground moving loop electromagnetic (MLTEM) survey over an area of E29/1030, with a view to identifying whether any conductive zones potentially indicative of accumulations of sulphide minerals are associated with this identified feature.

Such conductors would form high priority follow-up drill targets.

GEM Geophysics have been mobilised to site and the survey is expected to take four weeks to complete.

Results will be available after survey data is processed and modelled, a potentially market moving development.

Given the significant strike rate of successful exploration initiatives in the broader area, positive news could be imminent.

This comes as nickel hits a five year high.

Nickel demand

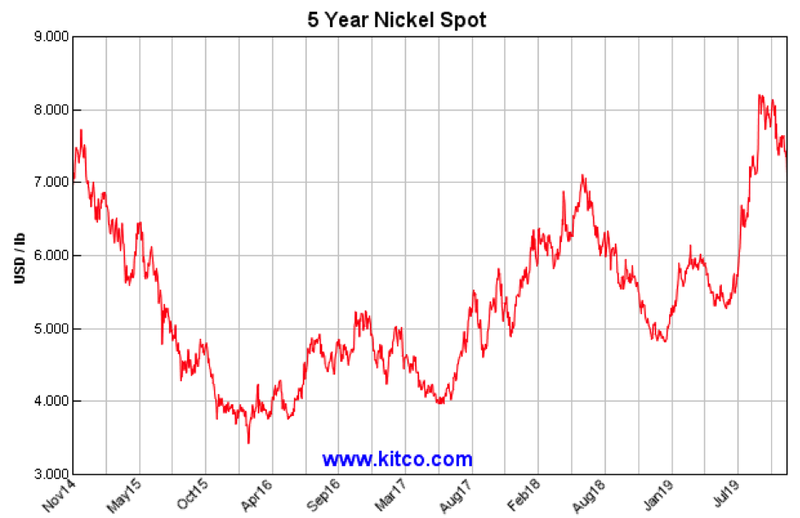

As evidenced by the following chart, nickel is one of the more volatile base metals, but it is worth noting that even since the retracement the metal is close to the five-year high of about US$7.60 per pound that it struck in August before surging beyond the psychological US$8.00 per pound mark.

Consequently, it would appear that nickel is taking a breather rather than experiencing a downturn.

It is a similar story on the equities front - with the bull run that lasted some four months finally topping out, there was no doubt some profit-taking would occur.

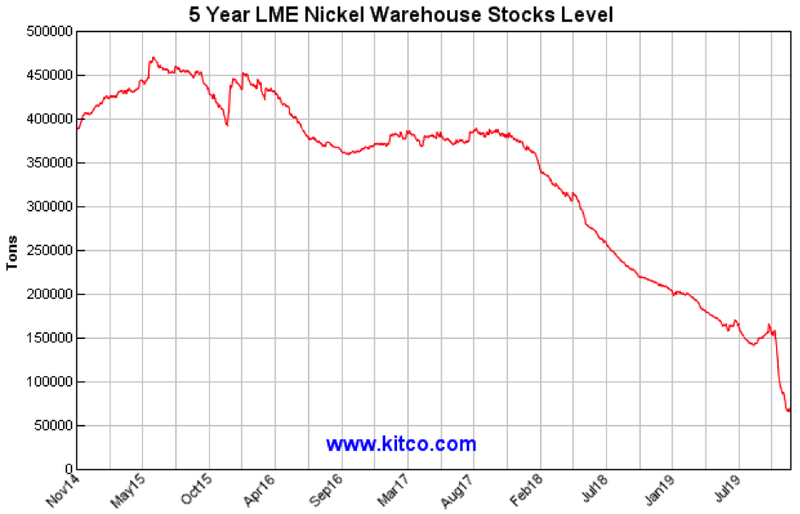

The supply side metrics support the premise that nickel’s retracement is more than likely short-term.

London Metal Exchange nickel warehouse stock levels are at a five-year low of about 66,000 tonnes compared with more than 160,000 tonnes in mid-September.

As indicated below, looking at the longer term picture, warehouse stocks have been in an almost uninterrupted downward trajectory since mid-2015, falling from more than 450,000 tonnes.

With demand for nickel expected to be driven by the proliferation of technological devices that require nickel as a component to achieve power storage and rechargeable functions, it would appear that the supply side of the equation is also looking promising.

Analysts upbeat and corporate activity is positive

Independent commodities research house, PCF Capital released its November report on Tuesday where it predicted average nickel prices in 2020 and 2021 of US$7.24 per pound and US$7.43 per pound respectively.

Analysts at Bell Potter also suggested a promising outlook for nickel with their 2021 and 2022 forecasts updated as recently as 31 October to US$7.45 per pound and US$7.85 per pound respectively.

At these price points there are healthy margins for nickel producers, indicating that renewed strength in nickel stocks may not be far away.

On the corporate front, PCF also pointed out that it was very recently one of Australia’s most prominent nickel groups, the $3.7 billion Independence Group NL (ASX:IGO), announced its intention to make an off market takeover bid to acquire all of the ordinary shares of Western Australian nickel producer Panoramic Resources Ltd (ASX: PAN) at an offer price of 47.7 cents per share, implying a value of $312 million.

This represented a hefty premium of nearly 50% to Panoramic’s previous closing price, not the type of deal Independence would entertain if it was sceptical about the nickel price.

With the company and its management team having such a long and successful history of generating substantial profits from astutely exploring, developing and operating nickel projects it is difficult to imagine that Independence Group has got it wrong.

If it was undeterred by the recent retracement in the nickel price that could be viewed as another box ticked.

The final word

The key positive takeaways for Aldoro, post Altilium acquisition, are its experienced and successful management team, multiple advanced exploration targets and diversified commodities exposure.

With extensive newsflow likely to emerge from four key areas in 2020, including the drilling program that will start as soon as possible, Aldoro has the potential to experience significant share price momentum over the next 12 months.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.