Strategic investor tips in $12.1M - 42% premium to share price

Our bauxite Investment Canyon Resources (ASX: CAY) has just secured a strategic investment from investors who specialise in projects in Africa - Eagle Eye Asset Holdings.

The strategic investment sees CAY raise $12.1M at a share price of 6c per share — a ~42% premium to the company’s 30-day VWAP (volume weighted average price).

The deal also sees CAY issue 1:1 free options to the strategic investor who will own ~19.9% of CAY after the deal is completed and become the company’s largest shareholder.

The dilution to existing CAY shareholders is as follows:

- 202,900,000 CAY shares

- 202,900,000 options (exercise price of 7c per share, expiry date - 10 August 2025)

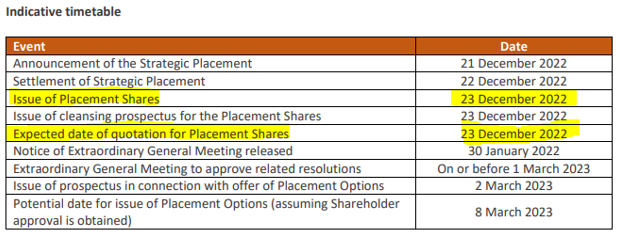

The shares are expected to be issued this Friday (23 December 2022):

What’s next for CAY?

Mining Convention Agreement 🔃

The Mining Convention is the key agreement with the State of Cameroon that sets out fiscal and legal rights on the project, and it is the precursor for a mining permit.

Once formally signed, this agreement will allow CAY to begin negotiating offtake agreements and development financing partnerships.

As of the latest quarterly report CAY confirmed that applications for the granting of a mining permit have been completed and submitted.

The next step will be to sign off on the Mining Convention agreement.