Raising $7.1M to move to full ownership of flagship project

Yesterday, our Catalyst Hunter copper exploration investment AuKing Mining (ASX:AKN) detailed its planned capital raise for upto $7.1M @ 14c per share.

The capital raise has been split into two:

- $3.61M to be raised via a placement.

- $3.51M to be raised via a one for three non-renounceable rights issue open to all existing shareholders.

Funds raised will enable AKN to move from 75% to full ownership of its flagship Koongie Park project in WA and accelerate drilling at its most advanced prospects.

The Placement is in two tranches, with the first tranche of 18.822 million shares to be settled shortly, with the remaining 7 million shares to be settled after shareholder approvals next month - this covers firm commitments that have already been received for ~$3.61M from sophisticated and professional investors.

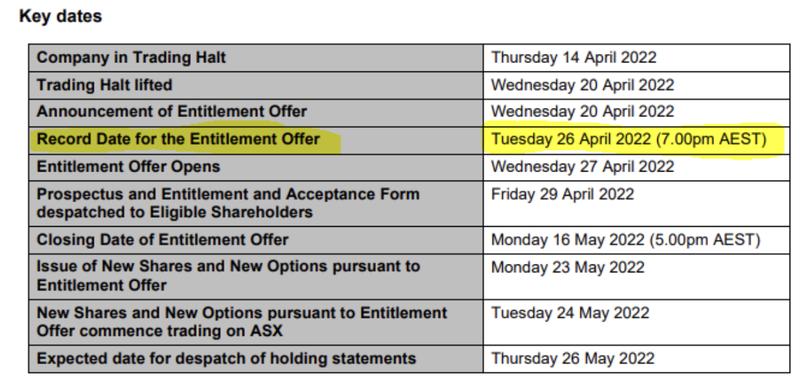

The non-renounceable rights issue on the other hand entitles existing shareholders to purchase 1 new share @ 14c for every three AKN shares held as at the record date of 26th April 2022. This means that any new investors that invest in AKN between now and Tuesday 26th April should be eligible to participate in the rights issue.

The key dates for the entitlement offer can be seen below with the offer opening on Wednesday, 27 April 2022 and closing on Monday, 16 May 2022.

Both the placement and rights issue shares will also have one free option for every three new shares applied for. The options will be listed and will have an exercise price of 25c per share with a 30 June 2023 expiry date

The raise is priced at 14 cents per share, representing a 12.5% discount to AKN’s trading price on 13 April 2022 and a 23.5% discount to the 15-day VWAP (18.3c) - whilst the discount might seem a little steep, we like that the placement is fully underwritten, which means that AKN is guaranteed the total $7.1M.

We suspect that trading in AKN will remain near the placement price until the raise is completed.

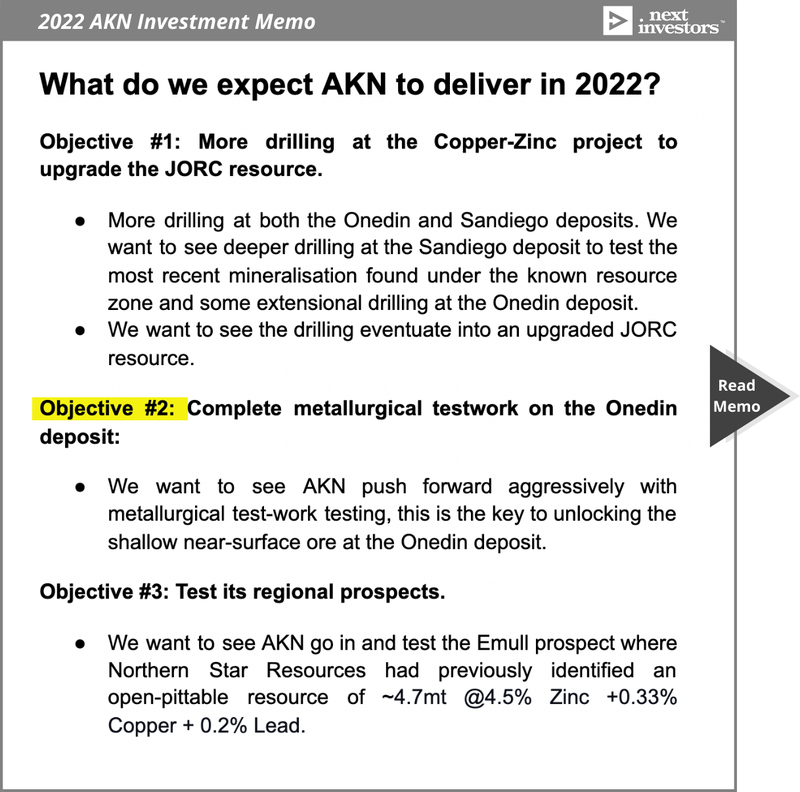

With funding secured to move to full ownership, the next key milestone we await are the metallurgical testwork results which is the key to unlocking the value in AKN’s JORC resource - with preliminary results likely in the next few weeks.

Our detailed take on AKN’s prospects and what else we are anticipating in the year ahead can be found at our AKN Investment memo.