LNR starts diamond drilling at big carbonatite targets

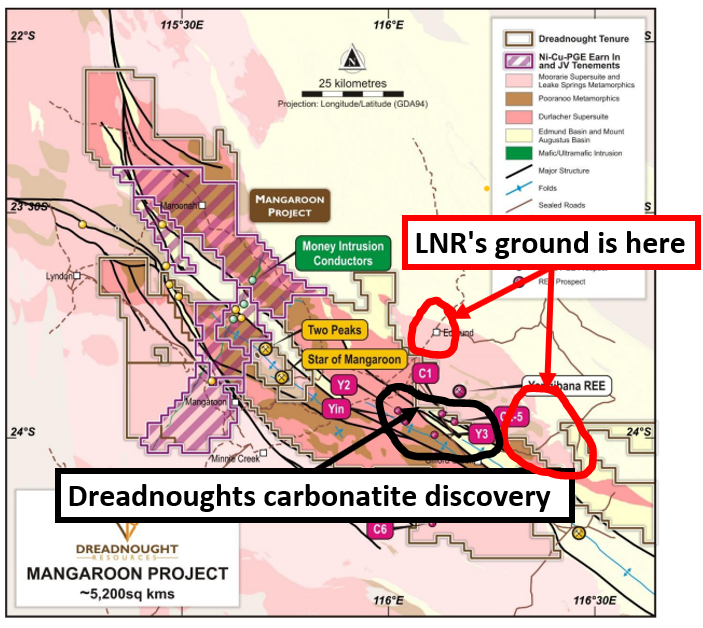

Our rare earths Investment, Lanthanein Resources (ASX:LNR) announced today that it has started drilling its big carbonatite targets in the Gascoyne Region of WA.

We’ve been eagerly anticipating this progress and we see these carbonatite targets as potential source of a re-rate for LNR given:

- The fact that Lynas Rare Earths’ Mt Weld is a carbonatite hosted deposit

- The scale of the targets - they are between 2-4km in diameter and go up to 2km deep - similar in size to the discoveries made by Dreadnought Resources.

- Potential to be the source rock for the rare earths in the region - the blue sky theory for the carbonatite targets are that they are the host rocks for all of the rare earths mineralisation in the region including $262M Hastings and $192M Dreadnought.

This is what the drill rig looks like, on site, right now:

That’s not all that LNR is up to either - the company is currently progressing a +10,000m RC drilling program which is testing numerous magnetic ironstone targets which have already delivered solid rare earths grades.

Read more about LNR’s current drilling program and our expectations

Today’s announcement also included some good rock chip grades (peak of 4.19% TREO) from newly found ironstones which form part of a 1800m strike ~3km south of Hastings Technology Metals’s proposed mine.

LNR’s proximity to Hastings and Dreadnought forms the basis of our Big Bet for LNR as per our LNR Investment Memo:

LNR discovers and proves a rare earths deposit significant enough to become an acquisition target for one of its bigger neighbours Dreadnought or Hastings - OR LNR becomes part of a consolidation play for all three companies.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LNR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

As for the macro theme of rare earths - the rare earths market has cooled a bit recently.

However, we are long term Investors in LNR and see LNR as part of a decade long push by Western countries to re-shore or “friend source” critical raw materials.

If Western countries are serious about weaning themselves off Chinese rare earth supply - they will need the resources that Australian rare earths companies can provide - and in the long-term we are betting on LNR contributing to that supply chain shift.

What’s next for LNR?

Drilling at WA rare earths project 🔄

We could see visuals and assays from LNR in the near term.

Assays from the South Australian rare earths project 🔄

LNR just recently finished its first ever drill program at its South Australian rare earths projects.

So far the company has put out some preliminary XRF (first pass hand held assay tool) results from the project, next will be the final assays from the program.

Here LNR is chasing a discovery similar to ASX listed Australian Rare Earths which is capped at $40M and has a 81.4Mt resource with grades of ~785ppm (Total Rare Earths Oxide).