HAR publishes resource update to uranium project in Senegal

Today our uranium exploration Investment Haranga Resources (ASX: HAR) upgraded its JORC uranium resource.

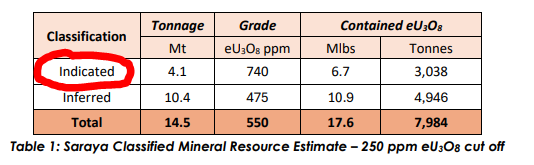

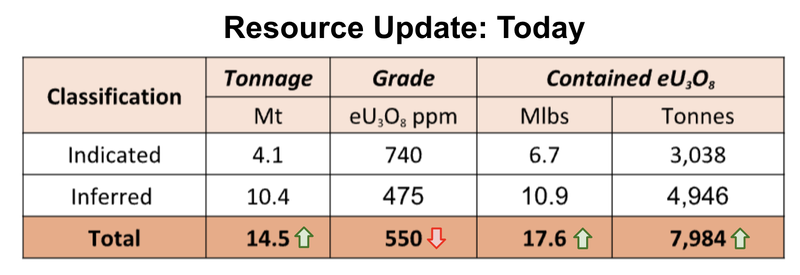

HAR managed to increase its JORC resource by ~9% to now sit at - 17.6M lb’s of uranium.

More importantly, though, HAR managed to increase the confidence categories of its resource.

Previously HAR’s entire resource was in the inferred category. Now HAR has a big chunk of its resource in the higher confidence Indicated category.

The higher confidence interval is important when a company is looking to move out of the exploration stage and into the feasibility study stage.

Almost 40% of HAR’s JORC resource is now in that indicated category.

HAR owns 70% of its project in Sengal.

Today’s resource update comes after ~6-9 months of drilling from HAR and we noticed HAR mention that if a lower grade cut-off was applied to its estimate the resource could grow even further to ~19.8M lbs of uranium.

Given the uranium price rally to above US$100/lb recently lower cut-off grades might become more relevant to HAR’s project.

(Source)

While it is early days, and the spot price is yet to recover from its +US$100/lb highs, we’re hoping a uranium/nuclear power renaissance can aid the HAR cause.

Learn more about cut off grades here: 🎓Cut-off grades explained

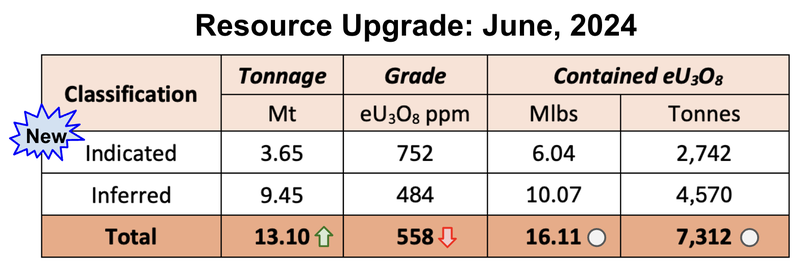

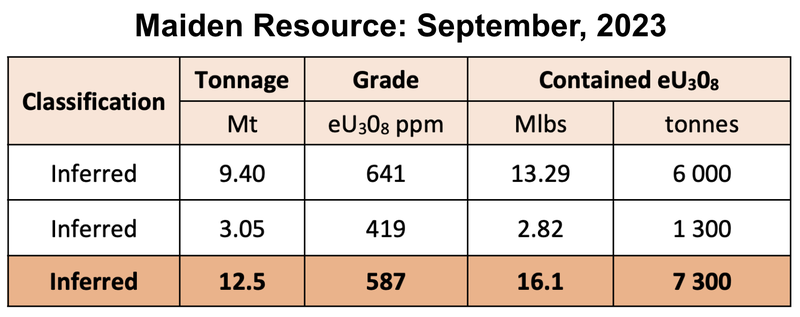

Here are the results and how they compare to the maiden resource published in September last year:

Our take on the results:

We think the resource upgrade on its own was a great result for HAR but, a big part of our Investment Thesis was to see HAR add to the resource through new discoveries.

When we first announced our HAR Investment we noted the company had six large anomalies remaining to drill test.

Our thinking was that HAR could make a new discovery similar to its current resource & increase the size/scale of its projects significantly.

Existing 16m lbs JORC uranium resource with plenty of exploration upside

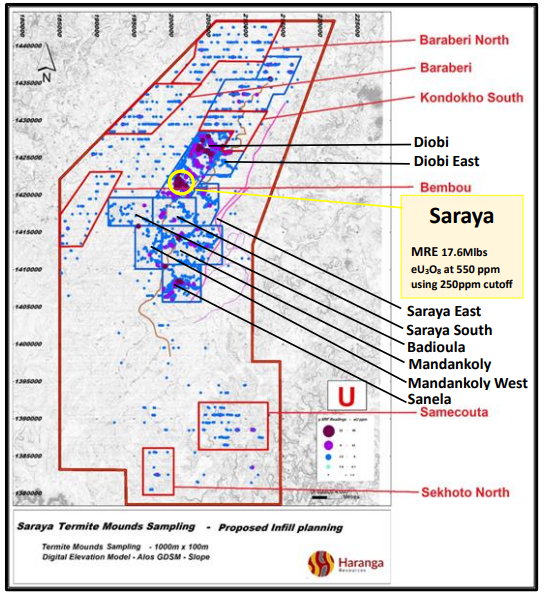

HAR’s initial resource released last week is only scratching the surface on its project. Mostly using Areva’s historical 62,000m of drilling, HAR has a further 6 anomalies covering far more ground than the initial resource yet to be tested.

Source: “Why did we Invest in HAR” - HAR Investment Memo 27 September 2023

Unfortunately, as it can happen with exploration targets, HAR didnt manage to make a discovery as big as Saraya (where the current JORC resource is.

There is still heaps of work HAR can do to look for that new discovery but for this first round of drilling we didnt get to see that big surprise new discovery.

HAR had ~$300k in cash in the bank at 30 June 2024 so its likely the company will need to raise more cash to go after the exploration targets at its project.

How does today’s news impact our HAR Investment Memo?

Objective #3: Increase JORC resource

We want to see HAR multiply its existing 16m lb JORC resource.

Source: “What do we expect HAR to deliver?” Section - HAR Investment Memo 27th Sept 2023

The results show a 17.6Mlb resource at 550ppm grade of uranium indicates that there was some progress in increasing their resource.

Exploration risk

HAR is planning to drill exploration targets to grow its uranium resource.

Exploration activities may or may not return any uranium mineralisation or low-grade uranium resource that is uneconomic.

Source: “What could go wrong” Section - HAR Investment Memo 27th Sept 2023

The results highlight that the exploration upside did not materialise to the extent that they had hoped for, which puts a spotlight on the risks associated with exploration.

Funding risk

HAR is a junior explorer with no revenues to fund exploration and ongoing costs. This means the company is reliant on capital raises to fund exploration programs

Source: “What could go wrong” Section - HAR Investment Memo 27th Sept 2023

With HAR having around $300k in the bank, they will likely need to raise more capital to continue exploration.

What’s next for HAR?

Strengthen balance sheet 🔄

The first thing we want to see HAR do is strengthen its balance sheet and add to its current ~$300k cash balance.

Exploration across remaining targets 🔄

After the balance sheet is strengthened we want to see HAR go out and re-test all of the targets where the company thinks it could make a Saraya style discovery.

Here are those targets relative to HAR’s existing JORC resource: