Elon Musk weighs in on lithium prices

Elon Musk had something to say about sky-high lithium prices over the weekend.

Musk dropped a comment in on Twitter:

Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.

— Elon Musk (@elonmusk) April 8, 2022

There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.

All of this feeds directly through to the prospects of our lithium investments across our Next Investors, Catalyst Hunter, and Wise Owl portfolios, more specifically:

Vulcan Energy Resources (ASX:EMH)

European Metals Holdings (ASX:EMH)

Each of these three companies is at a different stage in their life cycle. Vulcan has multiple offtakes secured, Latin Resources is an exploration stage company hunting a JORC resource in Brazil and EMH is working on a DFS and offtake negotiations.

Which means different styles of advancing the company’s business.

For example, we note that Vulcan CEO Francis Wedin also took the Musk comment as an opportunity to make a pitch.

Happy to help with our #ZeroCarbon #Lithium™️ @elonmusk and @Tesla. We’re fully sold out to #European customers for current production plans but can discuss future expansions. https://t.co/mn6fuDty2L

— Francis Wedin (@FrancisWedin) April 9, 2022

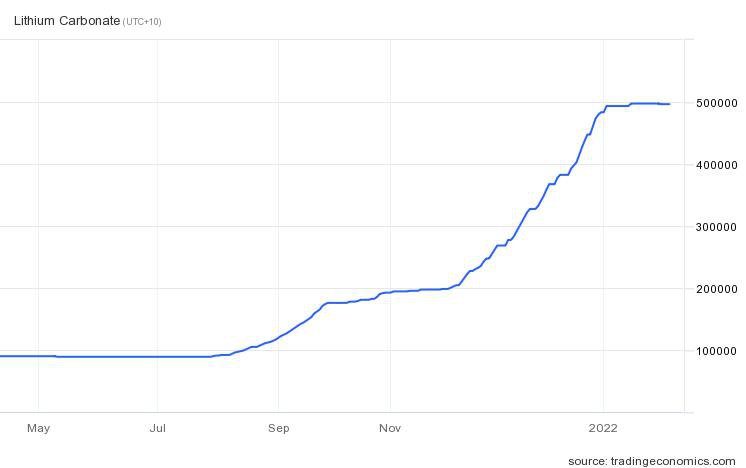

Below is the lithium price chart, which is starting to level off after a meteoric rise:

This run up in price has raised the spectre of demand destruction, and the potential for a 25% increase in the cost of an EV according to Morgan Stanley.

In this context, we think Musk’s comments indicate that Tesla and other EV manufacturers may look to take equity stakes in lithium companies to secure their access to the battery metal supply chain.

We also note that EMH in particular could stand to benefit from consistently elevated lithium prices as it makes their deposit more economic.

The EMH share price is in a consolidation phase and we think this is indicative of market sentiment towards lower grade lithium deposits - no matter how ideal their location (EMH is based in the Czech Republic).

Musk made a follow up comment regarding lithium processing as well, saying “We have some cool ideas for sustainable lithium extraction & refinement.”

If Tesla or other companies can make a breakthrough in processing technology or alternatively, lithium prices go even higher, we expect companies with well-defined resources (like EMH) to garner additional attention.

What’s next: We expect more EV battery makers to consider taking stakes in lithium companies, and with regards to EMH we’re looking forward to the completed DFS, progress on financing and potentially a positive surprise in the form of offtake agreement.