Macro Outlook US-Based Commodities - 2023

We believe the new trend of “de-globalisation” to bring security of supply will place high value on finding and developing resource projects inside a countries borders.

Specifically for critical materials required for the energy transition.

We had great success with this thematic in Europe, and now are adding the USA.

The 2020 COVID pandemic and the Russia/Ukraine war has changed the way world trade is conducted.

Decades of globalisation has led to the hollowing out of the US manufacturing/commodities complex and exposed shortages of critical raw materials/supplies.

For some context, China controls ~80% of the world's lithium hydroxide processing capacity and Taiwan makes 65% of the world’s semiconductors and almost 90% of the advanced chips.

The US government recognises this and over the last three years signed into law multiple infrastructure spending bills such as:

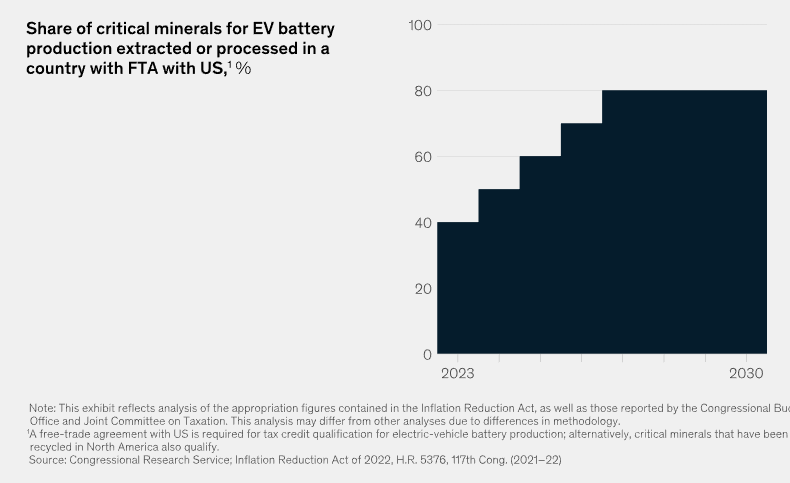

- The Inflation Reduction Act (IRA) - Allocating ~US$400BN over the next 10 years towards clean energy technologies and supply chains INSIDE the US.

- The Bipartisan Infrastructure Law (BIL) - Allocating US$1.2 trillion in funding over the next 10 years on US based infrastructure.

- The CHIPS & Science Act - Allocating ~US$280BN over the next 10 years on domestic semiconductor manufacturing, R&D and wireless supply chains.

The US is now throwing almost ~$2 trillion over the next 10 years into building up domestic manufacturing capacity and a secure supply of the critical raw materials needed for industries like Electric Vehicle (EV) batteries and semiconductors.

Our view is that the US government has recognised the need to build out domestic manufacturing capacity to ensure a safe, secure supply of the critical raw materials needed to produce the products of tomorrow.

This will mean that US based commodities projects, especially those that are considered critical raw materials will benefit the most from a wave of capital flooding back into the US.

An example of this is the US$700m conditional commitment from the US Department Of Energy for the Rhyolite Ridge lithium Project in Nevada.

What the analysts say

Professor for finance at the Perdue school of business at Salisbury University, Danny Ervin comments on the decades of underinvestment in US based commodities saying that “While China has made mineral production and processing a strategic priority, the U.S. has done the reverse. Mining in the U.S. has been pushed to the margins” and that “The reality is we rely on China, Russia, Afghanistan and other adversaries for two-thirds of the minerals and metals we import”.

With demand for batter metals expected to grow by 600% up to the year 2040 Ervin shares our view that the only way the US reduces import dependance and ensures secure critical minerals supply is by investing in its domestic mining industry.

What about the bear case?

This might get a little technical, so bear with us…

Our bear case is that the current financial system isn’t built to allow the US to localise everything and remain the world’s reserve currency at the same time.

As the world’s reserve currency the US dollar is the unit of account with which trade is settled.

Think of the oil price which is almost always quoted in US$ per barrel.

This system only works because of globalisation, the US exports its currency (USD) to the world in exchange for ‘stuff’ - the rest of the world gets USD and uses it to purchase ‘stuff’ it needs.

At the highest level for the system to work USD needs to be exported.

If the US stays as the reserve currency but no longer exports currency, as it tries to localise the supply chain, the system stops working as people don’t have USD to buy stuff.

This puts the rest of the world in a strong position to create a new reserve currency and new unit of account to settle global trade in.

The US won’t want to lose its status as the reserve currency as it allows them to dictate the terms of the World Order - which might mean that it returns to globalisation, or selective globalisation with a few key allies appointed as outsourced supply chains.

The other looming factor is a global recession.

A global slowdown in economic growth will mean demand for these commodities slows and the need to invest in new supplies shrinks.

Our Commentary on US-Based Commodities

What happened at RIU Sydney?

Weekender

May 13, 2023

|Next Investors

|15 min

This week we were at the RIU conference in Sydney, meeting our portfolio companies and looking at new investment opportunities. During this time, we saw Latin Resources (ASX:LRS) - our Brazilian Lithium Investment, have a nice little share price run. Let's dive in!

Potential Lithium Comeback, Sydney RIU Conference and more...

Weekender

May 6, 2023

|Next Investors

|12 min

In this weekender, we look at the potential for a lithium price bounce back and the current macro environment surrounding this possibility. We will also be heading to Sydney for the RIU Conference, where we will meet several of our portfolio companies and provide an update.

Why the US needs Uranium Enrichment

Weekender

Feb 20, 2023

|Next Investors

|15 min

We have been looking at new Investment opportunities in the US uranium space for a while now but it was only yesterday that we finalised an Investment in a company that fits the bill.

What happened at RIU Sydney?

Next Investors

|May 13, 2023

Potential Lithium Comeback, Sydney RIU Conference and more...

Next Investors

|May 6, 2023

Why the US needs Uranium Enrichment

Next Investors

|Feb 20, 2023