What is a share price catalyst?

Published 01-SEP-2023 14:04 P.M.

|

7 minute read

A “share price catalyst” can be any news that could move a company's share price in a significant way (up OR down), depending on the outcome.

One way to think about a potential share price catalyst is as a “known unknown”.

We may know the subject matter of the event and have a rough idea of when it will occur, but will never know the end result.

The result could be good, or it could be bad - especially when investing in early stage exploration companies that live or die by delivering drilling results.

In this article we will use a “high-impact oil & gas drilling” as an example of a catalyst to demonstrate the general behaviour of investors in the lead up to the results.

What happens to share prices before a key catalyst?

Small cap companies with an imminent catalyst will often see a run up in their share price.

As results approach, interest and excitement builds up and speculators start entering the stock ‘betting’ on a positive result.

When drilling is underway investors start to price in blue sky discovery scenarios and the share price may enter the “speculative mania” stage.

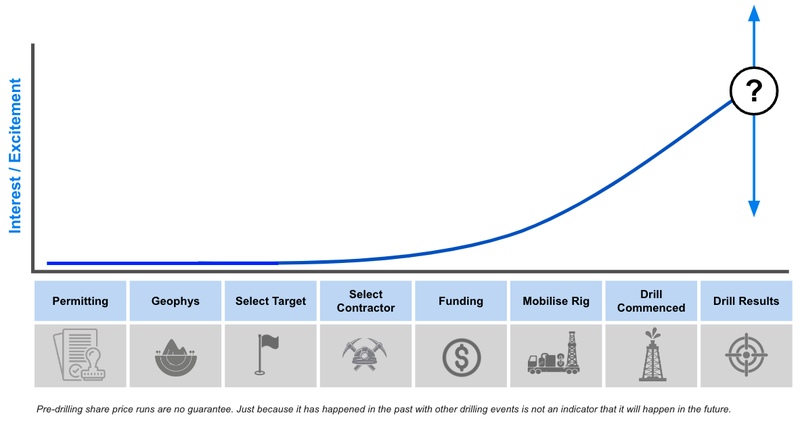

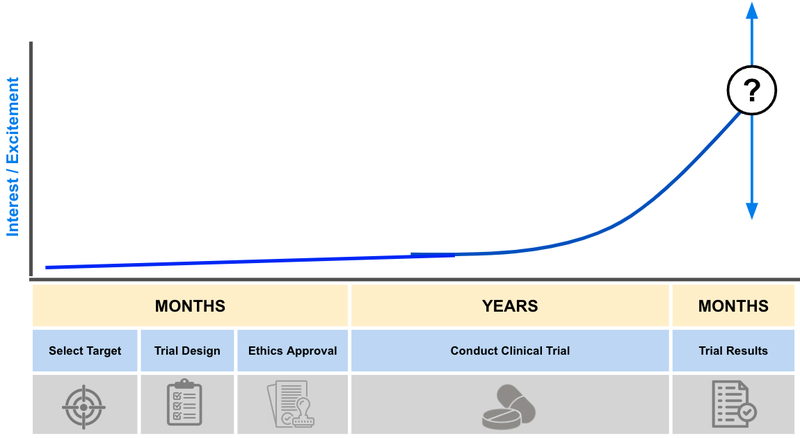

We created this chart that roughly approximates the general levels of increased excitement/interest in the lead up to a big drilling result for a small cap oil and gas explorer:

We have seen this pattern play out over a number of drilling events that we have invested in.

However, this doesn’t happen every time.

The share price of a company depends on many factors, including the broader market conditions, the amount of shares on issue for the company and the investor appetite for a specific project.

If the stars are not aligned on these factors, the share price may not run in the lead up to a catalyst.

Why do share prices run before a major catalyst?

A company’s share price is effectively a measure of supply and demand (buyers of shares vs sellers of shares).

As a catalyst approaches, those already holding shares are less likely to sell, as they want to be leveraged to the outcome of the results (holding on to their bet).

There is also an increase in demand from new buyers hoping to ‘bet’ on a positive result OR an increase in interest from existing shareholders looking to increase the size of their own ‘bet’.

This pushes the price of the stock upwards and the expectations for the company higher.

Our investment strategy in anticipation of a catalyst

Today, we will be using the example of a high impact oil & gas drilling event to demonstrate our investment strategy.

The outcome of an oil and gas drilling event is often binary, either the company finds something or it finds nothing.

Events with binary results are typically considered major catalysts - these provide large share price moves up OR down depending on the outcome.

As mentioned above, in the lead up to a big drilling event we often see that share prices of these companies slowly edge higher as investors speculate on what drilling “success” might look like.

Many years of observing these trends has lead to us developing our Investment approach to big drilling events:

- Invest early when the market isn't interested yet

- Hold our position as the company undertakes geophysics

- Set up bull/bear/base expectations as drill targets firmed up

- Increase position in pre-drill raise

- Top Slice/Free Carry (and Take Profit) in the lead up to drill results

- Hold our remaining position into the result

Let’s take a look at each of these stages in detail:

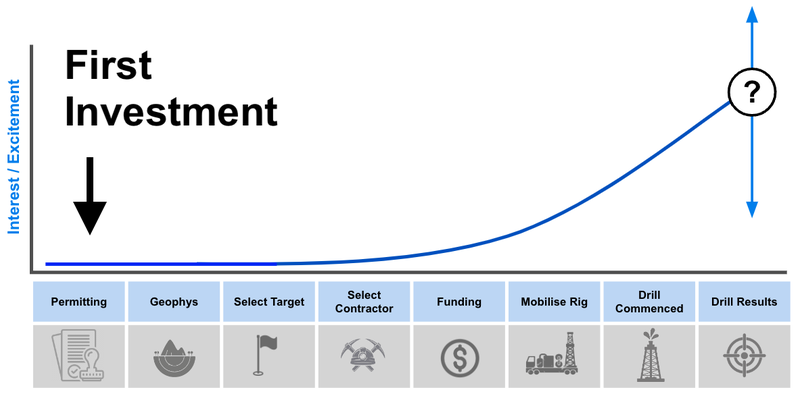

Invest early when the market isn't interested yet

We like to take a position well before a company lays out its drilling plan.

Generally this is when the company has just acquired a project and still needs to raise capital to identify some drill targets from geophysics/seismic work.

At this stage the company’s drill program could be years away and most investors are not interested yet.

Hold our position as the company undertakes geophysics

We like to hold onto our positions while the company completes geophysics/2D and 3D seismic work.

This process can often take longer than expected, leading to share prices trading sideways/lower, throwing up opportunities to increase our Investment in the company.

Set up bull/bear/base expectations as drill targets firmed up

The market first starts to take an interest as the company firms up its drilling targets and schedules a timeline for drilling.

We like to set up a bull/bear/base case in this scenario for the drill program.

🎓Read more about setting expectations for drilling events here: Expectation setting leading up to drilling programs

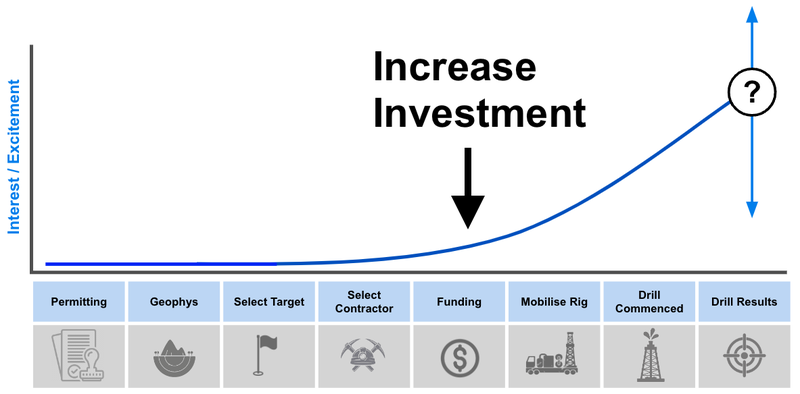

Increase our position in pre-drill raise

Drilling is expensive, and the company will likely undertake a capital raise to fund its exploration program.

At this stage, the exploration program has been de-risked, with a drill target identified, rig secured and date set for the drilling.

The market may expect this raise and so the share price can trade sideways or lower leading to a good opportunity to top up our Investment.

We sometimes like to take a position in this capital raise to increase our exposure to the drilling event.

Top Slice/Free Carry (and Take Profit) in the lead up to the results

In the lead up to, and during the drilling of a well, is when we tend to see the most market interest in an oil & gas explorer.

This typically leads to share prices spiking higher as investors speculate on exploration success.

We often look to Top Slice/Free Carry our positions here and sometimes even Take Profit.

Hold our remaining position into the results

We try to hold a meaningful position into the drilling results and then evaluate next steps based on the outcome of the drill program.

When evaluating the results will we look back on our bull/bear/base case scenario to objectively evaluate the merits of the results.

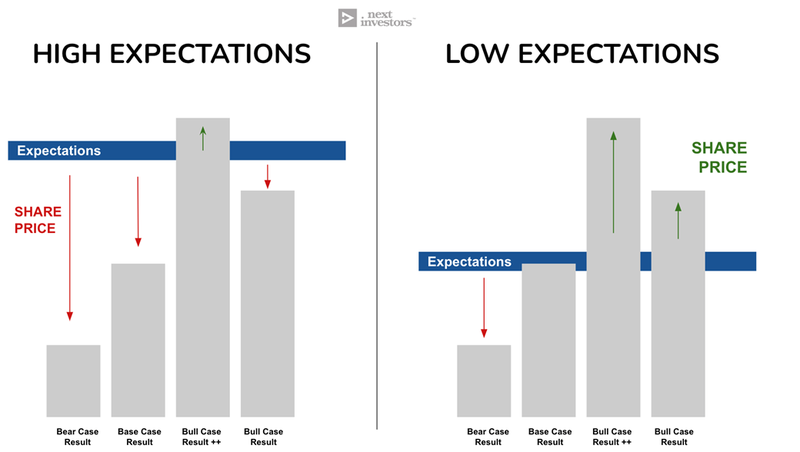

If the results beat our bull case but still go down, market expectations may have been too high for the drilling (this can happen for drilling events often caused by “speculative mania”):

In the event that the share price moves up, we still hold a meaningful position and have made a successful investment.

In the event that the share price moves down, we have (hopefully) Free Carried our position and are protected against large losses as the share price falls.

Share price catalysts in other industries

A share price catalyst is defined as an known event with an unknown result, where the result will have a meaningful impact on the share price of the company (up or down).

These events happen across all different small cap stocks across all different industries.

Trading behaviour for these “known, unknowns” often follow the same pattern as oil & gas drilling events, where there is a share price run in anticipation of the catalyst as investors look to ‘bet’ on the outcome.

Let’s take a look at some of these catalysts in different industries:

Biotech - Clinical Trials

The main catalysts for biotech companies are the results of a clinical trial.

Clinical trials are expensive and can take years to complete.

The results of a clinical trial can have meaningful impacts on a company’s ability to register the drug or technology.

The different phases of the clinical trials will have different results (also known as endpoints) that indicate different things like safety or efficacy of the treatment.

When companies publish these results, it could have a meaningful impact on the company’s share price (up OR down) depending if the company has met the safety and efficacy endpoints for the trial.

🎓If you would like to learn more about the phases of a clinical trial read: How we invested in early stage biotech

Mining - Drilling Results

Like high-impact oil & gas exploration, investors will like to ‘bet’ on the results of a company’s resource exploration.

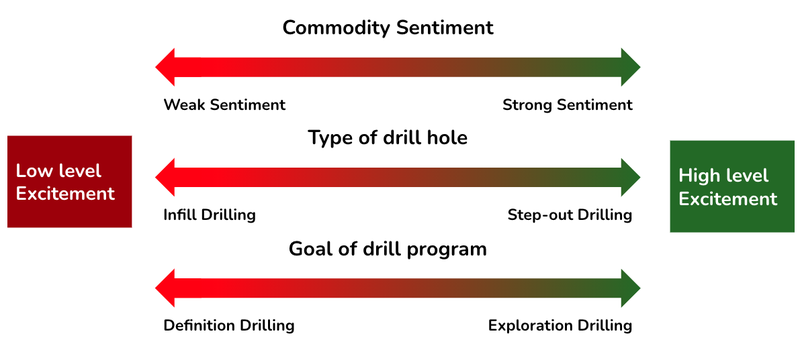

When evaluating the merits of a drilling catalyst there are a number of key factors:

- What is the commodity the company looking for

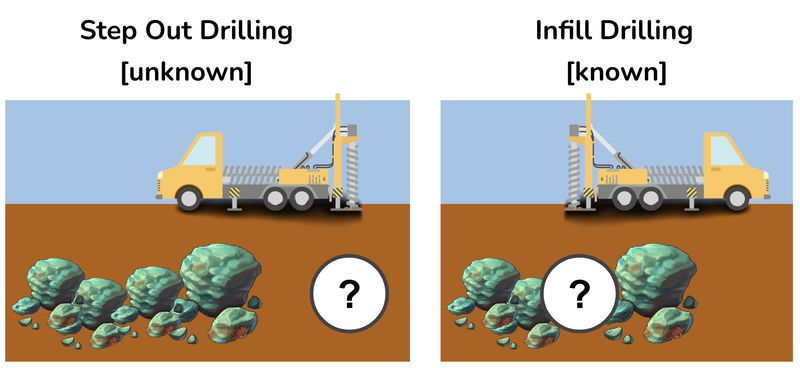

- What is the type of drilling done (step-out or infill)

- Is there known mineralisation: ‘definition’ or ‘exploratory’ drilling

Each of these factors will affect the levels of market excitement going into the drilling program and results.

It’s important to know that although exploration drilling and step-out drilling provide higher levels of excitement, they also come with greater risks of failure.

This is because the company will be drill testing an area where the company doesn't know what to expect - the known unknown...

Conclusion: Investing in catalysts

Investing for small cap catalyst opportunities is high-risk, high-reward.

It doesn't always play out as we expected and market conditions can play a big factor in how well we are able to execute this strategy.

We use this approach as part of a diversified Portfolio, so any losses we do have on these big drilling events are mitigated by our other Portfolio positions.

Importantly, while this Investment approach works for us, it may not be suitable for everyone.

Only invest what you can afford to lose when it comes to speculative small cap stocks, and always seek financial advice before investing.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.