Venus cashed up after sale of Yalgoo

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In an extremely positive development for the shareholders of Venus Metals Corporation Ltd (ASX:VMC), the company has sold its 50% interest in the Yalgoo Iron Ore Project for $2.5 million.

The Yalgoo Iron Ore project has a total JORC 2012 Mineral Resource of 698.2 Million tonnes at 29.3% iron.

This represents the divestment of what management referred to as a ‘stranded asset’ for the group given the substantial capital expenditure that would have been required to fully develop the project through to production.

An Australian company FIJV, ultimately controlled by a major engineering, procurement, and construction (EPC) contractor with over three decades' experience in the iron ore sector has acquired the project.

Shareholders will reap the rewards of the sale as the issued capital in Yalgoo Iron Ore, a wholly-owned subsidiary of Venus Metals is to be distributed to VMC shareholders on a pro-rata basis by way of a dividend, allowing those shareholders to potentially reap the benefit of any royalty payments.

Valuable royalty stream at current prices

Yalgoo Iron Ore Pty Ltd, a wholly owned subsidiary of Venus Metals, holds a 0.625% FOB royalty over alliron ore magnetite concentrate from the mining tenements being sold.

The current magnetite concentrate price is approximately over US$100 per tonne.

FIJV has advised the Mid-West Development Commission of its plan to develop magnetite open cut mines at Yalgoo, producing concentrate for shipment by export through the port of Geraldton.

Consequently, production from Yalgoo should generate a beneficial royalty stream for VMC’s shareholders.

Back to the core business

Venus now has $2.5 million to invest in advancing its various gold, base metal and vanadium projects, some of which already have an established JORC resource.

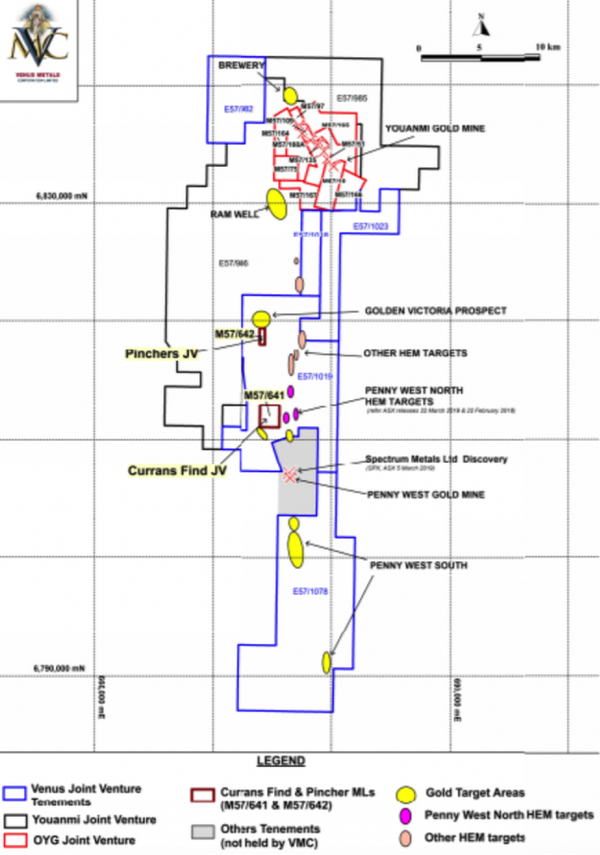

The company will undertake further drilling and mine planning at the 90% owned Bell Chambers gold project with a 14,000 ounce identified 2012 JORC resource near Youanmi in Western Australia.

In early 2015, Venus announced a JORC 2012 Compliant, Inferred Gold Mineral Resource Estimate of 219,000 tonnes at 2.0 g/t gold for 14,000 ounces at its Bell Chambers Gold Project.

However, surveys identified several anomalies, and these have been prioritised for modelling to determine geometry, depth and conductivity.

In addition, the company is reviewing all historical soil sampling and drilling data to further refine the drilling target locations for Venus’s future work programme.

Also on the gold front, further drilling will be undertaken at the 45% owned and managed Currans Find Gold Project in Youanmi where near surface high-grade mineralisation has been identified.

Vanadium project could be game changer

Venus will also be using its strengthened balance sheet to fund metallurgical work on the 90% owned Youanmi oxide vanadium project with a JORC Resource of 134 million tonne at 0.34% vanadium pentoxide.

Management had flagged this as a priority in March after the company established a new measured, indicated and inferred resource containing 459,000 tonnes of vanadium pentoxide.

Having established this resource, Venus is now positioned to confidently proceed with metallurgical test work and scoping studies with a view to rapidly advancing the project.

This comes at a time when the supply/demand equation for vanadium has improved significantly due to its applications in renewable batteries.

The proposed vanadium extraction for Youanmi is based on a potentially simple hydrometallurgical process taking advantage of the unique weathered vanadium oxide ore, and as such pointing to more positive project economics compared to conventional hard rock deposits.

The resource occurs from surface down to a depth of between 30 metres and 50 metres, making it the focus of initial studies for potential development through open cut mining activities which should enable relatively low cost production.

This is a significant aspect of the project given that vanadium developments generally are extremely capital intensive.

Early stage work at Doolgunna base metals project

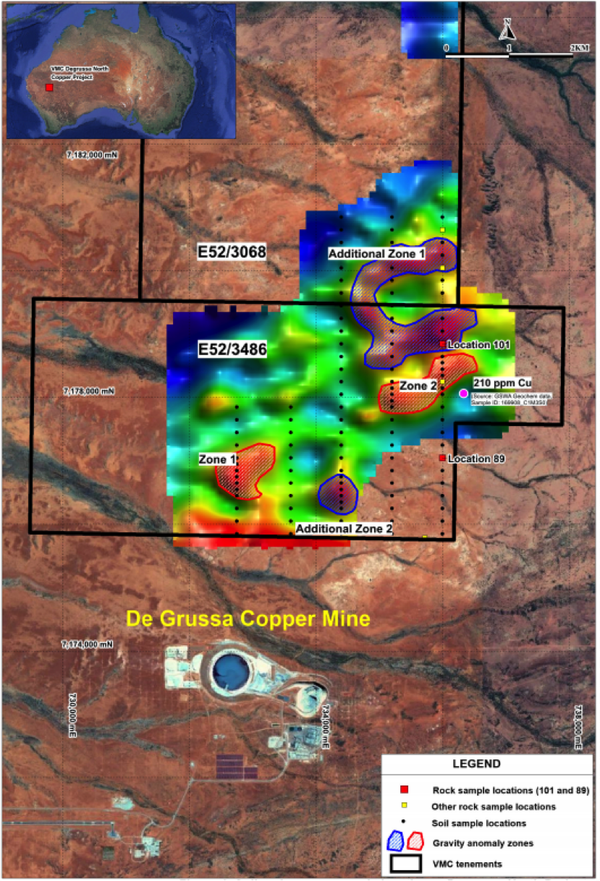

Venus also intends to undertake further mapping, sampling and geophysical work at the Doolgunna base metals project abutting Sandfire Resources’ (ASX:SFR) DeGrussa Copper Mine.

The discovery of sulphide boxwork gossans in the DeGrussa North tenement provided management with strong impetus for the electromagnetic testing of its targets aimed at the discovery of massive copper-gold sulphide at depth.

Given its close proximity to the high profile DeGrussa copper mine, the area under exploration could only be considered as highly prospective.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.