The Great WA Nickel Race has Begun

Published 29-JUL-2021 13:19 P.M.

|

5 minute read

Last week the starter gun was fired on a massive WA nickel race after Tesla signed a deal with BHP to buy its nickel.

This week our nickel investment Auroch Minerals (ASX: AOU) revealed its going to start its biggest drilling campaign to date in the next two weeks - drilling beneath its historic nickel mine.

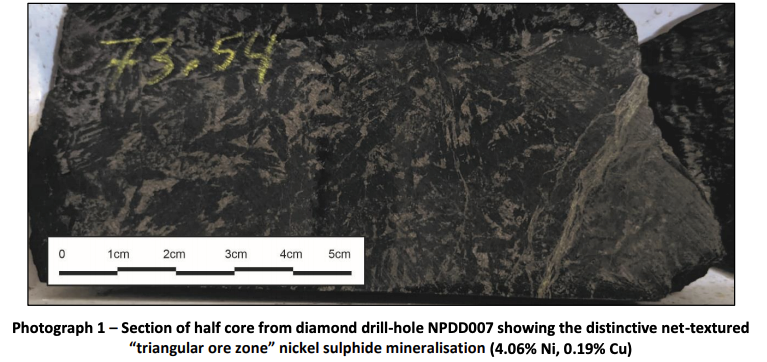

Today AOU also released two assay results from its recent drilling, confirming high grade textured nickel sulphides with 4.64m @ 2.99% Ni recorded.

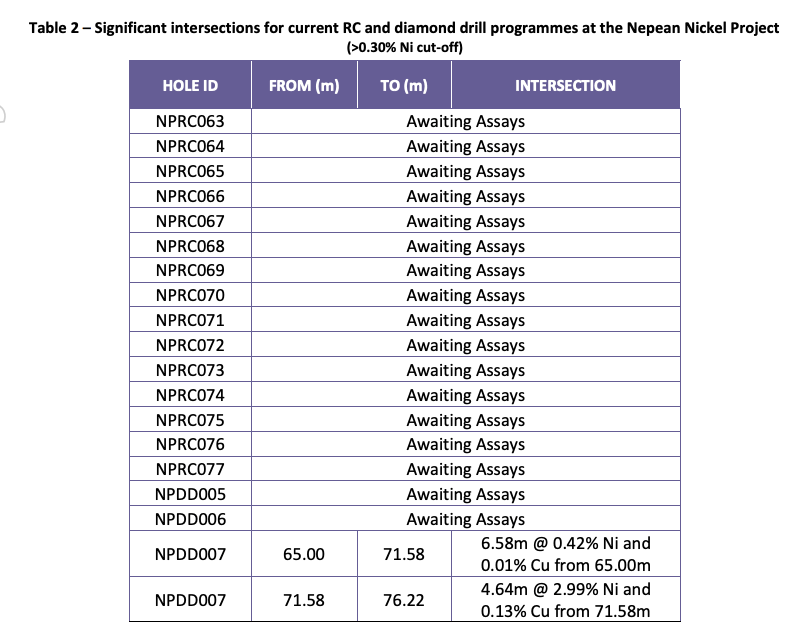

There are at least another SEVENTEEN assay results still to be released from AOU in the coming weeks.

70% of BHP’s WA nickel goes to the batteries market, and this market is expected to explode over the coming years.

High quality nickel sulphide - like that found in WA - is what all battery makers are searching for - it's the best type of nickel to power electric vehicles.

BHP is desperate for more high quality WA nickel near its smelters so it can sell it to battery makers, and AOU has one of the pole positions in this nickel race.

We invested in AOU at 20c in March because it is hunting large nickel sulphide deposits across a number of projects within trucking distance of BHP’s mining infrastructure.

One of AOU’s projects is a historic nickel mine that used to feed BHP’s smelter.

If AOU can discover a large high grade nickel resource, we would expect a large re-rate in the company’s share price.

BHP has publicly stated many times that it wants to buy nickel off third parties - like AOU - to feed its nickel smelters.

AOU will be drilling beneath this historic nickel mine in the coming weeks - large high grade nickel intercepts should capture the market's attention.

AOU already has an offtake agreement in place with BHP on one of its other nickel projects - which has over one million tonnes of ore - but AOU wants to find more nickel than that.

AOU’s current focus is drilling around and beneath its historic nickel mine to find and grow its nickel resource inventory.

AOU Drilling AROUND the historic nickel mine - more results in, a lot more coming

AOU previously found a number of EM conductor targets around the historic nickel mine and in the region that warranted drilling to test the nickel sulphide content of the targets.

Today AOU released two assay results from this drilling, confirming high grade textured nickel sulphides with 4.64m @ 2.99% Ni recorded.

There are another SEVENTEEN assay results still to be released - large high grade nickel intercepts will be viewed highly favourably by the market.

We want to see the lines on this table below changing from ‘Awaiting Assays’ to long high grade nickel intercepts over the coming weeks:

NEXT TWO WEEKS: AOU Drilling UNDER the historic nickel mine -

The big event for AOU investors starts in the next two weeks, with drilling under the historic nickel mine to take place.

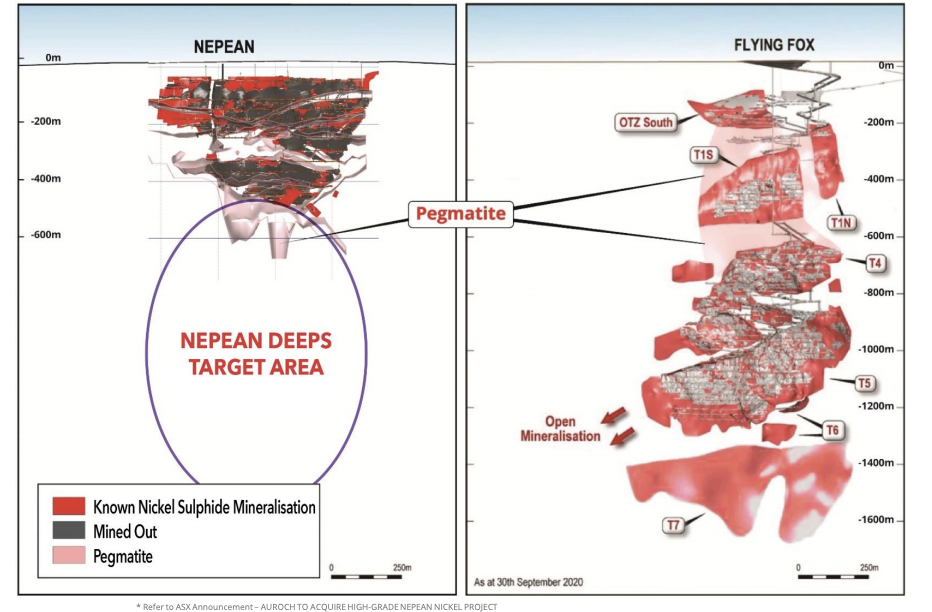

AOU is applying the same strategy that delivered additional nickel resources for Western Areas at its Flying Fox mine (on the right in the image below).

On the left shows how shallow AOU’s mine has been drill tested - to around 500m.

AOU’s drilling coming in the next two weeks is going down to a depth of 1,200m - two holes are planned.

AOU’s planning was completed with the help of WA nickel gurus. An expert group of nickel sulphide hunters that worked with the AOU team and all the data gathered to date to establish the precise locations for the upcoming drill holes.

As well as deep drilling, AOU will start geophysical surveys such as DHEM, as well as possible down-hole magnetometric resistivity (MMR) and/or down-hole induced polarisation (IP) to test for any conductive units that may represent nickel sulphide mineralisation within a radius of approximately 75–150m from each drill-hole.

Further drill-holes will then be planned to test any target areas that may arise from the initial drilling.

AOU capital structure and funding

AOU put out a corporate presentation last week that gives a good overview of all of AOU’s projects.

We got a glimpse at AOU’s cash balance ahead of the quarterly - the presentation shows AOU had $3M in cash at June 30.

Funding at the moment is coming in from option holders that are exercising at 10c a share.

AOU has another circa 20 million options on issue at a strike price of 10c that expire 30th November 2021, so assuming they all get converted, that would bring in another $2M to the company, which should give it enough cash for the foreseeable future of exploration.

That all depends on AOU’s share price remaining well above 10c between now and November - given the amount of drilling and results coming between now and then, we assume most will get converted.

Here is why we like AOU:

- WA nickel could be highly sought after if BHP and Tesla are seeking nickel in the state.

- Nickel is going to play a key part in EV batteries for the coming decades - we are bullish on the long term nickel price.

- AOU is aiming to unlock a much larger nickel resource below/along strike to an old nickel mine. This has happened before in WA – Western Areas is the case study here, and shareholders were hugely rewarded.

- AOU continues to deliver impressive drill results, confirming thick, high grade nickel at shallow depths at its historical nickel mine.

- AOU has a number of options that exercise at 10c that have been converting into shares over recent months. This is good in that it brings funds into the company without having to tap the broader market, however it is worth noting that this can also soften upward momentum in the share price. These options expire November 30th 2021.

- AOU is aiming to build over 100kt of nickel resources, and has multiple nickel exploration projects - we like the scale of the company’s goal.

What to expect next

- Quarterly report: We should see the AOU quarterly report out in the coming days where we get a better look at company progress last quarter.

- More assay and DHEM results from 2,000m regional RC drilling campaign at Nepean: Coming weeks

- 3,000m "Nepean Deeps" drill programme: Scheduled to begin in the next two weeks

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.