Tangiers Petroleum wins bid for Alaskan oil acreage

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tangiers Petroleum (ASX: TPT) has switched from offshore Morocco to onshore Alaska with a winning bid for Project Icewine in the US.

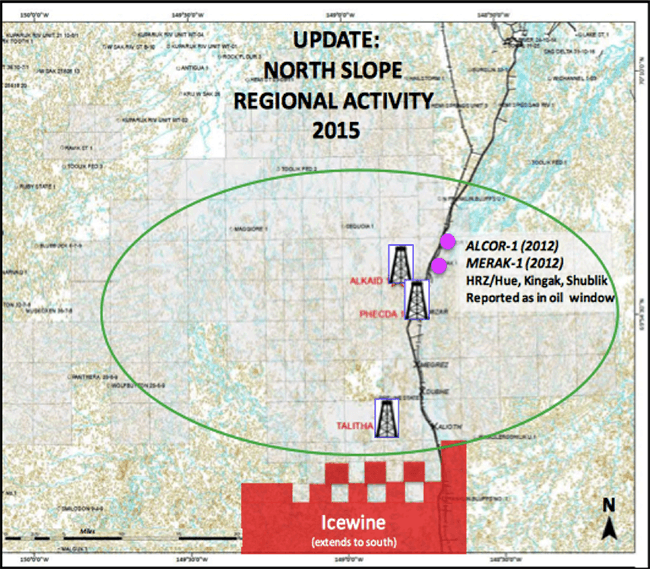

TPT has negotiated an 87.5% interest in Project Icewine, which is located in the heart of Alaska’s North Slope region. TPT will control over 80,000 acres of 100,000 contiguous acres bought at a ground floor price of $30 an acre – a large working interest for the $4M explorer.

The project has two main resource targets – an unconventional liquids rich shale play and a shallower conventional opportunity within a high porosity deep-water sand complex. TPT will work with its project partners to develop multiple targets on the play, with intentions to drill them as soon as possible.

TPT’s Moroccan exploration well TAO-1 was abandoned in mid-2014 after failing to find oil. The company then spent the remainder of the year rebuilding and Project Icewine is its new focus moving forward in 2015.

The next major goal for TPT is to negotiate a farm out at Project Icewine to assist in funding exploration costs of the acreage.

Neighbour’s drilling highlights potential

The North Slope is dominated by the huge oil field of Prudhoe Bay, estimated to hold 13BN barrels of recoverable resources. The source rocks that feed this large play in the north are part of the same shale formation that forms the primary exploration target of TPT’s Project Icewine in the south.

The company is focussing on exploring the HRZ band of the Hue shale formation, which is estimated to hold over two billion barrels of recoverable resources but is yet to be explored.

Project Icewine

These rocks are going to be drilled in the coming months by TPT’s immediate neighbour at Project Icewine, Great Bear (supported by US energy services giant Halliburton), which has three exploration wells scheduled for this year – one just four miles from TPT’s northern project boundary.

The results of this imminent exploration could have an impact on TPT’s farm out negotiations – clear results may re-rate the value of TPT’s acreage here.

The results may also point the way for a drilling programme at Project Icewine and may give indications as to the potential size and quality of any oil resource in the area.

Alaska – hot oil in a cold climate

Project Icewine is located within easy access distance of the Dalton Highway, a key arterial road on the North Slope that will allow TPT operate all year round. Also, the TransAlaska pipeline runs directly through the acreage.

In addition, TPT appears to have timed its entry in the Alaskan oil industry just right – coming as the state’s legislators passed new tax laws, dropping the price of doing oil business in the state.

TPT’s Managing Director Dave Wall says Project Icewine offers TPT a chance to rebuild and grow.

“Icewine ticks three of our key boxes for a start-up project: funding flexibility, ground floor entry and huge upside potential,” he says.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.