STL’s EBITDA Rising on the Back of Rapid Acquisitions

Published 21-JUN-2016 10:56 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

One of our more tech-savvy small cap stocks has outperformed the industry leader and gone cash flow positive within 12 months of us adding it to our portfolio.

Despite this, it seems the wider market has significantly undervalued Stargroup (ASX:STL), a value-accretive ATM operator, that’s quickly rising through the payments sector ranks.

The rabbit in STL’s top hat is all about employing an accretive mergers and acquisitions (M&A) strategy, designed to move STL up the ladder to become the top of the ATM pops in Australia.

STL recently outlined its plans for a third acquisition for this financial year , to assimilate yet more revenue generative assets to its balance sheet.

The current acquisition will give STL a network of 95 ATMs and associated business assets, including the CashmyATM brand.

Since June 2015, STL has more than trebled the amount of ATM machines it operates and raised all operational metrics without exception — in a bid to take on industry leader Directcash Payments (TSX:DCI), capped at $230MN CAD.

With the dust now settling from STL’s transformative 12 months, several near-term catalysts have reared up for us to convey to our readers.

Without giving too much away too soon, STL’s overall financial position seems to be in a rather better position, than what the market appears to value the stock at.

In other words, there is a strong chance STL has been significantly undervalued and under-priced by the market because of its current small size, with its illustrious list of takeovers seemingly overlooked.

This is still an early stage play though, so make sure you seek professional advice and take all factors relating to this stock into account before making an investment decision.

After 10 consecutive months of record performance, STL is rapidly becoming a bit of a habitual shooting star when it comes to operating a network of ATM machines in Australia.

With metrics improving in all departments and exemplary financial performance to date, STL is determined to move out of the small-cap league, and move up a division to par with current industry trend-setter, the Canadian-based DirectCash Payments Inc.

Now that is the kind of small cap stock we like to see, so without further ado, let us catch up with:

What does it take to be Star?

For Stargroup Ltd (ASX:STL), the answer to that question is growing its financial metrics, far and above what it set out to do 12 months ago.

That’s exactly what STL has done .

STL has recorded revenue of $2.9M in FY2015-16, compared with $430,000 the previous year. That’s a growth rate of almost 600% over 12 months. The company has also more than doubled its market cap.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Further cheer comes from the fact that STL generated the same amount of transactional revenue in June 2016, as it did for the entire FY2015.

What the above metrics show, is that STL is growing and carrying out its intended go-to-market plan outlined 12 months ago.

STL’s performance is all the more impressive when you consider that its entire mission plan was telegraphed by CEO Todd Zani last year.

It all happened like he said.

The story behind STL starts with its first of three acquisitions, back in June 2015. At the time, STL acquired iCash in a bargain deal that was rather more favourable for STL than iCash .

This got the ball rolling on STL’s plan to snap up the most attractive ATM operators and add their networks to its own growing list.

Next, in October 2015, STL acquired Cash+ for $6.5M paid in cash and shares, adding a further 104 ATM machines to its network and most importantly, taking STL from negative to positive annual EBITDA.

And now in June 2016, STL is back at the M&A table, acquiring CashMyATM for around $4.5M.

This acquisition adds a further 95 ATM machines and raises STL’s annual EBITDA by $1M.

The consideration payable is just over $4.4M, with 10% to be paid in STL shares above market at $0.05 (escrowed for 12 months) and the balance in cash. STL has issued approximately 8.9 million shares for the acquisition.

In order to pay for the proposed acquisition of CashmyATM’s 97 ATM network (and related assets), STL is currently undertaking a one (1) for six (6) non-renounceable pro-rata entitlement offer of fully paid ordinary shares at an offer price of $0.036 per share.

If fully subscribed, STL intends to issue over 83 million new shares, and the offer will raise almost $3 million before the costs of the issue. The rights offer is expected to close on the 23 rd June at 5pm AEST.

All in all, STL has been on an unprecedented acquisition spree for over 12 months, as part of what it calls a “transformative” period.

When everything is tallied and calculated, STL’s transformation is on course to achieve $11.4M in annualised revenue in FY2017.

For a small-cap company currently capped at $17.5M (before the completion of the CashMyATM acquisition), that represents significant present and possible future value.

After all, STL remains a micro-capped ATM operator...

...but has successfully acquired separate networks at bargain-basement valuations.

It is usually the big heavy-hitters that take the M&A route to rapid-fire growth. The fact that STL has successfully utilised M&A to its benefit, gives us the impression STL is well on the way to leaving its small days behind, and becoming a mid-tier ATM operator rivalling the world’s largest, held by TSX listed DCI.

How does STL stack up to its prime competition?

One of the more inspiring factors behind STL is its peer comparison.

For starters, STL is the only ASX-listed ATM operator with a stake in its hardware supplier — that’s a huge deal because this ensures STL can quickly update or tweak existing hardware and negotiate from a position of strength when it comes to cutting deals and making additional purchase orders.

However, STL’s coup de grace is its outperformance of market leader Directcash Payments (TSE:DCI), currently capped at CAD$229M.

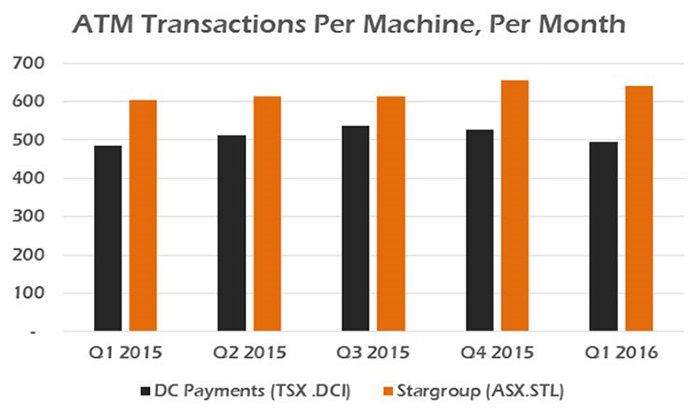

STL’s transactions per machine have outperformed those of DCI in every quarter since 2015.

This ability to beat not only its bigger rival, but also, the biggest ATM operator in the world, suggests that STL could well be a star in the making.

With its machines well-placed and generating just that little bit more than any other operator, it’s no wonder STL is on an acquisition spree. Each and every additional ATM machine that is added to its network...

...adds direct revenues and EBITDA to STL’s bottom line.

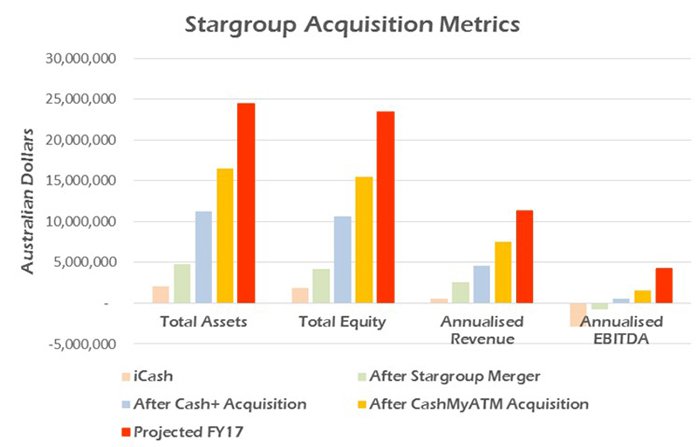

Here are STL’s three acquisitions, and most importantly, their effect on STL’s financial metrics:

As you can see, each acquisition adds to STL’s total assets, total equity and thereby raises its annualised revenue and EBITDA.

If we look forward to 2017, STL is on course to record over $11M in annualised revenue with an EBITDA a shade lower than $5M.

The forward projections are speculative and should not be taken as exact figures. Seek professional advice when looking at the numbers and apply caution to your investment decision.

STL has most certainly moved quickly with its aggressive M&A campaign and this strategy appears to be paying off.

After completing its current acquisition of CashMyATM, STL will have a network of 365 machines, in aggregate processing around 2,900,000 transactions and potentially generating annualised revenue of $7.5M in 2015/16 and then $11M in 2017.

That’s a very healthy growth track, and one we think STL may well be able to achieve...

...without including the additional revenue drivers such as ‘Recycler ATMs’. Recycler ATMs are newly designed ATM builds that allow both real-time deposits as well as withdrawals.

These Recycler ATMs are likely to be a huge hit with rural communities, feeling the bite of bank branch closures and lagging banking services from Australia Post.

Valued or undervalued?

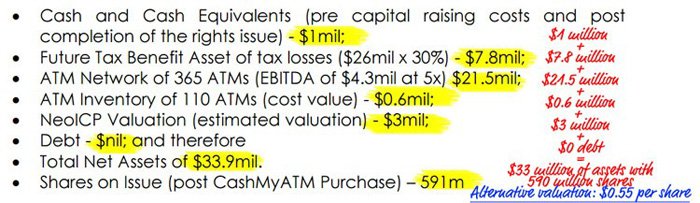

Sifting through STL’s long list of activities in the past year, we did manage to find one very interesting titbit of information that has potentially been missed by market analysts.

The reason why is because STL’s initial acquisition of iCash had to be renegotiated, which Mr. Zani accomplished with some aplomb , bringing the acquisition price down from $0.06 to $0.035 per share.

The net effect of its aggressive M&A campaign has been to leave market analysts a little perplexed as to exactly how much revenue and cash flow STL is likely to generate.

Here is a rough analysis, which already shows a discrepancy between the current list of STL’s assets, and its purported market value:

We found this alternative rough calculation of STL deep in its company literature , and upon seeing it, our decision to back this ATM assimilator was wholeheartedly reaffirmed.

Bear in mind, STL is trading at $0.035, around 60% lower than what it potentially could be worth if all its assets were priced at their true face value.

Who knows, maybe this discount is connected to a macro factor completely unconnected to STL, or, the majority of the market has simply not caught on to this rapidly expanding, yet still small-cap company.

Let’s go through STL’s proposition again, and see whether this Star is worth wishing upon

STL is arguably a triple-threat with three distinct products being distributed in Australia — StarATM, StarPayments and StarPOS:

StarPayments

Currently STL’s prime offering, StarPayments ATMs provide users with the ability to withdraw money at their convenience.

StarPayments has increased revenues from $429,840 in 2015 to $3,401,997 in 2016 – a 691% increase. These stellar sales and revenue numbers have continued to impress in 2016 and most importantly, the average number of transactions, per machine, per month has risen significantly over the past 12 months, from 613 to 635 — a 3.5% increase internally, and...

...a 22% outperformance of current industry pace-setter DC Payments.

When you’re beating your closest competition by 22% per machine, per month — that tends to be a good sign for the future.

StarATM

STL also owns an 11% interest in its ATM manufacturer – NeoICP, a private Korean Company.

As a result, STL is the exclusive distributor of all of its ATM technologies and software in Australia and NeoICP also manufacture back office, coin counting, casino settlement solutions and even an ATM that dispenses gold bars!

StarATM is the division that distributes those technologies in Australia and StarATM even sells these machines to other deployers. Sales revenue rose from approximately $20,000 in 2014 to almost $120,000 in 2015 – a 500% increase.

STL’s other product is StarPOS — the future of on-the-go payments

Operating a network of 365 ATM machines across Australia generates steady and reliable income from people withdrawing cash.

But what about small payments done via debit/credit cards i.e. EFTPOS?

EFTPOS payments are climbing each and every year as modern societies gradually move towards a cashless system where all ‘money’ is accounted for via online accounts and automated settlements without any cash ever changing hands. STL is well positioned in this regard also.

StarPOS

StarPOS machines are provided to merchants to allow cashless payments for customers through the EFTPOS system.

ATM machines provide an excellent staple income while cash is still around, but as we move towards a cashless society, cashless payments functionality is a must for any ATM operator.

For STL, its StarPOS system is already operational and being gradually rolled out across Australia. When you consider that there is almost 1 million EFTPOS terminals in Australia, growing at 8% per year, STL is operating in a thriving market.

STL entered this market by signing a leveraged wholesale agreement with Visa and MasterCard enabling it to roll out its very own EFTPOS machines to its customers – at excellent rates negotiated by STL’s industry veteran Todd Zani.

As we’ve mentioned already, under the stewardship of Mr. Zani, STL’s transformation has most certainly been a comprehensive and vivid one.

What do the analysts think?

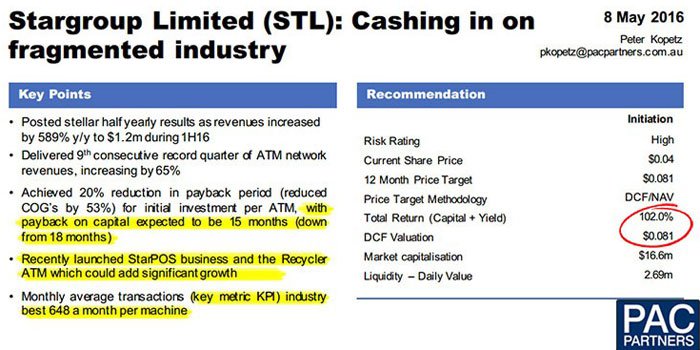

PAC Partners is targeting a share price of $0.081 over the coming 12 months — that’s a 131% premium to STL’s current share price of $0.035:

At the same time, analyst predictions are no guarantee to eventuate – so don’t consider just these reports when you are investing. Consider your personal circumstances and seek professional advice.

PAC analyst Peter Kopetz says that STL’s payback period is expected to be 15 months for initial investment per ATM, which is falling on the back of STL’s M&A activity. If STL snaps more ATM networks, that is likely to further reduce the payback time per ATM, and increase EBITDA.

A Fintech cherry on this cake

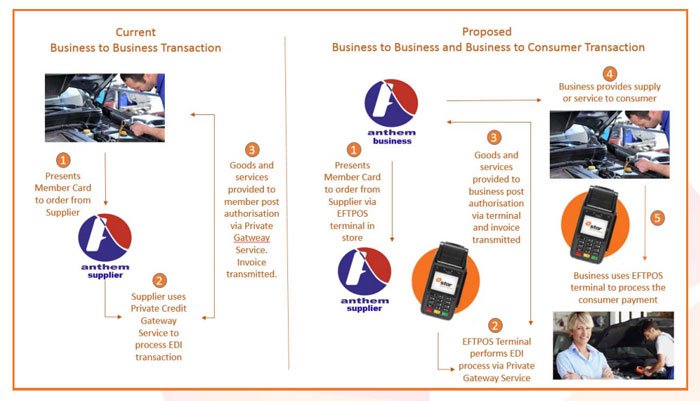

As part of its technology-driven approach, STL has done a deal with Anthem Software and Claim Co Group, a heavy hitter in the fintech space, to integrate STL’s StarPOS technology across Anthem’s business customer network in excess of 50,000 customers.

Here’s an illustration of how this integration is likely to unfold over the coming months:

One of Anthem’s key customers is Capricorn Society Limited, a member-based organisation which uses Anthem’s back end to process more than $1.4 billion of member purchases.

STL is hoping the resulting tech will allow it to roll out a bulk supply of EFTPOS solutions to buying groups, debtor financers, franchise organisations and to existing Anthem customers.

The great thing about this tech cherry is that STL will integrate the entire payments chain and reduce the need for unnecessary transactions purely for settlement reasons.

The deal with Anthem helps to streamline STL’s EFTPOS offering and is a good validation of STL’s innovation-focused approach.

Wishing upon a Star in the $670BN Payments Industry

STL has a simple and effective business strategy that is relatively insulated from other competition.

Not only that but STL’s technology offers an unparalleled operation advantage that is coming up trumps already, as evidenced by superlative performance metrics that outshine even the industry’s brightest name, DCI.

The good news for investors is that there could be substantial growth still to come.

At the same time, STL is still in its early stages as a company and caution should be applied to any investment decision relating to this stock.

STL has proven itself as an aggressive market player that’s not afraid to get in amongst it with the cream of the crop in Payments.

Back in early 2015, STL was an aspiring caterpillar, full of potential. Now 12 months later, with its transformative phase now complete, STL is finding its feet as a best of breed butterfly with a bright path to ATM dominance.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.